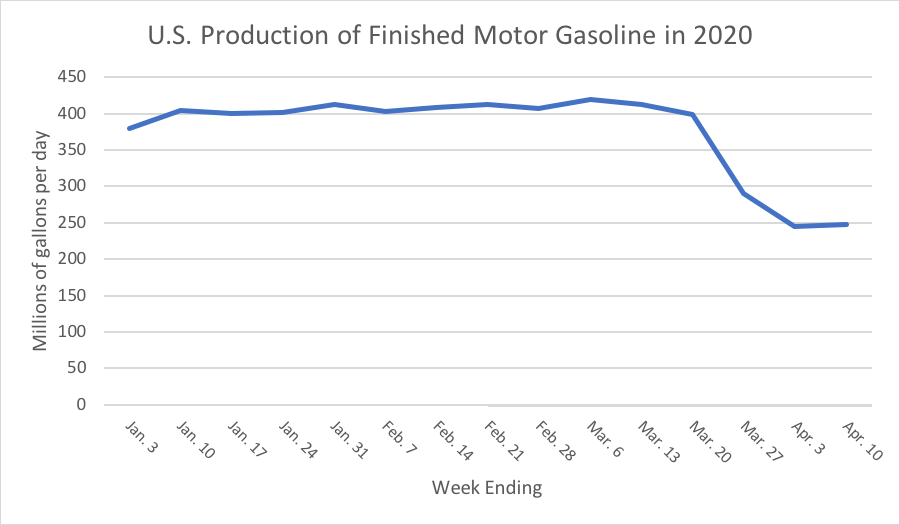

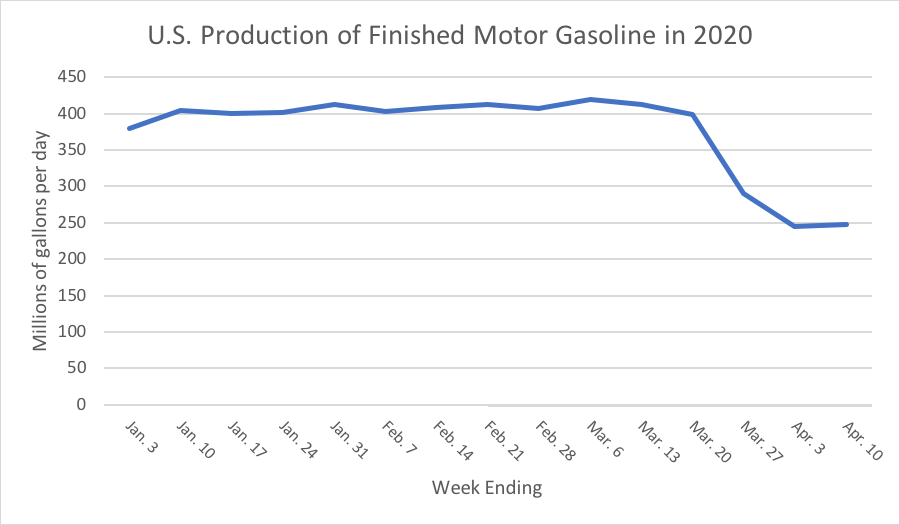

Data from the U.S. Energy Information Administration indicates that U.S. production of gasoline has dropped by about 40 percent since travel restrictions and business closures related to the coronavirus started in early March.

The EIA Weekly Petroleum Status Report, in Table 3, gives the average daily production of finished motor gasoline by refiners and blenders in the U.S. during the preceding week, in terms of 42-gallon barrels. Converted to gallons, U.S. production was averaging around 410 million gallons per day from late January through March 13. Since then, production dropped to 399 million gallons per day the week ending March 20, 291 million gallons per day the week ending March 27, before stabilizing at 245 million gallons per day the week ending April 3 and 248 million gallons per day the week ending April 10.

Production decisions made at the refinery/blender level lag several days, maybe a week, behind the decisions made by motorists at the pump whether or not to buy gasoline. Slowdowns at the service station level cause the station to delay orders from the wholesale terminal(where federal excise taxes are paid), which then get relayed into decreased production demand sent upstream the refinery or blender. (Gasoline travels from refinery to terminal via pipeline at the snail’s pace of between 3 and 6 miles per hour.)

The difference between the pre-COVID average production and the new average over the last two weeks of reporting is around 165 million gallons per day of reduced demand.

What does this mean for the Highway Trust Fund?

Simple – 165 million fewer gallons per day moving through the terminal point of taxation out to service stations means about $30.2 million dollars per day in reduced excise taxes being paid into the Highway Trust Fund – $25.5 million per day into the Highway Account and $4.7 million per day into the Mass Transit Account.

What about diesel?

EIA production data is not nearly as helpful there, because diesel is very different from gasoline chemically. At the refinery/blender level, there is no difference between the diesel fuel burned in truck engines and the diesel fuel burned in railroad engines and the diesel fuel burned in home furnaces in many states. The ultimate end use of the fuel is not known when it leaves the refinery/blender. Accordingly, it’s all lumped together in the EIA production report as “Distillate Fuel Oil, 15 ppm sulfur and Under.”

Production of all of the ultra-low-sulfur diesel for highway, rail and home uses was 194 million gallons per day last week, which isn’t noticeably different from the 196 million gallons per day the week ending January 17 or the 191 million gallons per day the week ending March 6.

Jet fuel production, on the other hand (“Kerosene-Type Jet Fuel” to the EIA), is in a bad way. Production averaged 75 million gallons per day from the start of 2020 through March 6. Last week’s production only averaged 30 million gallons per day, and even that was probably too much – an interesting Wall Street Journal article on April 13 noted that the industry is running out of places to store finished petroleum products, and crude oil, so producers are now having to take the almost unprecedented step of plugging up productive oil wells before the tanks, ships and barges fill up completely.