With high gas prices much on the mind of voters, a group of Democratic Senators led by Mark Kelly (D-AZ) and Maggie Hassan (D-NH) this week introduced a bill to suspend the current 18.4 cents-per-gallon federal excise tax on gasoline from the date of enactment of the bill through December 31, 2022.

“Arizonans are paying some of the highest prices for gas we have seen in years and it’s putting a strain on families who need to fill up the tank to get to work and school,“ said Kelly. “This bill will lower gas prices by suspending the federal gas tax through the end of the year to help Arizona families struggling with high costs for everything from gas to groceries.”

“This legislation is about making sure that we get Granite Staters relief at the gas pump. People are feeling a real pinch on everyday goods, and we must do more to help address rising costs, particularly the price of gas,”addedHassan. “We need to continue to think creatively about how we can find new ways to bring down costs, and this bill would do exactly that, making a tangible difference for workers and families.”

The bill is S. 3609 and the preliminary text can be read here.

The politics. These are the Democratic Senators sponsoring the new legislation, along with the Cook Political Report rating of their 2022 re-election prospects.

- Kelly (AZ) – Toss Up

- Hassan (NH) – Lean D

- Warnock (GA) – Toss Up

- Cortez Masto (GA) – Toss Up

- Rosen (NV) – not up until 2024

- Stabenow (MI) – not up until 2024

Kelly, Hassan, Warnock, and Cortez Masto are the only four Senate Democrats rated as anything less than “Solid D” by Cook at this point, so seeing the four of them together on a bill does inform a person which way the winds are blowing.

Now, lest you think this is a partisan issue, it’s not. In fact, during the 2008 election year, it was another Senator from Arizona, John McCain (who had just become his party’s Presidential nominee that year), who introduced S. 2890 (110th Congress) in April 2008, “to provide for a highway fuel tax holiday.” McCain’s bill (which was cosponsored by eight of his colleagues) was a bit different than the new Kelly-Hassan bill – it would have suspended both gasoline and diesel taxes, not just gasoline, and would only have lasted from May 26 to September 21, 2008, instead of from “date of enactment” to December 31. And the McCain bill was drafted by someone who was much more familiar with the way the fuel tax works than the Kelly-Hassan bill. (Lots of complicated “floor stocks” stuff in the McCain bill.)

Not to be outdone, the week after McCain introduced his bill, Sen. Hillary Clinton (D-NY), who was still fighting Barack Obama (D-IL) for the Democratic nomination for President, introduced her own motor fuel tax holiday bill (S. 2971, 110th Congress) of the same duration as McCain’s. But Clinton’s bill added a profits tax on oil companies, a suspension of SPR purchases, and the usual direction to the FTC and the CFTC to monitor price gouging.

Both the McCain bill and the Clinton bill, like the new Kelly-Hassan bill, required the Treasury to calculate the amount of revenue that was being lost because of the tax holiday and then deposit an equivalent amount in the Highway Trust Fund anyway. Depositing imaginary money into the Trust Fund has become old hat today, but it’s worth remembering that McCain and Clinton proposed this before the Trust Fund went broke in September 2008.

Technical problems. Because the federal motor fuel taxes are applied at the wholesale level (the refinery or tank farm, depending on some other factors), there is no guarantee that reducing the federal tax by 18.4 cents per gallon will result in anything like an 18.4 cent reduction at the pump. Even if fuel producers and wholesalers are inclined to pass every dime of potential savings onto the customers (big “if”), what happens if the 18.4 cent per gallon tax cut comes along just as the cost of new crude deliveries to the refinery increases by several dollars a barrel and increases the cost of producing a gallon of gasoline by, say, 10 cents? (Hint: the oil cost increase will partially offset the tax cut when reflected in the price charged to the retailer.) And then, of course, the actual price at the pump is set by the gas station owner, who has their own agenda.

And there is the overriding legal problem of S. 3609 being a Senate bill and the gas tax being a tax, meaning that it would be unconstitutional for both chambers to just pass S. 3609. At some point it would have to be added to a House-passed tax bill with an H.R. bill number. (Not that this thing is going anywhere.)

The cost.The Congressional Budget Office’s last baseline (all the way back in July 2021) projected that net gasoline tax receipts to the Highway Trust Fund would total $25.3 billion in fiscal 2022 and $25.6 billion in fiscal 2023. Doing just the de minimis back-of-envelope math, assuming a hypothetical enactment date of March 1, 2022 for S. 3609 and assuming all months are equal, 5/12ths of FY 2022 and 3/12ths of FY 2023 would total $21.1 billion in foregone revenue. The new revenue baseline will probably be slightly different, and if the Congressional Budget Office were to score this legislation, they might choose a different assumed enactment date and the result of that and the different baseline and the possible use of monthly rather than annual receipt data might cause a slightly different score. But it would still be in the ballpark of $20 billion of lost tax revenue.

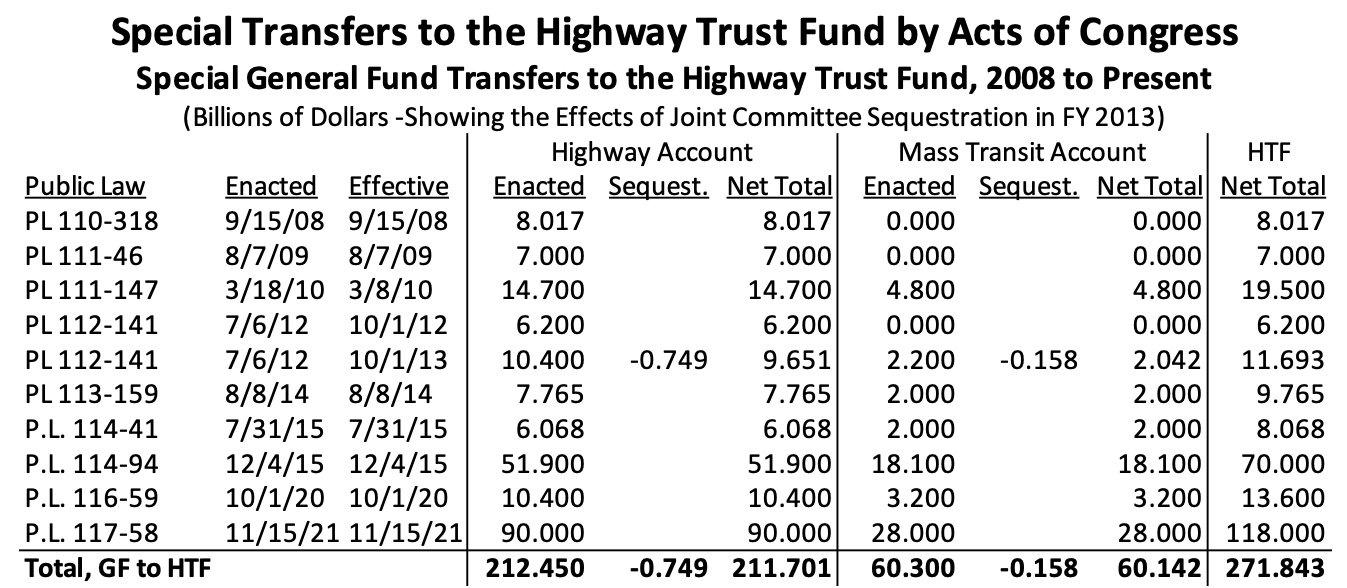

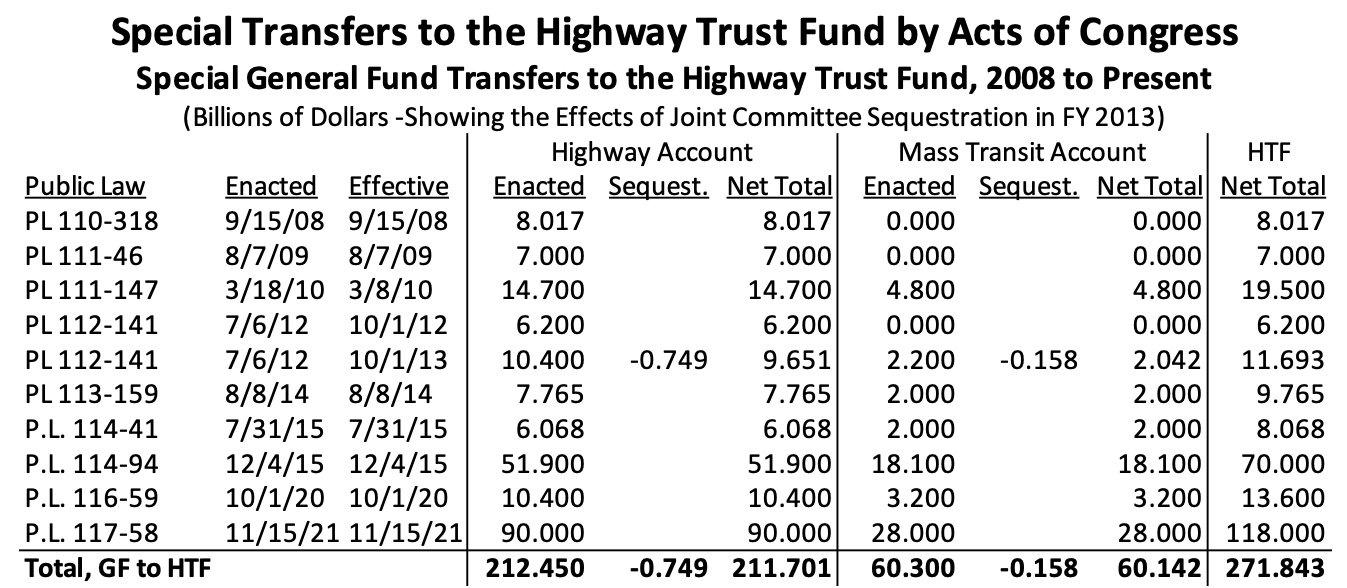

That $20-some billion would represent real tax dollars not being collected and thus not being deposited into the purportedly user-pay, user-benefit Highway Trust Fund. But, as the following table shows, Congress has already deposited $272 billion of imaginary money into the Trust Fund since it first ran out of real user taxes in 2008, so it’s not as if the user-pay basis can get much weaker.