June 21, 2018

New Jersey Transit (and Amtrak) face a July 14 deadline for getting the Federal Transit Administration (FTA) to approve their latest revised financial plan for the replacement of the Portal North Bridge, the first project of the $30+ billion Gateway Program of passenger rail projects in New York and New Jersey. The revised financial plan will take advantage of $600 million in state bonds approved by the state Economic Development Authority (NJEDA) and the New Jersey Transit Board of Directors last week.

The NJEDA will issue the bonds, which will be repaid over time by annual appropriations from the state transportation trust fund. New Jersey Transit board chairman Diane Gutierrez-Scaccetti said “We’re not going to kick the can down the road any longer. The time is long overdue for a new Portal Bridge, which is the foundation of many commuter frustrations. The taxpayers of New Jersey deserve a transportation system which will drive the economy and reliably get them to jobs, schools, and recreation.”

But Jersey Transit – and Amtrak, whose Northeast Corridor trains also use the existing drawbridge, which must be raised several times a day to allow boats to pass beneath – face a tight deadline. The Portal North Bridge project entered the Federal Transit Administration Capital Investment Grant “project development” phase on July 14, 2016. And federal law (49 U.S.C. §5309(d)(1)(C)) says that after two years in project development, a project must either get an overall rating of at least “medium” and thus be approved to enter the “engineering” phase or else be thrown out of the program. There is a provision in the statute for a project sponsor to apply for an extension of the two-year limit, but New Jersey Transit hasn’t applied for one yet and may not be intending to.

The original financial plan for the project received an overall rating of medium-high in February 2017, with both the project justification component and the local financial commitment component getting medium-high ratings. But then, NJT changed its financial plan, and that revised plan was downgraded by FTA in November 2017 because the local financial commitment portion of the rating had been downgraded.

The downgrading had to do with the bonds. The second plan replaced a $335 million federal loan assumption with $336 million in proposed state bonds, but the bonds had not been approved or even budgeted at the time FTA did that rating. The initial rating for local commitment of capital and operating funds was “medium-high” because, FTA said, “Approximately 57 percent of the non-Section 5309 Core Capacity funds are committed or budgeted, and the rest are considered planned.” Because of the bonding issue, the November 2017 rating for this was medium-low because “Approximately 21 percent of the non-Section 5309 Core Capacity funds are committed or budgeted, and the rest are considered planned.”

With the bonds now approved, at least 87 percent of the non-section 5309 money will likely be considered committed or budgeted, which should be more than enough to get the project to a better rating. But the timing of the re-rating is an issue–as noted above, FTA has not yet received the paperwork for a new rating (well, as of today they had not) and they are facing a July 14 deadline. The fiscal 2018 omnibus appropriations act’s accompanying report language “directs the Secretary to provide updated project ratings expeditiously at the request of the project sponsor.” But “expeditiously” is open to interpretation, and July 14 is not that far away.

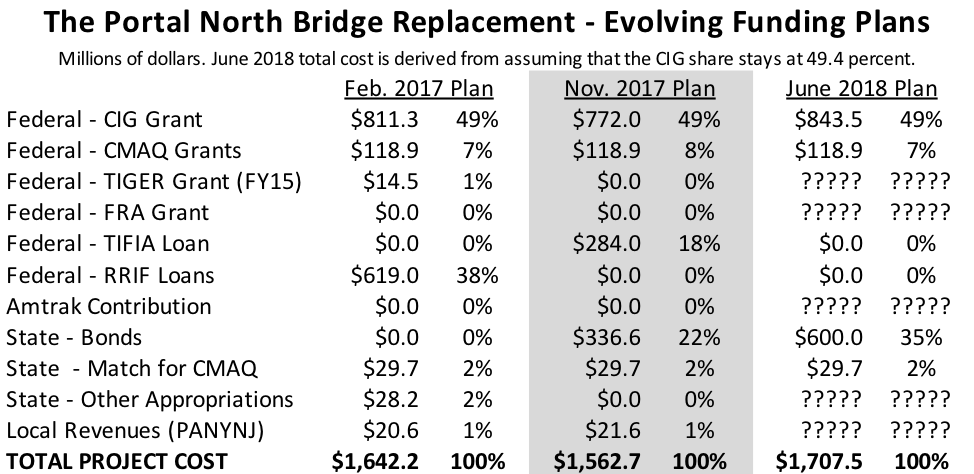

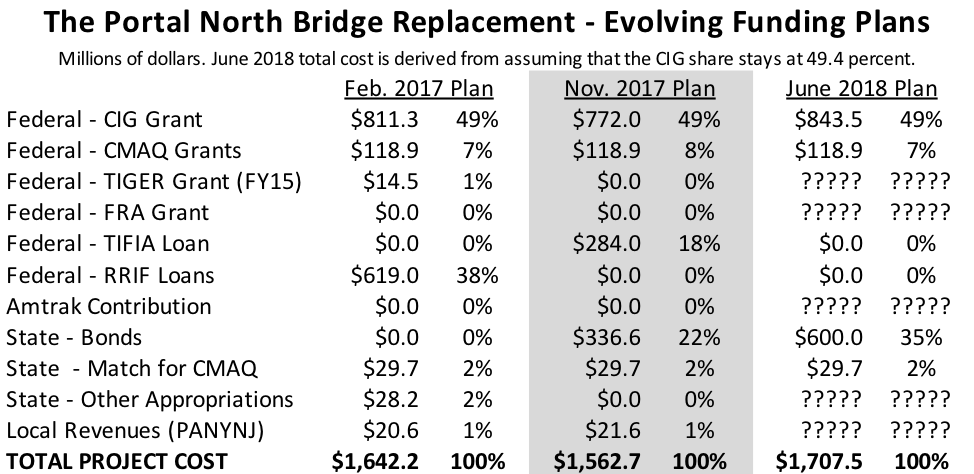

We expect the revised financial plan for the Portal North Bridge to look like this:

- CIG share –The NJEDA bond document says that the Capital Investment Grant appropriations promise in the revised plan will be “$844 million” and a source tells us that is rounded up from $843.5 million.

- Total project cost – Under the previous two iterations of the funding plan, the CIG share of total cost was 49.4 percent both times. So extrapolating that out, if we assume that the CIG share will be $843.5 million, the total project cost in the revised plan will be about $1,707.5 million (843.5 divided by 0.494).

- State bonds – As noted above, the revised plan includes $600 million in state bonds to be repaid from the state’s transportation trust fund.

- Federal loans – The first financial plan assumed $619 million in loans from the federal government and zero in state bonds. The second plan assumed $284 million in federal loans and $337 million in state bonds ($621 million total). Now that the state bonds are (a.) formally approved and (b.) increased to a total of $600 million, it is expected that the Portal Bridge project will not ask for any federal loans at all.

- CMAQ – The earlier financial plans assumed a total of $148.6 million in highway CMAQ formula money – 80 percent federal ($118.9 million) and 20 percent from the state DOT ($29.7 million). The bond document says that the CMAQ funding will be in the financial plan, and we don’t expect those numbers to change in the final financial plan.

- Other state/local funds – Aside from the CMAQ match, the first financial plan assumed $48.8 million in other state/local funding and the second plan assumed $21.6 million in such funding. We’re not sure what the final amount will be.

- Other federal funds (including Amtrak) – The first financial plan included a FY 2015 TIGER grant of $14.5 million, but the scope of the work funded by that grant was dropped from the second financial plan so the TIGER grant was not included. The bond document says “The other sources of funding for the Project, in addition to the proceeds of the 2018 Bonds and the CIG grant funds include a contribution from Amtrak for FRA grant proceeds, other Amtrak contributions” as well as the CMAQ money. We have no idea which FRA grant program to which they refer, nor do we know how much of Amtrak’s Northeast Corridor capital funding (which was greatly beefed up in the fiscal 2018 omnibus appropriations act) they intend to put towards this project.

However, the $843.5 million CIG share plus the CMAQ money plus the bonds total $1.592 billion, which means that all of the other state, local, federal and Amtrak funds only need to add up to $115 million to get to our assumed total project cost.

The transit community has been thrown into an uproar over the last sixteen months by the insistence of the Trump Administration of treating federal loans (from the TIFIA and RRIF programs) as the equivalent of federal grants when looking at the total level of state or local financial commitment. By this metric, the original Portal North Bridge application was a non-starter, with 95 percent of the funding coming in the form of either a federal grant or a federal loan. In the second financial plan, that number had dropped to 75 percent. In the upcoming revised financial plan, that percentage should drop to around 56 percent to 61 percent, depending on the mix of other federal grants versus state and local appropriations.

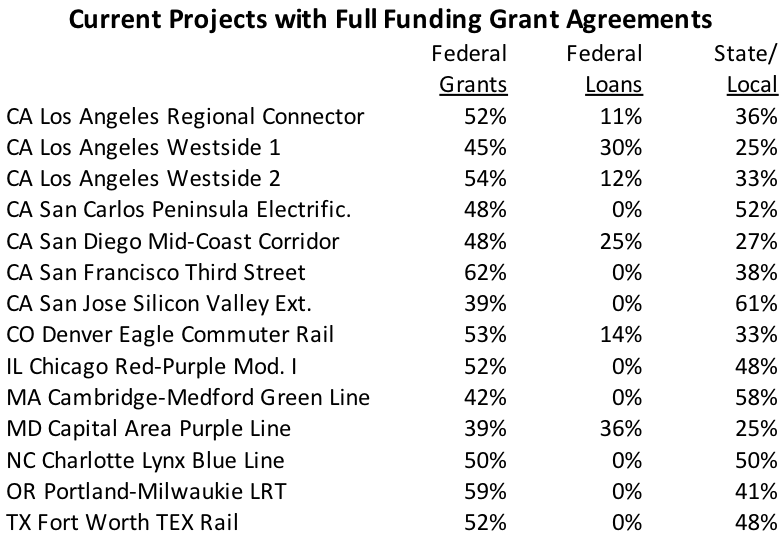

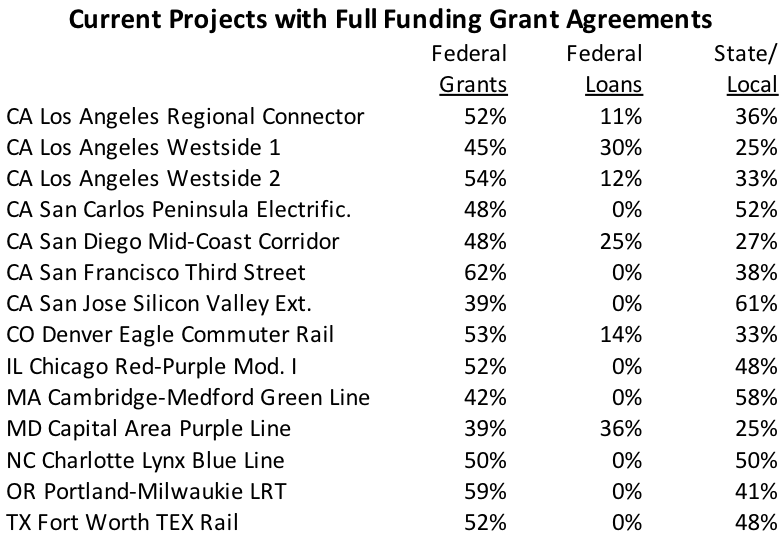

A state/local share of north of 40 percent, treating federal loans as federal grants, would put the Portal North Bridge project squarely in the mainstream of the ongoing CIG projects that have already received full funding grant agreements (FFGAs), as shown in the table below. In particular, the Trump Administration has only approved two FFGAs so far, and in one of them (the Maryland Purple Line), the federal grants and federal loans totaled 75 percent of the total project cost.