May 3, 2019

This week, the bipartisan leadership of the House Transportation and Infrastructure Committee introduced a bill (H.R. 2440) that would allow the immediate spend-down of $9.3 billion in balances that have built up in the Harbor Maintenance Trust Fund (HMTF).

The bill was introduced on May 2 by the full T&I chairman and ranking minority member, Peter DeFazio (D-OR) and Sam Graves (R-MO), and the chair and ranking member on the Water Resources and Environment Subcommittee, Grace Napolitano (D-CA) and Bruce Westerman (R-AR).

DeFazio said “The Federal government should be using the fees it collects at our ports for their intended purpose — harbor maintenance. By merely spending what is already being collected we can ensure our Nation’s ports and harbors remain open for business and can continue to sustain our local, regional, and national economies.”

Graves added “When any portion of our national infrastructure system doesn’t function properly that raises the costs of goods for everyone. Congress should ensure that the funds collected to improve the efficiency of our ports are invested for their intended purpose.”

The bill would allow the spending of the full built-up balance of the Trust Fund ($9.3 billion as of the end of the last fiscal year) as well as what the Congressional Budget Office estimates will be another $24.5 billion in tax receipts and interest over the next decade. Over the last two decades, Congress has systematically held annual HMTF appropriations well below tax collection levels (largely because HMTF spending is subject to the same budget ceilings that hold down general fund spending) so that year-end Trust Fund balances grew from $1.2 billion in 1998 to $9.3 billion in 2018.

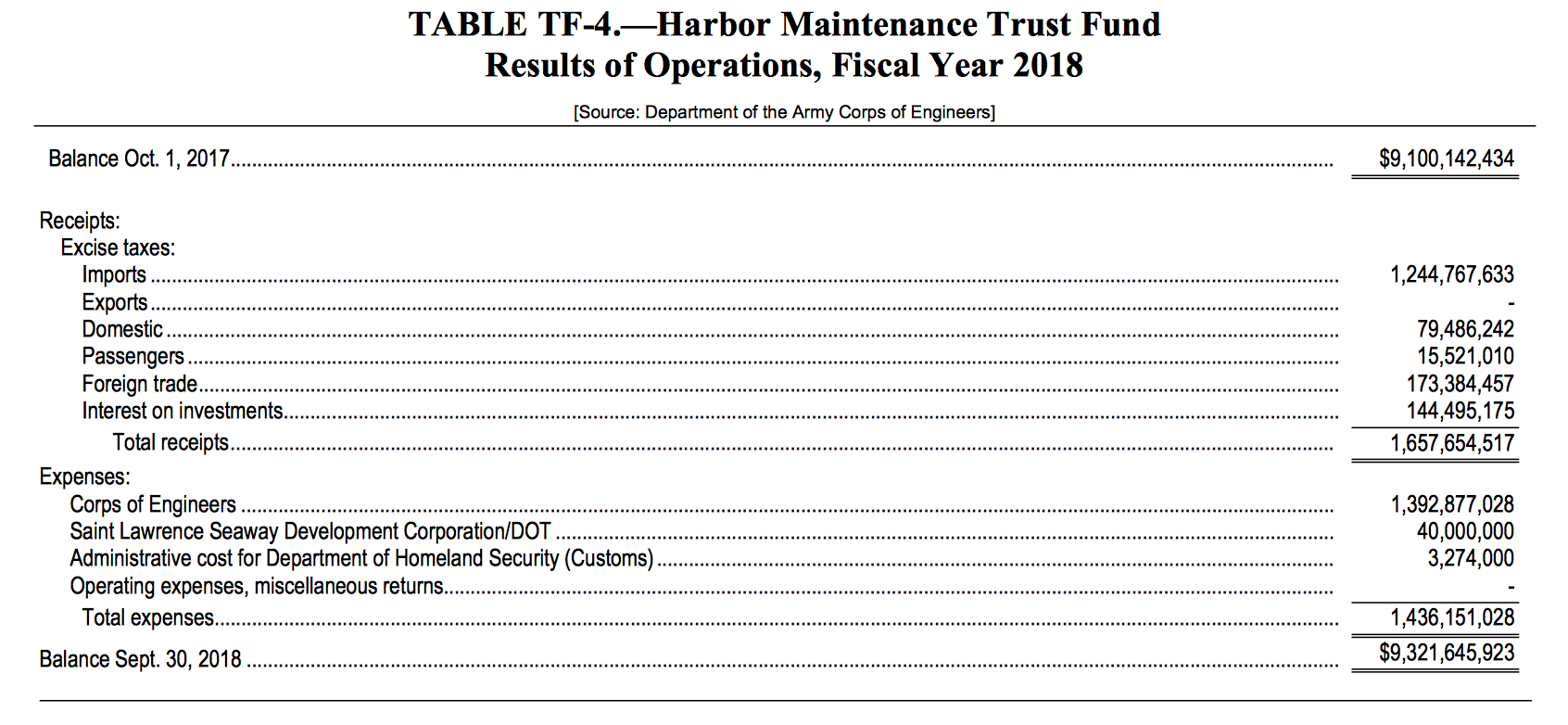

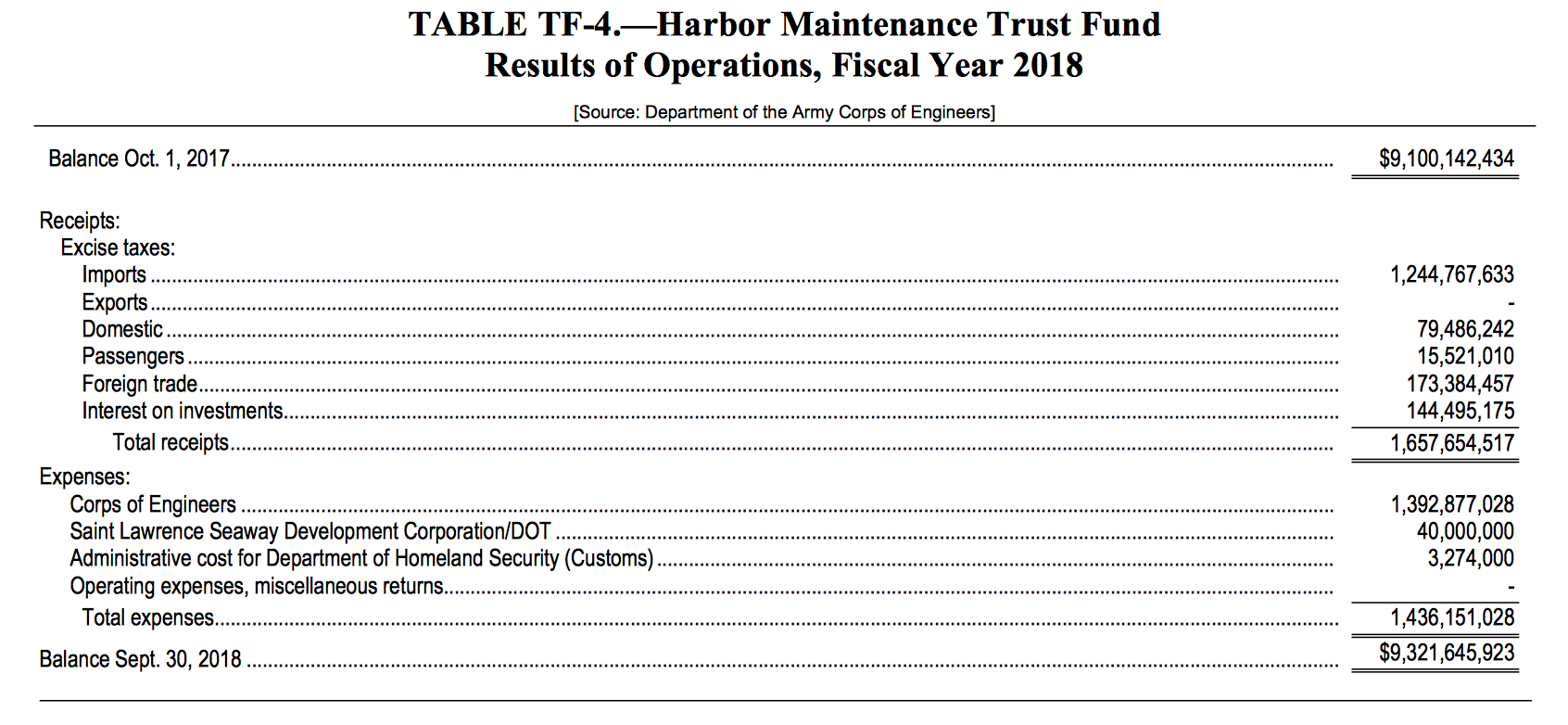

Here are the actual FY 2018 finances of the HMTF, from the March 2019 Treasury Bulletin.

How does the bill work?

If your spending account is currently classified as discretionary and is subject to the overall spending caps in the Budget Control Act (as all HMTF appropriations are at present), there are three ways to get out from under the spending caps:

- Reclassify the account as mandatory, not discretionary. This was the approach taken by DeFazio in the last Congress in order to deal with the HMTF backlog – his bill would have created new mandatory budget authority, available for expenditure, in the amount of the Trust Fund backlog. However, this approach also takes jurisdiction over the spending away from the Appropriations Committees, who really don’t like having their turf taken away.

- Adjust the spending caps upwards for the amount you want to spend. There are already a half-dozen “cap adjustment” mechanisms on the books. Some are open-ended, like the cap adjustments for emergency spending and for Overseas Contingency Operations (in both cases, the law lets Congress and the President jointly designate whatever appropriations they want as emergencies or OCO, but each such designation requires 60 votes in the Senate, and the President has a sort of line-item veto). Other cap adjustments protect spending only for certain accounts and programs and only up to a certain amount per fiscal year (disaster relief, the various program integrity adjustments, and the new Stephen Sepp Wildfire Suppression Funding cap adjustment).

- Order OMB and CBO to pretend that the spending doesn’t exist. This is the approach taken by the 21st Century CURES Act a few years ago (fighting the opioid epidemic) – that law provided that the appropriations for opioid programs, up to a certain amount per fiscal year, “shall be subtracted from the estimate of discretionary budget authority and the resulting outlays for any estimate under the Congressional Budget and Impoundment Control Act of 1974 or the Balanced Budget and Emergency Deficit Control Act of 1985.” This is the approach used by Senate Appropriations Chairman Richard Shelby (R-AL) in the HMTF fix that he has been trying to attach to various appropriations measures for the last few months.

The new DeFazio-Graves bill uses the second approach. It would create a new cap adjustment written into section 251(b)(2) of the Gramm-Rudman-Hollings Act that increases the Budget Control Act spending cap in the amount of annual harbor maintenance appropriations derived solely from the HMTF and made solely for the three purposes listed in 26 U.S.C. §9505(c) (authorized harbor maintenance activities, St. Lawrence Seaway toll rebates, and Harbor Maintenance Tax collection expenses). The maximum amount of the cap adjustment in any year is limited to “the total amount within the Harbor Maintenance Trust Fund…on the last day of the fiscal year that is two years prior to that fiscal year.”

This means that, if someone wearing the Infinity Gauntlet were to snap their fingers tomorrow and enact H.R. 2440 into law immediately, the fiscal year 2020 appropriations bills could appropriate up to a total of $9.322 billion from the HMTF for those purposes and the Budget Control Act spending caps would be increased upwards by that amount, meaning that those appropriations effectively don’t count towards the cap.

This would have the secondary effect of also giving the appropriators an extra $1.4 billion or so in room under the spending caps – their total appropriations in 2019 from the HMTF were $1.436 billion (all of which did count towards the spending caps. The appropriators could then spend that $1.4 billion on something else without breaching the spending caps.

It should be noted that DeFazio’s approach in the new bill is within Budget Committee jurisdiction, so H.R. 2440 has been jointly referred to Budget as well as to T&I.

(Ed. Note: We should also point out that, at present, the amount of annual HMTF spending for the Corps of Engineers is not written anywhere in law – instead, budget scorekeepers have to look up every project funded by the Corps for that year, figure out how deep the harbor dredging is on that project, then figure out the HMTF cost share of that project, which varies by depth. If we are going to do a cap adjustment or cap exemption for HMTF spending, it really would be a good idea to do what the Trump Administration has suggested and make HMTF spending its own separate budget account, or at least spell out the HMTF amount specifically in the language of the appropriations bill, as is done for the FAA Operations account, which is split-funded between the general fund and the Airport and Airway Trust Fund. Transparency, yo.)

(Further Ed. Note: At present, Corps of Engineers water resources appropriations are not classified as transportation spending. Since the water resources program is not just about navigation but also about flood control, beach erosion, and other environmental functions, the major Corps accounts are currently classified in budget function 300 (Natural Resources and Environment). A stand-alone HMTF account would be all about navigation, so presumably, the scorekeepers could reclassify that account as function 400 (Transportation) and make it part of the answer to the big question of “how much does the federal government spend on transportation?” When the budget functional classification system was created under President Truman, the river and harbor navigation functions of the Corps had separate budget accounts from the flood control functions of the Corps, and the river and harbor account was classified as transportation while the flood control account was classified as natural resources (see here starting on p. A81). At some point, Congress combined accounts and the whole Corps program ceased to be included in the transportation budget function.)

As Congress and the President work towards a jaw-dropping $2 trillion in hypothetical infrastructure spending, we can expect the $9 billion HMTF balance spend-down, and the $25 billion or so in future 10-year HMTF spending, to be counted towards that total if the new T&I bill is included in the package. And since the most difficult part of the infrastructure debate will be the “pay-fors,” one can expect DeFazio and others to argue, persuasively, that unlocking HMTF spending shouldn’t need a separate pay-for because all of the tax receipts deposited in the HMTF were already paid by shippers as a kind of user charge for their usage of U.S. ports. (Spending down the interest paid by the general fund to the HMTF on unexpended balances is a separate argument, because that money did not come from shippers as part of user charge, it’s just Uncle Sam paying money to himself for no valid reason.)