July 14, 2016

Senator Mike Enzi (R-WY), the chairman of the Senate Budget Committee, this week released a six-page outline of proposed reforms in the federal budget process. Enzi said “The last time Congress reformed the budget process was in 1974. Times have changed and the 40-year old process has only grown more dysfunctional and antiquated. It is time to unstick the budget gridlock that has gripped Washington in recent years, and begin to put our nation on not just another path, but a better path.”

The list does not address any of the transportation-specific issues mentioned in the May 26, 2016 editorial in ETW. But one specific suggestion could have profound implications for federal spending on transportation and public works.

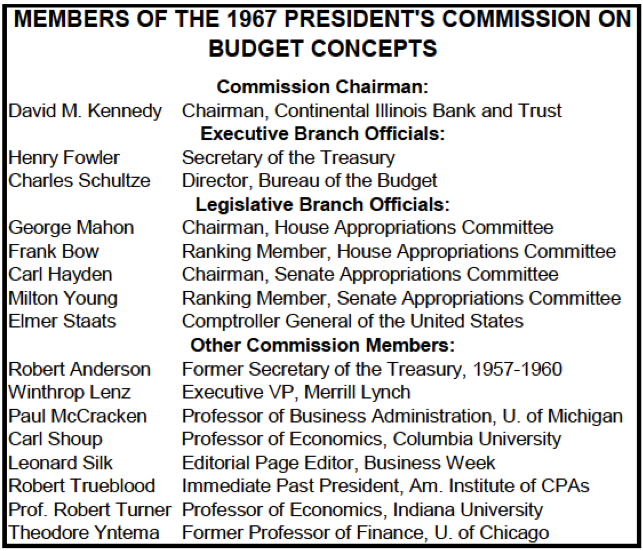

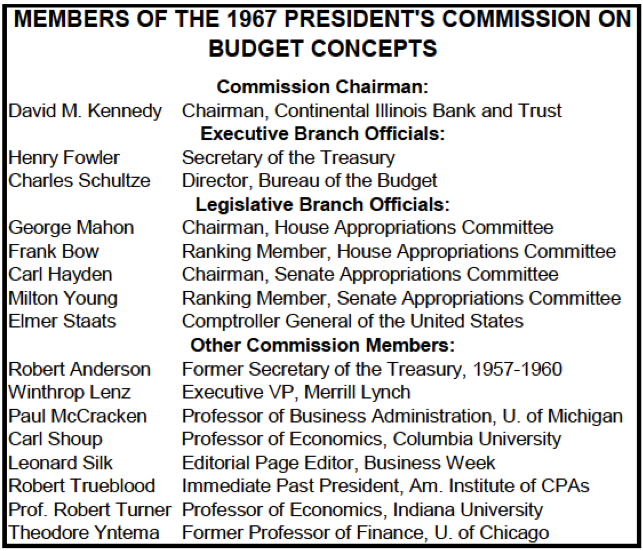

Enzi proposes to establish a new blue-ribbon commission to update the budget concepts used by the federal government. The last such panel, the President’s Commission on Budget Concepts, was appointed by President Lyndon Johnson and issued its final report in October 1967.

Presidents appoint blue-ribbon panels all the time, and most of them see their final reports fade away into obscurity fairly quickly. But the 1967 Concepts Commission report is still cited as holy writ by the Office of Management and Budget and the Congressional Budget Office. (Remember the CBO cost estimate of chairman Shuster’s FAA bill? How it scored the proposed private Air Traffic Control Corporation as being a part of government? CBO wrote “…in keeping with guidance specified by the 1967 President’s Commission on Budget Concepts, the proposed corporation’s cash flows should be recorded in the federal budget.”)

The original Commission’s recommendations were wide-ranging. Most of them (the current classification of receipts as wither taxes, offsetting receipts, or offsetting collections; mid-session reviews and multi-year budget projections; and separation of loans from outlays) were incorporated into the federal budget starting in fiscal 1969. The Pentagon was able to kill the Commission’s proposal to switch the federal government over from cash accounting to accrual accounting through inaction. But transportation interests are probably most familiar with the Commission’s work because of its recommendation number one, which was adopted starting in 1969: “The Commission’s most important recommendation is that a unified summary budget be used to replace the present three or more competing concepts that are both confusing to the public and Congress and deficient in certain essential characteristics.” This had the effect of counting federal trust funds, like Social Security, Highway, and Airport and Airway, as part of the federal budget for the first time since 1932.

Partisans of the federal-aid highway program ever since have looked upon the 1967 Commission as if it expelled them from some sort of Eden – a trick to use trust fund “surpluses” to mask federal spending. (That argument has faded since the HTF went broke in 2008.)

But the Commission had good Keynesian reasons for unifying the budget: “It is clear to the Commission that the current surpluses of trust funds must be considered in calculating the effect of Federal Government activities on the level of income and employment, in managing Treasury cash balances, in deciding on Treasury cash borrowing needs, and in program evaluation.”

Another recommendation of the 1967 Commission has also frustrated supporters of infrastructure spending over the years: “The Commission strongly recommends against a ‘capital budget’ which would provide separate financing of capital or investment expenditures on the one hand and current or operating expenditures on the other. Such a budget would seriously distort the budget as a decision-making tool…Use of a capital budget would seriously understate the current draft by the Government on the economic resources of the private sector. The level of government borrowing should be conditioned, not by the amount of capital goods that the Government is purchasing, but by much broader budget requirements. In periods of inflationary pressure the appearance of a balanced budget, with capital expenditures excluded, might pose a psychological barrier to adequate taxation.”

Enzi’s proposal specifically mentions capital spending: “capital investments, e.g., building roads and bridges, have a positive effect on productivity and long-run growth. But these investments are treated the same as other current expenditures that do not provide similar benefits.”

A 1999 commission under President Clinton also studied the capital budgeting issue recommended against a formal capital budget because the demands to have programs reclassified as “capital” would be overwhelming. But the 1999 panel also recommended a new Concepts Commission be appointed, and one of the 1999 commissioners co-wrote a Brookings Institution paper earlier this year called Time for a New Budget Concepts Commission. The Brookings paper recommended that a new Concepts Commission revisit the issue of capital budgeting.

A new Concepts Commission could fundamentally transform the way the federal government budgets and spends money on transportation and infrastructure (not least of which might be through accrual accounting – a pending ETW research project will examine the 1978 effort to put the Highway Trust Fund on a form of accrual accounting, which would have precluded the ability to spend the HTF into bankruptcy).

(Photo: USAToday)