July 12, 2019

Pressure mounted on Congressional leaders this week to enact legislation increasing the public debt limit and statutory spending ceilings before Congress departs for its scheduled five-week August recess, which is to begin three weeks from today.

The statutory ceiling on the public debt of the United States was reached on March 2, 2019 ($22.99 trillion), but the Treasury has broad powers to move money around between retirement funds, to and from the Federal Reserve, and in operating balances which means that the impact of hitting the debt limit can be delayed for months. Treasury Secretary Stephen Mnuchin last updated Congress in a May 23 letter that indicated those “extraordinary measures” might run out in “late summer.”

But new estimates from the Bipartisan Policy Center on July 8 indicated that the drop-dead date on the debt limit – the date on which the Treasury Department is finally unable to move any more money around and has to start missing scheduled payments and defaulting on legal obligations – could come in early September. This was echoed earlier today by Mnuchin himself, in a new letter to Congress:

If Treasury can make it to September 16, when billions of dollars from quarterly estimated tax payments are due, they could buy themselves a few more weeks. But the possibility of hitting the drop-dead date in early September, combined with the fact that Congress is not scheduled to come back from the August recess until Monday, September 9, seems to have jump-started budget talks again in the last 48 hours.

House Speaker Nancy Pelosi (D-CA) spoke with Secretary Mnuchin several times yesterday afternoon and evening and told reporters last night that a deal on the debt limit and spending caps should happen “prior to recess.”

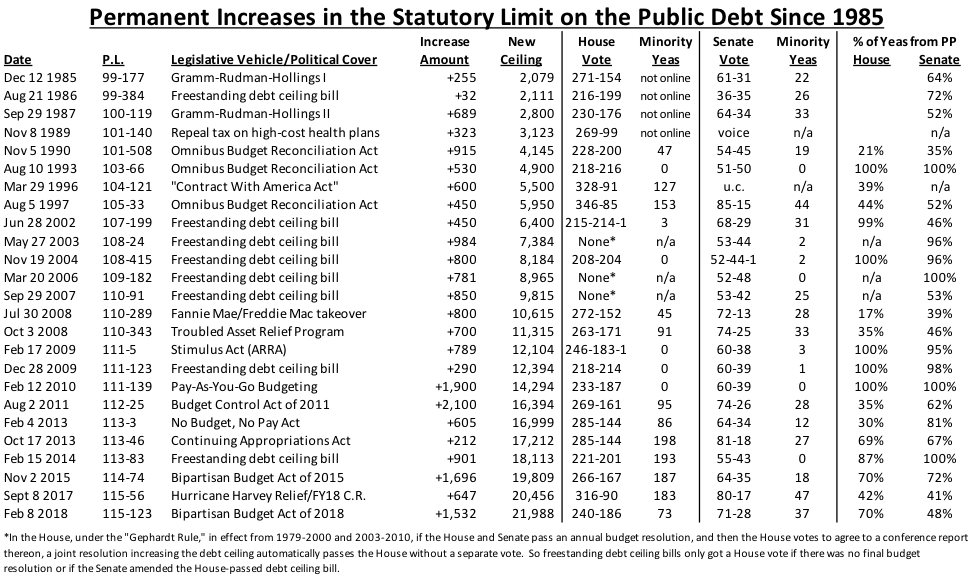

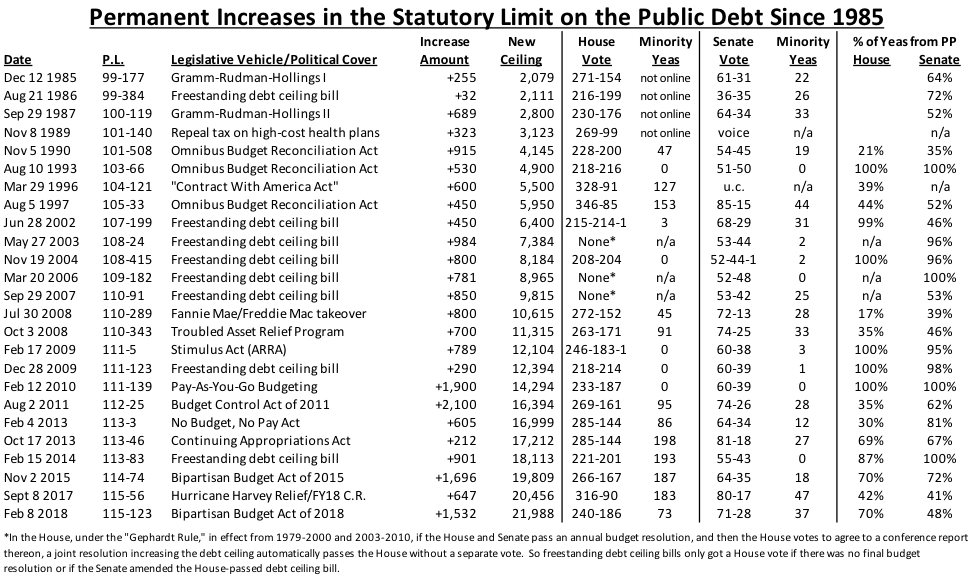

The debt limit doesn’t necessarily have anything to do with spending caps or anything else, but while it is a “must-pass” item, raising the debt limit is so politically painful that the legislation is usually paired with more palatable things, or other must-pass items that equal a too-big-to-fail package. The following table shows every debt limit increase since 1985, what it was attached to (if anything), and the votes in the House and Senate.

The creation of the spending caps in 2011 was an add-on to a debt limit vote, as were the 2015 and 2018 spending cap increases, so the next set of spending cap increases is a logical add-on to the next debt limit bill.

Under current law, the spending caps are scheduled to be reduced from $1.244 trillion in fiscal 2019 ($647 billion for defense and $597 billion for non-defense) down to $1.119 trillion in 2020 ($576.2 billion for defense and $543.2 billion for non-defense). If Congress simply extends 2019 appropriations in a year-long continuing resolution, automatic across-the-board sequestration cuts would take place reducing all non-defense discretionary accounts by 9.0 percent each and reducing all defense accounts by at least 11 percent (military salaries are exempt from sequestration so the exact percentage cut is hard to figure).

The Trump Administration and the Democratic leadership of the House of Representatives have vastly different ideas on where the 2020 cap levels should be set, with the Administration’s budget request looking to essentially cheat the caps by putting its Pentagon funding increase in the Overseas Contingency Operations category that is not subject to the caps. The House, meanwhile, wants to increase the defense and non-defense caps by $87.8 billion each. Totals are below (the CBO re-score of the President’s budget is used).

|

|

——–FY 2020——– |

|

FY19 |

Cap |

Trump |

House |

| Defense Cap |

647.0 |

576.2 |

576.1 |

664.0 |

| Defense OCO |

69.0 |

no cap |

164.9 |

69.0 |

| Total Defense |

716.0 |

???? |

740.9 |

733.0 |

|

|

|

|

|

| Non-Defense Cap |

597.0 |

543.2 |

566.7 |

631.0 |

| Non-Defense OCO |

8.0 |

no cap |

0.0 |

8.0 |

| Total Non-Defense |

605.0 |

???? |

566.7 |

639.0 |

In recent weeks, the White House had been advocating a one-year debt limit suspension (which would net to an increase of over $1 trillion) coupled with a cap deal that sets the 2020 caps at the 2019 levels. This is not enough defense money for a lot of Capitol Hill Republicans and is definitely not enough non-defense money for the new Democratic majority in the House.

The Senate Republican Whip, John Thune (R-SD), told reporters yesterday that Senate Republicans want a two-year debt limit and spending cap deal so they don’t have to take another painful set of fiscal votes before the November 2020 elections. But that doesn’t mean that all of his colleagues have coalesced around a particular set of numbers. Appropriations chairman Richard Shelby (R-AL) has been working extremely closely with his Democratic counterpart, Patrick Leahy (D-VT) on all committee business, which could mean that Shelby will have an easier time cutting a deal with House Democrats than he will with the Trump White House.

Other items of budget-related business that might be included in a debt limit and spending cap deal include the repeal of the $7.6 billion highway contract authority rescission scheduled to take place on July 1, 2020 (or, failing that, a re-setting of the budget baseline for the highway program so that budget points of order would not lie against a separate bill repealing the rescission) and a provision taking some or all appropriations from the Harbor Maintenance Trust Fund outside the discretionary spending cap (a top priority of chairman Shelby).