February 14, 2018

Ten days ago, another fatal Amtrak accident occurred in South Carolina, and once again, the National Transportation Safety Board indicated that, if positive train control (PTC) technology had been installed and fully implemented on that route, the accident would likely have been avoided.

(Ed. Note: Of course, a more low-tech kind of automatic train signaling was already installed and implemented along that route which also would likely have prevented the accident, but that system was apparently turned off so that the host railroad could work on installing the more modern PTC technology. No kind of electric technology works if the ON/OFF switch is in the OFF position.)

When combined with December’s Amtrak derailment near Tacoma, Washington, which the NTSB also said could have been avoided if Amtrak had waited to start service along a new route until after PTC was installed and implemented on that new route, the effect is to focus public attention on the looming deadline of December 31, 2018 for all U.S. railroads to have PTC technology implemented. (If a railroad has all technology installed and all spectrum purchased by the 12/31/2018 deadline, and has met certain implementation and training benchmarks, they can ask the Federal Railroad Administration on a railroad-by-railroad basis for a two-year extension to get the new technology fully implemented and tested. See here for FRA’s October 2017 update of how each major railroad is looking for possible deadline extensions.)

As of last October, freight railroads were farther along on their PTC implementation than were passenger railroads (especially commuter railroads):

The technology is costly. The railroad trade association estimates that as of the end of 2017, U.S. freight railroads together have spent more than $8 billion — of their own funds, not taxpayer’s — on PTC development and deployment and expect to spend $2-3 billion more through the end of 2020 (in addition to never-ending operational costs). Costs to passenger and commuter railroads, most of which get passed on to various levels of government, are estimated to be at least $3 billion in addition to that. S0 the PTC mandate in the United States is expected to take about 12 years from start to finish (the mandate was enacted in late 2008) and take maybe $13 billion.

Now imagine trying to install such a system across the borders of several dozen sovereign nation-states, most of which have different underlying railroad signaling systems and languages, and you will begin to understand how much more difficult the European Union’s similar project has been.

A November 2017 report from the staff of the European Commission (one of the EU governing bodies) lays out the progress made to date on installation of their PTC equivalent, ETCS (European Train Control System), which is:

…a train control standard, based on in-cab equipment, an On-Board Unit able to supervise train movements and to stop it according to the permitted speed at each line section, along with calculation and supervision of the maximum train speed at all times. Information is received from the ETCS equipment beside the track. The driver’s response is continuously monitored, and if necessary the emergency brakes would be taken under control.

ETCS is being implemented in tandem with an EU-wide GSM-based radio communications system standard. Together, the ETCS system and the new radio standard are called ERTMS (European Rail Traffic Management System).

The report describes the barriers that have slowed implementation of the new systems, including:

- Uncoordinated ERTMS trackside deployment between and within Member States.

- Requirements introduced on to On Board Units, for example by national rules, the necessity of running on different infrastructures, interactions with legacy systems in Member States (Class B systems) – these changes can result in On-Board Units that can run in one Member State but not another and can increase costs through customisation.

- Different engineering rules within and between Member States, with a high variety of trackside configurations impacting testing procedures and leading to higher costs.

- Inefficiencies in conformity assessments and authorisation, for example differing assessments by NSAs on whether modifications are minor or major (with reauthorisation being needed for major modifications).

- Market inefficiencies, where short-term economic incentives for suppliers and customers may work against the goal of interoperability.

- Different interpretations of the ERTMS specifications during the rollout of projects that may lead to errors and incompatibilities between ETCS subsystems.

The EU and its railroad association first signed a Memorandum of Understanding in 2006 calling for full implementation of ERTMS within 10-12 years (in other words, to have it done by now). Installation did not start in earnest until 2016, and as of the end of last year, 2,400 miles of interoperable systems were deployed and operable.

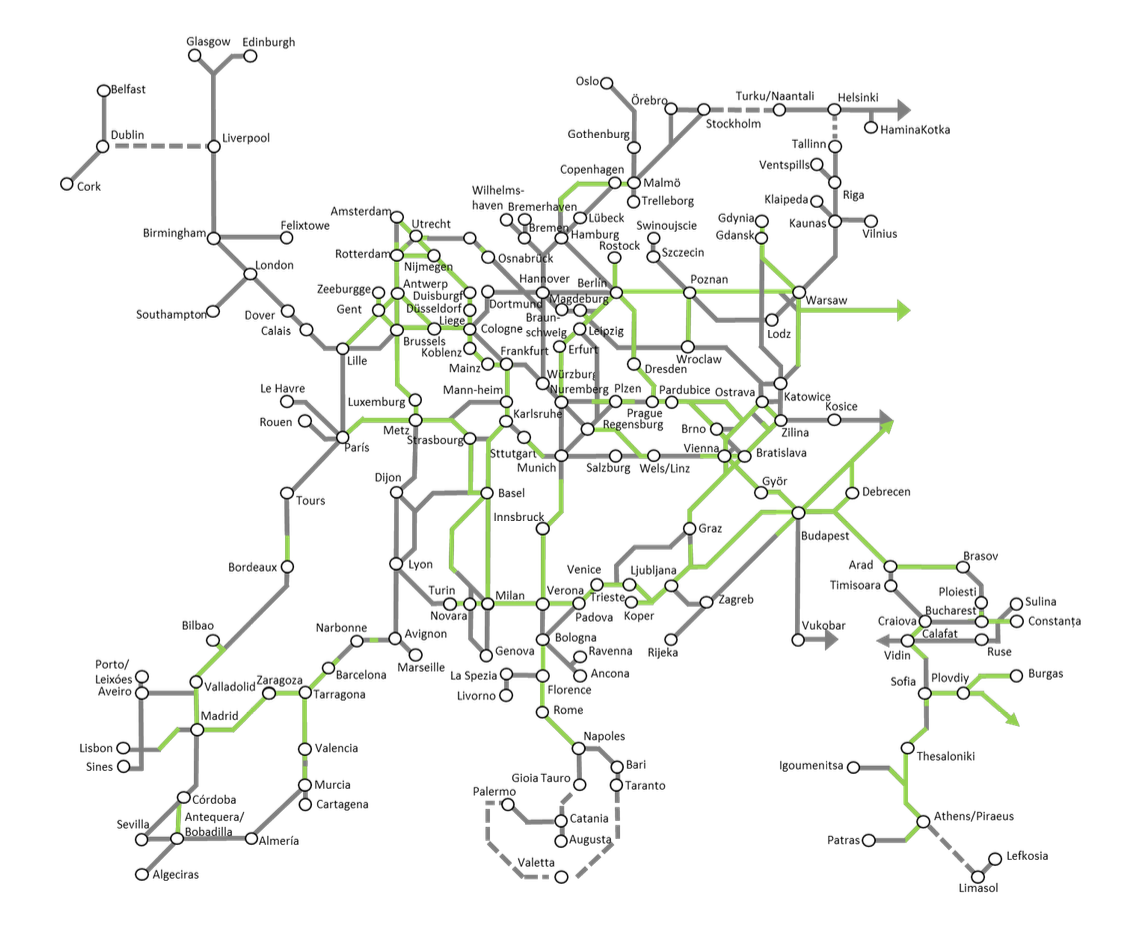

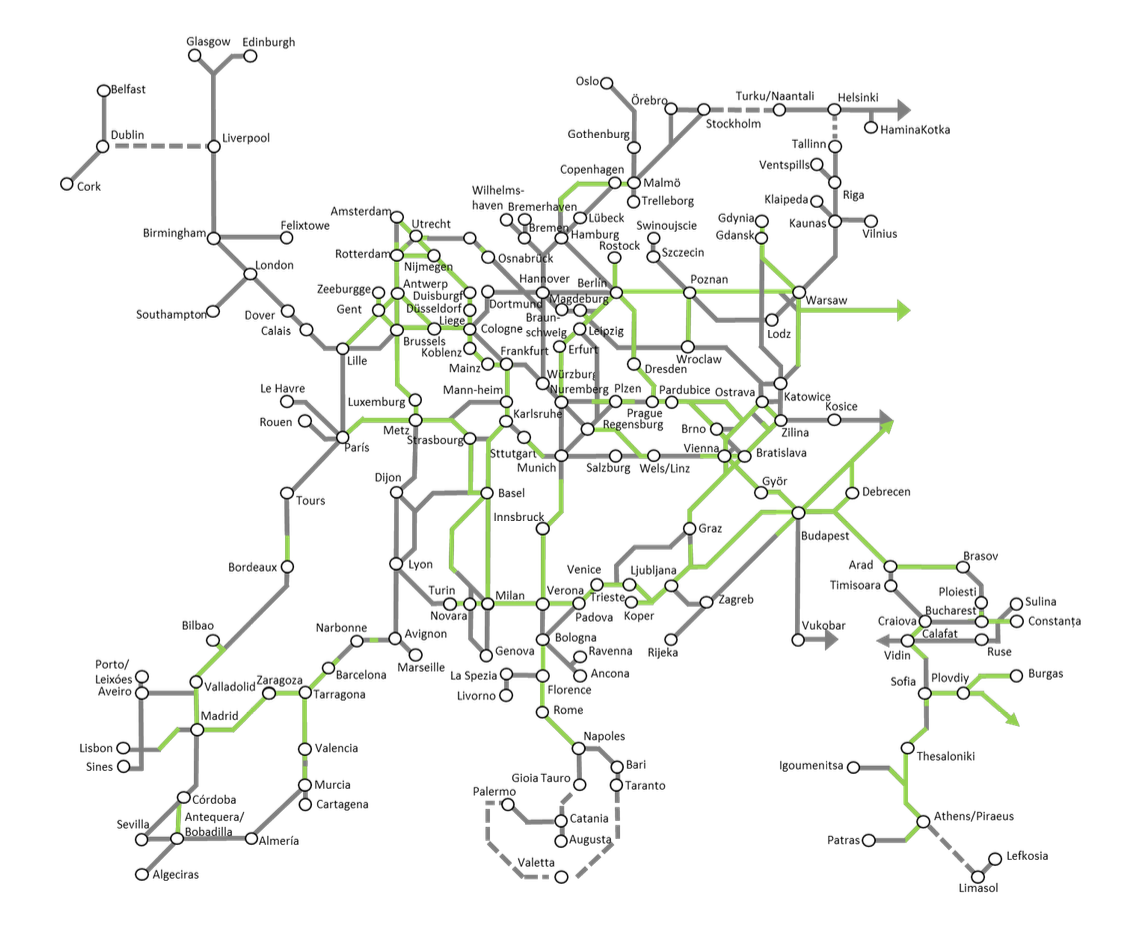

But the long-term schedule is now much, much slower. The following map shows the 30,000-mile EU “Core Network” of railroads. The green routes are expected to have ETCS installed by the year 2023, and the gray routes by 2030.

The eventual goal is to have about 73,000 miles of the European rail network fully controlled by the new ERTMS system by the year 2050. But if the EU were operating under the terms of the American PTC mandate enacted by Congress in 2008, another 40,000 miles of their network would have to be upgraded.

And as far as cost goes, a 2017 report by the European Court of Auditors found that:

…the total cost of ERTMS deployment trackside throughout the core network corridors or the comprehensive network could range between 73 and 177 billion euro, depending on the extent of the deployment.

On the high end of that range, that’s at least a dozen times as much as PTC implementation will cost in the United States.

And a 2015 article in a British railway publication pointed out another problem – because this process has taken so long, the interoperable radio signaling part of the ERTMS was first designed using mid-1990s specification and uses the GSM-R technology, a “2G” type of wireless tech. As the rest of the wireless industry is already turning its attention from 4G to 5G, there is a limit to how long manufacturers may continue to support the 2G standard.

So, while the financial, technical and logistical barriers to full PTC implementation in the United States are significant, they are dwarfed by the problems faced by the similar project in the European Union.