February 12, 2018 – 10:30 a.m.

Today, the White House released the Trump Administration’s long-awaited proposal to increase infrastructure investment in the United States. The 53-page detailed proposal is here.

Before discussing what is in the plan, here’s what’s not included:

- The plan does not indicate how much money will go to each individual mode of infrastructure. New grant programs would be created for which infrastructure projects would be eligible in not just transportation (highways, mass transit, freight and passenger rail, airports, air traffic control, ports, and inland waterways) but also electrical grid, broadband, hydropower, drinking water, sewer, flood control, and brownfield/Superfund site redevelopment. And the plan says that funding for these grant programs would be split between the Transportation and Commerce Departments and the Corps of Engineers and the EPA (and, by implication, the Agriculture Department as well) – but it does not say which agency or what mode gets how much money.

- The plan does not have a specific “pay-for.” Instead, the outlays from the $200 billion federal funding commitment are fungible with the rest of the Administration’s mandatory spending and tax proposals, which total $1.89 trillion in deficit reduction over 10 years (less $200 billion in new spending for the infrastructure plan, the total changes in mandatory programs and tax receipts proposed by the White House over ten years equals $1.69 trillion in reductions from the baseline, mostly in Medicare, health and income security programs). Congress may feel the need to attach a specific pay-for to the legislation, but the Administration does not (though Administration officials have repeatedly said that no pay-for is off the table and that they would probably accept whatever Congress decided to do).

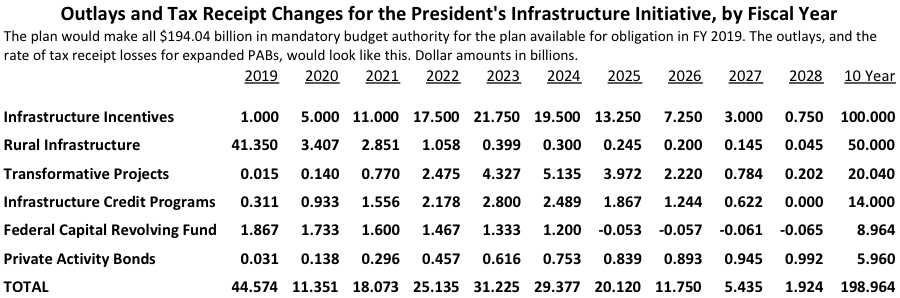

Funding. The main components of the plan have been telegraphed by the Administration for some time. It would provide $200 billion in federal budget authority, as follows:

- $100 billion for a new “incentive grants” program. This money would be distributed between USDOT, the Corps of Engineers and the EPA (again, we don’t know how much to which agency) and then other federal agencies could ask DOT/Corps/EPA for some of the money. Potential project sponsors could then apply to their lead federal agency for a grant, which will be judged primarily on how much new non-federal revenue can be brought to the table. (The plan spells out a fixed weighting system with some factors that don’t require human judgment but some that do, making this program still discretionary where the Administration picks winners and losers.) State/local sponsors who enacted a tax increase for infrastructure in the three years before February 2018 would get some credit for those revenues on a not-spelled-out sliding scale. After application of the overly complicated weighting system, the amount of an incentive grant would be capped at 20 percent of “new revenue” (not sure how that differs from “project cost”) and could be combined with the face value of a federal loan or a PAB.

- $50 billion for grants to rural areas that lack the tax base or the passenger/freight throughput to utilize much financial leveraging. 80 percent of that money ($40 billion) would be given out as block grants to state governors via some kind of rural population/rural road-miles formula that is not spelled out in the plan. Apparently this block grant money would have very few federal strings attached. The other 20 percent would go for “performance grants” selected by the federal government (which agency is unclear, but the Agriculture Department has always done double duty as the Department of Rural America). States that could prove good stewardship of their block grants and leveraging of funding from existing federal programs would have an advantage in the performance grant selections. Some part of the non-formula money would also go to projects in U.S. territories and on tribal lands.

- $20 billion for a new “transformative projects” program led by the Commerce Department that would select “bold, innovative, and transformative infrastructure projects that could dramatically improve infrastructure. Funding under this program would be awarded on a competitive basis to projects that are likely to be commercially viable, but that possess unique technical and risk characteristics that deter private sector investment. The transformative projects program would support projects that, with Federal support, are capable of generating revenue, would provide net public benefits, and would have a significant positive impact on the Nation, a region, State, or metropolitan area.”

- $14 billion to be given to existing federal credit programs (TIFIA, WIFIA, RRIF, RUS) to pay for credit subsidy authority to make new loans and loan guarantees to sponsors of infrastructure projects. This is where most of the leveraging in the plan comes from. (More details below.) The plan does not say how much goes to TIFIA, how much to RRIF, etc.

- $10 billion to endow a revolving fund to allow the General Services Administration to make big real estate purchases all at once without overly inconveniencing the Appropriations Committees, which currently have to pay for major GSA buys out of their annual budget allotment all at once, affecting other programs competing for the same dollars. A revolving fund would allow the appropriators, in essence, to borrow money from the mandatory budget and then pay it back over several years.

- $6 billion to represent the estimated cost to the Treasury over ten years of the lost tax revenue because of the increased issuance of private activity bonds (PABs) paying tax-exempt interest that will be issued under the more expansive PAB rules proposed in the plan.

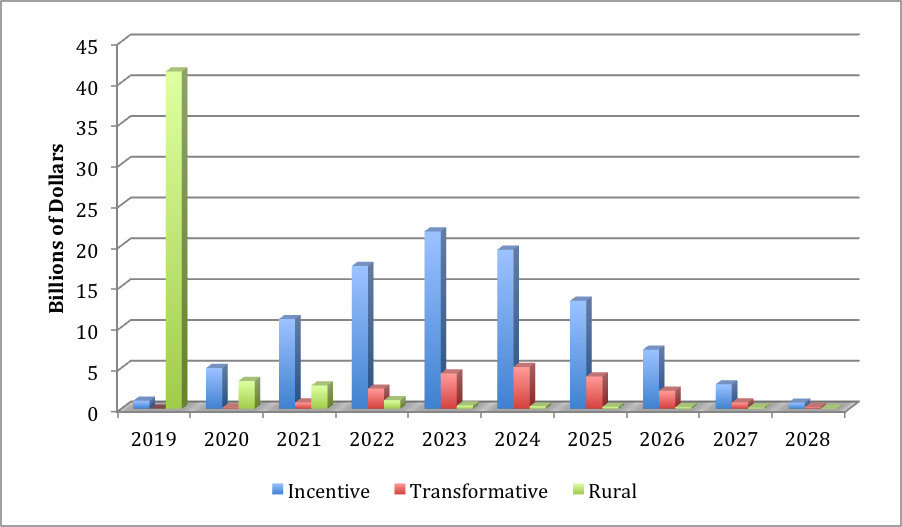

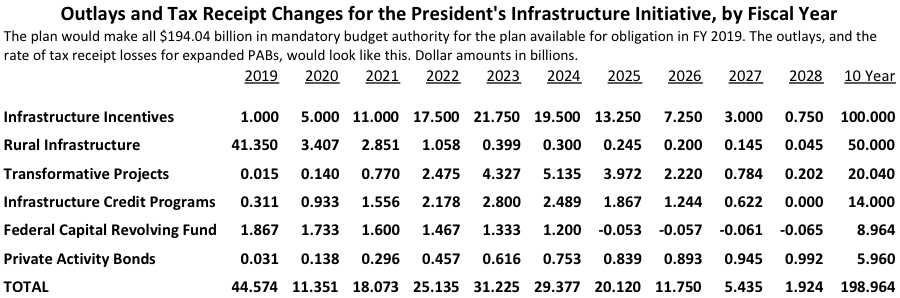

Last year’s budget also contained a “placeholder” of $200 billion for an infrastructure plan, but it was just one line of budget authority providing $200 billion, all of which was made available in 2018. This year, the budget provides more detail, separating the various components of the infrastructure plan and showing how the outlays (or estimated tax loss) for each program will trickle out over each fiscal year. However, because of the nature of the proposed block grant for rural infrastructure, the economic effect (from a federal budget point of view) is not distributed evenly. The federal government will simply write $40 billion of checks to states once the bill is enacted, enabling a 100 percent outlay rate for this program in the first year, while the rest of the programs would have slow startups.

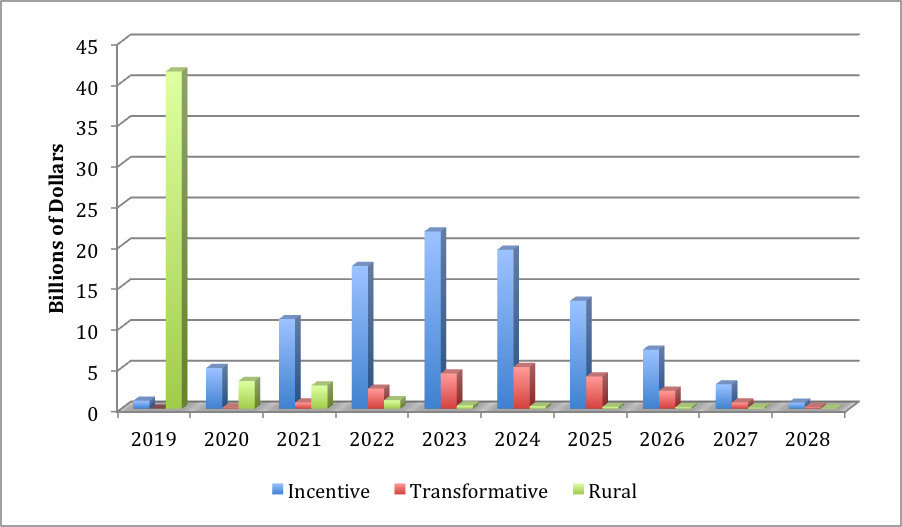

To give a more visual representation, here is how the outlays (cash flow) for the plan’s $170 billion for incentive, transformative and rural grants would, by OMB’s estimation, flow out of the Treasury over the course of a decade.

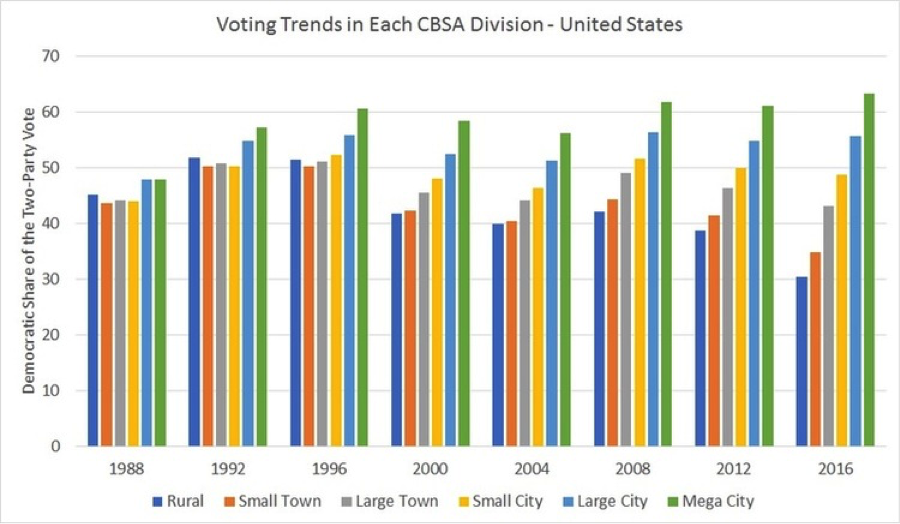

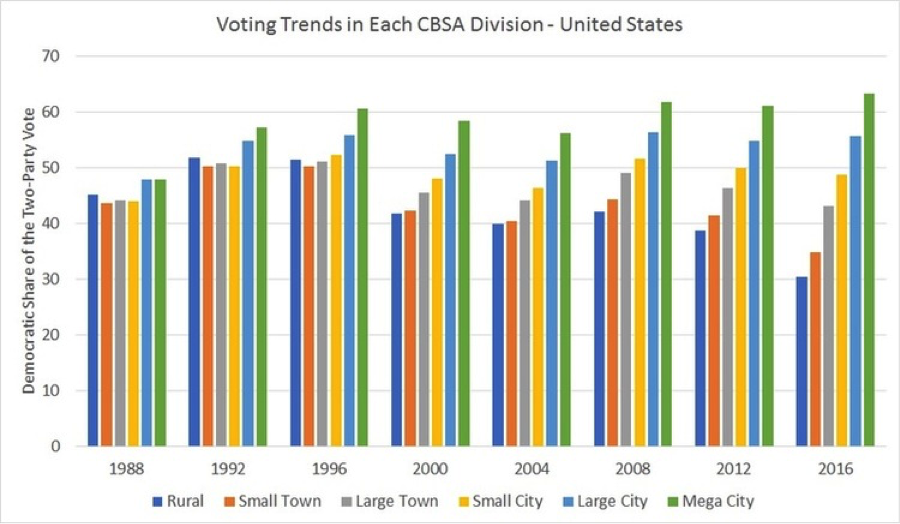

Lest you think that the rural-suburban divide is not inherently political, allow us to reprint this amazing chart from the epic five-part “How Trump Won” data deep-dive on realclearpolitics.com by Sean Trende and David Byler in January 2017. The following chart breaks down the Democratic share of the two-party presidential vote in the 1988, 1992, 1996, 2000, 2004, 2008, 2012 and 2016 elections by Census CSBA division (rural, small town, large town, small city, large city, mega city). Taller bars are more Democratic, shorter bars are more Republican. Just look how the urban-rural political divide has grown from 1988-2016.

(1 p.m. 2/12/18 update – Since the budget deal enacted last week provided tons of extra discretionary spending permission in both 2018 and 2019, the White House just sent the Appropriations Committees a document asking for Congress to jump start the infrastructure plan in the pending 2018 omnibus appropriations bill by appropriating $11 billion for the incentives grant program and $5 billion for the rural grant program immediately.)

And while the $200 billion does represent real money for infrastructure, it is also true that other parts of the President’s Budget propose the reduction or repeal of existing infrastructure programs (TIGER grants and mass transit new starts, for example). If you count the cuts in the FY19 budget for TIGER, new starts, rail infrastructure grants to states, and Corps of Engineers and USDA water programs, you get about $35 billion in budget authority for infrastructure that was provided in 2017 (and will almost certainly be provided in 2018, perhaps at higher levels) that would not be repeated in 2019 or thereafter.

And the Budget does not propose to fix the Highway Trust Fund’s looming insolvency. Instead, like last year, the budget assumes that no one will fix the Trust Fund and that states will have to wait for weeks, then months, and then possibly years for reimbursements from the federal government. These delays would reduce federal deficits by over $100 billion starting in 2021 (we have to wait for the budget documents to see the details, but the cost was estimated by CBO last summer to be $143 billion over 2021-2027). White House officials are adamant that the Highway Trust Fund insolvency is not a policy proposal but is instead something already scheduled to happen, which may be technically true. But it is also true that government and private sector stakeholders view fixing the Trust Fund as much more important than adding new infrastructure programs in addition to Trust Fund spending, so if you don’t reduce the $200 billion spent by the President’s infrastructure bill by the $143 billion (or whatever) cost of Highway Trust Fund solvency, you need to add the Trust Fund to the infrastructure plan, so the real cost of the infrastructure plan to the federal budget is $343 billion, not $200 billion.

Leverage. The plan does provide $200 billion in proposed federal funding. $200 billion is not the $1 trillion that was discussed during the 2016 campaign and all throughout last year, nor is it the $1.5 trillion that the President promised in the State of the Union address last month.

How do you turn $200 billion into $1.5 trillion? Leverage.

The leverage of the $100 billion in incentive grants seems fairly clear. If you assume that the “20 percent of new revenue” maximum federal share of the program translates into 20 percent of project costs, that $100 billion leverages another $400 billion. If it turns out to be less than 20 percent of project costs, the leverage goes up a bit. But that doesn’t get you to $1.5 trillion.

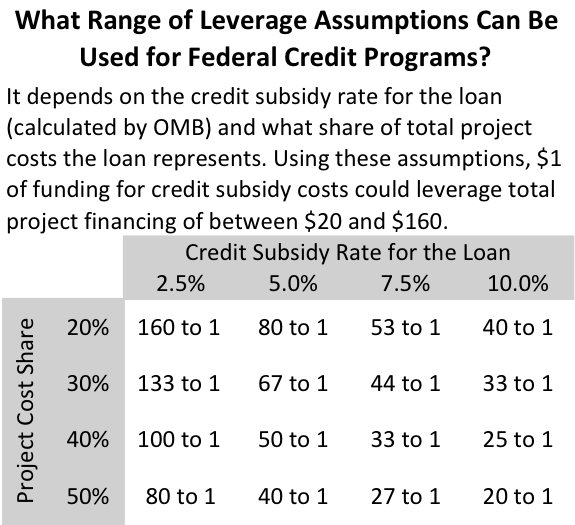

The big leverage comes from the $14 billion that goes to federal credit programs. Under the terms of the Federal Credit Reform Act of 1990, the face value of federal direct loans and loan guarantees no longer shows up in the budget, and neither does the repayment of loan interest and principal to the Treasury. The only thing that shows up in the budget is the “credit subsidy cost” of the loan, a percentage of face value estimated by OMB and based on estimated default risk, interest differentials, administrative costs, etc. (See section 185.5 of OMB Circular A-11 for more details.)

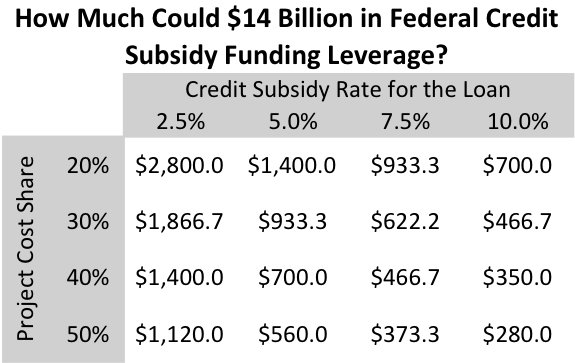

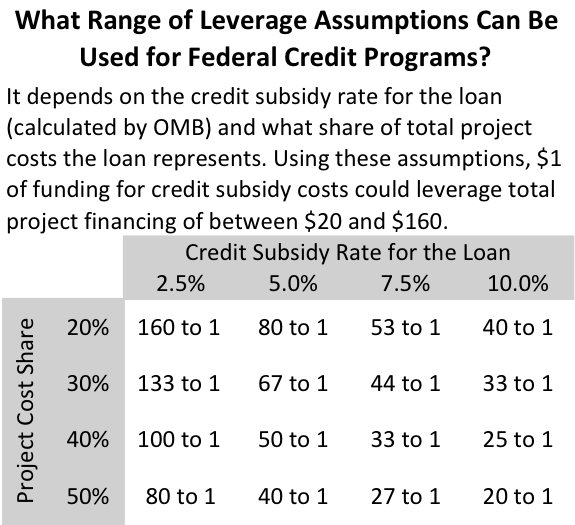

The FY 2018 OMB average estimate for the TIFIA loan program was a subsidy cost of 6.64 percent. (The WIFIA program is lower – below 2 percent.) Depending on what percentage of a project’s cost comes from a federal loan, one dollar of federal spending on the subsidy cost can leverage between $20 and $160, as shown in the table below.

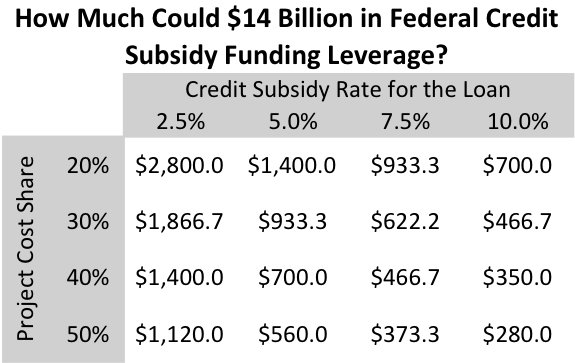

So that $14 billion for TIFIA/WIFIA/RRIF/RUS could, under these assumptions, leverage between $280 billion and $2.8 trillion in project costs. If the White House is assuming that the $100 billion in incentive grants leverage $400-500 billion in projects, and the transformative and rural grants leverage a little money, then they are probably also assuming that the $14 billion for credit programs leverages somewhere between $800 billion and $900 billion, which is somewhere near the plausible middle spot of the table below.

So these leverage assumptions for the $14 billion are not outlandish – on paper. In the real world, however, simply throwing subsidy money at a federal credit program does not necessarily translate into more loans. The 2012 MAP-21 law provided an eightfold increase in subsidy funding for the TIFIA program, to $1 billion per year, much of which went unspent and in one instance had to be transferred out of the program to highway formula funding where it could actually get spent. (For details, see ETW’s December 2015 article “Was the FAST Act’s 70 Percent Cut in TIFIA Funding Justified?”

(Ed. Note: Also, it’s not as if an extra billion dollars in federal direct loans and loan guarantees and PABs can be evenly distributed across the country, because some states and local governments are already too overleveraged. States like Illinois and New Jersey, and various bankruptcy-teetering cities, can’t reasonably be expected to take out massive new federal infrastructure loans because they have already borrowed too much to pay operating costs and avoid pension shortfalls. The higher a state/local government’s current credit rating, the more easily they could take advantage of low-cost federal loans for infrastructure.)

The Administration plan does propose statutory changes that would make these credit programs easier to use. At present, TIFIA loans are reserved for projects eligible for funding under title 23 U.S.C. (federal-aid highways) and chapter 53 of title 49 U.S.C. (mass transit). The Administration plan would open TIFIA up to loans to airport projects, port projects, and non-federal waterways.

The new WIFIA program at present supports loans for the various types of water infrastructure project under EPA jurisdiction (drinking water, wastewater, stormwater and drought mitigation) but not for water projects under Corps of Engineers jurisdiction (flood mitigation, hurricane and storm damage reduction, navigation, and environmental restoration projects). The White House plan would make those projects WIFIA-eligible as well. And it would get rid of the current $3.2 billion cap on WIFIA loan volume (at an estimated subsidy rate of less than 2 percent, a far higher volume could theoretically be supported).

The RRIF railroad loan program works differently. Under current law, federal funding cannot be used to pay the credit subsidy cost – railroads have to pay the cost themselves. (So even for a low-interest loan, the additional fees for the subsidy cost make RRIF loans unattractive to many potential borrowers.) The Administration plan would amend the statute to allow federal money to be used for the credit subsidy cost for RRIF loans to short-line freight railroads and to passenger railroads.

Another type of financing, tax-exempt private activity bonds (PABs), survived a surprise effort by House Republicans to abolish them in last fall’s tax cut debate. The Administration plan would broaden their use. Under 26 U.S.C. §142, such “exempt facility” bonds can be issued for projects relating to airports, docks and wharves, mass transit, water supply and sewage, sanitation, high-speed rail, hydro power, schools, power generation, federal-aid highway projects, international bridges and tunnels, and rail-freight transfer facility projects already receiving federal funding. The Administration bill would expand this list to include more highway and transit projects, non-high-speed passenger rail, flood control and stormwater faciltiies, rural broadband, and brownfield/Superfund sites.

The proposal would also get rid of the PAB state volume caps and transportation volume caps and would treat PABs the same as other tax-exempt securities under the Alternative Minimum Tax (AMT).

However, the plan would add a new restriction to PABs – projects would either have to have state or local ownership or (for projects that have private ownership) there would have to be some kind of state or local regulation of the rates they charge, or it would have to be available for general public use or to provide services to the general public.

Changes to existing programs. The Trump plan also proposes a wide variety of changes to the laws governing existing infrastructure programs, many of which are not new and have some degree of support in Congress and with stakeholder groups. There are a few cross-cutting provisions across modes – most notably, an attempt across modes to exempt projects with only a “de minimis” federal financial contribution from the regulatory and planning paperwork burdens that come with federal funding. (The plan does not spell out how much money it takes to cross the de minimis threshold, though.)

Highways.

- The plan proposes to add an exemption to 23 U.S.C. §129 to allow states to toll existing Interstate highway lane-miles, so long as the proceeds are used for infrastructure.

- States would be given the flexibility to commercialize Interstate rest areas.

- The threshold for FHWA “major project oversight” rules would be increased from a $500 million project to a $1 billion project.

- States would be given general authority to pay the federal government back for the federal contribution for already-completed highway projects in order to be freed from perpetual federal restrictions on the project.

- States would be authorized to perform utility relocation before the NEPA process is completed.

Mass transit.

- The plan would mandate the use of “value capture” as a component of all new subway and light rail projects and would eliminate existing legal constraints on the use of public-private partnerships in mass transit.

- The existing mass transit PPP pilot program (is that 5P?) in section 3005(b) of the FAST Act would be permanently codified and have its federal share increased to 50 percent.

Airports.

- The plan would allow small hub airports to apply for permission to levy passenger facility charges (PFCs) with the much lower paperwork burden that now only applies to non-hub airports.

- The existing airport privatization pilot program would be expanded and improved – the current cap on the number and type of airports that can participate would be removed, and the current double-supermajority requirement for airline approval of an airport’s entry into the privatization program would be lowered to a simple majority.

- The plan promises vague amendments to 49 U.S.C. §47107 to reduce FAA reviews of projects other than critical airfield infrastructure.

- Airports would be allowed to offer incentive payments for early completion of AIP projects, and oversight of AIP grants would loosened from advance application approval to post-expenditure audits.

Rail.

- The plan proposes to lower the statute of limitations for challenges to the permitting of rail projects (2 years) to that of highway and transit projects under the FAST Act (150 days).

Water (EPA).

- The Clean Water State Revolving Fund would be allowed to lend to private owners, like the Safe Drinking Water Revolving Fund already does, and other areas of the Clean Water Act would be amended to “level the playing field” between public and private providers.

- The plan would provide the EPA with similar statutory authority to the old FHWA SEP-15 authority to experiment with new project delivery provisions.

Water (Corps).

- The plan would authorize the Corps of Engineers to execute agreements with non-federal entities to use federal dollars for construction, repair, rehab, maintenance and operation of inland waterways.

- The plan would establish a pilot program that would authorize the issuance of user fees to carry out Corps of Engineers water projects at up to 10 sites to enable public-private partnerships.

- The plan would amend current law to extend the duration of a contract that the Corps of Engineers can sign from 5 years to 50 years.

- The plan would amend the law to allow the Corps to determine whether operation and maintenance functions at hydropower facilities on Corps projects are commercial activities and appropriate for performance by non-Federal entities would increase the opportunity for open competition and lead to more efficient operations and maintenance.

- The plan would create a streamlined deauthorization process for old WRDA projects.

- The plan would allow the Corps to waive the maximum total cost limitation for Congressionally authorized projects.

(Some of the water provisions may move in this year’s WRDA law even if a larger infrastructure package goes nowhere.)

Permitting and Workforce Development. In addition to the funding/leverage and the policy changes, the plan also proposes extensive advances in synchronizing and speeding up the processes by which infrastructure projects receive permits from various federal agencies. And the plan also contains proposals for workforce development to help mitigate the looming labor shortage. Both those are beyond the ken of this author – check back in a few hours for more analysis of these provisions.