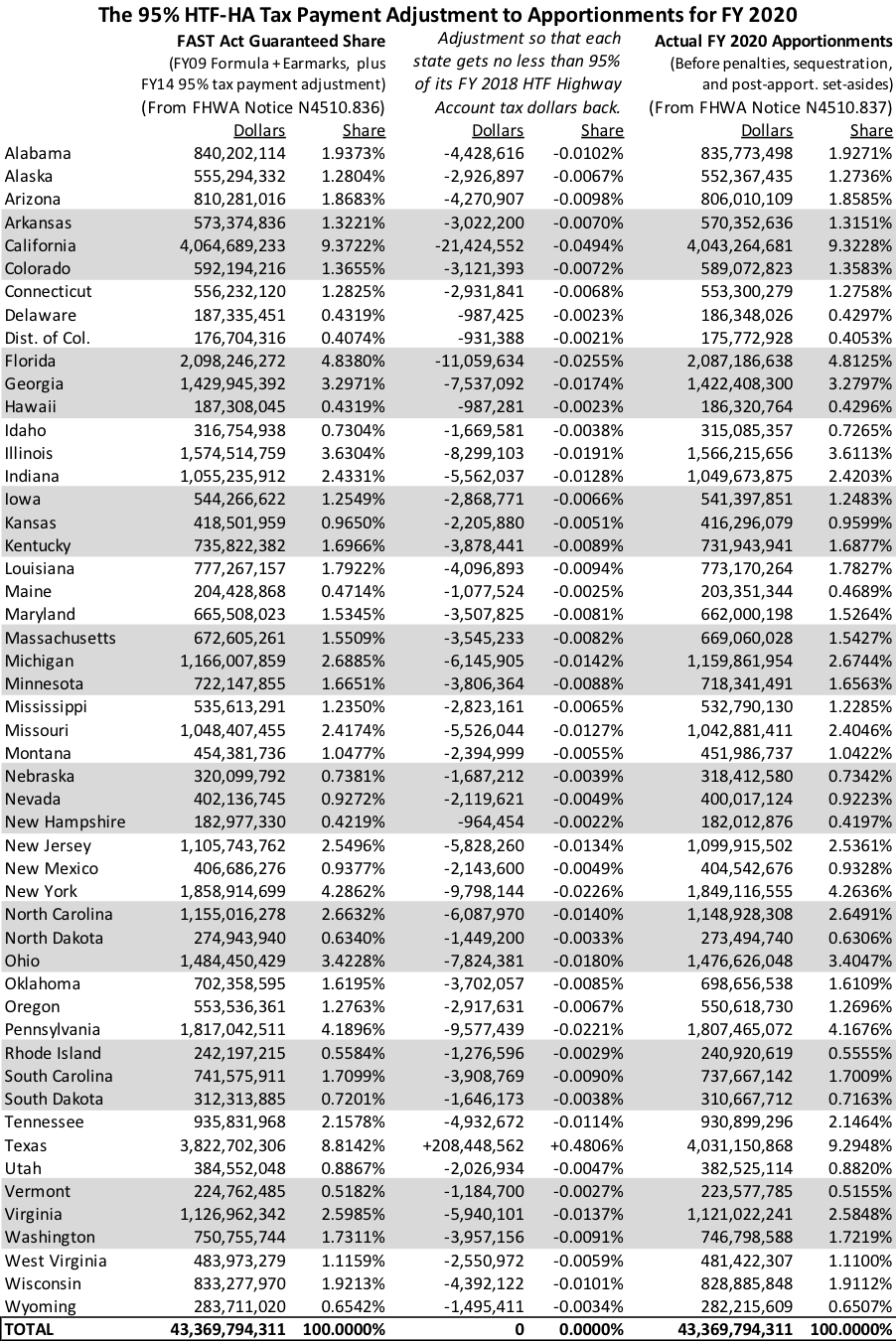

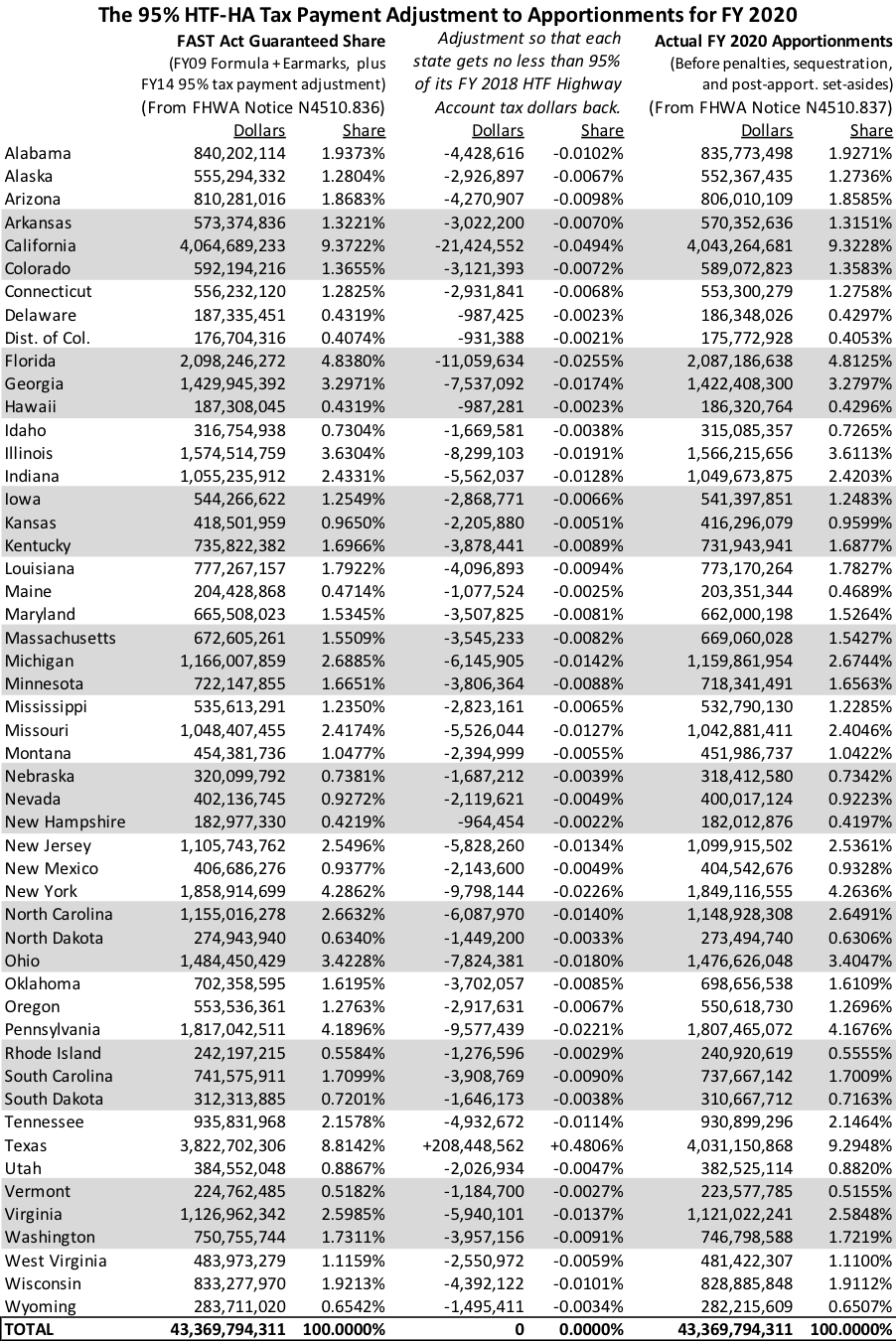

As part of the FY 2020 highway funding apportionment process this week, it was revealed that, once again, Texas is the only state to trigger the “donor state” guarantee under MAP-21 and the FAST Act whereby each state’s total annual apportionment is guaranteed to be no less than 95 percent of the estimated dollars that the state paid into the Highway Account of the Highway Trust Fund two years prior to the apportionment year.

For FY 2018, Texas’s HTF-HA tax payments were estimated to be $4.243 billion, and 95 percent of that is $4.031 billion. Texas’s regularly scheduled percentage share of total highway formula funding for FY 2020 was 8.8142 percent (which, we never tire of telling people, as in this article, is basically the FY 2009 share of SAFETEA-LU formula funding plus earmarks). 8.8142 percent of the FY 2020 total formula funding amount ($43.370 billion) would only have been $3.823 billion, so FHWA had to give Texas an extra $208.4 million in funding, which was then deducted, pro rata, from the other 49 states and the District of Columbia.

(To find out how much funding your state gave up so the Lone Star State could hit the 95 percent guarantee, see the table below.)