The Trump Administration’s fiscal 2021 budget request includes $1.9 billion for the Federal Transit Administration’s Capital Investment Grant program (almost equal to last year’s enacted level), and the accompanying documents show that FTA has advanced several projects in the CIG “pipeline” and has upgraded the project rating of the Portal North Bridge in New Jersey to a passing level (but the proposed Hudson River Tunnel still has a failing rating).

And, the day after the budget and the CIG documents were released, FTA then notified Congress that it will sign the full funding grant agreement (FFGA) for the third and final phase of the Los Angeles Westside Purple Line extension next month, which would become the seventh multi-year funding agreement for a CIG project signed by the Trump Administration. (They have also signed 17 one-off “small start” project agreements to date.)

The CIG Annual Report is here and the updated project summaries and ratings for each project in the “pipeline” are here.

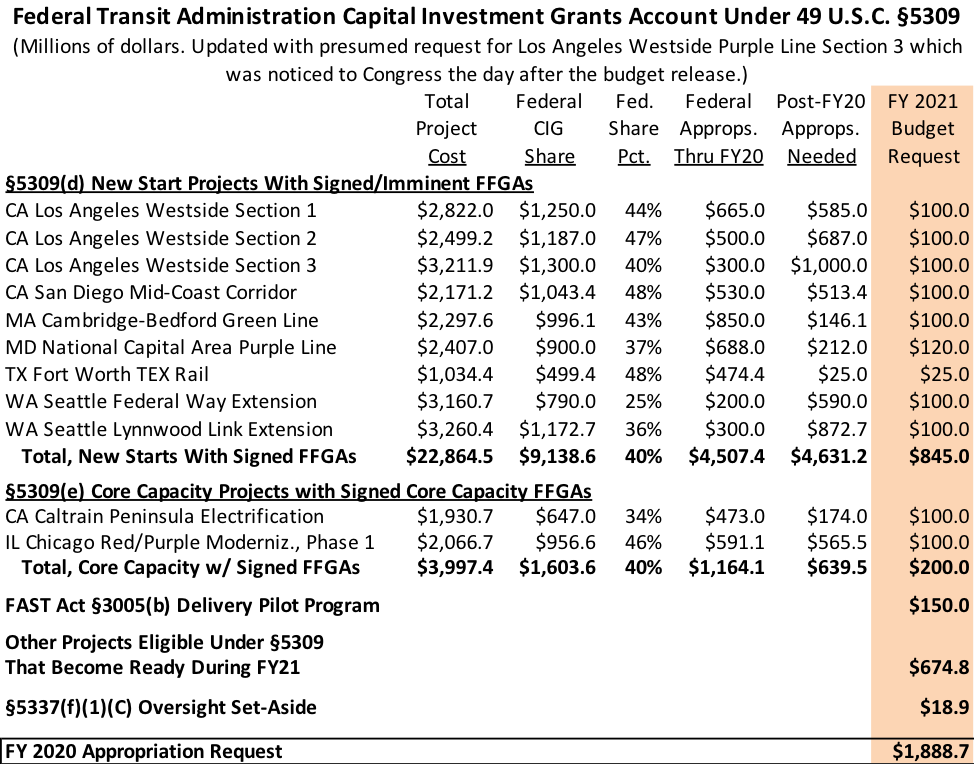

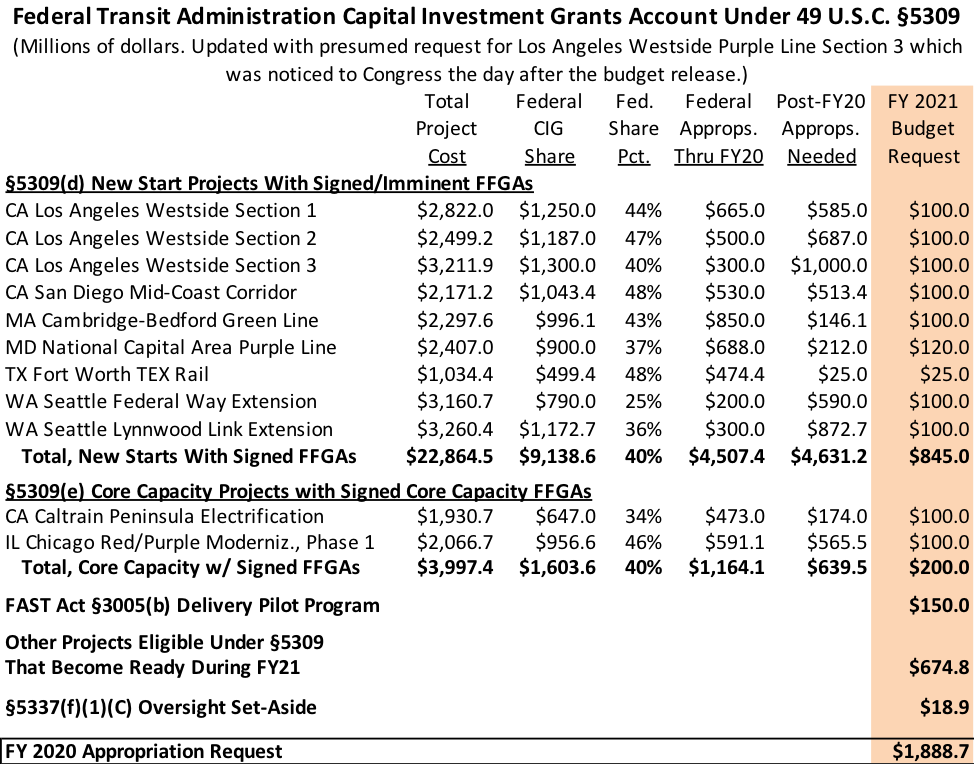

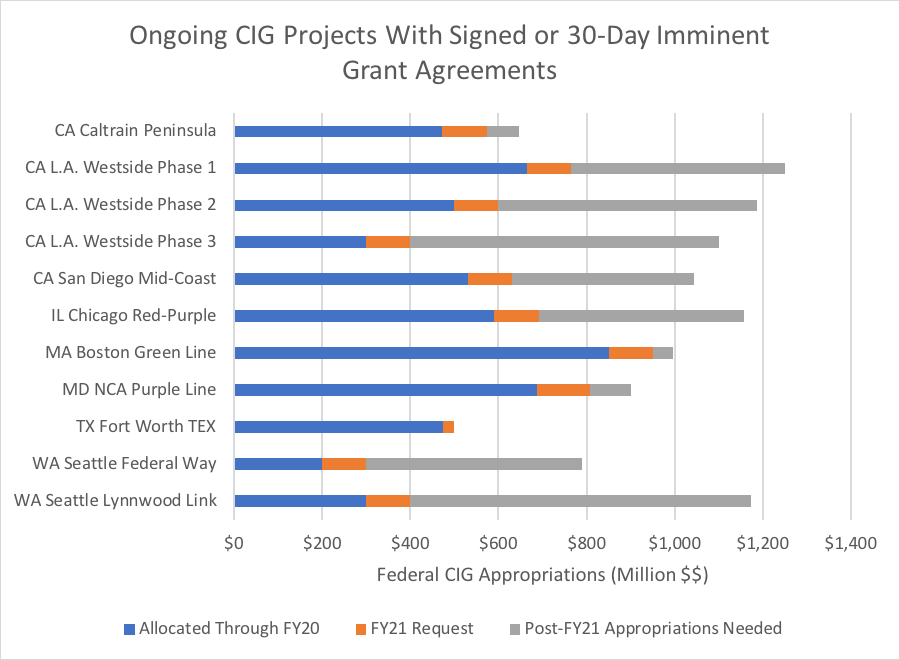

The request list for specific CIG projects, which we have edited to add L.A. Westside Section 3, is as follows:

These projects collectively need $5.3 billion in federal appropriations in 2021 and future years to pay off their signed federal commitments, and the budget (amended, presumably, for the 2021 tranche of funding for L.A. Westside 3, because why would you sign a grant agreement and then refuse to request the money for it), asks for $1.045 billion for those, leaving $4.2 billion in post-FY21 appropriations needed.

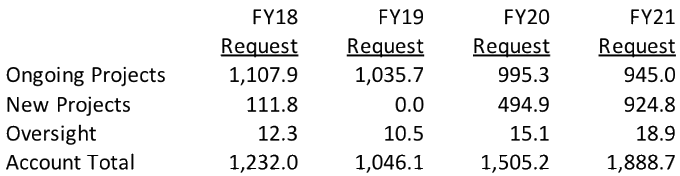

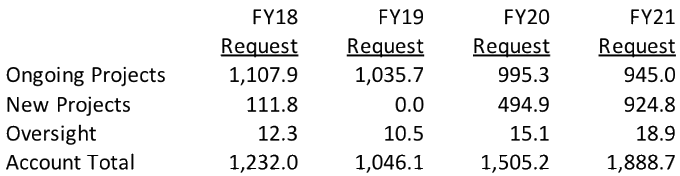

As originally submitted, the request had almost $925 million for new projects ($774.8 million for regular CIG projects and $150 million for the project delivery pilot program, which seems destined for the BART Silicon Valley Extension II project in Santa Clara). This is a drastic reversal from the Trump Administration’s attitude towards new CIG projects, as expressed in its first two budget requests:

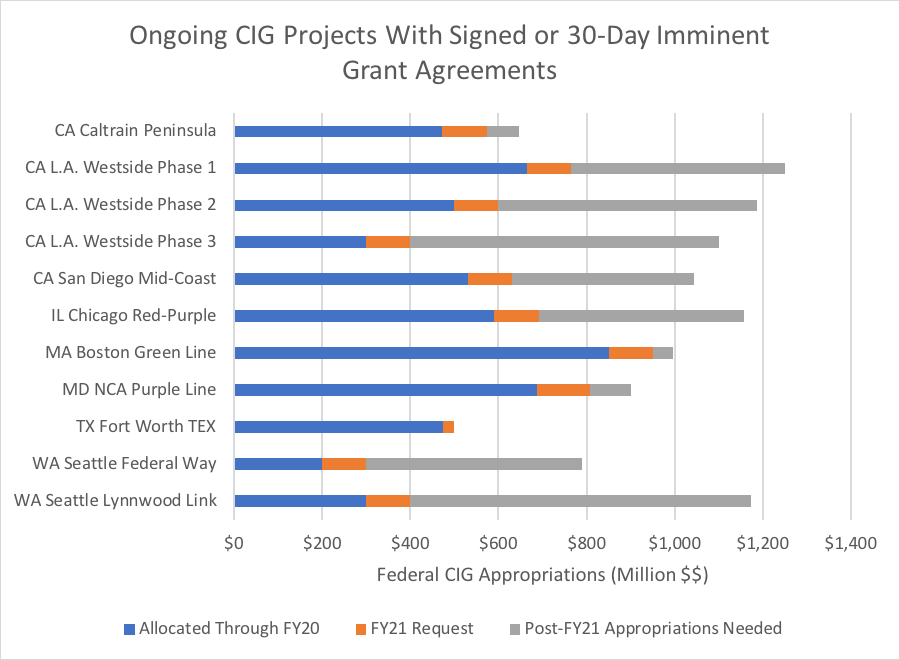

We figured out a better way to visualize the long-term costs of the projects that have ongoing multi-year grant agreements and the money that FTA has made promises (not legally binding promises, but promises nonetheless) to deliver, subject to appropriations, in future years:

The Fort Worth TEX project will have its federal CIG commitment completely fulfilled if the FY 2021 budget request is appropriated, and the Caltrain peninsula electrification, Boston Green Line, and Maryland Purple Line projects are on track to be fully paid off in the FY 2022 appropriations process. The others will take several more years.

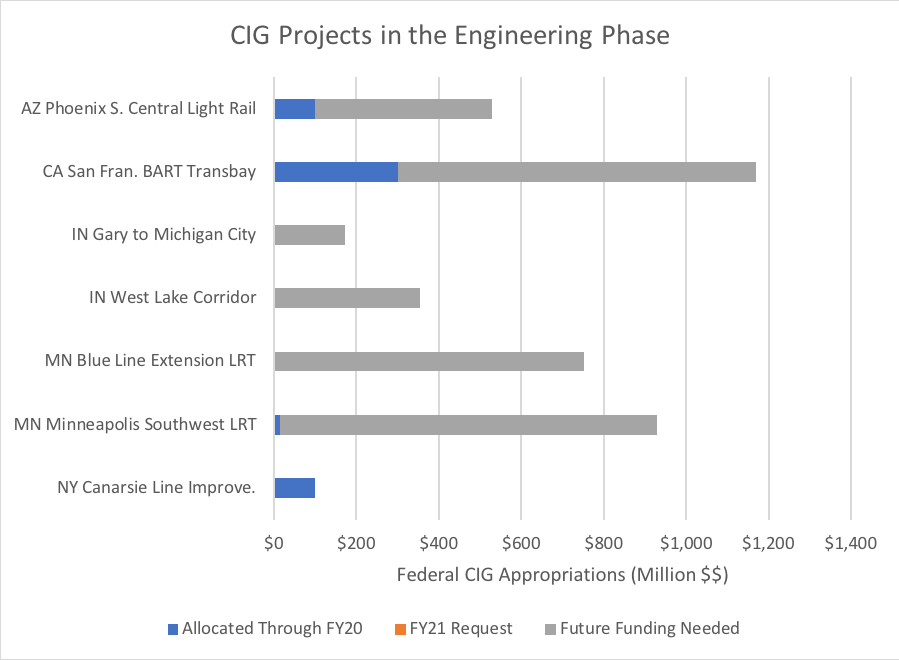

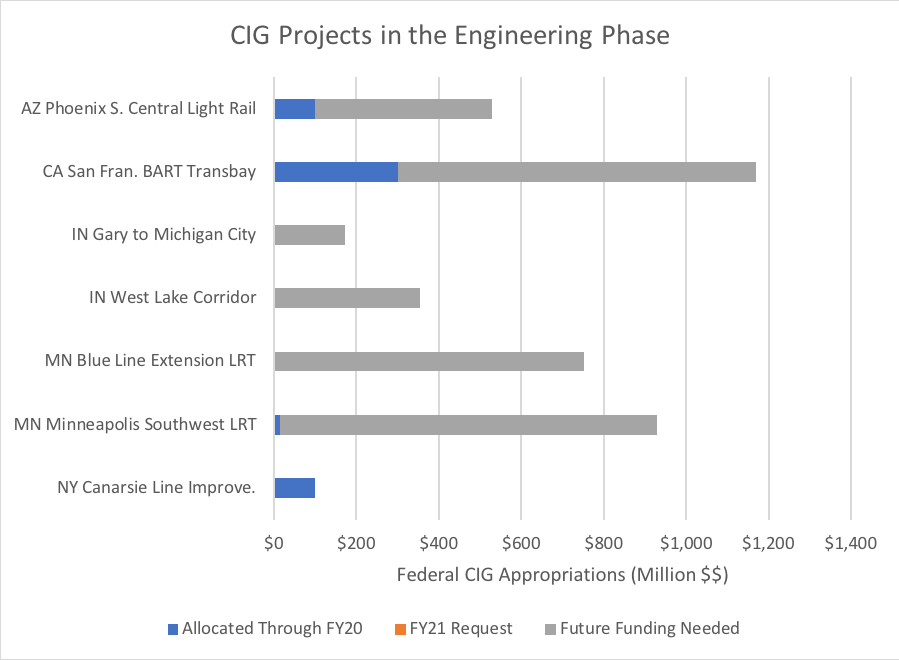

There are also seven multi-year projects in the Engineering phase of the CIG process, which is the final step before a construction grant agreement can be signed. Four of these are new (Phoenix South Central LRT, BART Transbay Corridor improvements, and two projects in Indiana), while three others entered into Engineering in prior years.

Those projects have a collective federal CIG share of $4.0 billion, of which $515 million has already been appropriated and allocated. (That includes the entire cost of the NYC Canarsie project, which will get all of its money just as soon as the agreement is signed.) If all of these projects get their grant agreements, an additional $3.5 billion in appropriations (in combination with possible allocation of some unallocated FY 2019 and 2020 appropriations) will be needed.

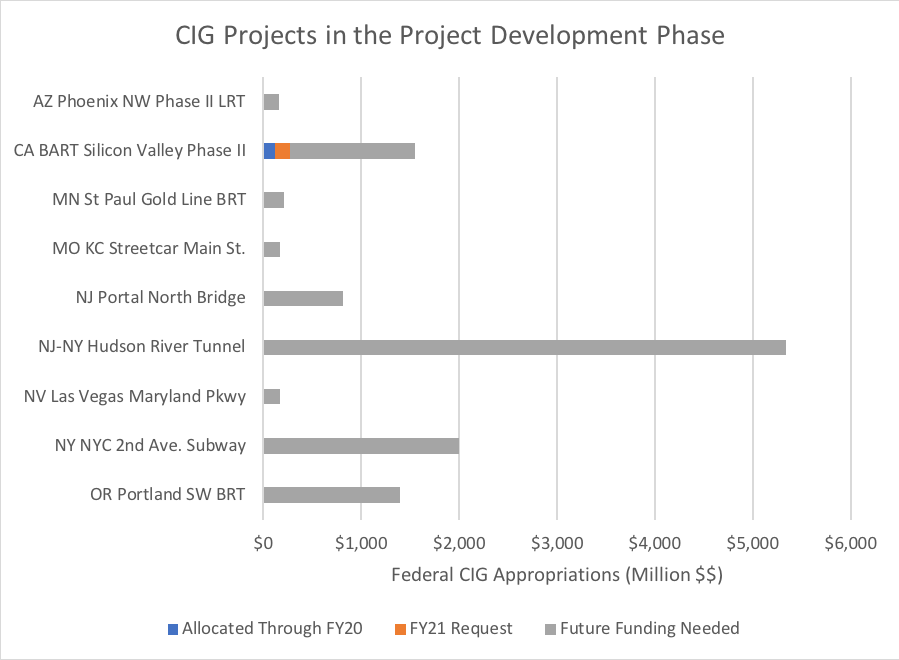

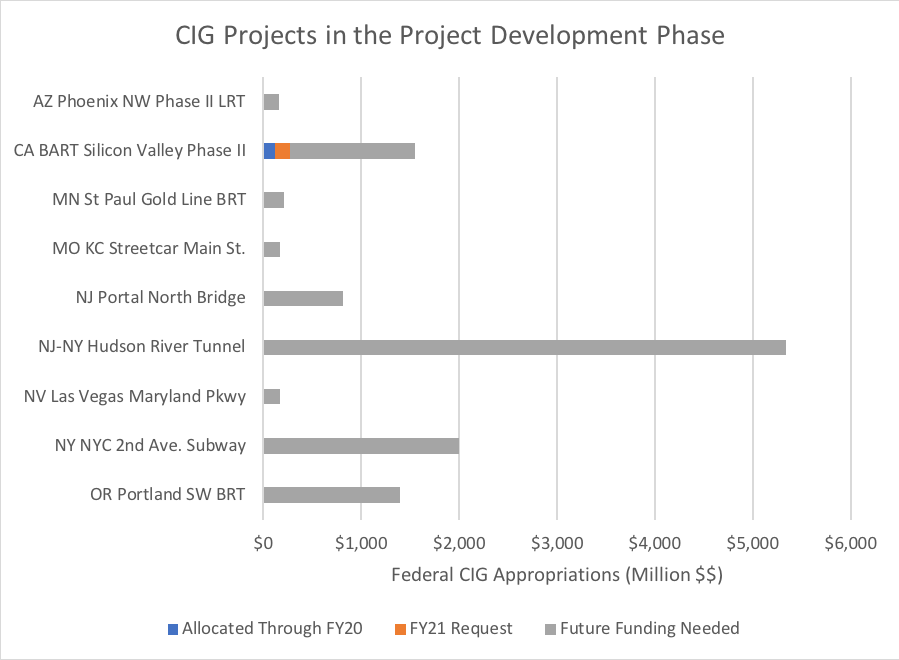

Farther out on the drawing board, we have the Project Development phase (the phase before Engineering). There are ten multi-year projects that want to be approved to get into PD and from there into Engineering and from there to a signed grant agreement. (One of them, in South Carolina, is so early that it does not have a cost estimate yet so it is not shown below.) Note the scale on the horizontal axis in the following chart is vastly different than the scale in the prior two charts:

These projects have a requested CIG share that totals $12.5 billion – $5.3 billion for the Hudson River Tunnel and $7.1 billion for all the other projects put together. The only money allocated so far is the initial $125 million to date for Silicon Valley Phase II and this chart shows the $150 million request for the alternative delivery pilot project as really being a request for Silicon Valley because that is what we think it is.

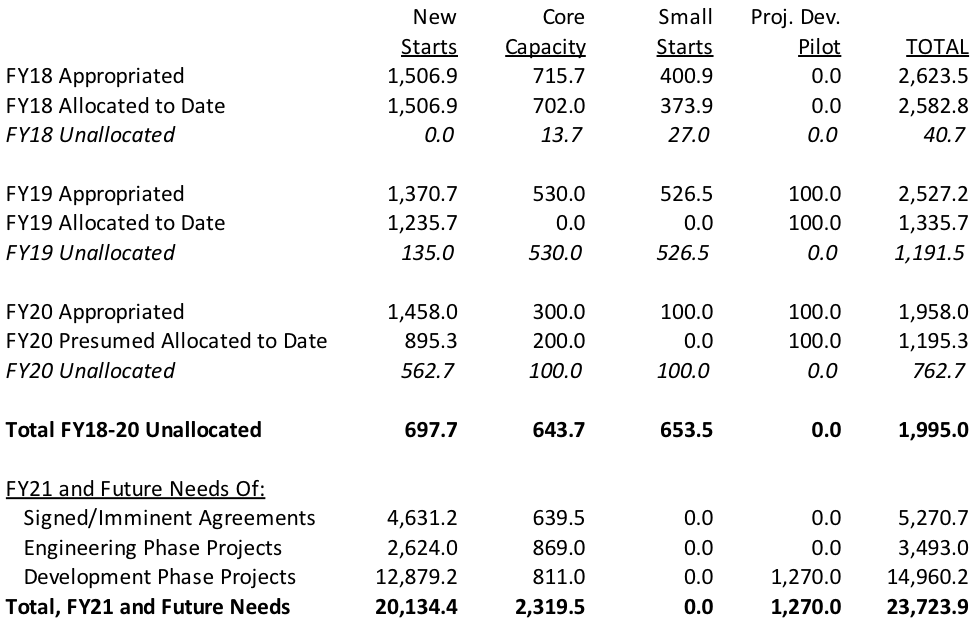

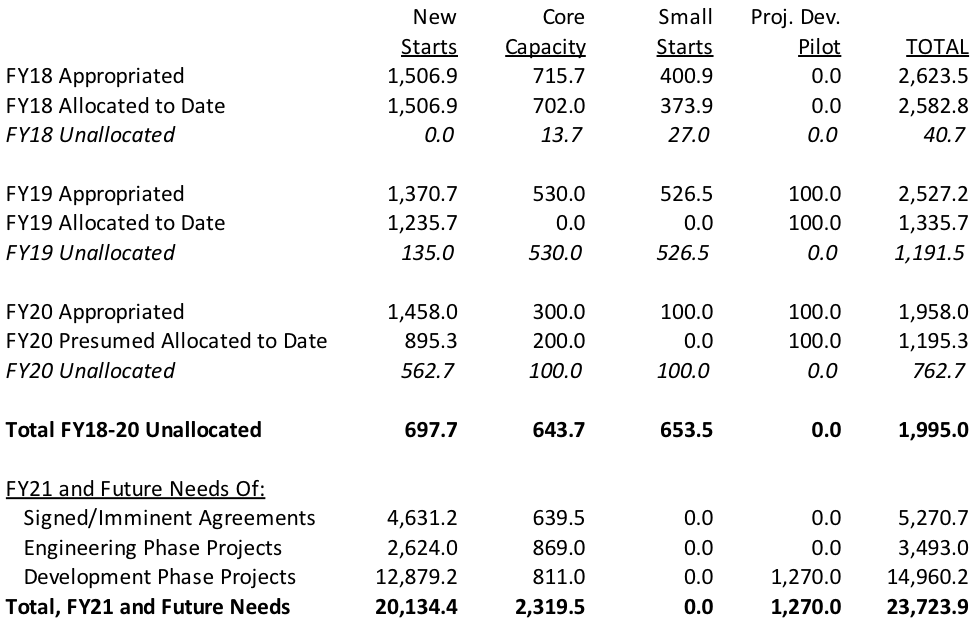

All told, the total CIG funding needed for all multi-year projects in development appears to be $27.3 billion. This is offset by $2 billion in unallocated appropriations from fiscal years 2018, 2019 and 2020.

The budget was also concurrent with the release of the annual updated project ratings. The statute requires a five-point scale (low, medium-low, medium, medium-high, high) in a variety of areas, and those are then averaged to an overall rating. Only projects with an overall rating of medium, medium-high, or high are eligible to be promoted through phases of the CIG process or to get a final grant agreement.

This year’s ratings only flunked five projects: The St. Paul, MN Gold Line BRT project, the Los Angeles downtown streetcar restoration, the Lansing, MI BRT project, the Everett, WA Orange Line BRT project, and the mammoth Hudson River Tunnel between New York and New Jersey. Of those, St. Paul and the Hudson Tunnel are the only multi-year projects – the other three want to be one-off small starts. The reasoning was as follows:

- St. Paul Gold Line BRT – This $461 million project gets a High rating on local financial commitment, but the FTA career staff doesn’t feel that the project, as currently presented, is justified – it got a “Low” rating on the mobility improvements question, and Medium-Low ratings on environmental benefits, congestion relief, and cost effectiveness.

- L.A. Downtown Streetcar – This one got a Medium on its project justification but failed the financial side – a Low rating on commitment of funds and a Low rating on reasonableness of it financial plan.

- Lansing BRT – This project was also marked down because FTA gave the reasonableness of the financial plan a Low rating.

- Everett BRT – This one got a High on its finances, but Low ratings for environmental benefits and mobility improvements dragged it down below the median line.

- Hudson Tunnel – The financial plan continues to bedevil this project, which (if approved) would be almost three times as expensive as any other CIG project in the history of the program. FTA is unchanged from last year’s ratings and has marked its financial plan reasonableness and its commitment of local funds as Low in both instances, with the current financial condition of the non-federal partners a Medium-Low. By law, this outweighs the Medium-High rating on the project justification side (it gets High marks for mobility improvements, cost effectiveness, and land use). The detailed project summary notes that while the local sponsors have made changes to the plan in the last year to lower the project cost and the CIG share, that’s not enough: “None of the non-CIG funds are committed or budgeted” and “No funding is currently available to cover unexpected CIG capital cost increases or funding shortfalls. [New Jersey Transit] did not demonstrate access to funds via additional debt capacity, cash reserves, or other committed funds to cover annual system wide operating expenses in excess of the current forecast.” Also, they are just asking for too much money: “assumptions regarding CIG capital funding for the Project are very optimistic, including the total amount assumed and annual CIG funding levels.”

These five projects are statutorily ineligible for federal funds unless FTA changes their rating.

But this can happen – last year, FTA also gave the Portal North Bridge a failing rating because its non-federal dollars were not fully committed, but this time, the rating has changed and is now Medium-High overall. This could allow the project, which wants an $811 million CIG appropriation, to move from Project Development to Engineering and thence to a grant agreement, but those are all steps that the Secretary has to approve.

The rating was changed despite a concerted campaign from the editorial board of the New York Daily News, which ran repeated editorials stating that the project was legally ineligible for CIG funding because it has been on the drawing board for so long that New Jersey Transit has already made enough capacity improvements on the bridge that the project no longer meets the minimum requirement of a 10 percent peak capacity increase. (See here, here and here.)

The Daily News did catch NJT submitting four-year-out-of-date ridership numbers in last year’s application, which they then had to resubmit with updated data. And NJT did pull a 21st rush hour train out of service during the measuring period, and had that train been in service, it seems likely that the peak ridership increase from the new bridge would have fallen just below the 10 percent minimum. But the FTA career staff apparently did not want to go back and re-litigate the whole thing, so the project justification side of the rating stayed the same as it always has, and because the financial side came up, the whole project passed.

This does draw attention to a potential flaw in the CIG core capacity statute, however. Should a project that increases hourly ridership capacity by, at best, a little over 10 percent get the same CIG cost share as a project that increases capacity by, say, 30 percent (like the Chicago core capacity project which was the whole reason that Congress created the program) or higher? In fact, Portal North will actually get a 47 percent CIG share of capital costs, versus Chicago’s 46 percent (Chicago’s CIG total is $957 million versus Portal North’s $811 million).