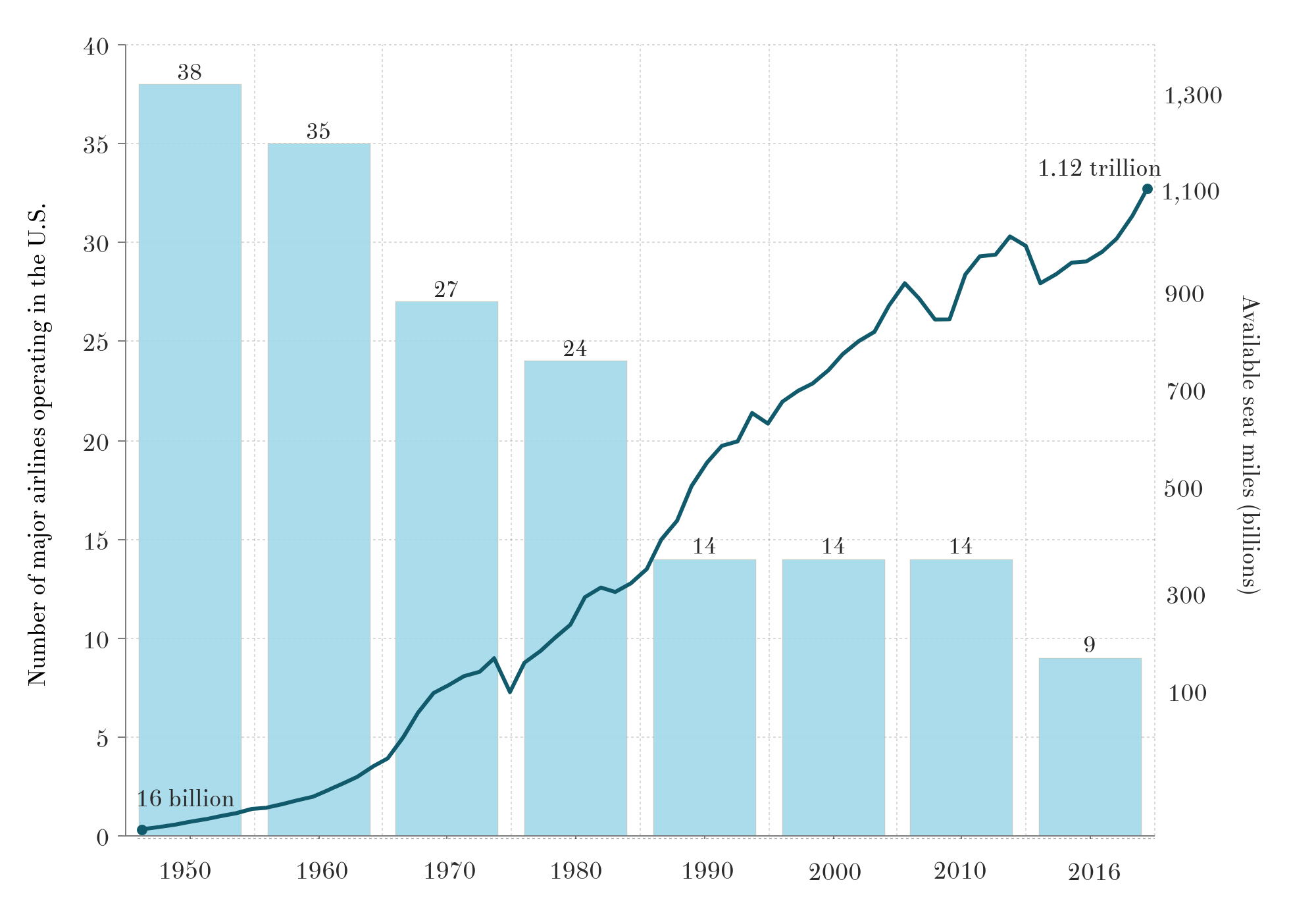

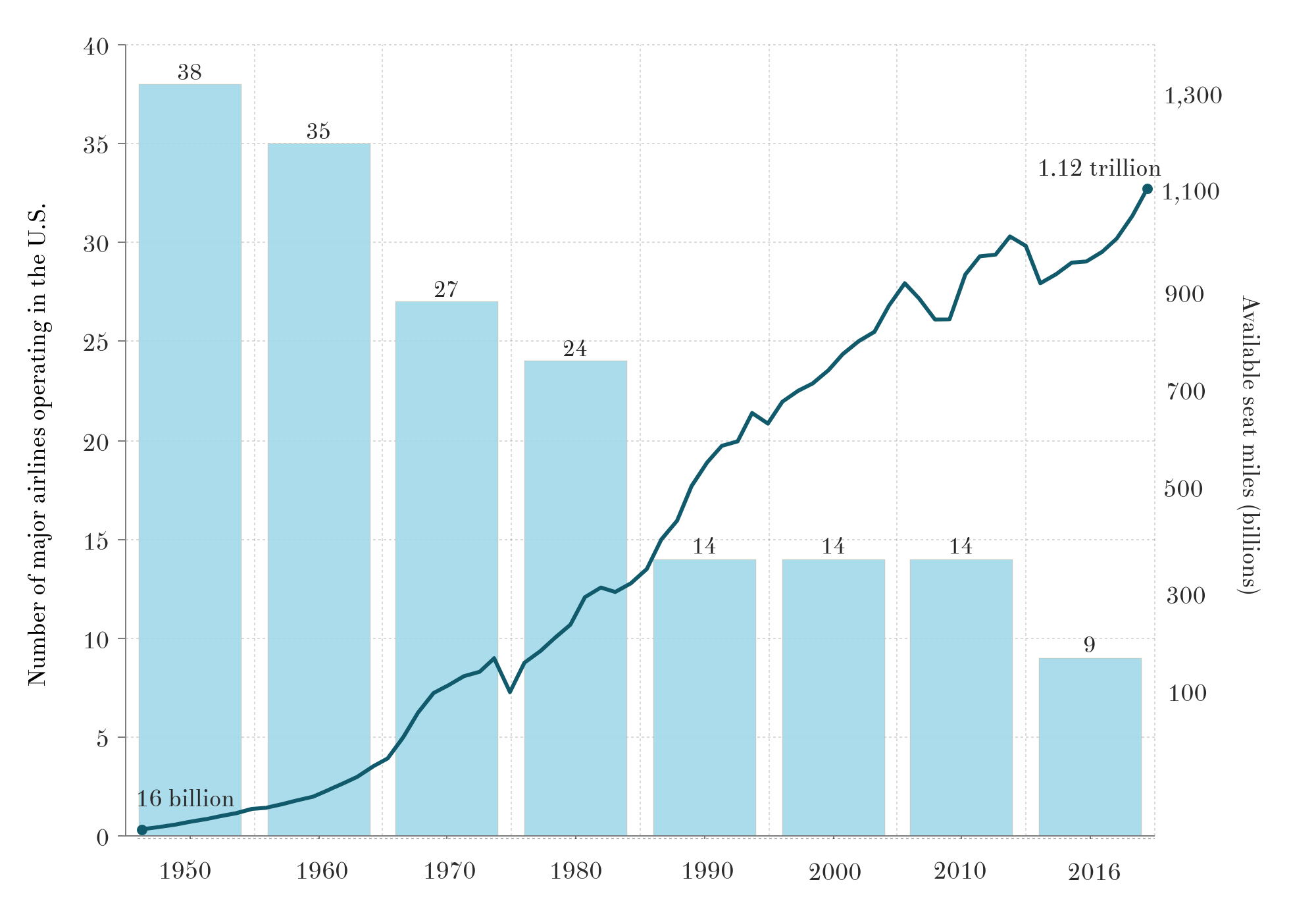

In 1980, airline passengers were able to choose from two dozen different airlines operating across the United States. Yet even as air traffic has grown over the past few decades, the number of airlines has shrunk to just nine today. Competition for passengers remains intense with a number of bankruptcies and acquisitions in recent years. Today, the four largest airlines (American, Delta, United, Southwest) carry 76 percent of U.S. domestic passengers.[1]

Figure 1. Number of major airlines operating in the U.S. and billions of available seat miles, domestic and international (1950-2016)

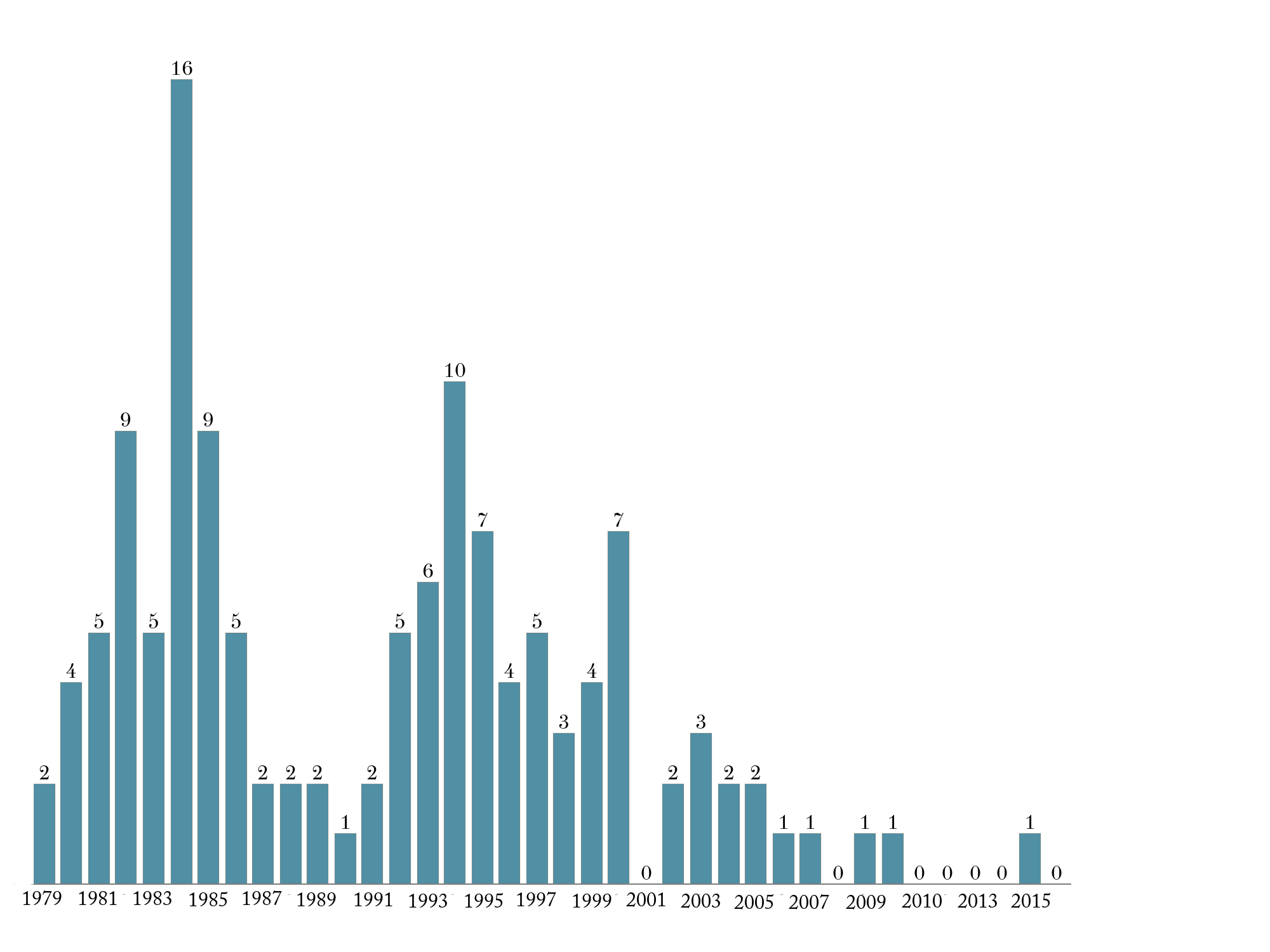

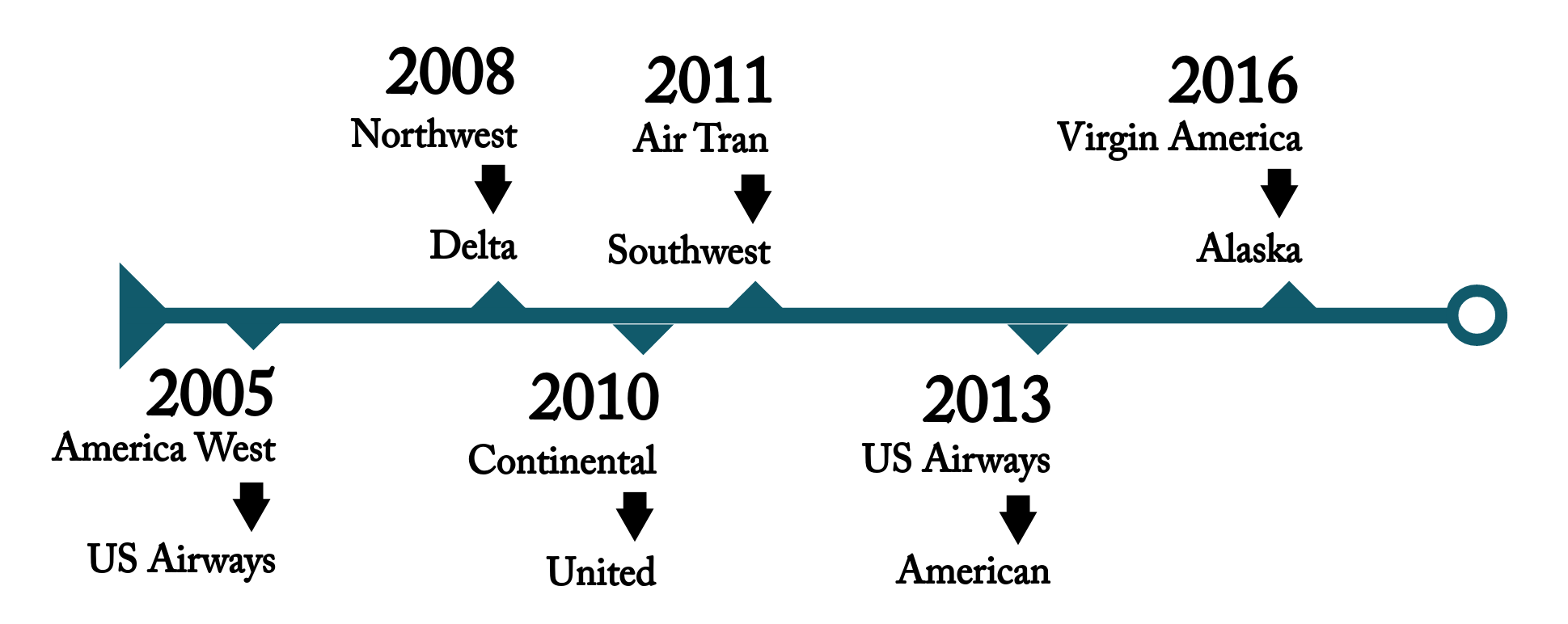

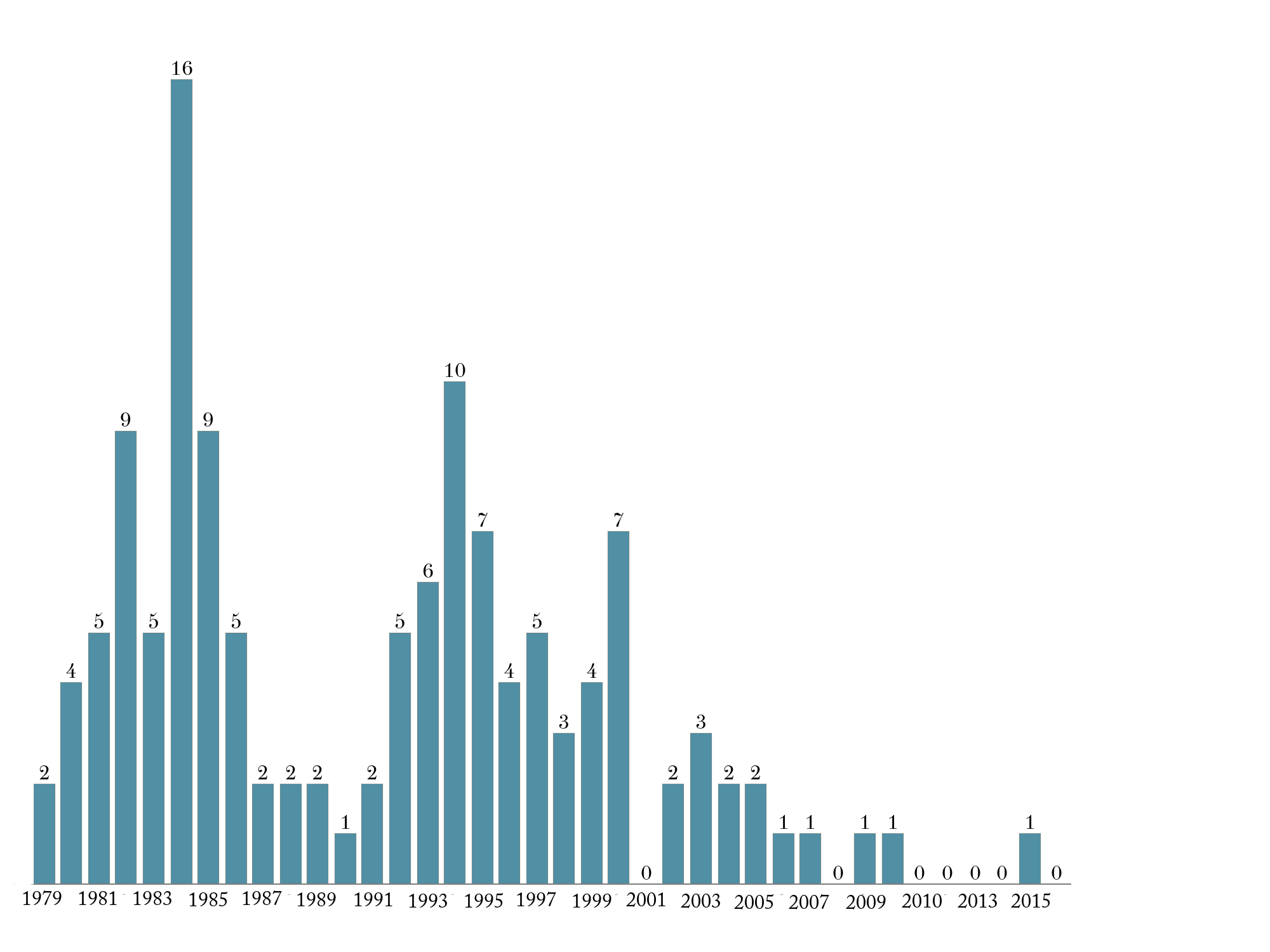

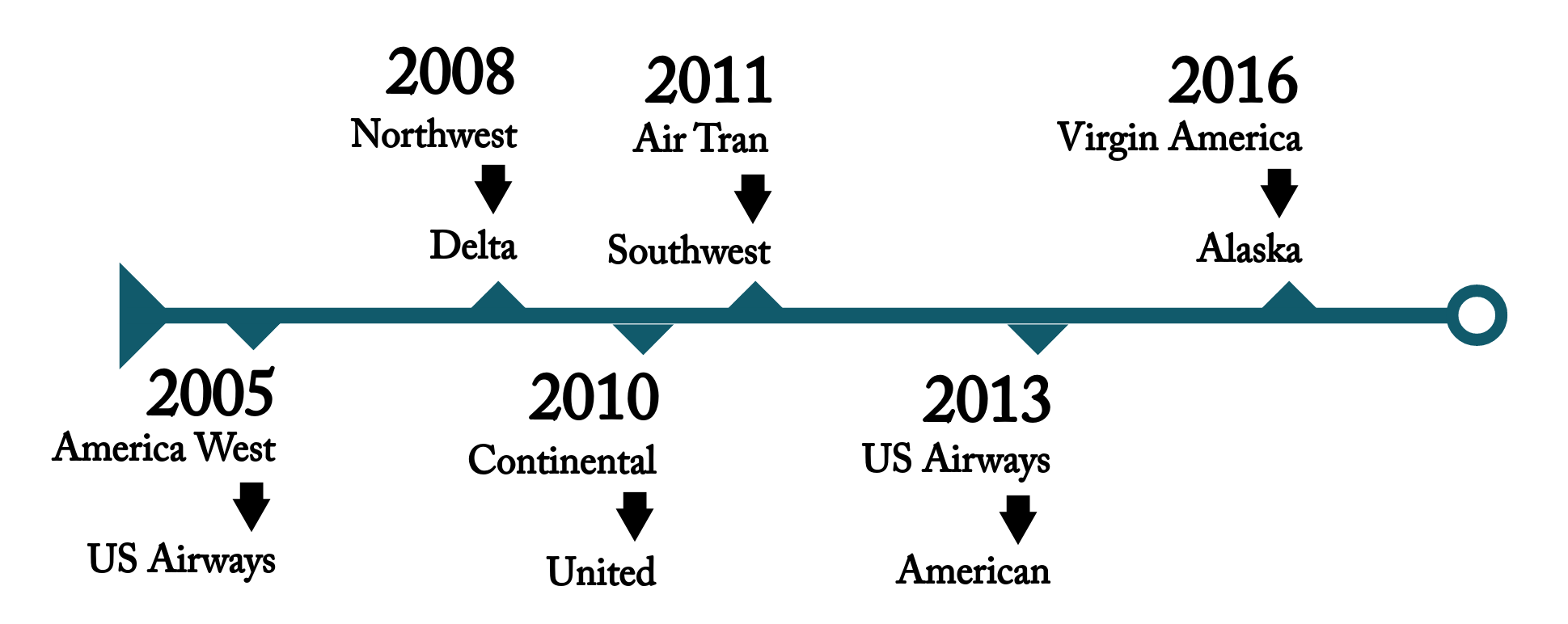

In the two decades following deregulation in 1979 more than 100 new airlines entered the market (Figure 2). But most of these disappeared quickly, either through mergers with larger airlines or through insolvency. In fact, between 1979 and 2012 there were 194 airline bankruptcies.[2] Since 2001, the pace of new entries into the market declined sharply and only one company, Virgin America, became a major airline during that time. Meanwhile, the biggest airlines consolidated into the nine carriers operating today, including the 2016 merger of Virgin America with Alaska Airlines (Figure 3).

Research shows that new airline entrants in concentrated markets results in lower airfares and increased frequencies.[3] But the prospects for new entrants is dim, despite airlines making record profits.[4] Stakeholders have identified several barriers to entry including new difficulties in accessing investment capital, high federal taxes and airport fees, and a strenuous certification process.[5] Also, smaller airlines complain about access to scarce runway slots and terminal gates at large airports, which limits their ability to enter and compete in the market.[6]

Figure 2. New airline entrants per year

Source: William A. Jordan, “Airline Entry Following U.S. Deregulation: The Definitive List of Startup Passenger Airlines, 1979-2003,” Transportation Research Forum, 2005 and Eno Center for Transportation internal research.

Figure 3. Major airline mergers, 2005 to present

Source: Airlines for America, U.S. Airline Mergers and Acquisitions

With few new entrants and four airlines controlling over three quarters of the market, the question is: have consumers benefited from airline mergers?

When seeking permission from the federal government to consolidate, airlines argue that mergers result in financially stronger carriers, allowing them to better compete in the market. A recent study estimated the effects of these mergers on the passengers’ consumer benefits, including attributes such as fares, service frequency, availability of different routes and nonstop flights, and total travel times, pre and post mergers. The finding shows that up until the American/US Airways merger, passengers have benefited.[7]

The study also indicates that future mergers would probably not result in any net benefits to consumers. This is because most benefits of legacy carrier mergers come from increasing flight frequencies at their main hubs, with passengers at these hubs benefitting most.[8]

Data on overall traffic trends supports the notion that the average flier has not been negatively affected by consolidation. As the industry has consolidated and grown throughout the decades, the number of seats that are available for passenger use—available seat miles—has increased multiple times over.[9] By some measures, the cost of domestic air travel has remained level since 2006, adjusting for inflation.[10]

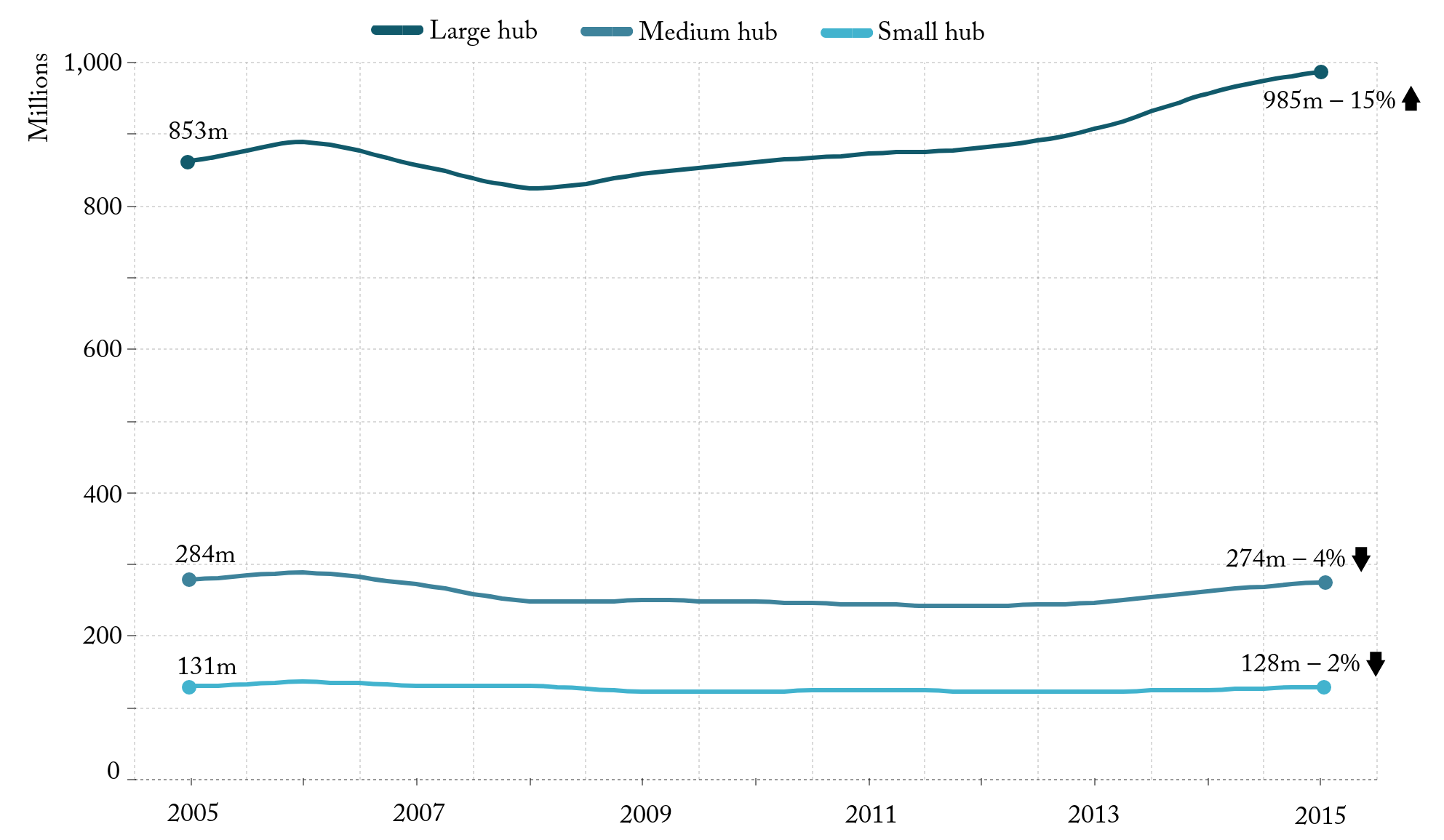

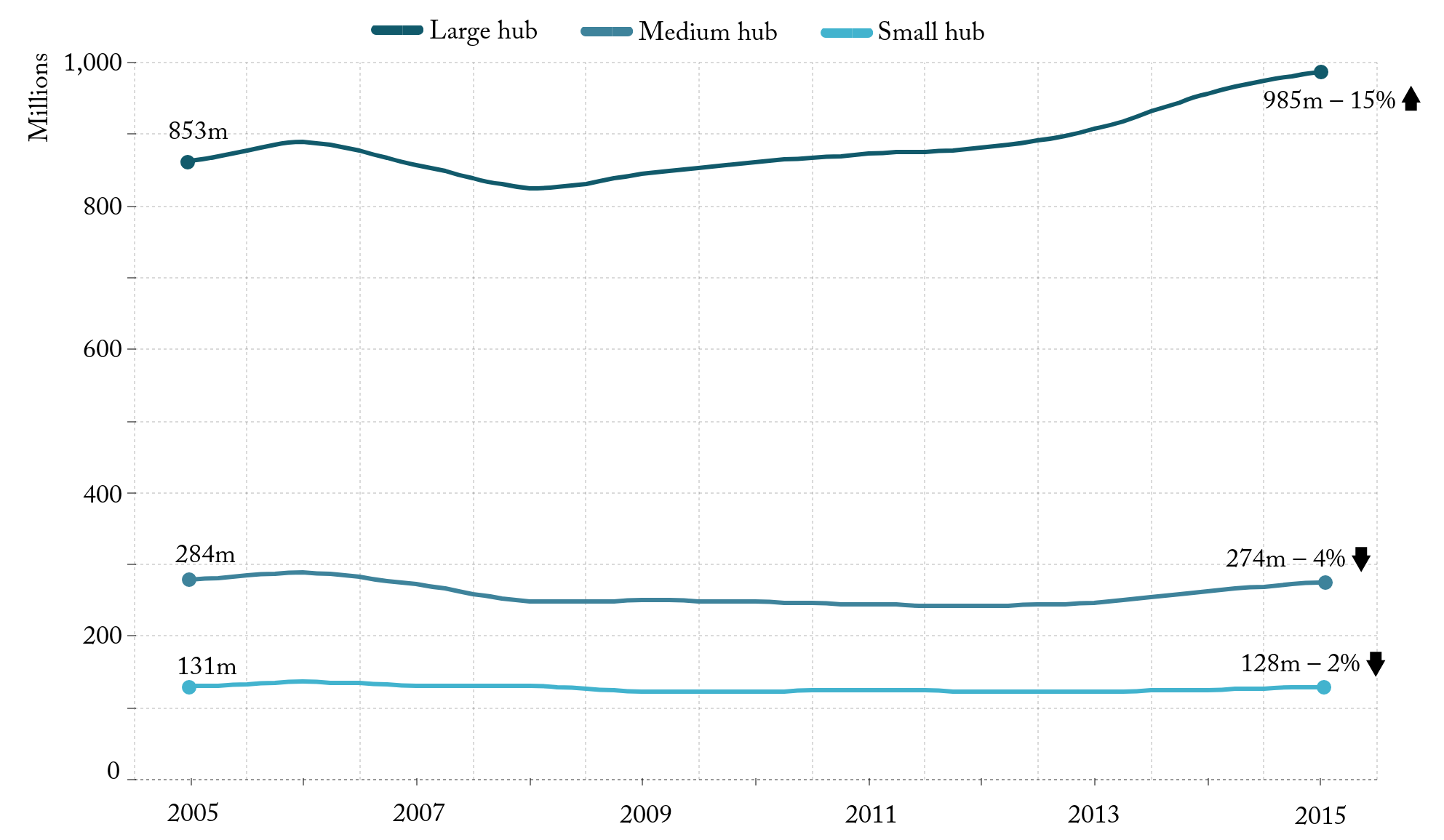

However, consolidation has concentrated traffic at the largest airports. Figure 4 demonstrates that since 2005, passenger traffic at large hub airports increased 15 percent, while medium and small hubs lost traffic.

Figure 4. Total number of domestic passengers carried by small, medium, and large hubs

Source: Bureau of Transportation Statistics, “Airport Snapshot,” U.S. Department of Transportation, 2017.

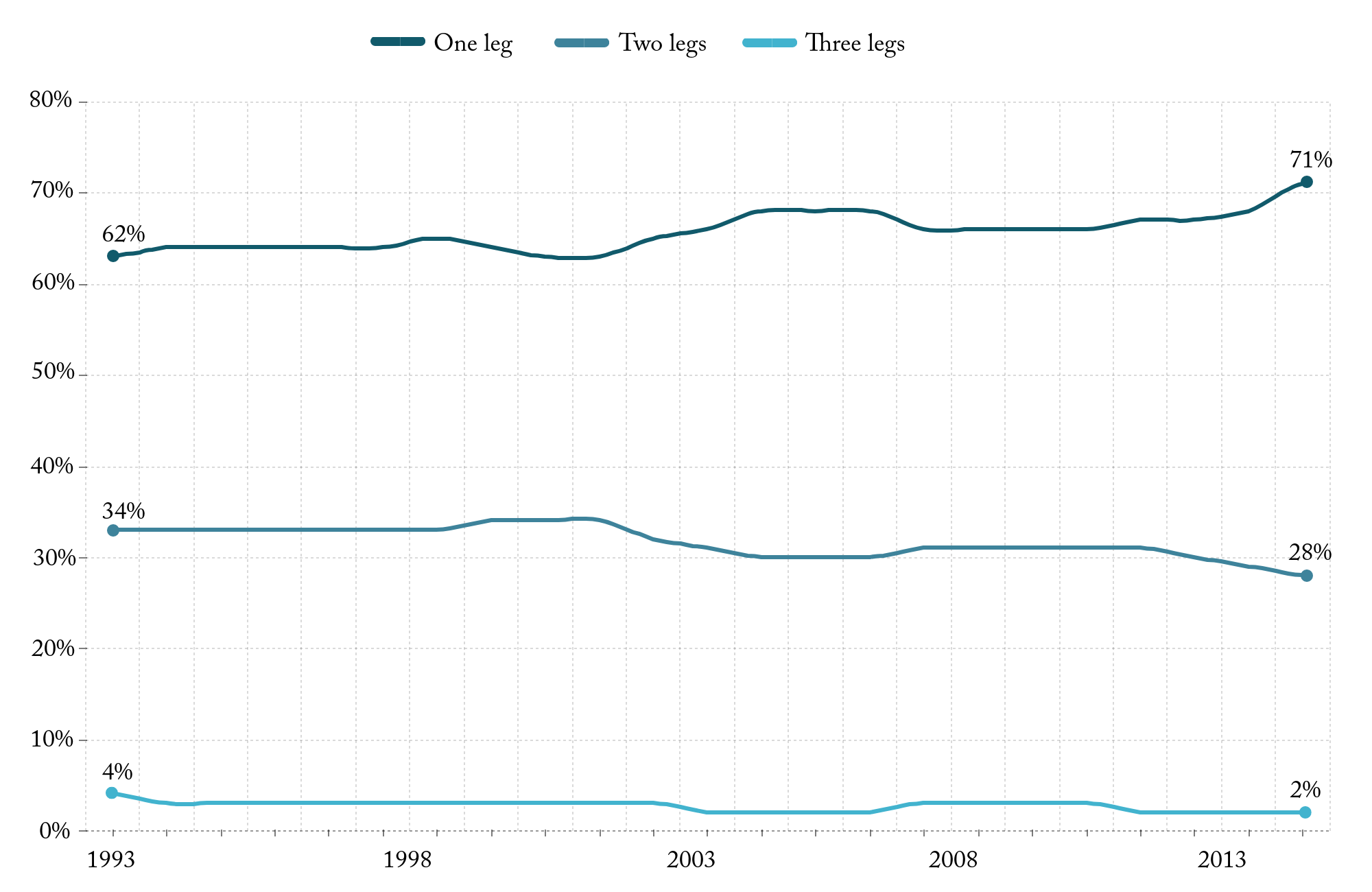

Consolidation could also negatively affect passengers if it forces more connecting flights for customers not flying out of large hubs. Airlines typically concentrate their traffic in a few large airports because of the efficiency advantages of connecting passengers.[11] For example, two-thirds of passengers in Atlanta, a major hub for Delta, are connecting to another flight.[12] With fewer major airlines and fewer hubs, one would suspect more connecting passengers.

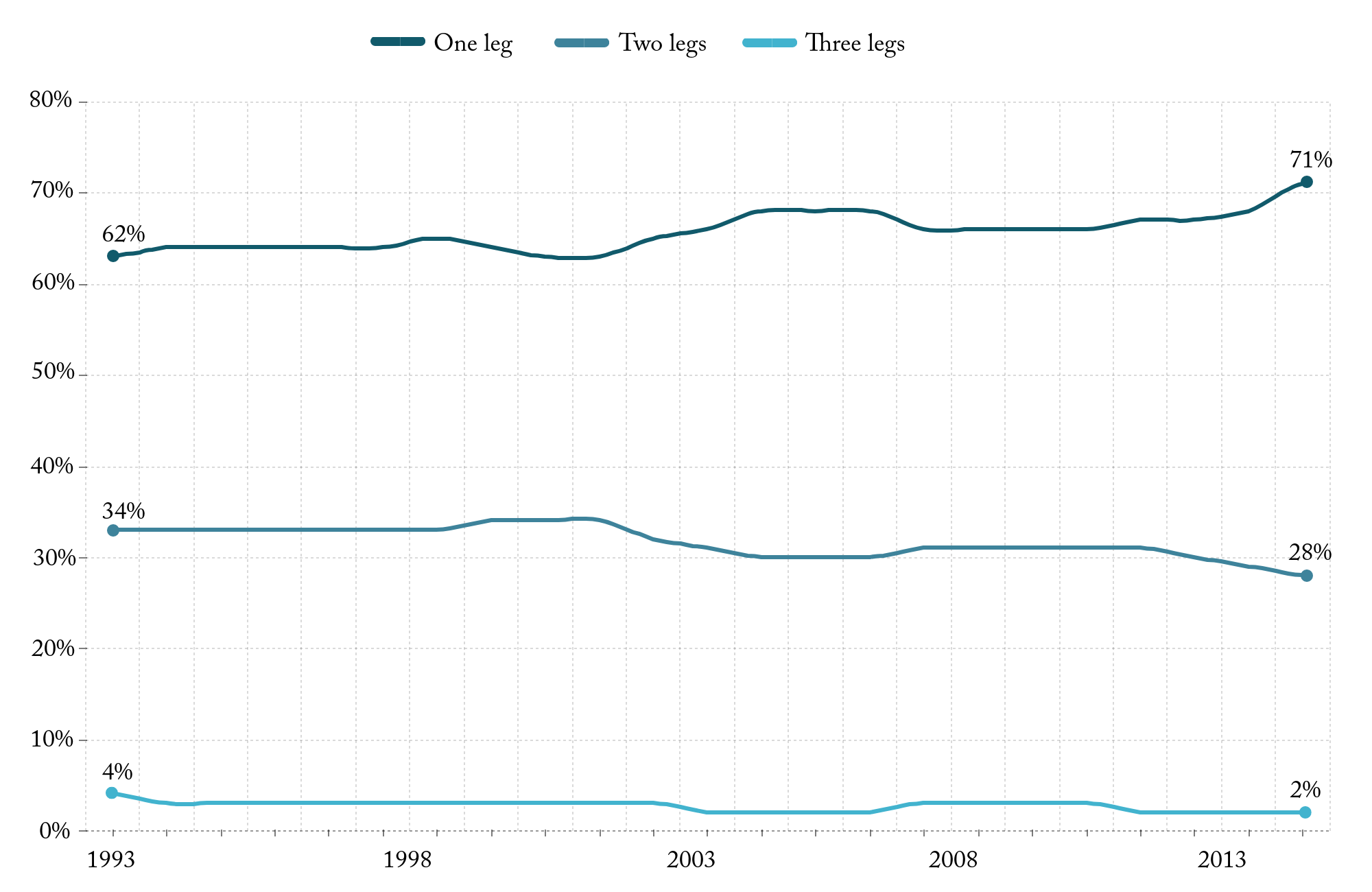

However, the number of passengers flying direct, and the proportion of all trips taken that are direct, are both increasing. Figure 5 shows the number of legs, i.e., flights, in tickets issued in a given year has actually decreased, and more fliers are taking direct flights.[13]

Figure 5. Percentage of tickets issued by number of legs per trip

Source: Bureau of Transportation Statistics, “Number of Coupons in the Market,” U.S. Department of Transportation, 2017.

What effect does airline consolidation have on passengers?

Answers:

• Research indicates that the average consumer has benefited from the airline consolidation. Average airfares have not spiked, the availability of seat miles has increased, and competition between large hubs served by several airlines, has enabled more nonstop options.

• However, service is concentrating in the largest metropolitan areas. Passengers using small and medium hub airports could be worse off as airlines have reduced service in several smaller markets.

Question 3: How are airlines making money?

Eno Aviation Insights homepage

[1] Federal Aviation Administration, “FAA Aerospace Forecast – Fiscal Years 2016-2036,” U.S. Department of Transportation, 2016.

[2] Many of those bankruptcies resulted in restructuring, not in dissolution. See: U.S. Government Accountability Office, “Airline Mergers – Issues Raised by the Proposed Merger of American Airlines and US Airways,” GAO-14-403T, 2013.

[3] FAA/OST Task Force Study, “Airport Business Practices and Their Impact on Airline Competition,” Federal Aviation Administration, October 1999.

[4] Eno Center for Transportation, “How Are Airlines Making Money?” Eno Aviation Insights No. 3: October 2017.

[5] Calvin Clifford Fayard, III, “Building a 21st Century Infrastructure for America: Enabling Innovation in the National Airspace,” Hearing before the Committee on Transportation and Infrastructure, Subcommittee on Aviation, U.S. House of Representatives, 115th Congress, April 4, 2017.

[6] Susan Stellin, “Seeking a Place at Airports,” New York Times, January 25, 2010.

[7] Studies also examine other impacts of consolidation in terms of productivity. One concluded that the airline industry and the second-best performer among 63 U.S.industries in terms of productivity improvements during the 1997-2014 period. See: Matthew Russell, “Economic Productivity in the Air Transportation Industry:Multifactor and Labor Productivity Trends, 1990–2014,” Monthly Labor Review, U.S. Bureau of Labor Statistics, March 2017.

[8] The recent Alaska Airlines merger with Virgin America was not included in the study.

[9] Bureau of Transportation Statistics, “U.S Air Carrier Traffic Statistics,” U.S. Department of Transportation, 2017.

[10] Eno Center for Transportation, “Is Air Travel Becoming Pricier for Travelers?” Eno Aviation Insights No. 1: October 2017.

[11] Dartmouth Engineer Magazine, “Airline Mergers Benefit Most but Not All … To a Point,” March 27, 2017.

[12] Kelly Yamanouchi, “Hartsfield-Jackson Tops 100 Million Mark,” Atlanta Journal-Constitution, December 27, 2015.

[13] Bureau of Transportation Statistics, “Number of Coupons in the Market,” U.S. Department of Transportation, 2017.

Eno wishes to acknowledge its Aviation Working Group, a standing advisory body that provides Eno staff with guidance and expertise on all matters related to aviation policy. The opinions expressed are those of Eno and do not necessarily reflect the views of our supporters.