Eno conducted an analysis of the international market for air travel in November 2018 for the Japan International Transport Institute. This multi-part ETW series (part 1, part 2 & part 3) details some of the most interesting facts and findings of that work. Although the research does not predict the future or propose any recommendations, the results are instructive for thinking about how international air service has evolved over the past few decades.

The data analyses use three data sources: (1) publicly available data from the U.S. Department of Transportation, (2) Sabre Corporation’s Market Intelligence Data and Analytics, and (3) existing reports and other publicly available information. The data from Sabre is not publicly available, but the Eno Center for Transportation was able to gain access through a subscription paid for by the Japan International Transport Institute, USA. Sabre takes public and private data to create a suite of data resources to analyze traffic trends and fills in gaps missing in the T-100 data set. The data available during the creation of this report includes a “final” dataset from 2010-2017, where Sabre’s algorithms verify the accuracy and update data points as necessary. The data set also includes “preliminary” MIDT (Marketing Information Data) data from 2002-2009. While this data is not as precise as the final dataset, it can provide enough information for broad trends.

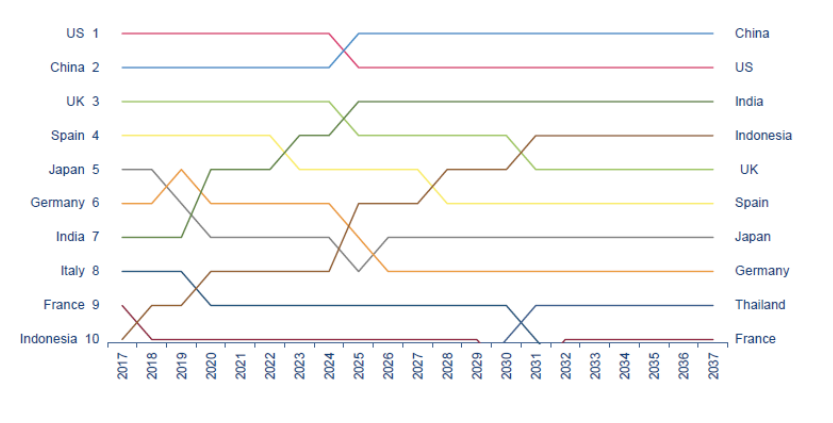

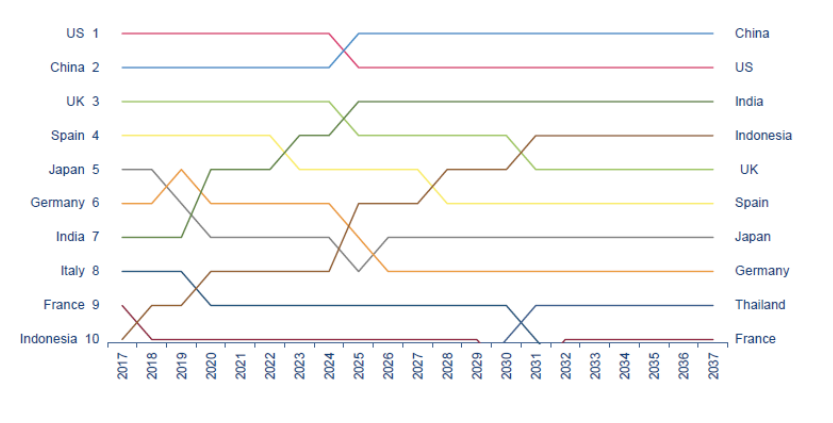

Parts 1, 2, and 3 of this series show the trends in growing passenger air traffic between the U.S. and many Asian countries, as well as new airport capacity projects in progress, and the power of various policies and bilateral and multi-lateral agreements. According to the latest edition of IATA’s 20-year air passenger forecast, the Asia Pacific region is the fastest growing market for aviation.[1] By 2025, China will replace the US as the world’s largest aviation market (defined by traffic to, from, and within the country) and India will displace the UK for third place in 2025, and will be surpassed by Indonesia in 2031. By 2036, Spain, which has a large aviation market due to its international hub in Madrid and its rail connections to other parts of Europe (although not as convenient as the German and French intermodal hubs), will fall from the fifth largest aviation market to the sixth, just ahead of Japan. Figure 1 shows that Japan, which currently has the fifth largest aviation market, will fall to seventh even though it is expected to grow in overall passengers.

Figure 1: Top Ten Passenger Markets, ranked by passenger numbers to, from, and within each country.

Source: International Air Transport Association, 2018

Of the five fastest-growing markets in terms of additional passengers per year over the forecast period, four will be from Asia.

- China (1 billion new passengers for a total of 1.6 billion)

- US (481 million new passengers for a total of 1.3 billion)

- India (414 million new passengers for a total of 572 million)

- Indonesia (282 million new passengers for a total of 411 million)

- Vietnam (116 million new passengers for a total of 214 million).[2]

Table 1 shows select international markets and their predicted growth rates for the coming 20 years. Most international aviation markets are growing, especially those involving developing and growing economies. The only market in Table 4.1 where IATA projects a decline in travel is between Japan and Korea. From the U.S, Japan will remain the largest international travel market in the Asian continent.

Table 1: IATA 2037 Market Forecast, select markets

[table id=19 /]

Source: Air Passenger Forecasts, Country Reports for Japan, China, and the United States, International Air Transport Association, April 2018

According to recent public statements and announcements from the three major U.S. carriers, their attention to Asian airports is apparent.

American Airlines is expanding its daily service between Seattle and Narita in spring 2019, making this its sixth West Coast route (via its joint venture with Japan Airlines) between North America and Japan. However, American will be reducing its Chicago-Narita flights from daily service to every three days (but still 10 flights) per week beginning December 2018 with increased service during peak summer travel months.[3] They are also discontinuing Chicago O’Hare flights to Beijing and to Shanghai (formerly once-daily).[4] At the end of 2017, American flew up to 16 daily nonstop transpacific flights from 8 Asia Pacific destinations (the newest at the time being Los Angeles-Beijing, its third nonstop route to the capital) to its U.S. hubs in Chicago, Dallas Fort Worth and Los Angeles.[5]

According to a statement from American Airlines, “…these adjustments to our Asia service are necessary in this high fuel cost environment, but we remain committed to the network we’ve worked hard to build.“ The statement continued, “…our Chicago–Shanghai service is unprofitable and simply not sustainable in this high fuel cost environment and when we have opportunities to be successful in other market. As with Shanghai, American will continue to serve Tokyo through our hubs in Dallas/Fort Worth and Los Angeles.”[6]

Approaching 2019, United focused on strengthening its domestic networks to connect to six hubs optimized for international flying.[7] Its new, second, daily San Francisco to Singapore service, replaces a former flight originating in Los Angeles; in 2017, the airline began daily Los Angeles to Singapore flights.[8] United is the only U.S.-based carrier that flies direct to India, and is expanding the size of its aircraft from the 777-200 (272 seats) to the 777-300, which has 366.[9] It has not announced any other new US-Asian routes.

Delta is aggressively expanding international flight options. 2020 may bring about a Minneapolis-St. Paul origin flight to China through Shanghai, following a new 2019 Minnesota-Seoul Incheon long haul and current MSP-Tokyo-Haneda service.[10] Their Seattle hub will end service to Hong Kong and instead fly transpacific to Osaka, reviving a route that stopped in 2013.[11] Through joint venture with Korean Airlines, Boston-Logan service to Seoul-Incheon will commence 2019.[12] Delta will also begin nonstop flights to Mumbai, India in 2019 now that it has become more economically viable after Gulf carriers (Open Skies conflict initially resolved in January and May 2018) expansion in South Asia has receded.[13]

While market leaders may shift between countries and airports, the market for air travel between the U.S. and Asia is clearly growing, and policies, aircraft, and infrastructure will continue to shift along with travel trends and growth. Infrastructure, policy, and population changes in one country or city or with one carrier or alliance can have broad-reaching impacts on overall travel as well as market share across the globe through changes in desired locations and layover patterns.

[This is the final and fourth installment of the international travel trends ETW series. Parts 1, 2 and 3 of this series can be accessed here, here, and here]

- “2036 Forecast Reveals Air Passengers Will Nearly Double to 7.8 Billion”, International Air Transport Association, Press Release No. 55, October 24, 2017. ↑

- “IATA Forecast Predicts 8.2 billion Air Travelers in 2037”, International Air Transport Association, Press Release No. 62, October 24, 2018. ↑

- American Airlines, “Japan Airlines and American Airlines Announce Nonstop Service to Seattle, Strengthening Pacific Joint Business International Network,” Sep. 26, 2018. ↑

- American Airlines, “American Airlines Expands European Footprint

and Modifies Asia Service,” August 21, 2018.; Russell, E., “American unveils 19 new routes for 2019,” Flightglobal, October 2, 2018. ↑

- American Airlines, “Snapshot of American in Asia Pacific,” December 2017. ↑

- American Airlines, “American Airlines Expands European Footprint

and Modifies Asia Service,” August 21, 2018.; Russell, E., “American unveils 19 new routes for 2019,” Flightglobal, October 2, 2018. ↑

- United Airlines, “United Airlines Bolsters Domestic Network: Adds 22 New Routes for 2019,” October 15, 2018. ↑

- United Airlines, “United Airlines Announces Nonstop Service Between Los Angeles and Singapore,” June 1, 2017. ↑

- Varun Aggarwal, “As direct flights catch on, United Airlines to expand capacity on Indian routes,” BusinessLine, October 30, 2018. ↑

- Delta Air Lines, “Delta proposes Minneapolis-St. Paul – Shanghai route to begin in 2020,” October 22, 2018. ↑

- Hemmerdinger, J., “Delta to add Seattle-Osaka flights, axes Seattle-Hong Kong,” Flightglobal, June 14, 2018. ↑

- Delta Air Lines, “Delta to begin nonstop service from Minneapolis/St. Paul to Seoul-Incheon in cooperation with JV partner Korean Air in 2019,” June 13, 2018. ↑

- Delta Air Lines, “Delta to serve Mumbai nonstop from the U.S. in 2019,” May 24, 2018. ↑