Airport congestion, and ensuing nationwide delays, are disruptive to travelers and to the American economy. The federal government is capable of awarding grants aimed at bolstering our nation’s airports.[1] But is that the best way to improve airports for most travelers?

Congestion and delays often start at high demand airports with limited runway capacity and become national problems because they have ripple effects across the country. But runway capacity issues are actually limited to only a few U.S. airports. The three airports in the New York City region, Washington Reagan National Airport, San Francisco International, and Los Angeles International are the only airports that need substantial increases in their runway capacity in the short term.[2]

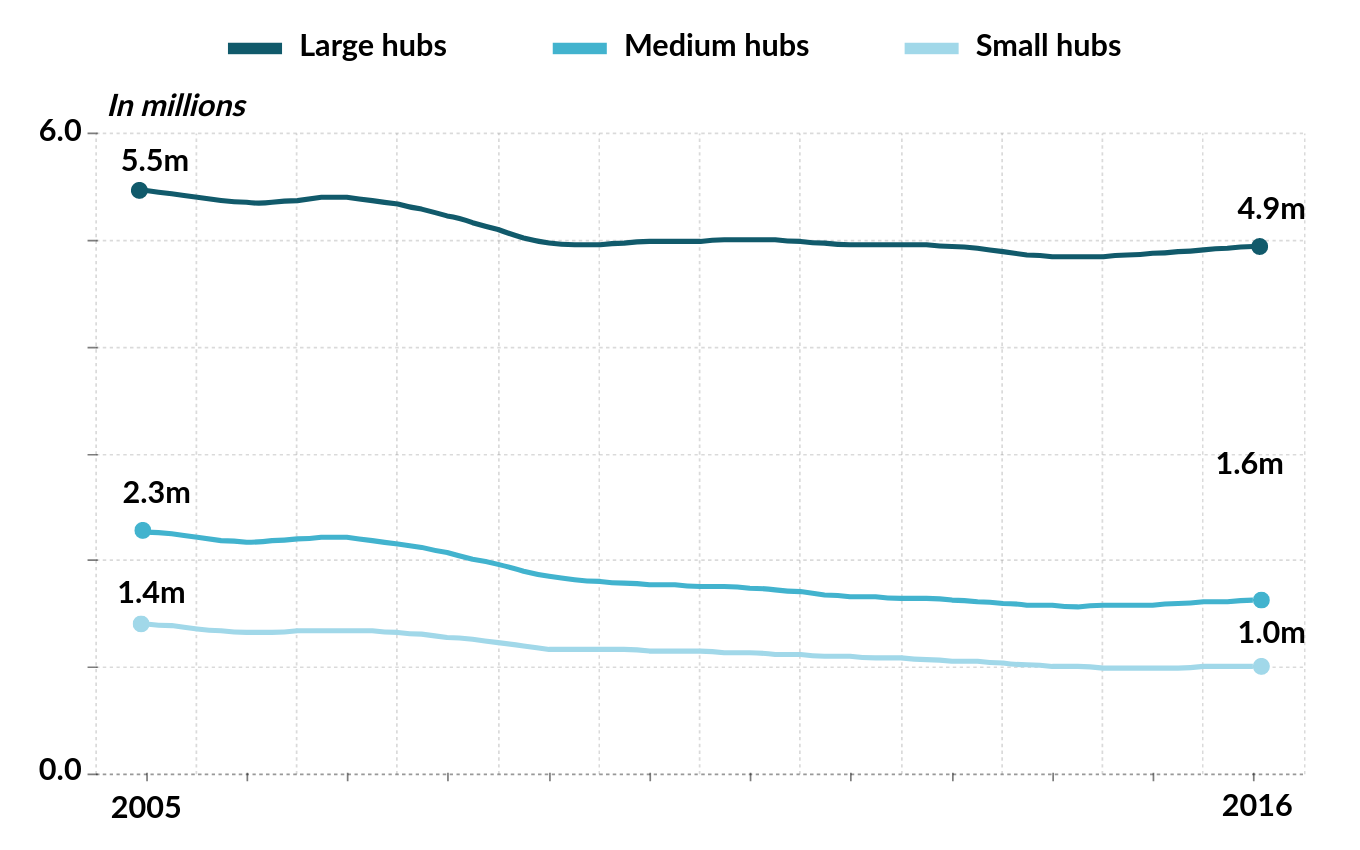

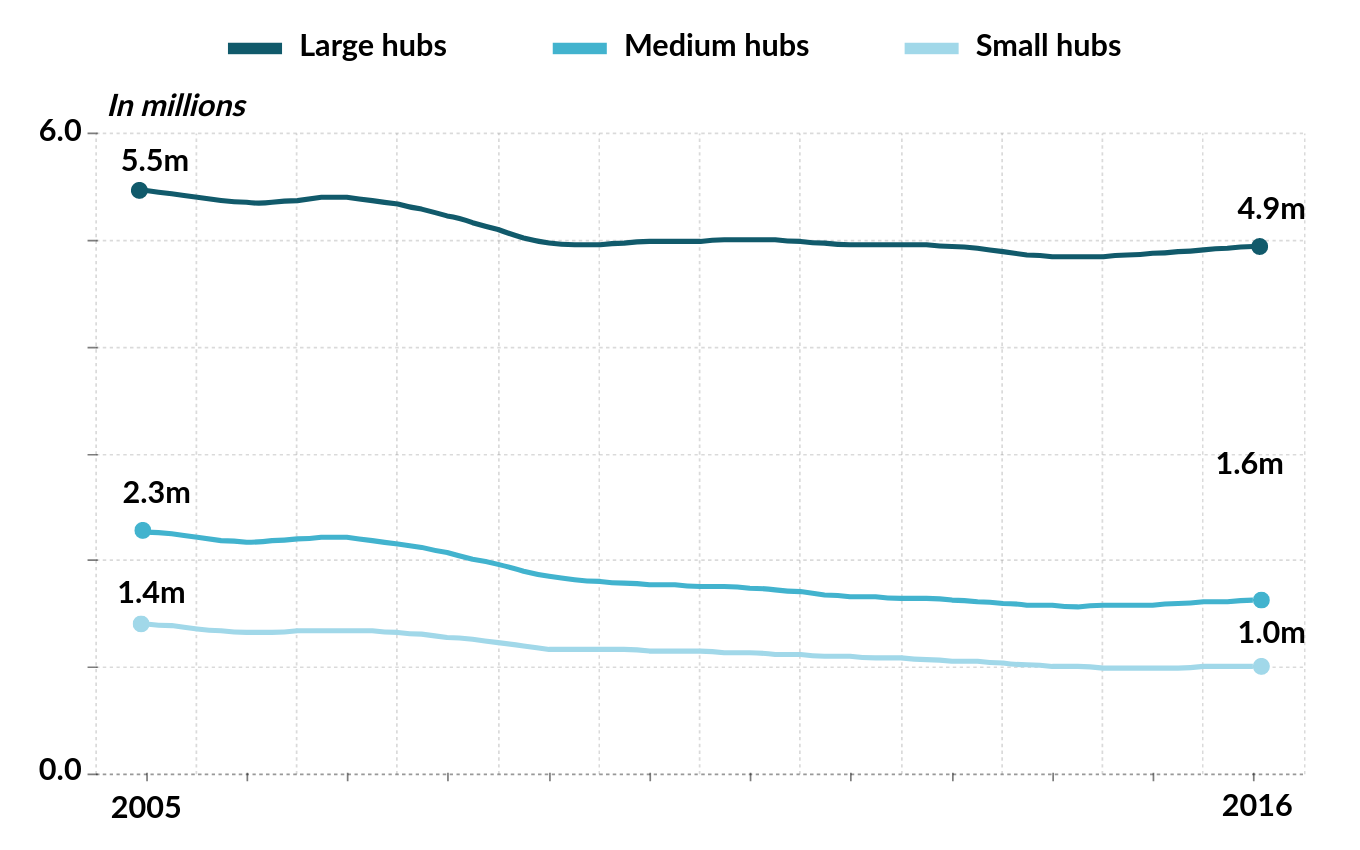

In fact, most airports are seeing fewer flights than 10 years ago, as shown in Figure 1. Of the top 50 busiest airports in the United States, only eight increased their domestic departures in the past decade.[3] While passenger traffic is up at more than half of these airports (not due to airlines flying fewer flights but larger aircraft), the need for new runways, which is the most expensive capital investment an airport can make, is actually decreasing.

Figure 1. Total number of scheduled departures at small, medium, and large hubs (2005-2016).

Source: Bureau of Transportation Statistics, “Airport Snapshot,” U.S. Department of Transportation, 2017.

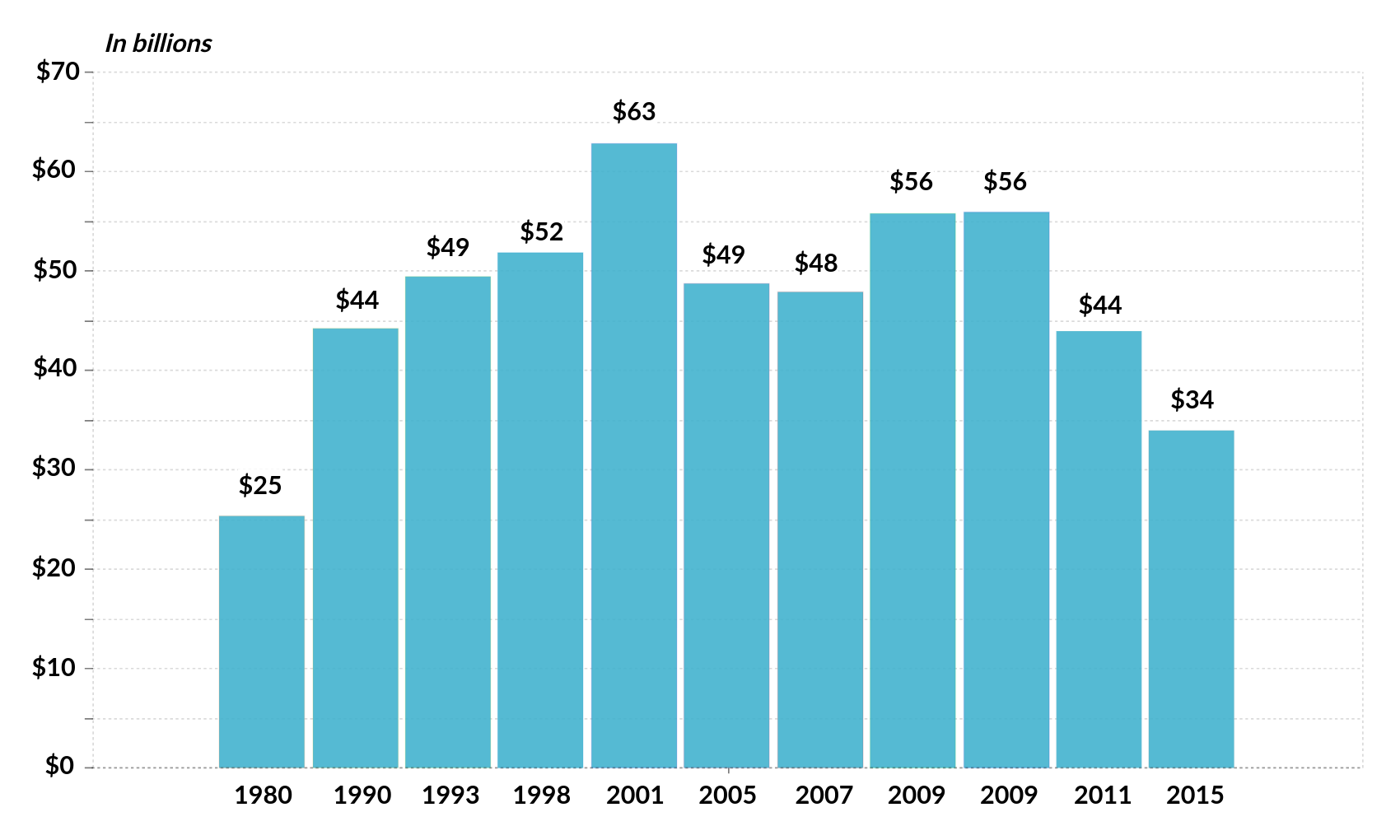

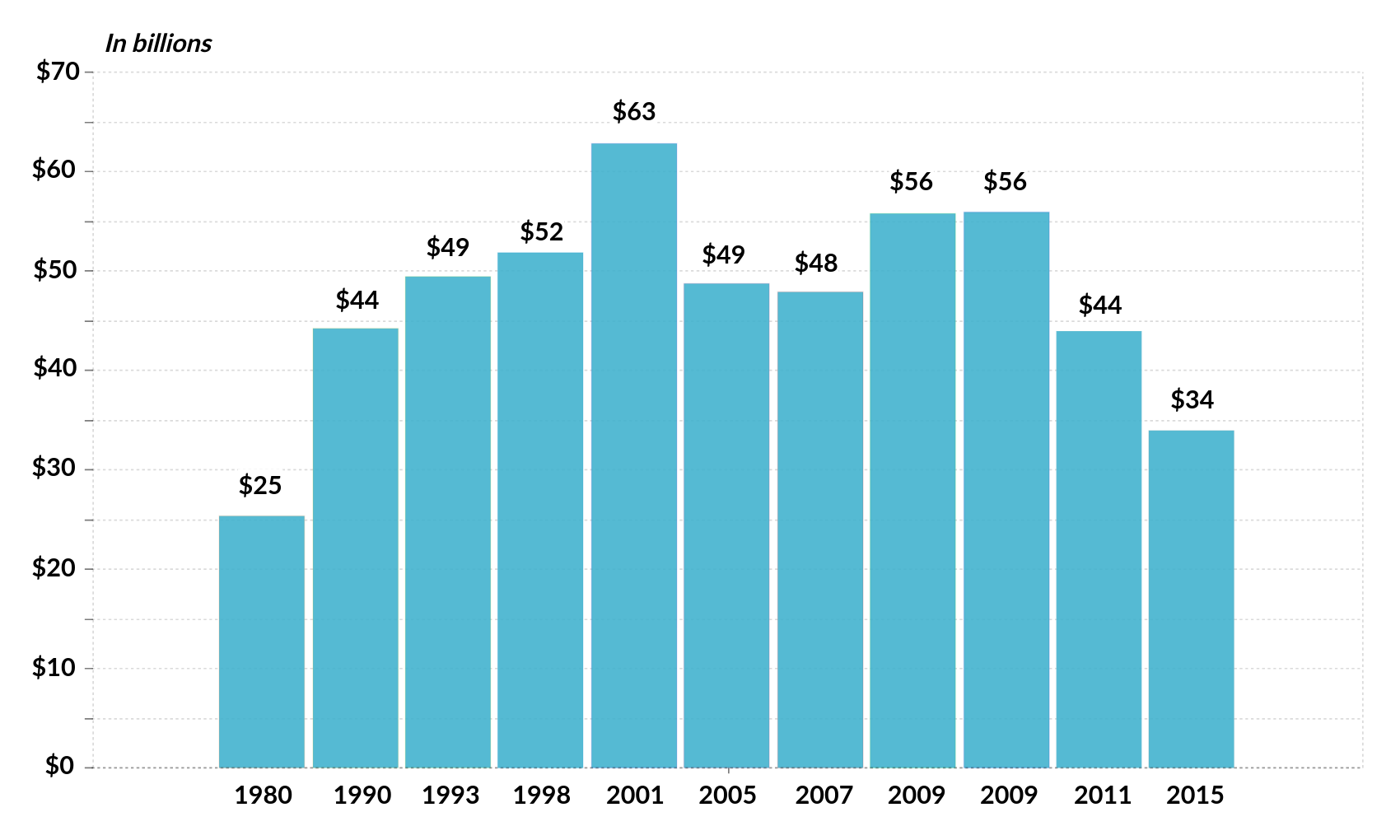

Since 2011, airports have reported a 40 percent reduction in capital investment needs. Figure 2 shows the unfunded investments such as regular maintenance, improvements in safety, and capacity expansions continue to decline (terminals and access to the airports are not included in these estimates).[4]

Figure 2. Unmet airport capital investment needs in billions of constant 2016 dollars (1980- 2015). Values in each column represent the purported needs for the following five years.

Source: Federal Aviation Administration, “Report to Congress – National Plan of Integrated Airport Systems (NPIAS) – 2015-2019,” U.S. Department of Transportation, 2015.

Three main factors explain why unmet airport investment needs are decreasing.[5] First, some airports might have capacity expansions that are beyond their five-year horizon, and therefore are not included in this estimate. Since the budget figures submitted to the FAA only measure capital needs for the next five years, any project expected to start after that period is not captured.[6] Second, the FAA has been working more closely with airports to assess their true needs. Between the 2013 and 2015 reports, airports removed 1,600 out of 19,000 projects that were deemed not feasible.[7] Finally, airports are handling fewer commercial and general aviation planes, meaning less need for capacity expansions.[8]

Regardless, $34 billion in unmet investment needs is a daunting number. However, less than half of that is for improvements at the nation’s busiest airports. Table 1 shows that among large, medium, and small airports, where 97 percent of all passengers fly, $15.5 billion in new investment is needed.

Table 1. Airport capital investment needs by airport category (2015-2019).

[table id=12 /]

Source: Federal Aviation Administration, “Report to Congress – National Plan of Integrated Airport Systems (NPIAS) – 2015-2019,” U.S. Department of Transportation, 2015.

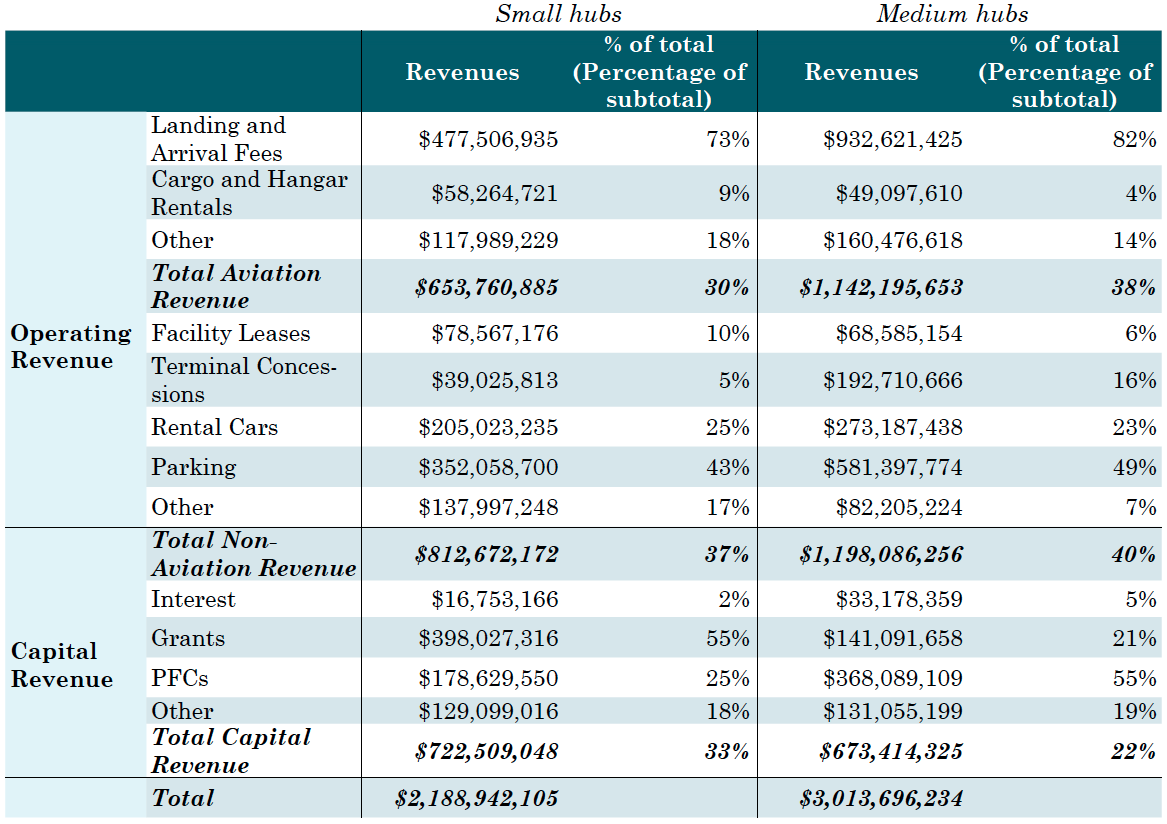

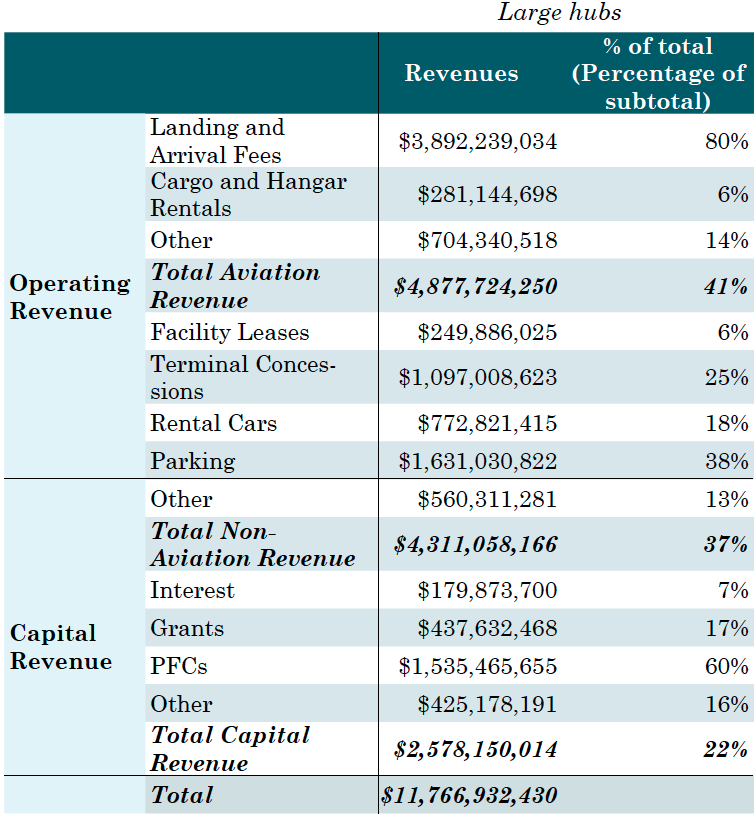

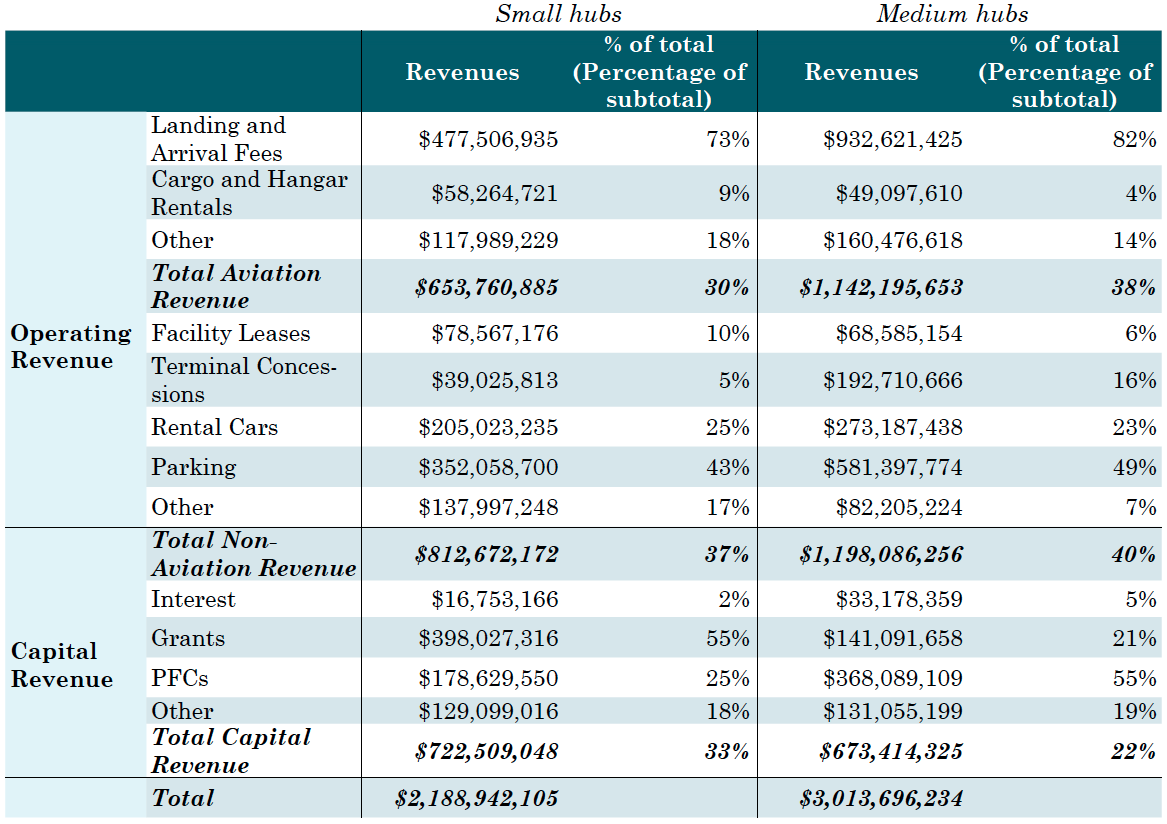

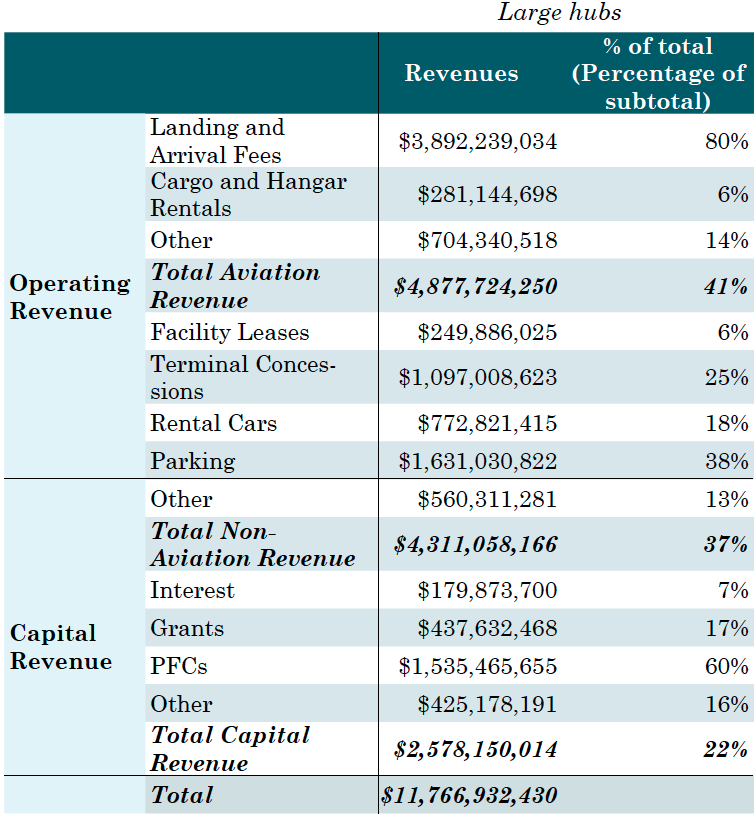

To cover their capital expansion and operating costs, airports are currently funded through a multitude of mechanisms. Table 2 shows how large, medium, and small hub airports raise revenues, including landing fees, concessions, and parking fees. Capital construction on airports comes from revenue sources that include bonds issued by airport authorities, the Passenger Facility Charge (PFC), investment by the airlines, or federal grants via the Airport Improvement Program (AIP).[11]

Table 2. Sources of revenue for small, medium, and large hubs (2016).

Source: Federal Aviation Administration, “(CATS) Certification Activity Tracking System,” U.S. Department of Transportation, 2017.

Table 2. Sources of revenue for small, medium, and large hubs (2016) (continued)

Source: Federal Aviation Administration, “(CATS) Certification Activity Tracking System,” U.S. Department of Transportation, 2017.

While the proportion of revenues for operating expenses is relatively consistent among airports, the source of revenue for capital improvements shifts as airports get smaller. Small airports are heavily dependent on federal grants through the AIP program, and larger airports mostly use revenues from PFCs for their capital needs. Under the current PFC program, the federal government allows airports to charge passengers a fixed fee up to a cap of $4.50 for capital improvements on the airport.

Airport Improvement Program

The AIP is a federal grant program funded through the Airport and Airway Trust Fund (AATF) and managed by the FAA. It distributes money to eligible projects in all public airports and select private airports. Eligible projects include enhancing airport safety, capacity, security, and environmental concerns. Depending on the size of the airport, grants from the AIP program can cover up to 95 percent of the cost of a project. In fiscal year 2016, the AIP funded more than 1,750 projects, with costs ranging from $15,000 to $36 million per project.[12]

Of the $3.3 billion that AIP distributes each year, primary airports, which carry more than 99 percent of U.S. passengers each year, receive around two-thirds of AIP funds. These airports have purported needs of $20.5 billion for the next five years. Very small non-primary airports, each with a maximum of 10,000 annual passengers, receive the remaining third. Their capital needs for the next five years are $12.6 billion.

Should the federal government invest heavily in expanding American airports to relieve congestion?

Answers:

• Airlines are moving a record number of passengers, but are using fewer flights than a decade ago. Unmet capital needs are 40 percent lower than in 2011, in part due to declining number of flights. Only a few airports, namely San Francisco, Los Angeles, Washington Reagan, and those in New York, could justify new runways in the short term.

• Current capital needs at large and medium hub airports, which carry 88 percent of all domestic traffic, are relatively low on a per passenger basis. $3.04 per passenger for five years would cover all unmet capital needs at those airports for the next five years.

• Federal grants through the AIP program will not adequately address the capacity needs of most fliers. This revenue source is vitally important to small airports, but not significant to the largest.

• New funding from the federal government to address capacity needs cannot be a one size fits all solution. Making a real difference in capacity means investing billions in just a few major airports. And new federal funding might not be enough: expanding runways can mean removing nearby homes and businesses, or affecting sensitive wildlife areas.

Eno Aviation Insights homepage

Question 8: How do taxes and fees change if air traffic control is privatized?

Eno wishes to acknowledge its Aviation Working Group, a standing advisory body that provides Eno staff with guidance and expertise on all matters related to aviation policy. The opinions expressed are those of Eno and do not necessarily reflect the views of our supporters.

[1] Ally Marotti, “Trump Tells United CEO, Other Airline Execs He Wants to Rebuild U.S. Airports,” Chicago Tribune, February 9, 2017.

[2] Eno Center for Transportation, “Addressing Future Capacity Needs in the U.S. Aviation System,” November 2013.

[3] For a full explanation see: “How has air travel in specific metropolitan areas changed in recent years,” Eno Center for Transportation, December 2017.

[4] 79 percent of the capital needs in the latest (2015) report relate to maintaining current infrastructure, with the remaining being used for capacity expansions.

[5] Federal Aviation Administration, “Report to Congress – National Plan of Integrated Airport Systems (NPIAS), 2015-2019,” U.S. Department of Transportation, 2015.

[6] A report by Airports Council International – North America, a trade group for airports, estimates that the capital needs for U.S. airports total $99.9 billion for the 2017-2021 period, an increase of 32 percent since the last estimate made in 2015. This estimate includes all airport projects, not only on the airside like the FAA’s report, and includes both ongoing and proposed projects, with each representing around 50 percent of the purported needs. See: Airports Council International – North America, “Airport Infrastructure Needs – 2017-2021,” 2017.

[7] The actual dollar amount of these 1,600 projects was not reported. See: Federal Aviation Administration, “Report to Congress – National Plan of Integrated Airport Systems (NPIAS), 2015-2019,” U.S. Department of Transportation, 2015.

[8] While traffic in the 1990s kept growing at a fast pace, airports saw the need for major investments in the near future. However, the events of September 11, 2011, combined with a struggling economy, financial problems at the airlines, and raising fuel prices, led to declines in traffic for all types of airspace users. The forecasts for the next two decades, while predicting some growth, expect that traffic for both commercial airlines and general aviation users, to be at or below the levels seen in 2001, thus reducing the need for expansions. See: Federal Aviation Administration, “FAA Aerospace Forecast – Fiscal Years 2016- 2036,” U.S. Department of Transportation, 2016.

[9] As defined by the FAA. See: Federal Aviation Administration, “Airport Categories,” U.S. Department of Transportation, 2016.

[10] Estimates cannot be made for general aviation and reliever airports, since those airports do not carry passengers commercially.

[11] Initially established in 1990 with a cap of $3.00 per passenger, the PFC maximum cap was increased to $4.50 in 2001 and has remained the limit since.

[12] Federal Aviation Administration, “Airport Improvement Program (AIP),” U.S. Department of Transportation, 2017.