A revised version of the trillion-dollar-plus coronavirus response bill circulated by Senate Republicans this morning, after a long weekend of consultation with Senate Democrats, contains almost $90 billion in federal assistance for transportation. The bill also effectively takes Harbor Maintenance Trust Fund spending off-budget, in perpetuity.

A four-way McConnell-Schumer-Pelosi-McCarthy meeting was going on late this morning to go over the proposed bill (photo here), which has not yet been agreed to by Speaker Pelosi, and a procedural vote on moving forward in the Senate is set for 3 p.m. today.

(6:52 p.m. 3/22/2020 update: Senate Democrats voted en masse against the procedural motion to move forward on the bill today (moved from 3 p.m. to 6 p.m.), meaning that it fell 11 votes short of the 60 required (the final vote was a 47-47 tie, with Majority Leader McConnell having to switch his vote from yes to no so he would be eligible to move for a re-vote, and with five Republicans absent due to coronavirus self-quarantine). Negotiations will continue in hopes of a re-vote later tonight on a (possibly) modified version of the bill.

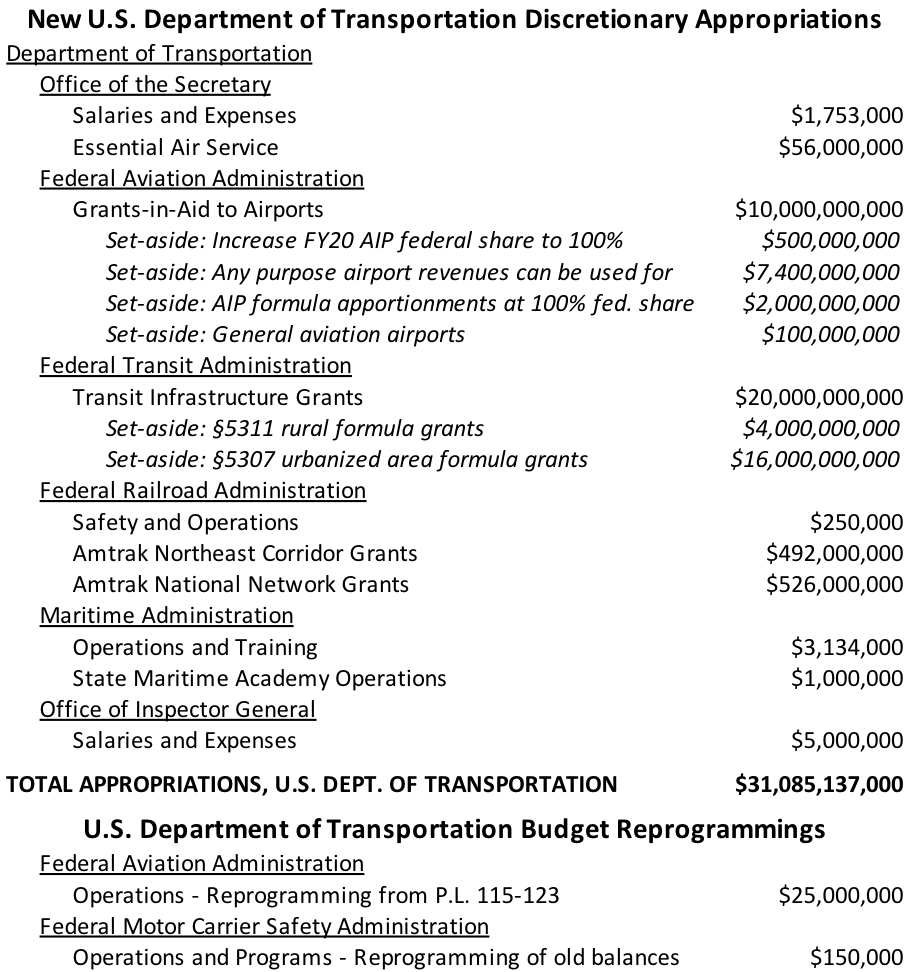

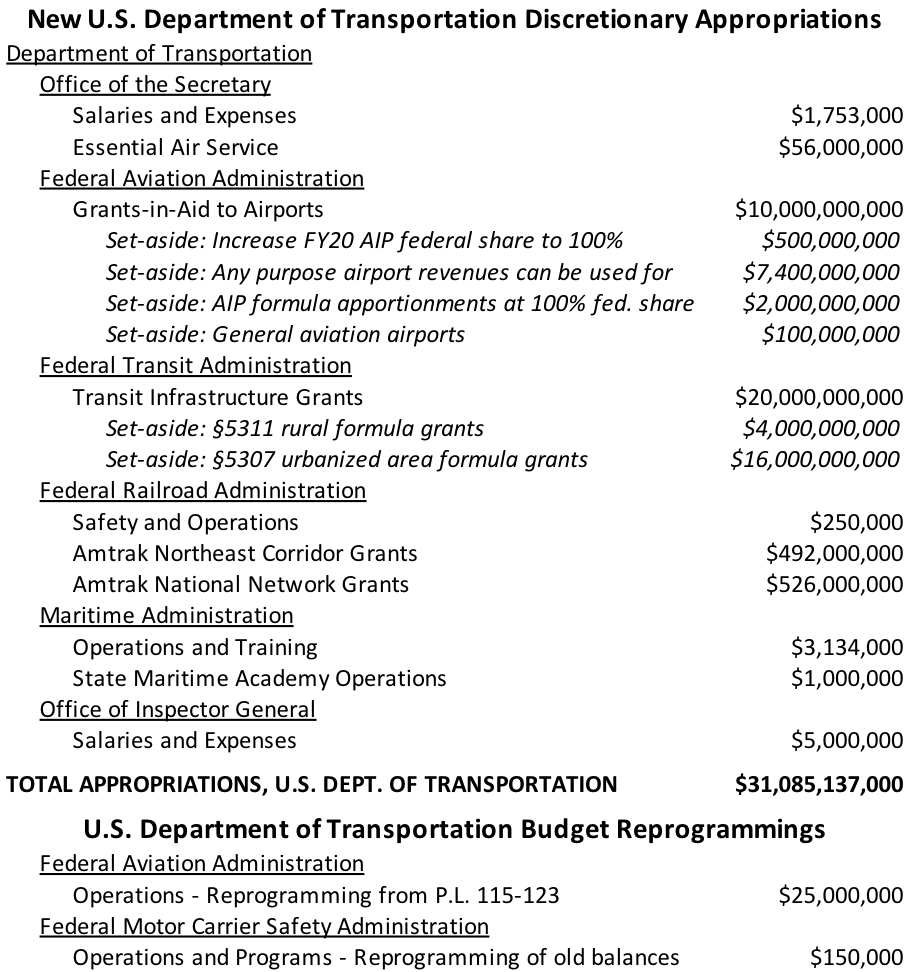

Appropriations. A new division of the draft bill providing appropriations includes $31.1 billion for the U.S. Department of Transportation, including $20 billion for mass transit providers, $10 billion for airports, and $1 billion for Amtrak, as follows:

Mass transit aid. The bill appropriates $20 billion in “transit infrastructure grants” to transit systems “to prevent, prepare for, and respond to coronavirus,” and is split 80-20 between the section 5307 urbanized area formula grant distribution and the section 5311 rural area formula grant distribution, respectively.

The bill says that “notwithstanding 49 U.S.C. 5307(a)(1) or (b), 49 U.S.C. 5311(b) or 49 U.S.C. 5324(1), funds provided under this heading in this Act are available for the operating expenses of transit agencies to prevent, prepare for, and respond to coronavirus related to the response to a public health emergency as defined under section 319 of the Public Health Service Act, including reimbursement for operating costs and lost revenue, the purchase of personal protective equipment, and applicable preventive maintenance, such as vehicle cleaning: Provided further, That such operating expenses are not required to be included in a transportation improvement program, long-range transportation, statewide transportation plan or a statewide transportation improvement program: Provided further, That recipients of assistance under this heading in this Act should make every effort to appropriately adjust operations in response to reduced demand as a result of coronavirus: Provided further, notwithstanding 49 U.S.C. 5324(d), the Secretary shall not waive the requirements of 49 U.S.C. 5333 for funds appropriated under this heading in this Act or for funds previously made available under 49 U.S.C. 5307 or 49 U.S.C. 5311 as a result of coronavirus.”

Airport aid. The $10 billion for grants-in-aid to airports is structured a little differently. The bulk of it ($7.4 billion) carries a 100 percent federal cost share, is for commercial service airports, “shall be available for any purpose for which airport revenues can lawfully be used” and is to be distributed two ways: half by calendar year 2018 enplanement percentage, and the other half “based on an equal combination of each sponsor’s fiscal year 2018 debt service as a percentage of the combined debt service for all commercial service airports and each sponsor’s ratio of unrestricted reserves to their respective debt service…”

An additional $2 billion is apportioned by the AIP formula (“as set forth in section 47114(c)(1)(C)(i), 47114(c)(1)(C)(ii), or 47114(c)(1)(H) of title 49, United States Code”) at a 100 percent federal share but does not carry the “for any purpose for which airport revenue can be lawfully used” proviso, so the $2 billion is only for regular AIP-eligible projects.

An additional $500 million is appropriated so that the $3.35 billion in regular airport grants for FY 2020 appropriated last year can be spent a 100 percent share instead of the 80-to-100 percent federal share required by statute. And a further $100 million is for general aviation airports.

Amtrak aid. The bill appropriates $1 billion for grants to Amtrak ($492 million for the Northeast Corridor and $526 million for the National Network) “to prevent, prepare for, and respond to coronavirus.” The National Network grants contain a proviso that “a State shall not be required to pay the National Railroad Passenger Corporation more than 80 percent of the amount paid in fiscal year 2019 under section 209 of the Passenger Rail Investment and Improvement Act of 2008 (Public Law 110-432) and that not less than $239,000,000 of the amounts made available under this heading in this Act shall be made available for use in lieu of any increase in a State’s payment…”

The bill also requires that, in the event of any Amtrak furloughs, “the Secretary shall require the National Railroad Passenger Corporation to provide such employees the opportunity to be recalled to their previously held positions as intercity passenger rail service is restored to March 1, 2020 levels and not later than the date on which intercity passenger rail service has been fully restored to March 1, 2020 levels.”

Aviation sector loans and loan guarantees. In the non-appropriations division of the new bill, title IV establishes a new $500 billion loan and loan guarantee program, divided as follows:

- Up to $50 billion for loans and loan guarantees to passenger air carriers;

- Up to $8 billion for loans and loan guarantees to cargo air carriers;

- Up to $17 billion for loans and loan guarantees to “businesses critical to maintaining national security” (the bill does not define this term, but it sounds like Boeing); and

- Up to $425 billion for “loans, loan guarantees, and other investments in support of programs or facilities established by the Board of Governors of the Federal Reserve System for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities by – (A) purchasing obligations or other interests directly from issuers of such obligations or other interests; or (B) purchasing obligations or other interests in secondary markets or otherwise.”

As in the previous iteration of the bill released by Senator McConnell a few days ago, the credit assistance for airlines and for the business that sounds like Boeing can only be provided if the Treasury Secretary determines, at his discretion, that the applicant does not have regular credit “reasonably available” and the obligation is “prudently incurred.” The amount provided cannot exceed “covered losses,” defined as “losses incurred directly or indirectly as a result of coronavirus, as determined by the [Treasury] Secretary.”

Other requirements include that the loan or loan guarantee be at a rate that reflects the risk involved and that the rate, to the extent practicable, be not less than pre-coronavirus interest rates, and that the loan duration be “as short as practicable and in any case not longer than 5 years.”

The bill also prohibits loan and loan guarantee recipients from buying back any of their stock while the loan or loan guarantee is outstanding and requires them to maintain their existing employment levels as of March 13, 2020, to the extent practicable. Restrictions on executive compensation for companies that receive loans or loan guarantees is also included.

Also, any loans to the business that sounds like Boeing can only be made if the company has “incurred or is expected to incur covered losses such that the continued operations of the business are jeopardized, as determined by the Secretary.”

For airlines receiving assistance, the bill allows USDOT to require, “to the extent reasonable and practicable,” that those carriers “maintain scheduled air transportation service as the Secretary of Transportation deems necessary to ensure services to any point served by that carrier before March 1, 2020.” The Secretary is required to take into account the needs of small and remote communities, and the authority to require such service expires on March 1, 2022.

The bill also suspends collection of aviation excise taxes under sections 4261 and 4271 of the Internal Revenue Code (and on jet fuel taxed in other sections of the tax code) from the date of enactment through December 31, 2020.

(2:47 p.m. 3/22/2020 addition) Harbor Maintenance Trust Fund balance spend-down. Buried in the middle of the appropriations division of the bill by Senate Appropriations Chairman Richard Shelby (R-AL) is a provision that he has long sought that appears to allow the eventual appropriation of the $9 billion in excess balances in the Harbor Maintenance Trust Fund that have accumulated over the last 30 years. The provision in essence provides that appropriations of these balances won’t count towards the scoring of appropriations bills (once Congress enacts a new water resources development act or January 1, 2021, whichever is earlier. The language reads as follows:

“Sec. 16003. Any discretionary appropriation for the Corps of Engineers derived from the Harbor Maintenance Trust Fund (not to exceed the total amount deposited in the Harbor Maintenance Trust Fund in the prior fiscal year) shall be subtracted from the estimate of discretionary budget authority and outlays for any estimate of an appropriations Act under the Congressional Budget and Impoundment Control Act of 1974 or the Balanced Budget and Emergency Deficit Control Act of 1985: Provided, That the modifications described in this section shall not take effect until the earlier of January 1, 2021 or the date of enactment of legislation authorizing the development of water resources and shall remain in effect thereafter.”