Airlines in the United States are experiencing their most profitable years since deregulation.[1] However, average ticket prices are much lower than they were in the 1980s and early 1990s.[2] So what is responsible for airlines’ financial success?

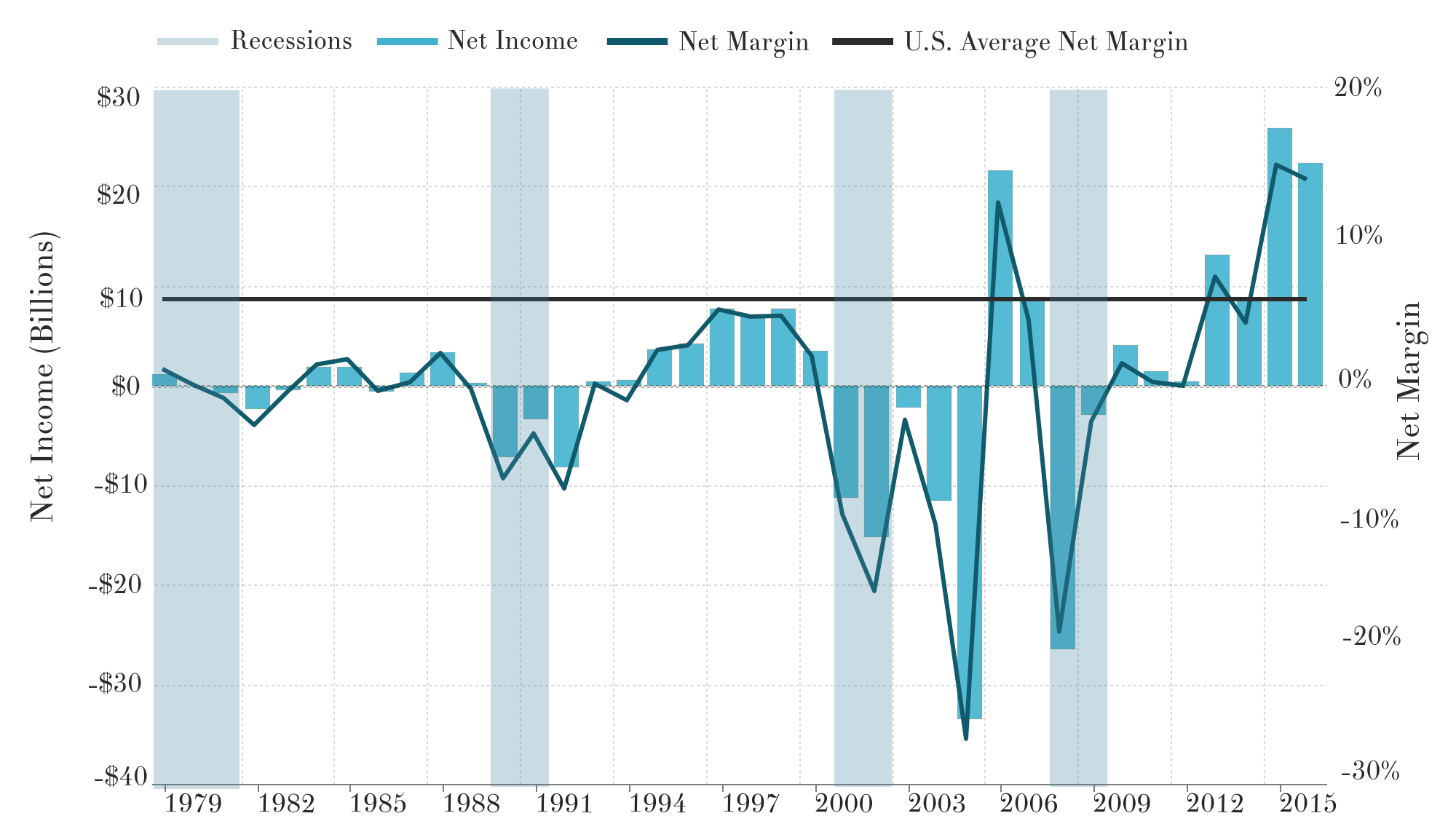

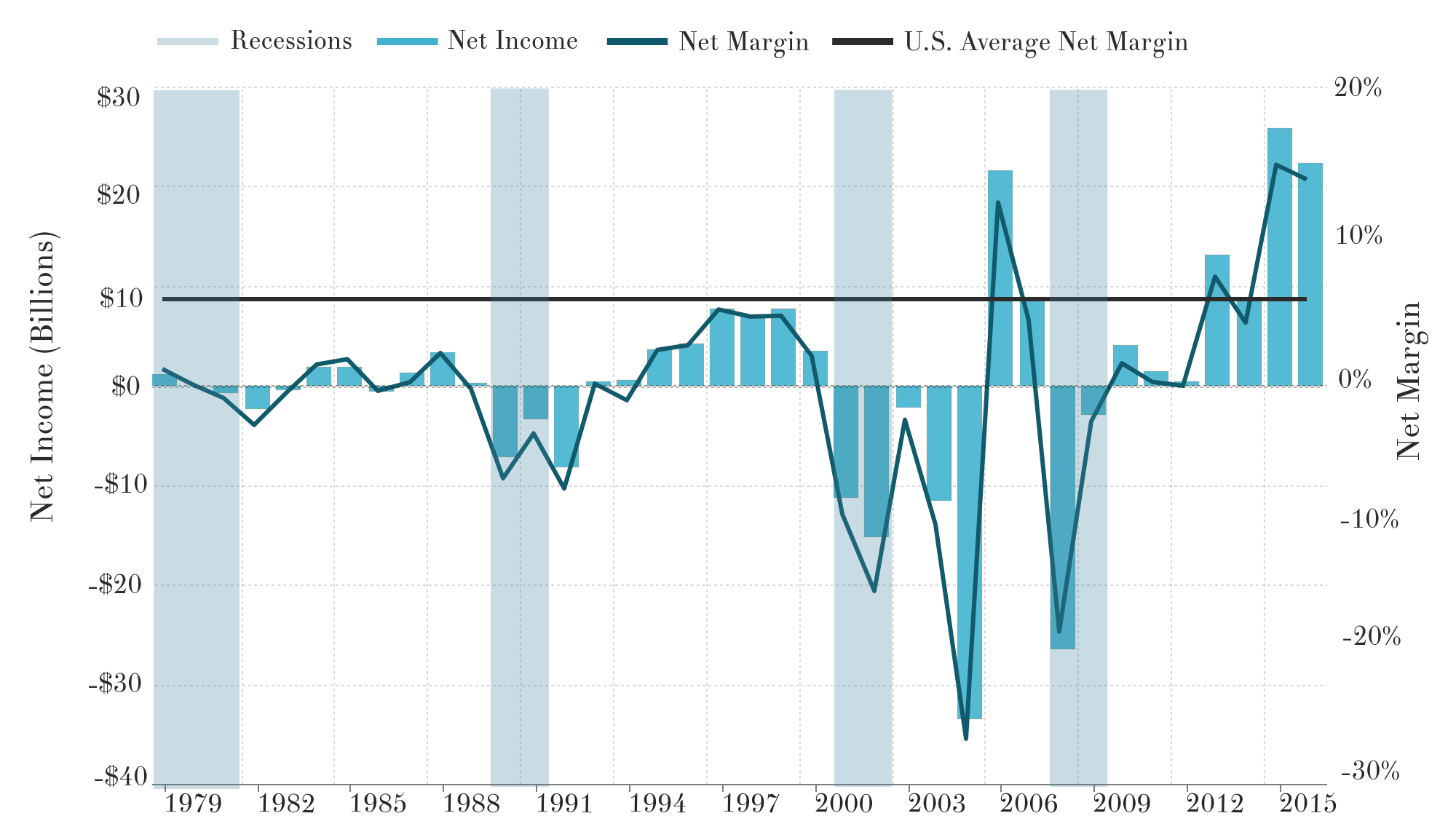

Profit margins for airlines vary considerably since air traffic is dependent on economic cycles. Naturally, both business and leisure travelers fly less during recessions and economic slowdowns. For airlines, this means cycles of boom and bust, sometimes accompanied by bankruptcies and consolidations. Figure 1 shows a comparison of airline profits to the “average net margin” of other large companies in the United States.[3] Airlines underperformed almost every year until 2013 when net income rose sharply, and much higher than the U.S. average net margin.

Figure 1. Net income and net margin for U.S. airlines

Source: Airlines for America, “Profitability Trend of U.S. Passenger Airlines in the Deregulated Era”, 2017 and National Bureau of Economic Research, “U.S. Business Cycle Expansions and Contractions”, 2017. Net income is in billions of constant 2016 dol-lars and includes all income deducted of all expenses. Net margin is the ratio of the net income over all the revenues.

The profitability after 2012 followed a spate of mergers among major carriers.[4] Continental, US Airways, Northwest, TWA, America West, and Air-Tran all folded into other airlines. This left American, Delta, Southwest, and United with nearly all of the domestic market. Consolidation allowed airlines to shed unprofitable flights, withdraw from smaller markets, and reduce the amount of major operational hubs in the U.S.[5] Eno Aviation Insights will explore the effects of the mergers on individual markets and consumers in a later brief.

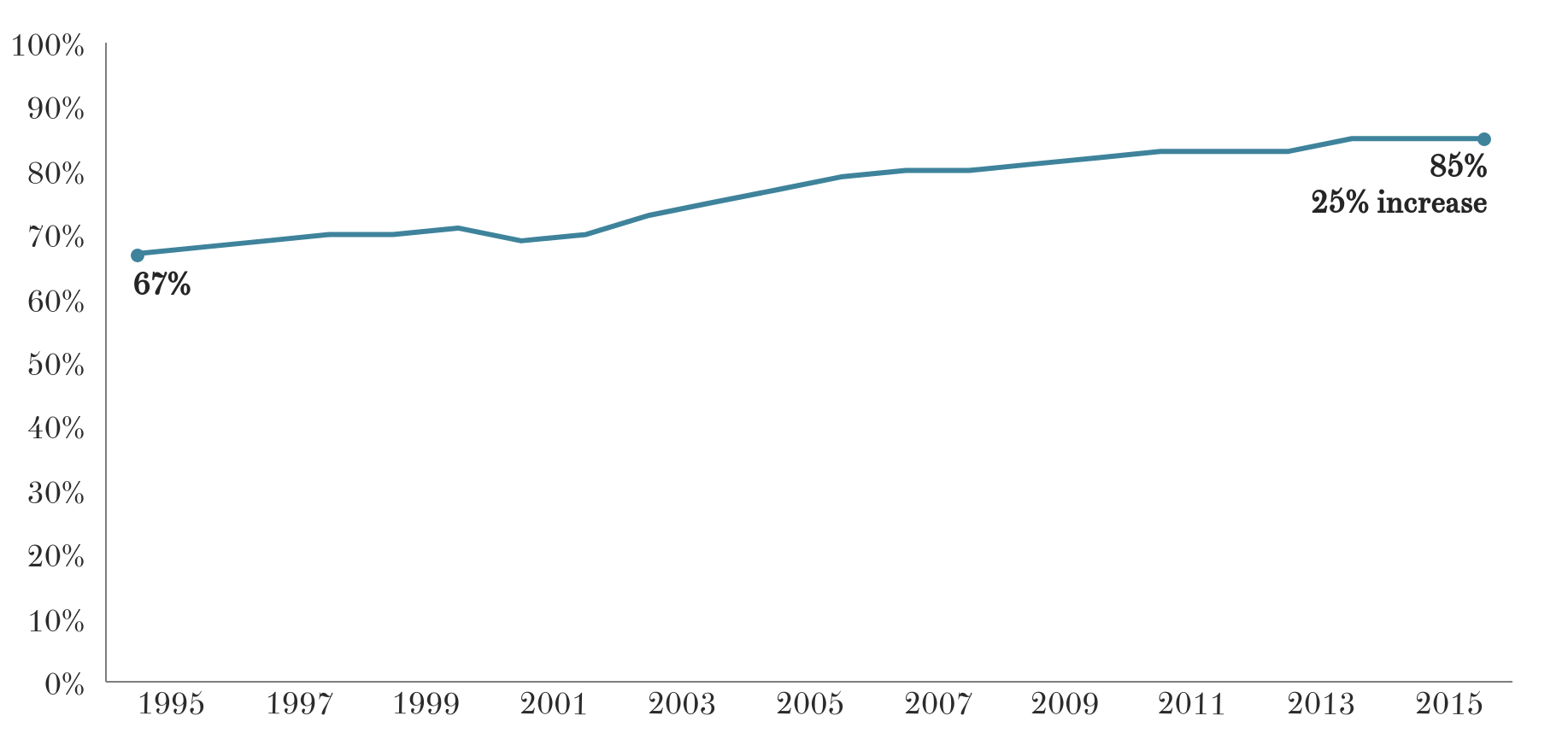

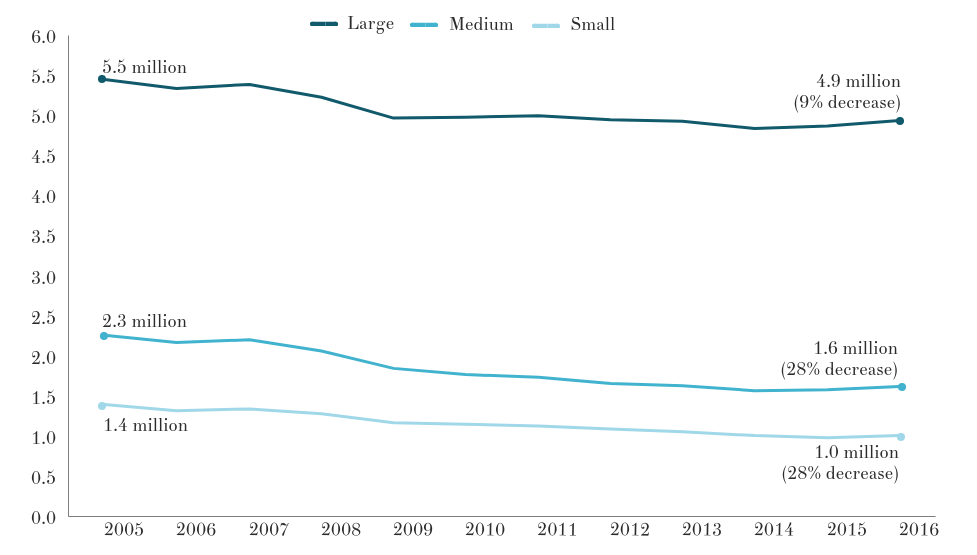

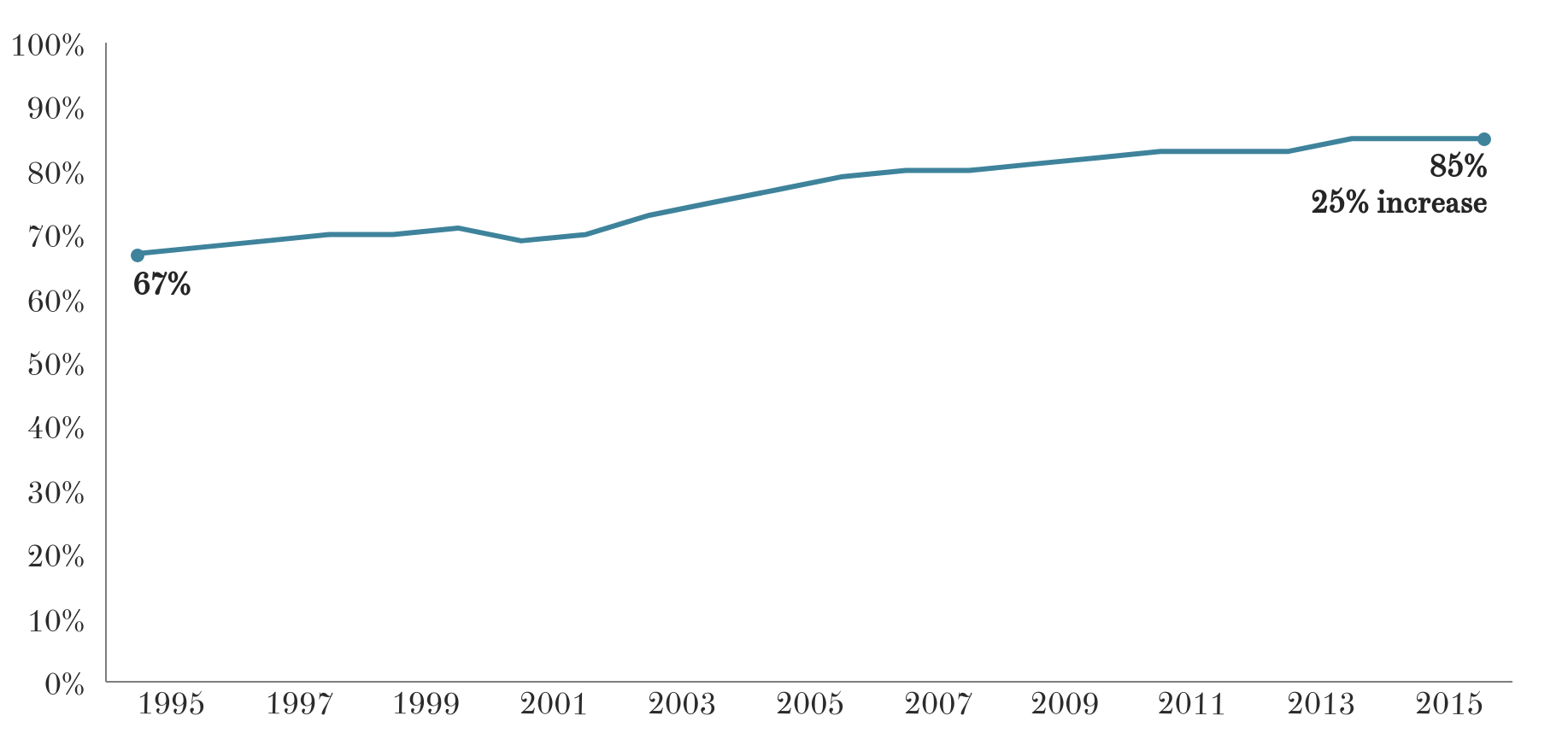

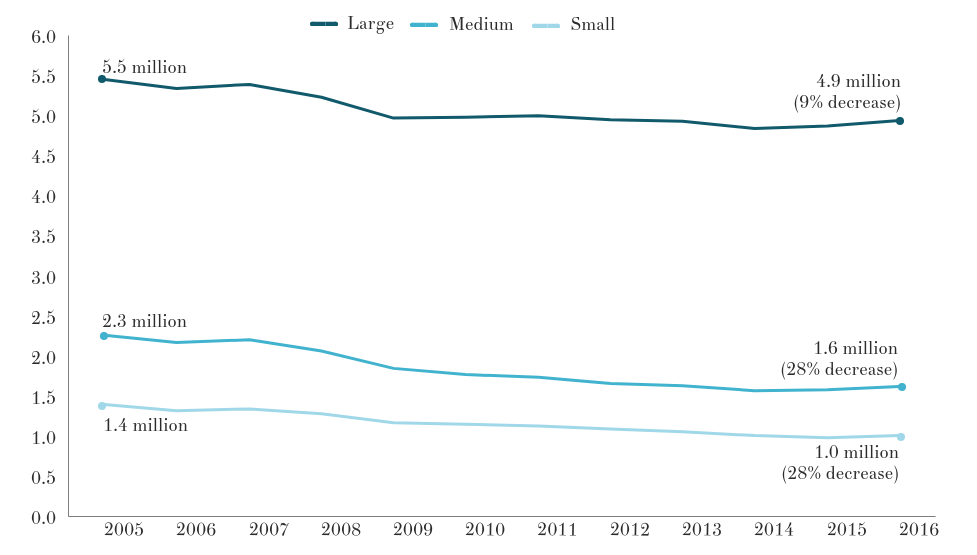

Beyond consolidation, airlines have been able to turn profits in recent years not by increasing average fares but in large part by increasing the occupancy, or “load factor,” of each aircraft as illustrated in Figure 2.[6] Higher occupancies on aircraft has helped to accommodate the increased number of flyers while decreasing the number of flights, particularly for small and medium-sized hubs where the total number of scheduled departures dropped by 28 percent since 2005 (Figure 3). Fuller flights, however, can cause headaches for travelers and airlines, as disruptions in travel such as cancellations and missed connections take longer to find a seat on another flight.

Figure 2. Load factor on domestic flights

Source: Bureau of Transportation Statistics, “Load Factor”, U.S. Department of Transportation, 2017.

Not only are load factors higher on planes today, but as seats have gotten smaller there are also more passengers in the same size aircraft. Every eight rows of seats that are reduced by four inches means adding a new row of passengers.[7]

Figure 3. Total number of scheduled departures at small, medium, and large hub airports

Source: Bureau of Transportation Statistics, “Airport Snapshot”, U.S. Department of Transportation.

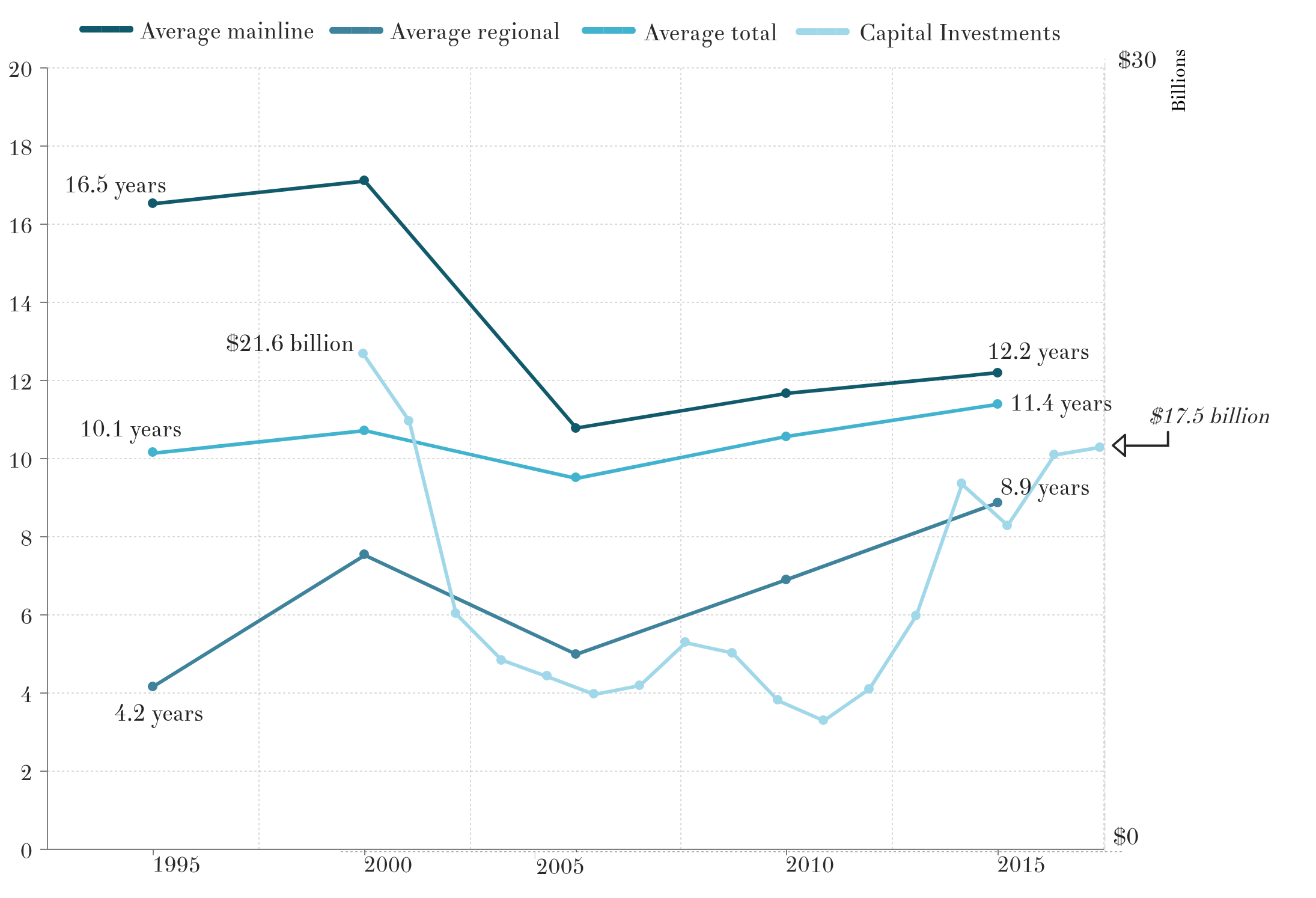

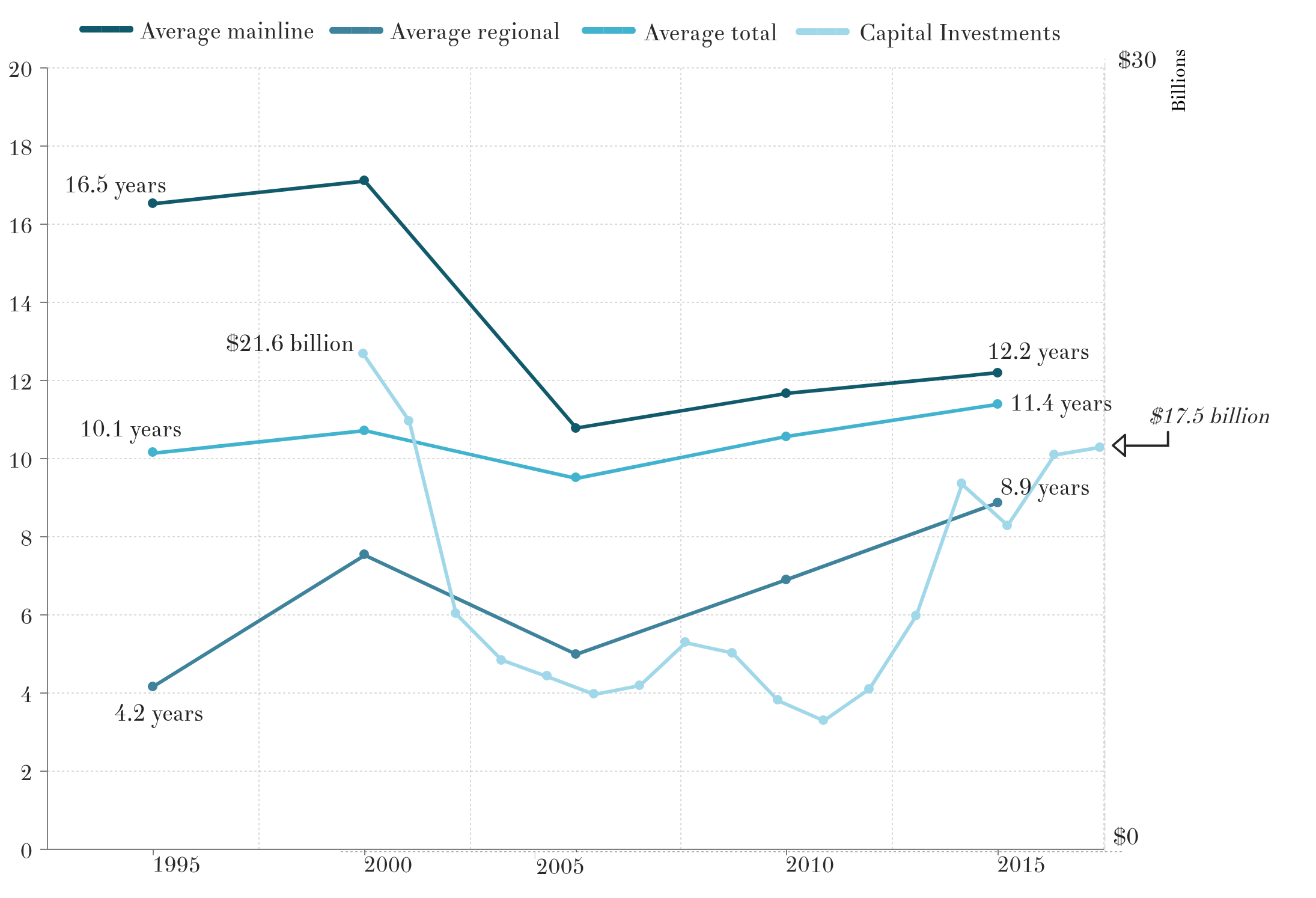

Of course, investors and shareholders benefit greatly from a profitable airline sector. Stock prices for the largest airlines neared all-time highs this summer.[8] At the same time, the average age for mainline and regional aircraft is increasing (Figure 4). It is conceivable that growing profits and margins are enabling airlines to invest more in customer product and services. Fleet renewal programs are underway at major U.S. airlines while several low-cost competitors continue to grow using new aircraft.[9]

In 2015 and 2016, capital expenditures by U.S. airlines surpassed $17 billion, a level unseen since 2001. This includes new planes, Wi-Fi equipment on aircraft, and investments at airports from check-in kiosks and baggage delivery systems, to entire terminal facilities like JetBlue’s $200 million investment at New York’s JFK airport.[10]

Figure 4. Average fleet age and capital investments by U.S. airlines

Source: Bureau of Transportation Statistics, “U.S. DOT Schedule B-43 – Aircraft Inventory”, U.S. Department of Transportation, 2017 and Airlines for America, “A4A Presentation: Industry Review and Outlook”, 2017.

How are airlines making money?

Answers:

- Airlines’ recent financial success appears to be due largely to increasing efficiencies, both from

consolidation and from accommodating more passengers on fewer flights.

- While airlines are turning record profits they are making large capital investments in assets like

fleet renewal that should directly benefit consumers.

[1] See e.g., Benjamin Zhang, “Warren Buffett’s $10 billion Airline Investment Reveals Everything You Need to Know About the Industry,” Business Insider, February 19, 2017.

[2] Eno Center for Transportation, “Jet Fuel Prices Have Dropped Significantly. Why Haven’t Ticket Prices?” Eno Aviation Insights No. 2: October 2017.

[3] Aswath Damodaran, “Margins by Sector (US)”, Damodaran Online, New York University, 2017.

[4] Eno Center for Transportation, Eno Aviation Insights No. 4, forthcoming.

[5] Claire Groden, “These cities have lost the most flights,” Fortune, July 23, 2015.

[6] While a 100-seat aircraft in 1995 had 67 occupied seats on average, in 2016 that value had risen to 85.

[7] Stephanie Rosenbloom, “Fighting the Incredible Shrinking Airline Seat,” New York Times, February 29, 2016.

[8] Nasdaq, “Airline Stock Roundup,” August 23, 2017; and Nasdaq, “Airline Stocks Regain Strength as Irma Loses Intensity,” September 12, 2017.

[9] Benjamin Zhang, “Airlines are Trying to Make Flying Less Terrible—Here’s How,” Business Insider, August 7, 2017.

[10] Heather Muse, “Can JetBlue Make Customs Less Painful? It Hopes So”, Fortune.com, November 12, 2014. One of the areas were airlines have been investing in is onboard Wi-Fi. Since Wi-Fi was first offered onboard an American Airlines flight in 2008, U.S. airlines have installed the technology in hundreds of aircraft. Now, the biggest carriers offer the service in the majority of their airplanes, with the three “ultra-low cost” carriers (Allegiant, Frontier, and Spirit) being the exception. Virgin America was the first airline to have Wi-Fi available in its fleet (in 2009). Now Delta, JetBlue, and United also do and Southwest is planning to do the same in 2017 after older aircraft are retired.

Eno wishes to acknowledge its Aviation Working Group, a standing advisory body that provides Eno staff with guidance and expertise on all matters related to aviation policy. The opinions expressed are those of Eno and do not necessarily reflect the views of our supporters.

Question 1: Is Air Travel Becoming Pricier for Travelers?

Question 2: Jet fuel prices have dropped significantly. Why haven’t ticket prices?

Eno Aviation Insights Homepage