October 12, 2018

Presentations of future Highway Trust Fund financial operations are generally done on a cash flow basis, and present four lines of numbers over multiple fiscal years – start each year with a beginning balance in the Trust Fund, add that year’s anticipated excise tax receipts (plus interest and safety penalties), then subtract that year’s anticipated outlays, resulting in an end-of-year balance, which then gets moved to the top of the next year’s column. (For an example, see the Congressional Budget Office’s April 2018 rounded-to-the-billion-dollars baseline here.)

This kind of presentation is good for certain kinds of analysis, but is notably deficient in distinguishing between controllable expenditures and uncontrollable expenditures. We have often wondered: is there a better way to present this information to make this distinction easier? And now that the new fiscal year has begun, this is a good time to examine the question again.

Realistically, there are two types of “uncontrollable” spending – legally uncontrollable, and politically uncontrollable. The former category is straightforward – if the federal government has already entered into a legally binding spending obligation, the federal government has to spend (outlay) the money to liquidate that obligation, or else the person to whom the money is owed can go to court and get the money that way.

“Politically uncontrollable” spending is a bit more complicated. One way to look at it is if the budget authority has already been provided but not yet obligated. For a bill containing multi-year contract authority like the FAST Act, the budget authority is provided several years in advance. Congress could, in theory, repeal some of that money before it comes up from obligation, but practically speaking there is zero appetite (and really no legislative vehicle) for doing so.

(Dividing up future outlays into outlays from prior year obligations and outlays from future year obligations requires detailed account-level data from either the Office of Management and Budget or the Congressional Budget Office that is normally not available to the public.)

As mentioned above, we just started a new fiscal year (Anno Pecunia 2019), which is the perfect time to distinguish between such types of Trust Fund spending. Legally uncontrollable spending comes from legally binding obligations entered into prior to October 1, 2019, to be drawn on the Trust Fund, so we split up Federal Highway Administration outlays (subject to limitation) and Federal Transit Administration outlays, from the Congressional Budget Office April 2018 baseline over the next decade, and isolated only those projected to stem from pre-FY19 obligations.

Then we took the FAST Act’s provided new spending levels for FY 2019 and FY 2020 and entered the long-term cost of those outlays separately using standard CBO annual outlay rates.

Then we added the baseline outlays for the next ten years for the National Highway Traffic Safety Administration and the Federal Motor Carrier Safety Administration (since (a) no one is proposing to kill NHTSA or FMCSA ever, and (b) we weren’t able to get access to the data breaking down their future outlays by year of obligation) and the $739 million per year in permanent mandatory funding for highways outside the regular budget process (since messing with that has PAYGO implications and is more trouble than it’s worth).

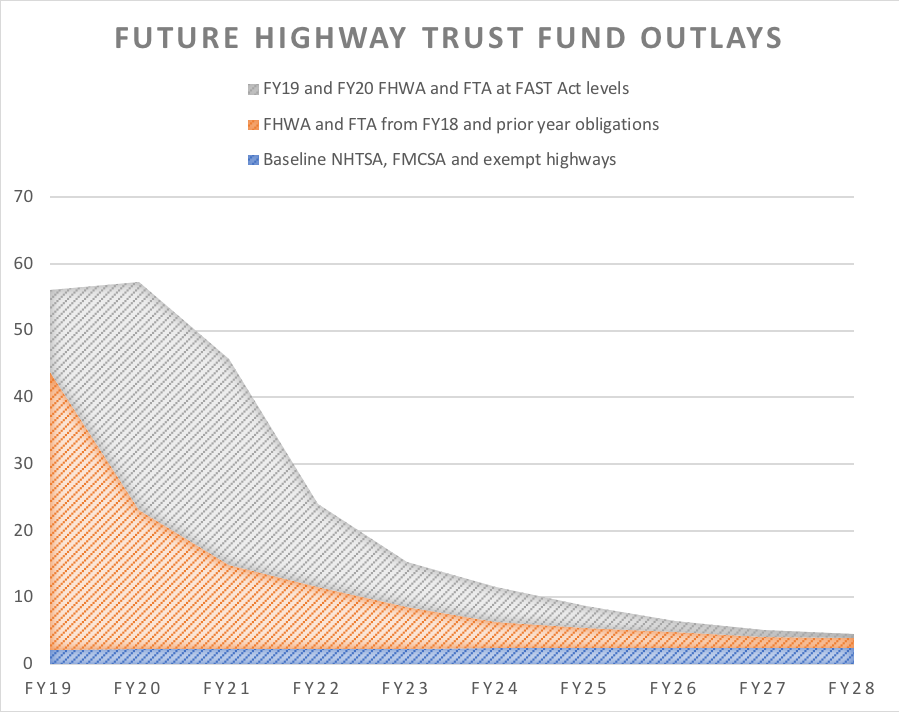

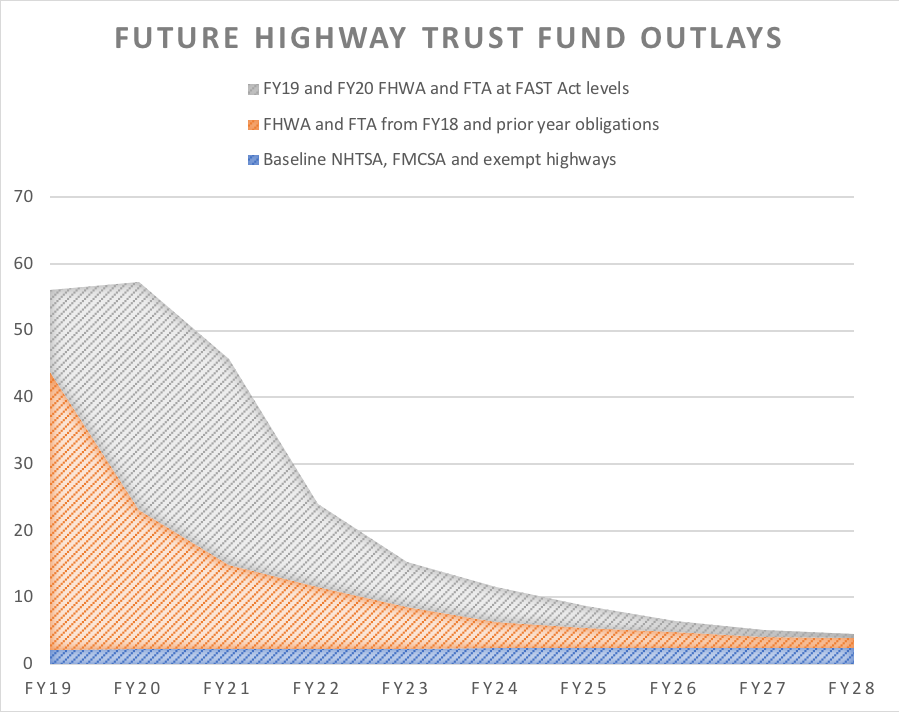

Then we graphed all of these together in the following chart. The blue strip at the bottom of the chart is the permanent baseline for NHTSA, FMCSA and the $739 million per year in exempt highway funding. Then the orange area above it represents all of the legally uncontrollable outlays from highway and transit obligations incurred prior to October 2, 2018. Then the gray area at the top represents the cost of the FAST Act’s FY 2019 and FY 2020 highway and transit funding.

(The Highway Account and the Mass Transit Account are combined for the purpose of this exercise. Left axis is in billions of dollars.)

The blue strip along the bottom averages $2.3 billion per year ($23.3 billion over the ten-year FY 2019-FY 2028 period). The orange area – the legally uncontrollable outlays from FHWA and FTA from pre-FY19 obligations – totals $103.2 billion over ten years. (That means that even if you could get in a time machine, go back to last week, and shut FHWA and FTA down permanently, with no new projects approved, ever, they would still have to pay over $103 billion to liquidate past obligations.) And then the gray area totals $108.2 billion in new highway and transit funding commitments for the last two years of the FAST Act.

| Future HTF outlay commitments |

|

| Baseline NHTSA, FMCSA and exempt highways |

$23.3 billion |

| FHWA and FTA from FY18 and prior year obligations |

$103.2 billion |

| FY19 and FY20 FHWA and FTA at FAST Act levels |

$108.2 billion |

| TOTAL COMMITTED (LEGALLY AND POLITICALLY) |

$234.7 billion |

So, starting last week, there are still about $235 billion in future Highway Trust Fund funds that are more or less committed to be spent in the coming years to fulfill the FAST Act and maintain safety programs indefinitely.

How much money will be available to meet these claims?

We won’t have the end-of-FY18 balance levels for the Trust Fund until sometime around October 15-17. But the April 2018 CBO projection was that the Trust Fund would end the year with a total of $42.3 billion in cash on hand (all of it, one could argue, from the $70 billion in transfers from the general fund made in December 2015 by the FAST Act). Then the CBO baseline of net Trust Fund excise tax receipts for the last two years of the FAST Act totals $82.9 billion, for a total remaining revenue at the end of the FAST Act of $125.1 billion.

| Available revenues/transfers |

|

| End-of-FY18 HTF cash balances projected to be |

$42.3 billion |

| Baseline excise tax receipts for FY19 and FY20 total |

$82.9 billion |

| TOTAL CASH AVAILABLE BY END OF FAST ACT |

$125.1 billion |

If, from this point onwards, future spending liabilities from the FAST Act and prior authorizing legislation total $235 billion and the future funding available to pay those liabilities will only total $125 billion, then where will the other $110 billion to pay off the remainder of the obligations incurred before October 1, 2020 (plus NHTSA and FMCSA) come from? In the first place, obviously, from tax revenues collected after the FAST Act expires. CBO currently projects that the Trust Fund will collect $41.3 billion in net taxes in FY 2021, $41.1 billion in net taxes in FY 2022, and $40.9 billion in net taxes in FY 2023. So paying off all pre-FY21 Trust Fund obligations will require every tax dollar (at current rates) collected in 2021 and 2022 and three-fourths of all the tax dollars collected in 2023.

This has always been the big problem with plans to “devolve” or “turnback” most highway and transit funding to states and localities – the transition period. If you wanted to devolve most of these programs after the FAST Act ends, you still need to keep the current federal taxes going for 2.75 years after you devolve everything to the states, just to pay off the old bills. But states would have to raise their taxes immediately to take over spending responsibility, which would lead to a multi-year period of double taxation for highway users.

But if Congress wants to keep authorizing new spending from the Trust Fund after the expiration of the FAST Act, this will require more money from somewhere. All of the FY 2021 and FY 2022 Trust Fund tax receipts and three-fourths of the FY 2023 tax receipts are already spoken for in order to pay off FAST Act obligations, so any money to continue highway and transit programs past September 2020 has to come from some combination of post-2023 tax receipts at existing rates, excise tax increases, or more general fund bailouts.

Put another way, the FY 2020 highway and mass transit obligation limitations under the FAST Act total $56.5 billion, so presumably a FAST Act extension would provide at least that much for 2021. CBO projects Trust Fund tax receipts at existing tax rates to be stable at around $40 billion per year for the rest of the decade…