The midterm elections in November 2018 held major political ramifications for the United States given the high-profile Congressional, gubernatorial, statehouse, and mayoral choices American voters considered. But before and during Election Day, voters also played a critical role in shaping communities from coast-to-coast by casting their votes on investments and other decisions about transportation.

The Eno Center for Transportation has released a new issue brief analyzing the results of the 2018 transportation ballot measures.

Voters in 34 states approved over $40 billion for transportation this year, about 58 percent of what was considered. Every region of the country considered at least one measure, though most were in the West and Midwest. Florida voters approved the most new funding for transportation, in particular in Broward and Hillsborough Counties.

The vast majority of funding approved by voters this year was passed in multimodal measures, meaning the funding will be available to many different modes of transportation. And while far more measures were considered—and approved—for road improvements, the transit-specific measures that passed will provide for more new funding in dollars than the road-specific measures. Similarly, though most of the approved measures will raise money for transportation through bonds and property tax increases, the sales tax measures that passed will raise far more money.

The Eno Center for Transportation does not endorse or oppose any of the measures in this document. The information is provided for research purposes only.

Key Findings

It is important to note that, in terms of the overall count, about two-thirds of transportation-related measures were in just two places: Michigan and Ohio. These states require certain tax questions to go before voters, therefore routine property tax measures to generate revenue for local street maintenance are numerous in Michigan in August and in Ohio in November. These are usually quite small and overwhelmingly popular. Michigan voters approved 91.5 percent of this year’s local road questions, with an average of $379,557 annually; Ohio voters approved 86 percent of their local road questions, with an average of $155,965 annually. For this analysis, the local road questions in those states are kept separate. Click here to view a database of the Michigan and Ohio road millage measures.

Excluding these local road measures, voters considered $70.65 billion in transportation funding in 2018 and approved about 58 percent of that total, though 77 percent of the ballot measures passed (the average ballot measure that failed was worth more money than the average measure that passed). These measures will raise an average of $287.99 million for transportation, though they vary considerably. Of the 10 largest ballot measures by dollar amount, five of them passed. The biggest, a one percent sales tax increase in Broward County to fund various transportation improvements, will itself bring in over $15 billion.

Mode

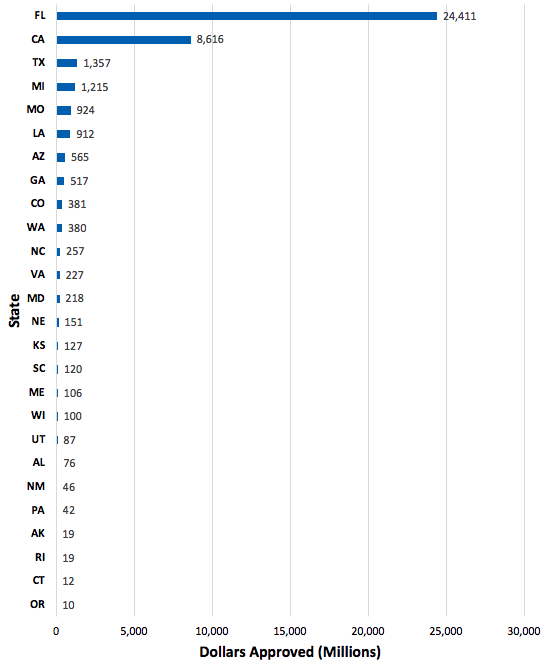

For the purposes of our analysis, we catalogued each ballot measure based on the primary mode of transportation identified in the measure’s language–in other words, which mode would receive the most funding as a result of the measure passing, or which mode was otherwise at issue for measures where money wasn’t being considered. A measure was categorized as “multimodal” if the measure made it clear many modes would receive funding or if it was impossible to tell based on the measure’s language which modes would receive how much of the money.

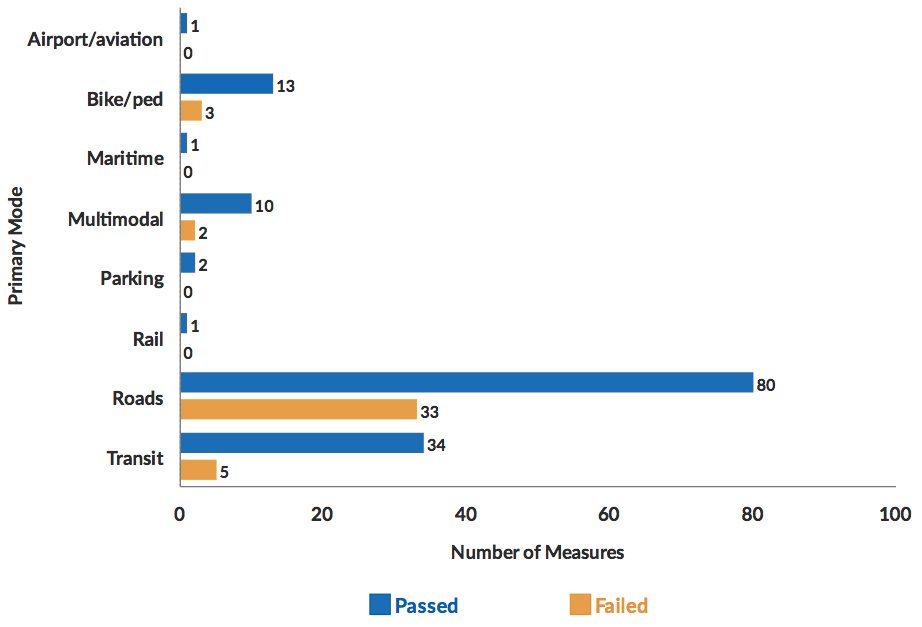

Voters approved far more ballot measures to raise money primarily for roads than for any other mode, passing 80 of the 113 ballot measures to raise money for roads – a 71 percent success rating. Again, this does not include the hundreds of local road millage renewals in Michigan and Ohio.

Figure 1: Ballot Measures Approved by Mode, 2018

*Does not include Michigan and Ohio local road millages.

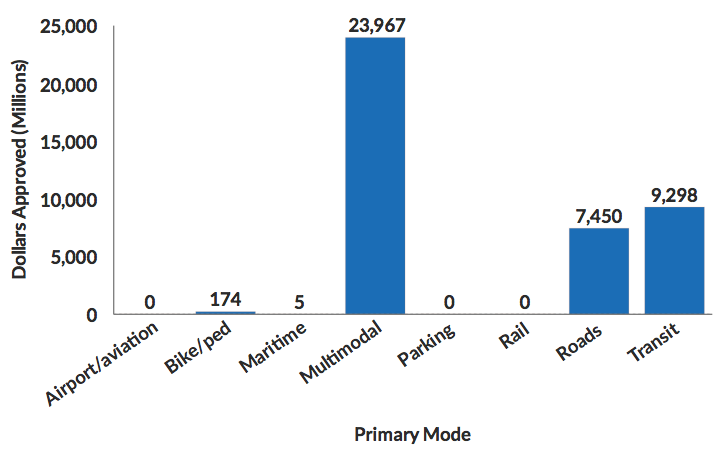

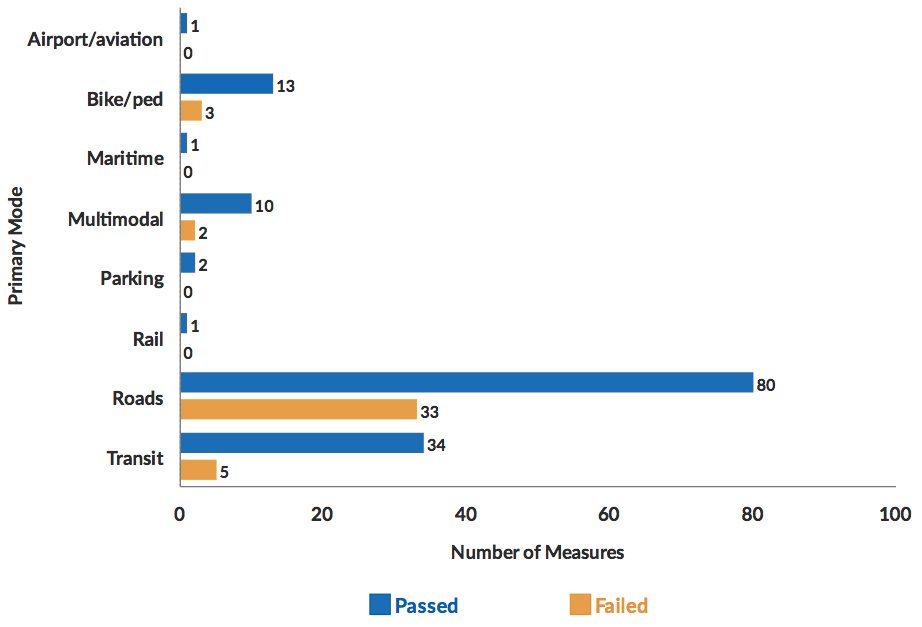

While more measures were approved for road funding than for any other mode, looking at the actual dollar amounts approved tells a different story. Voters approved far more money for multimodal and transit projects than for roads. Again, the “multimodal” measures will also result in more money for transit, roads, and other modes–but at the time of this analysis it was unclear how much money will go to each.

Figure 2: Total Funding Approved by Mode, 2018 (Millions)

*Does not include Michigan and Ohio local road millages.

Click here for an in-depth look at how each transportation mode fared at the ballot box this year.

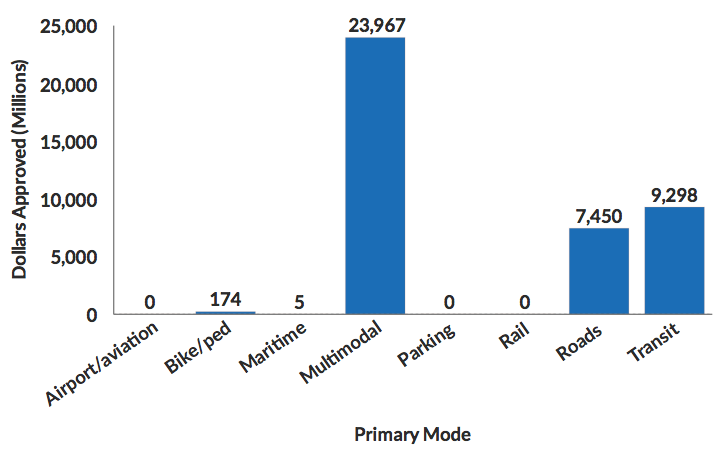

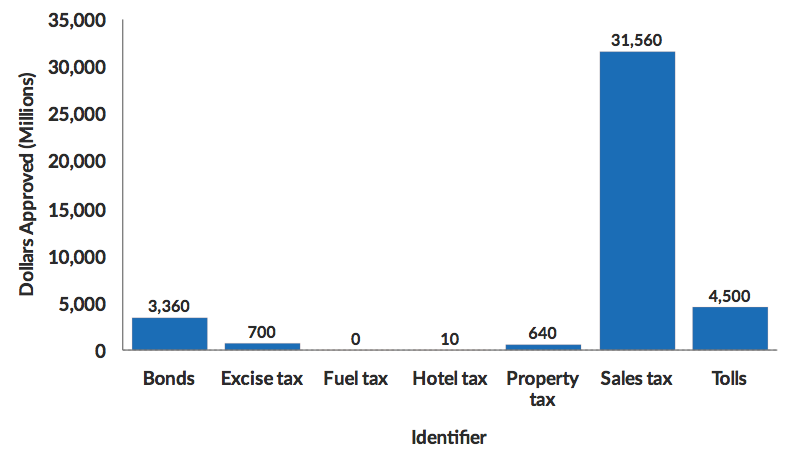

Identifier

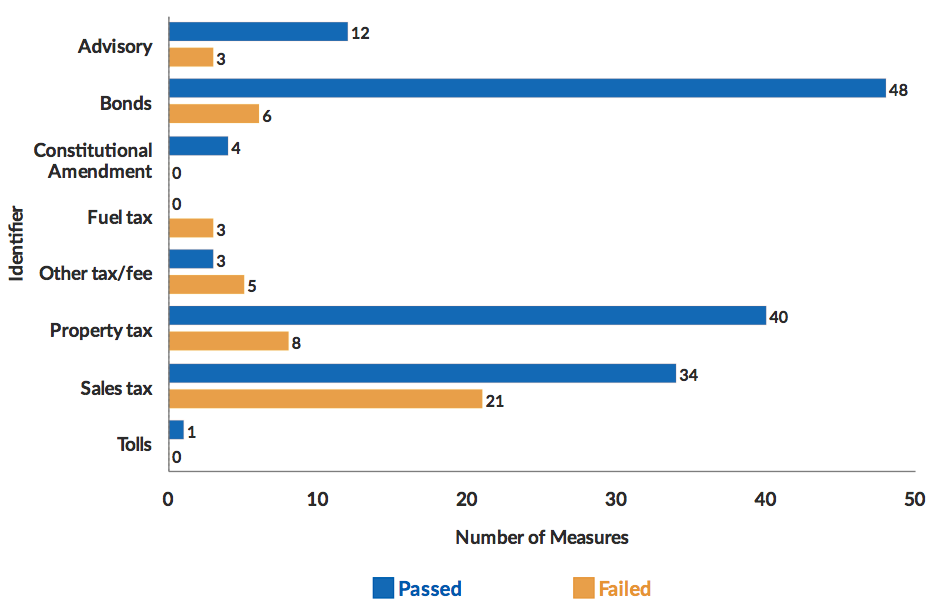

Ballot measures raise revenue for transportation measures in a wide variety of ways. The most common in 2018 were sales taxes (55 measures), bonds (54), and property taxes (48). Bonds were the most popular at the ballot box, enjoying an 88.89 percent success rate. Eighty-three percent of property tax increases were passed, and sales taxes enjoyed a lower success rate of 61.8 percent.

Figure 3. Ballot Measures Approved by Identifier, 2018

*Does not include Michigan and Ohio local road millages, which are property tax assessments.

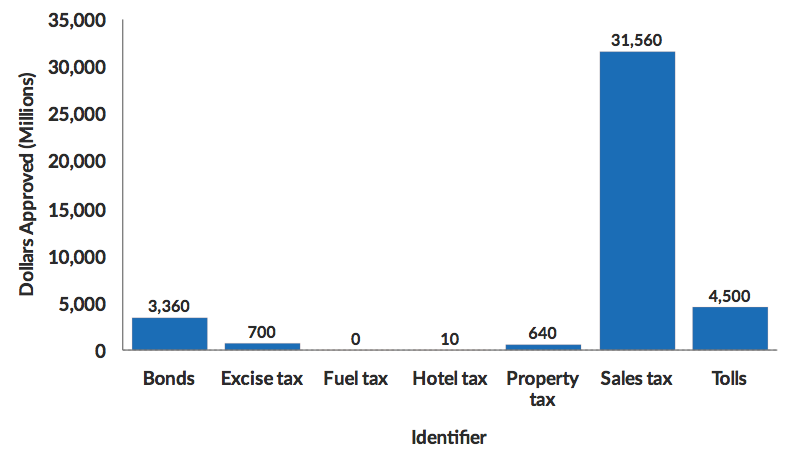

That said, voters approved far more money for transportation through sales tax increases ($31.7 billion) than through bonds ($3.36 billion) or property tax increases ($640 million). This is thanks in large part to the penny sales tax increases passed in Broward County and Hillsborough County, FL.

Figure 4: Total Funding Approved by Identifier, 2018 (Millions)

*Does not include Michigan and Ohio local road millages, which are property tax assessments.

Transportation-specific user fees like tolls and vehicle registration fees were scarce, with only one measure for each of those sources. Fuel taxes were also uncommon, and all three were rejected by voters, including statewide measures to raise the state’s gasoline tax in Missouri and Colorado. California voted against repealing the 2017 gas tax increase. While we did not include a dollar amount associated with this initiative because voters were asked whether to eliminate an existingrevenue stream, studies have found repeal would have cost the state $100 billion over 20 years, far more than any of the other measures considered on Election Day.

State

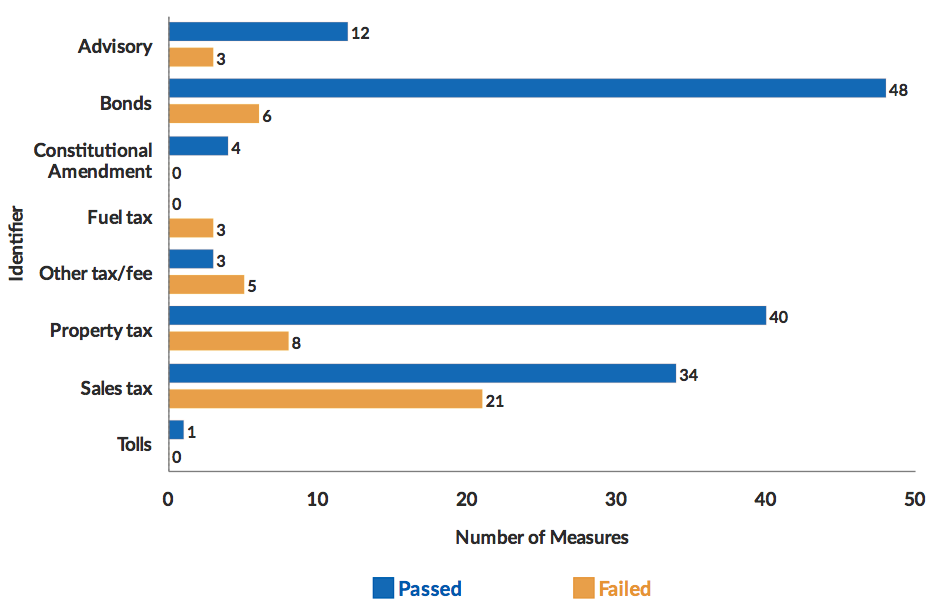

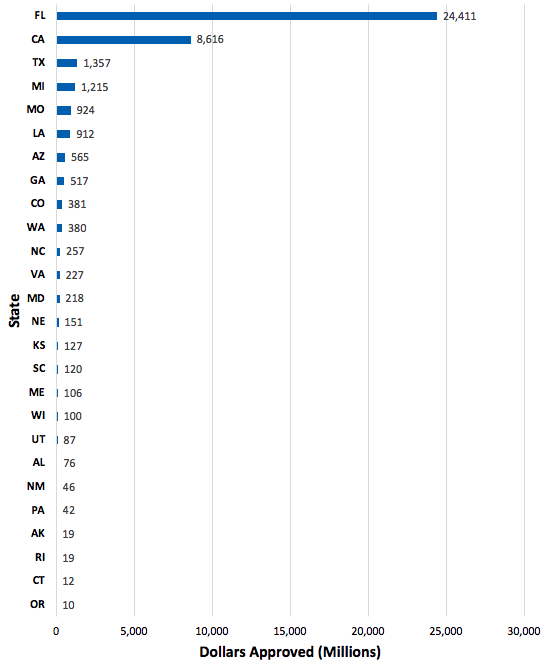

Thirty-four states had at least one transportation ballot measure this year.

Looking at the map of where voters supported raising money for transportation shows no real pattern, with voters in just about every region approving transportation ballot measures. One exception is the north-central United States, where no funding was approved: there was only one measure each in North Dakota and Idaho – both sales tax increases that failed – and none in South Dakota, Montana, or Idaho. The Northeast, where voter initiatives are not as commonplace as they have historically been out West, also did not see many transportation ballot measures this year.

Figure 5: Map of Funding Approved by State, 2018

Made with Visme Infographic Maker

It is important to note that of the $40.89 billion approved for transportation this year, only $811 million of it was approved in statewide measures. Maine voters approved $106 million in bonds for transportation improvements; Rhode Island voters approved $5 million in bonds for its State Bikeway Development Program; and Michigan will contribute $700 million of its marijuana excise tax revenue to road improvements. All of the rest was approved at the regional, county, or municipal level. Looking at state-level data can help show the geographic dispersal of voter-approved transportation funding but should not be taken to mean everyone in those states will see the benefits of those investments equally.

Voters in Florida approved far more funding for transportation than voters in every other state combined. The vast majority of the $24.411 billion approved by Florida voters came in the form of two penny sales tax increases passed in Broward County ($15.63 billion) and Hillsborough County ($8.28 billion). Together, those account for about 98 percent of transportation funding approved by Florida voters this year.

California came in a distant second place, with just over $8.6 billion approved for transportation. The largest chunk of this was passed not on Election Day, but back in June, when a nine-county region in the Bay Area approved Measure 3 to raise $4.5 billion in tolls for traffic relief and public transit. California voters also rejected Prop 6, which would have repealed last year’s fuel tax increases.

Figure 6: Total Funding Approved by State, 2018 (Millions)

*Does not include Michigan and Ohio local road millages.

These numbers also do not include the 327 local road millages that went before voters in Michigan and Ohio; while most of these millages passed, they raise relatively small amounts of money and would not change the total state-wide numbers much (though including them would put Ohio on the map).

Other Transportation at the Ballot Box Resources:

- 11/7: Watch: Transportation at the Ballot Box Rapid Response. Eno’s Robert Puentes and Jeff Davis talk 2018 elections, including which key ballot measures passed and failed and what the next Congress will look like.

- Listen to our podcast mini-series from before Election Day, featuring on-the-ground experts talking about five transportation ballot measures in California, Colorado, Connecticut, Florida, and Missouri.

In the News: