The release of President Biden’s $2.3 trillion “American Jobs Plan” on March 31 prompted an ad hoc debate on the very meaning of the word “infrastructure.” As with most debates that take place on Twitter, it was not particularly edifying. But agreeing on a definition of the word is important because it can make a difference in how the federal government pays for “infrastructure.”

Republicans on Capitol Hill, quick to find any argument they could to oppose the Biden proposal, started the debate by saying silly things like just because less than 6 percent of the proposed funding went to roads and bridges, none of the rest of the money counted as infrastructure. (Obviously they had never looked closely at the American Society of Civil Engineers scorecard which lists 16 other kinds of infrastructure in addition to roads and bridges.)

Then Congressional Democrats started saying equally silly things at the opposite end of the definitional spectrum, such as “Paid leave is infrastructure. Child care is infrastructure. Caregiving is infrastructure.” (This kind of thing prompted several funny responses on Twitter, the best of which was “The friends we made along the way are the real infrastructure,” which actually traces back to a joke Brian Beutler made in 2018.)

The Administration, to its credit, never really claimed that the entire AJP was infrastructure, only that infrastructure was a dominant component of the plan. Transportation Secretary Pete Buttigieg stayed at a middle ground nearer the ASCE definition, asking “Why would anyone turn against broadband because it’s not a bridge, or come out against water pipes because they’re not highways?”

Republicans, especially those from rural areas whose constituents only have electric and telephone service because of the direct federal intervention of the Rural Electrification Act and the Universal Service Fund, have since regrouped. The Senate GOP put out its own proposal that, while providing far less funding than the Biden AJP, acknowledged roads and bridges, mass transit, rail, ports, inland waterways, airports, water supply, water storage, wastewater treatment, and broadband infrastructure as legitimate infrastructure modes for federal spending.

(In terms of broadband, there is actually a much stronger case to be made for a direct federal role here than in other traditional infrastructure modes. Most federal infrastructure spending is justified by the Constitutional authority grants to regulate commerce between states or to provide for the general welfare. But think of what the power to “establish Post Offices and post Roads” meant in the 1780s. Pre-telegraph, the only way to transmit a large amount of information over a distance was through words written or printed on paper. (This is why the Stamp Act of 1765 was so intolerable as to help set off the American Revolution – because by taxing any piece of paper with words printed on it, it was a tax on the transmission of information.) An efficient post office was necessary to move information as quickly as possible throughout the nation, and Congress wanted that post office run directly by the federal government. If the post office was to the Founders, primarily, a national information transmission network, then it stands to reason that the Founders would have approved of a strong and direct federal role in developing and administering subsequent types of information transmission networks, had they been able to envision them. For more information on what the Postal Clause meant to the Founders, see this fascinating 2018 law review article by Robert G. Natelson, and then check out the wonderful book The Creation of the Media: Political Origins of Modern Communications by Paul Starr.)

Where the word came from. The word “infrastructure” is a fairly recent addition to the American lexicon. The word is originally French, a 19th-century combination of “infra” (meaning below, or under) and “structure” (meaning a building or edifice). In France, the word gained use in the railroad sector as a name for track, catenary and switching that was separate from rolling stock.

The word jumped the Atlantic and first came to America in the 1950s, in the context of federal funding for a NATO program. The first-ever appearance of the word in the Congressional Record came in July 1954 in a debate over the foreign aid appropriation bill, which funded military assistance to NATO.

NATO defined infrastructure at the time as:

By the 1970s, the term had come to be used to describe civil public works and networks in the U.S. as well as in other countries.

The traditional modes of infrastructure all have a few things in common: they are systems of capital items (useful stuff) that are physical in nature (not virtual assets like IP) and which are owned by the public (governments, or in some instances the definition can be stretched to include physical capital assets owned by private entities if they are natural monopolies serving a public purpose and governed by regulation, like railroads and utility companies). So all of your traditional infrastructure will be a subset of “public physical capital.”

“Investment.” As it happens, “public physical capital” is itself a subset of a type of federal spending called “investment” which various parts of the government have been tracking for decades. Investment spending, from this perspective, is about spending money on things that provide benefits for a long time after their acquisition.

The Treasury Department provides an annual total amount of federal investment in the Financial Report of the United States Government, which only includes spending on public physical capital. The Bureau of Economic Analysis includes an investment category in their National Income and Product Accounts that includes not just physical capital but research and development as well.

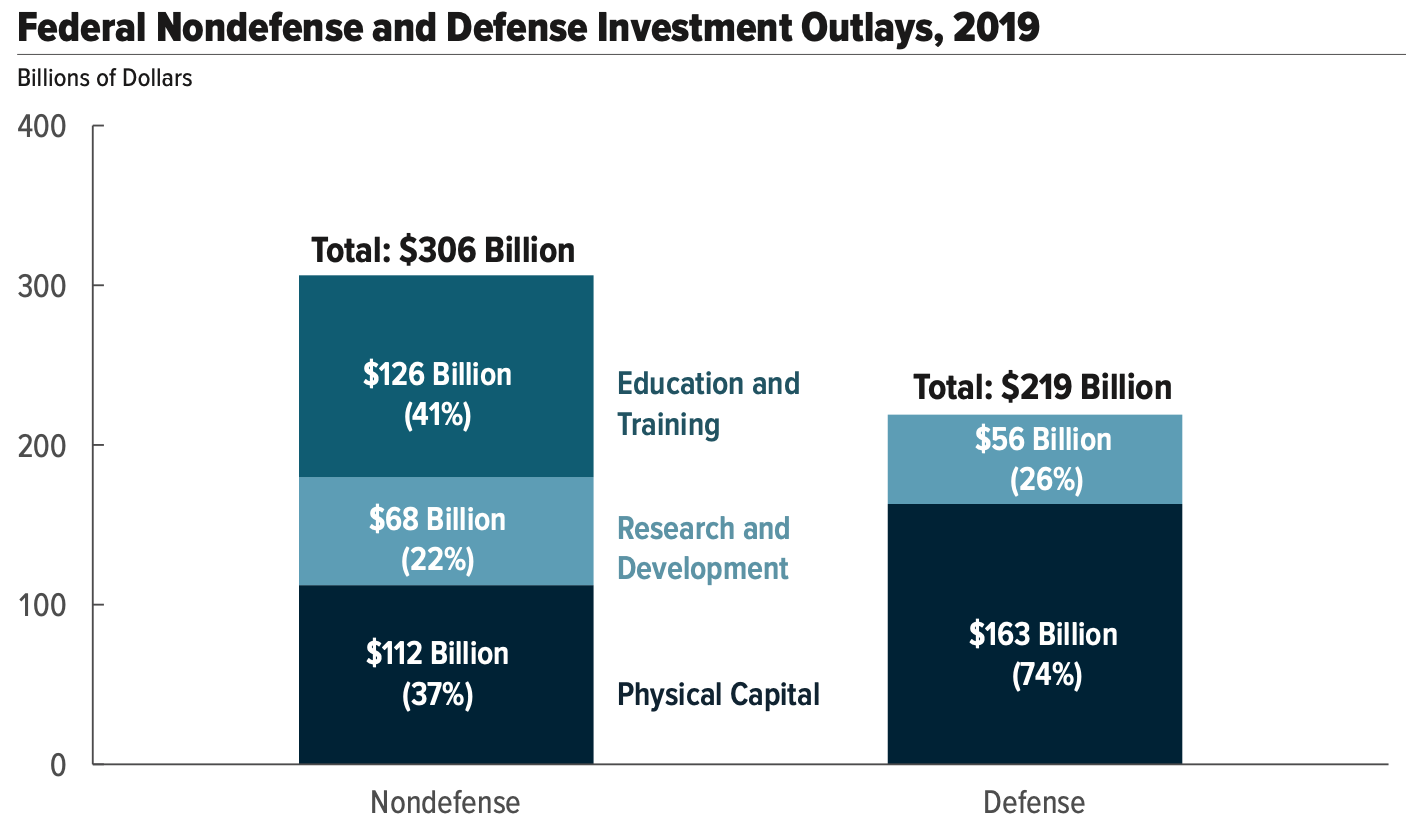

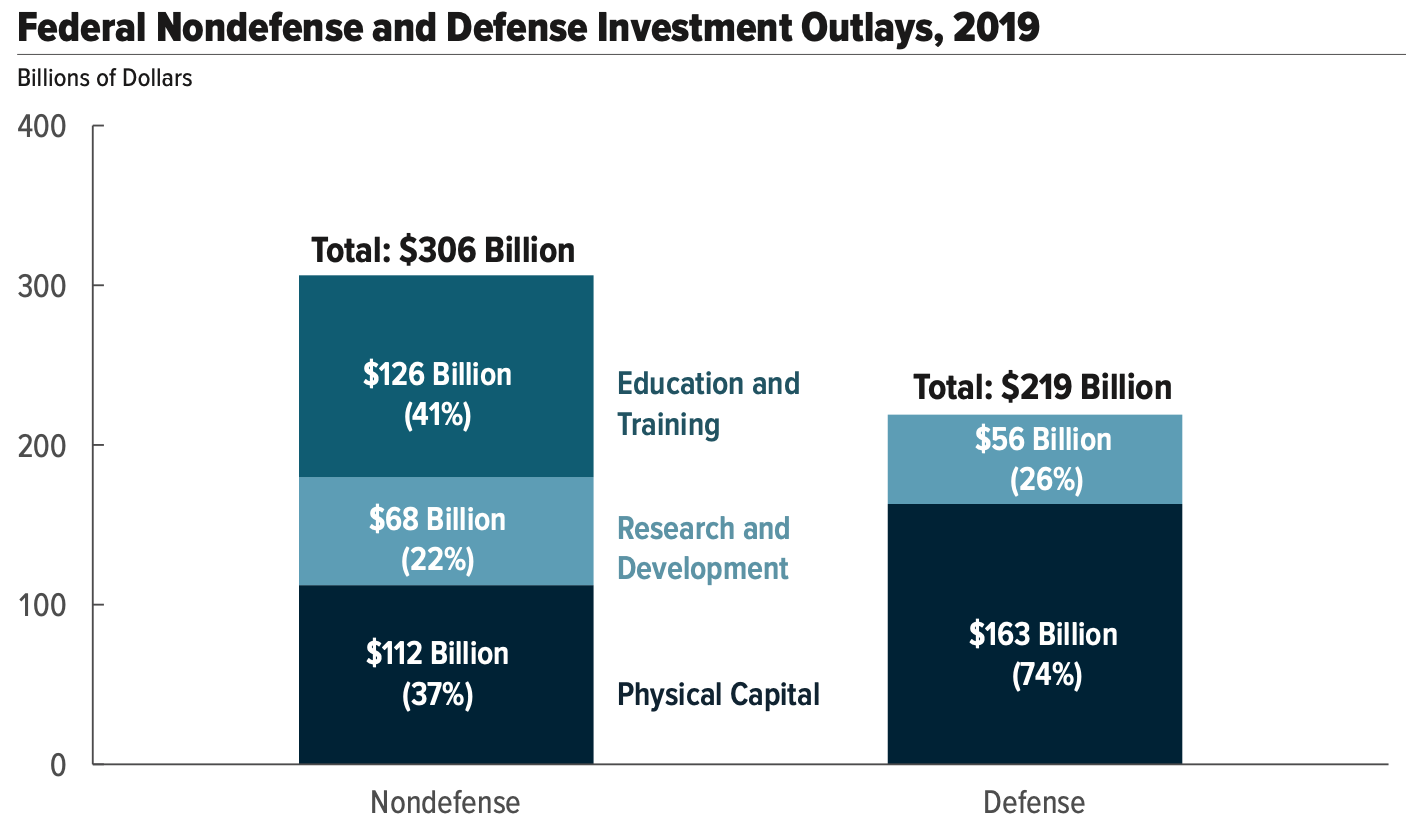

The Office of Management and Budget and the Congressional Budget Office use a definition of investment that is even more expansive, including not just public physical capital and R&D spending, but education and training spending as well. CBO says that federal investment spending totaled $525 billion in 2019 ($306 billion nondefense and $219 billion defense):

That nondefense physical capital total includes federal spending on roads, bridges, airports, airways, ports, rail, mass transit, water supply and treatment, housing assistance, etc.

Most of the spending in the American Jobs Plan counts as “investment” if not actual infrastructure. (From an “investment in the future” perspective, it was probably a mistake for the Biden Administration to include care for the elderly in this legislation. Taking care of persons who have aged out of the workforce and stopped contributing to the economy is the exact opposite of taking care of children who will, if properly nurtured, enter the workforce at adulthood and contribute to the economy for decades. Both child care and elder care are important and necessary, but only one could conceivably qualify as investment in the future.)

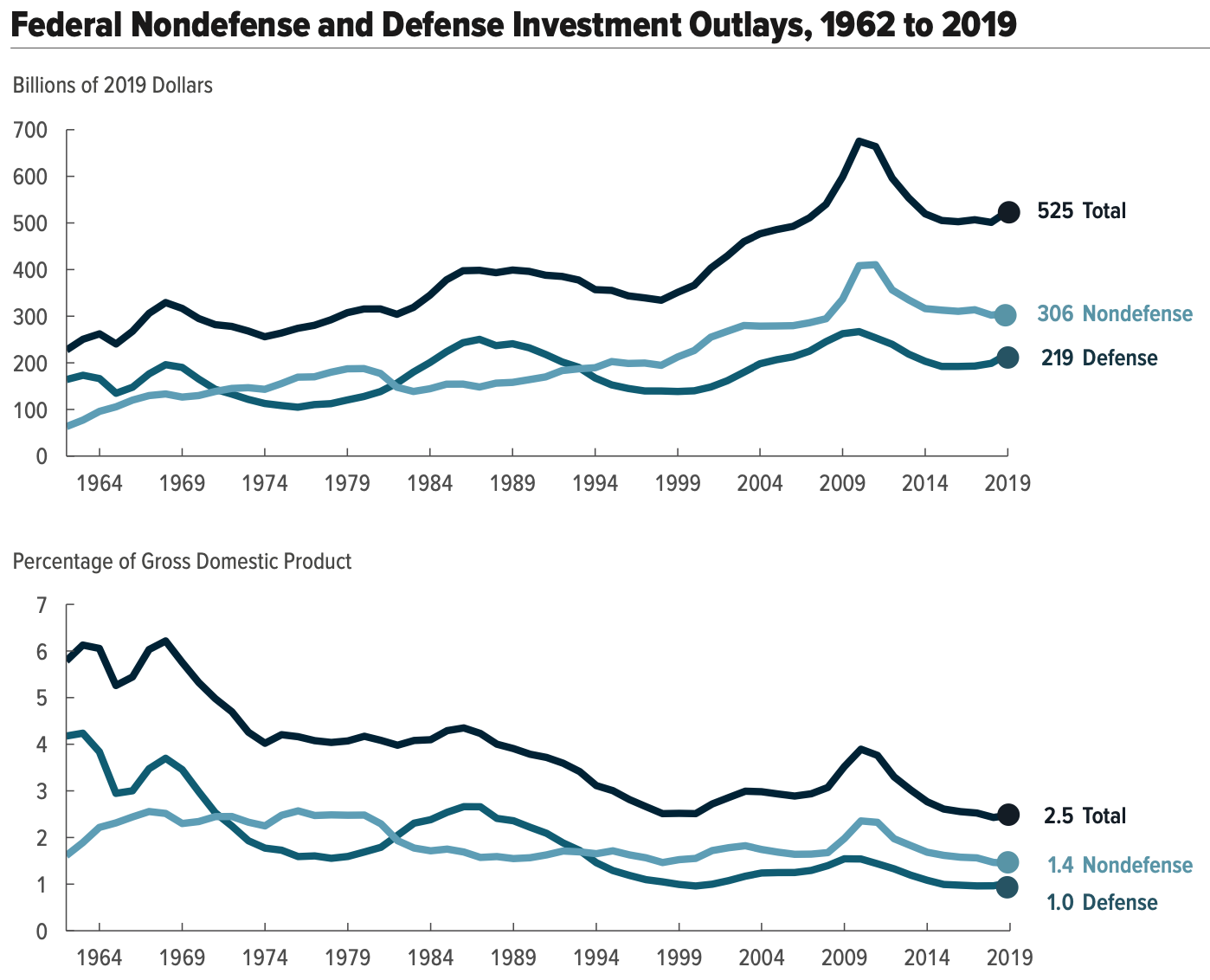

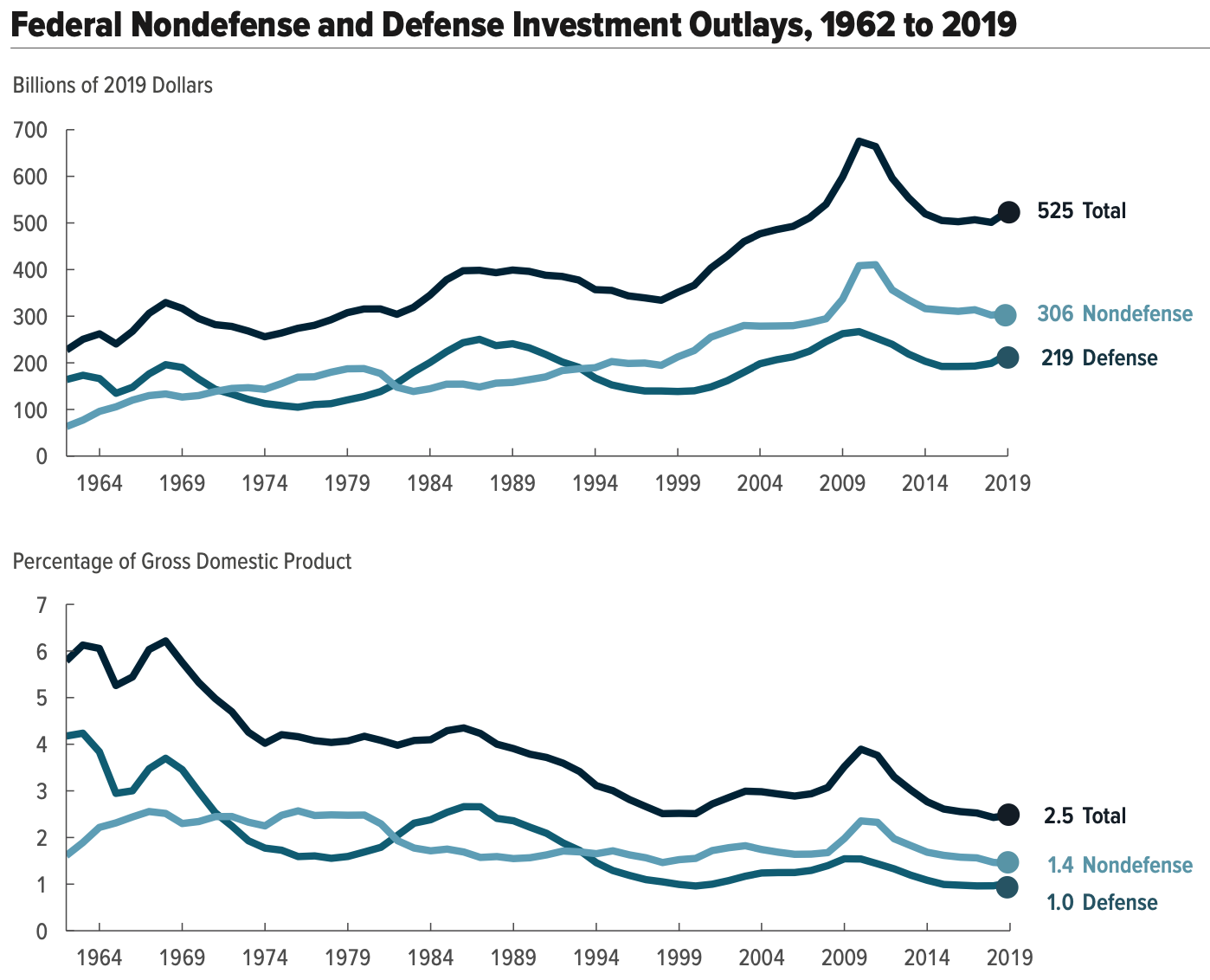

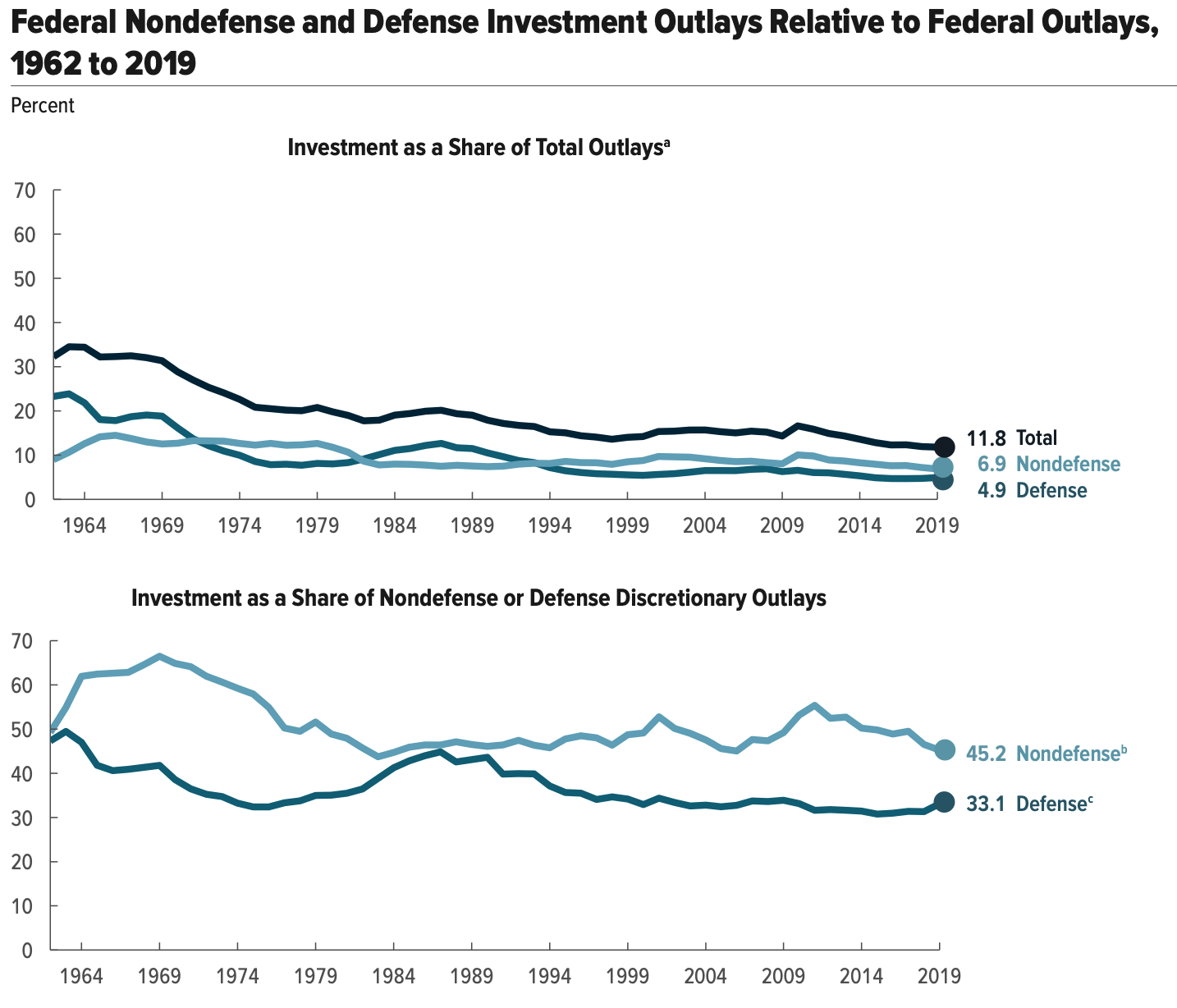

CBO also provides two different ways to measure how federal spending on investment has fluctuated since 1962 – as a share of gross domestic product, and in constant 2019 dollars (adjusted looking backwards using the composite GDP price index):

No matter which line you use, you can see the variance in the defense line (post-Vietnam drawdown, then Reagan buildup, then post-1989 drawdown, then 9/11, GWOT and Iraq buildup). The nondefense line has been more steady with the exception of the 2009-2010 Obama stimulus spike.

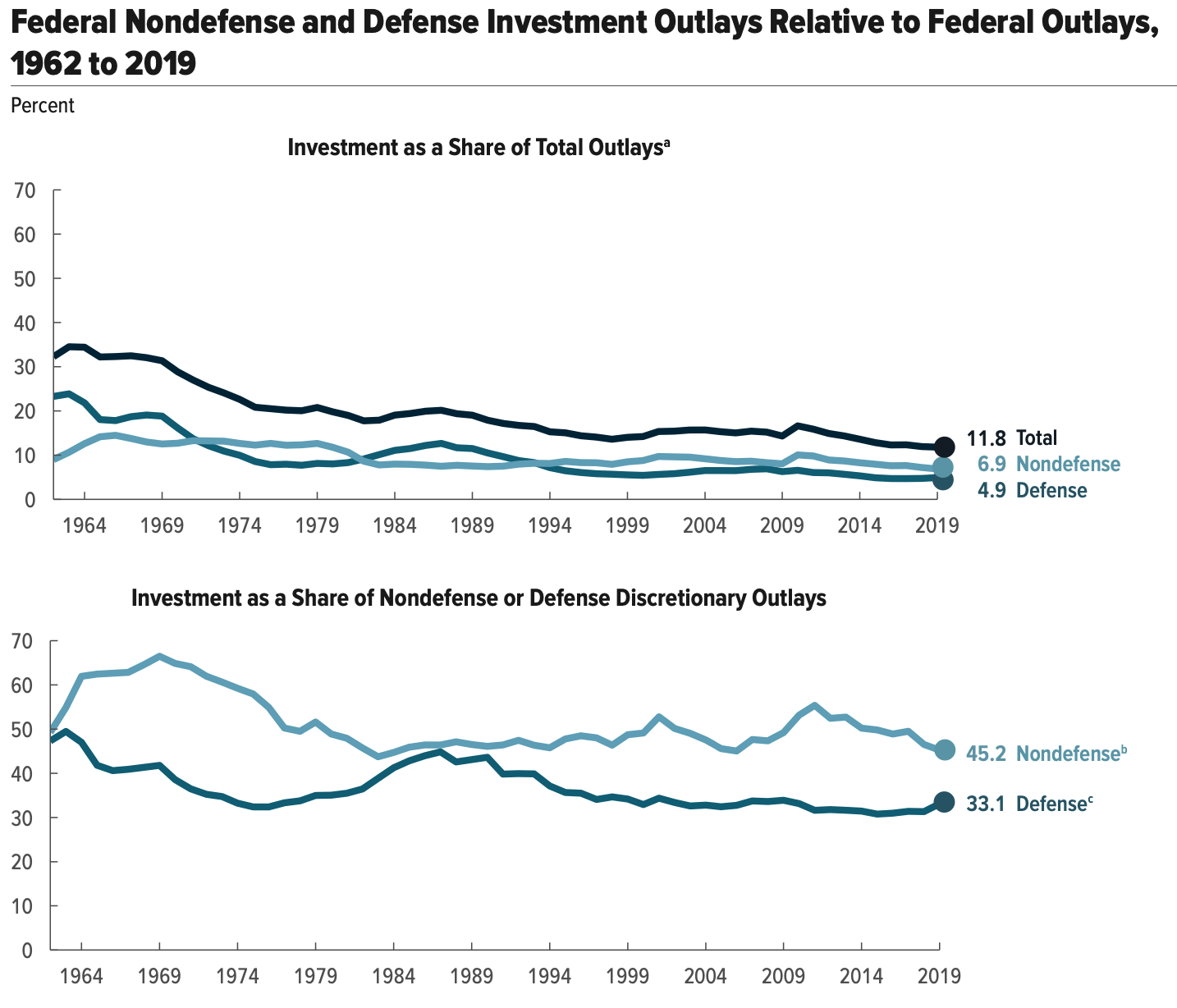

As a share of total federal spending, investment has been crowded out by social safety net spending over the last 60 years. But importantly, almost all federal investment is on the discretionary side of the budget, not the mandatory side. And the various investment programs total almost half of total discretionary spending.

Being on the discretionary side of the budget means that investment spending is subject to downward political pressures every time the deficit or public debt start dominating the news (which happens every so often, and will happen again, we’re just not sure when). Whenever the total discretionary budget is constrained, the accounts that pay federal salaries will tend to crowd out the investment accounts.

Why it matters. Defining infrastructure as a subset of public physical capital, which is in turn a subset of “investment,” matters because most states and almost all corporations budget capital (and possibly other investment) differently than they budget operations. But the federal government, at present, does not.

The Congressional Budget Office last month published a report (from which the charts above were stolen) making this point: “The federal budget records expenses for investment projects up front, not over the project’s lifetime of use. Because of that mismatch between when costs are recorded and when benefits occur, investment projects may seem expensive relative to other government expenditures, and the large amounts of up-front funding required for some types of investments can make it difficult to fund them within the constraints of the budget process.”

CBO examined several options for changing the federal budget process to change the way investment spending is budgeted:

- A shift from the present system of cash-based accounting to accrual accounting, with a separate capital budget.

- Presenting both cash and accrual measures of capital spending in the unified budget.

- Adopting a separate cash-based capital budget.

- Establishing a cap on investment funding within the cash-based unified budget.

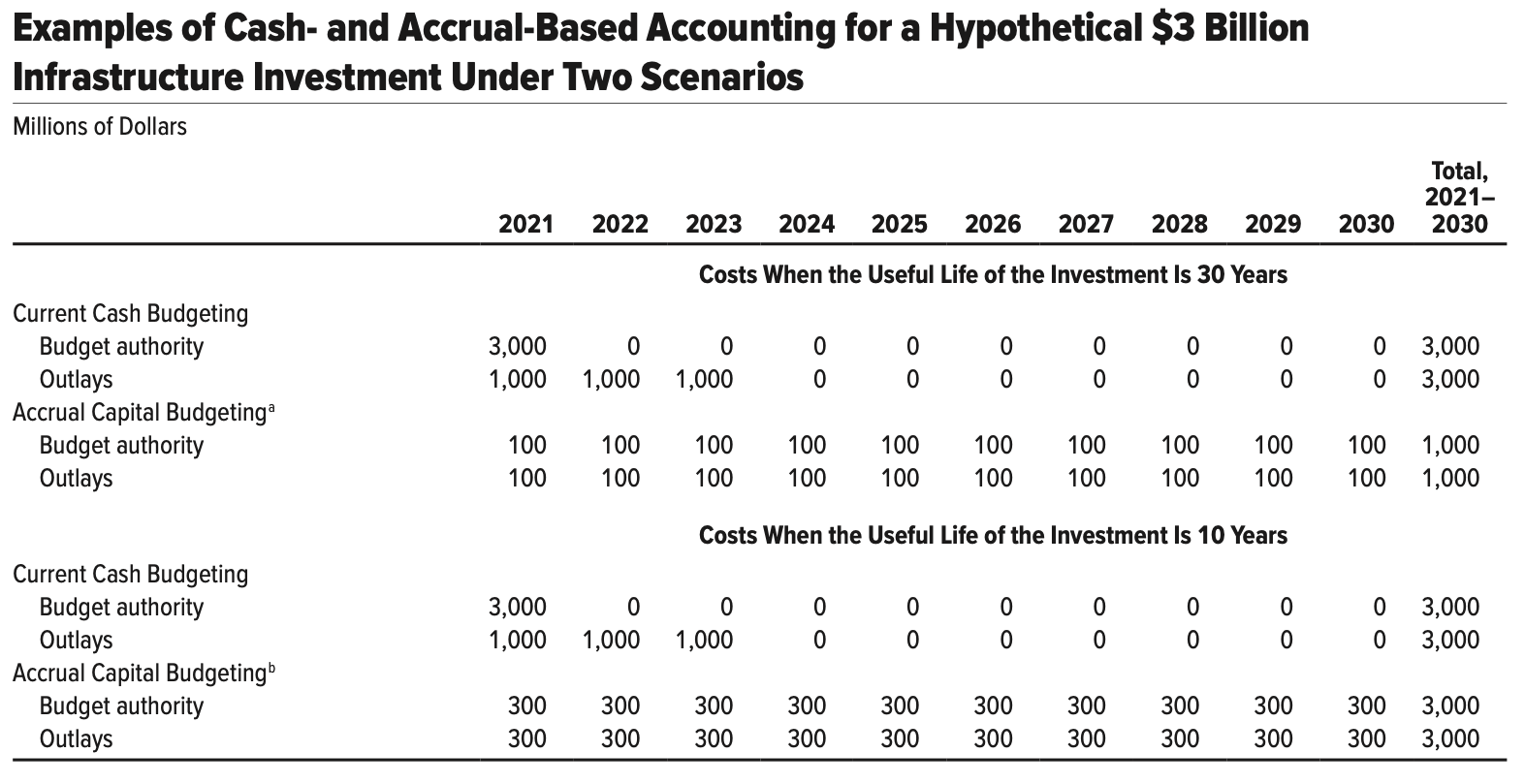

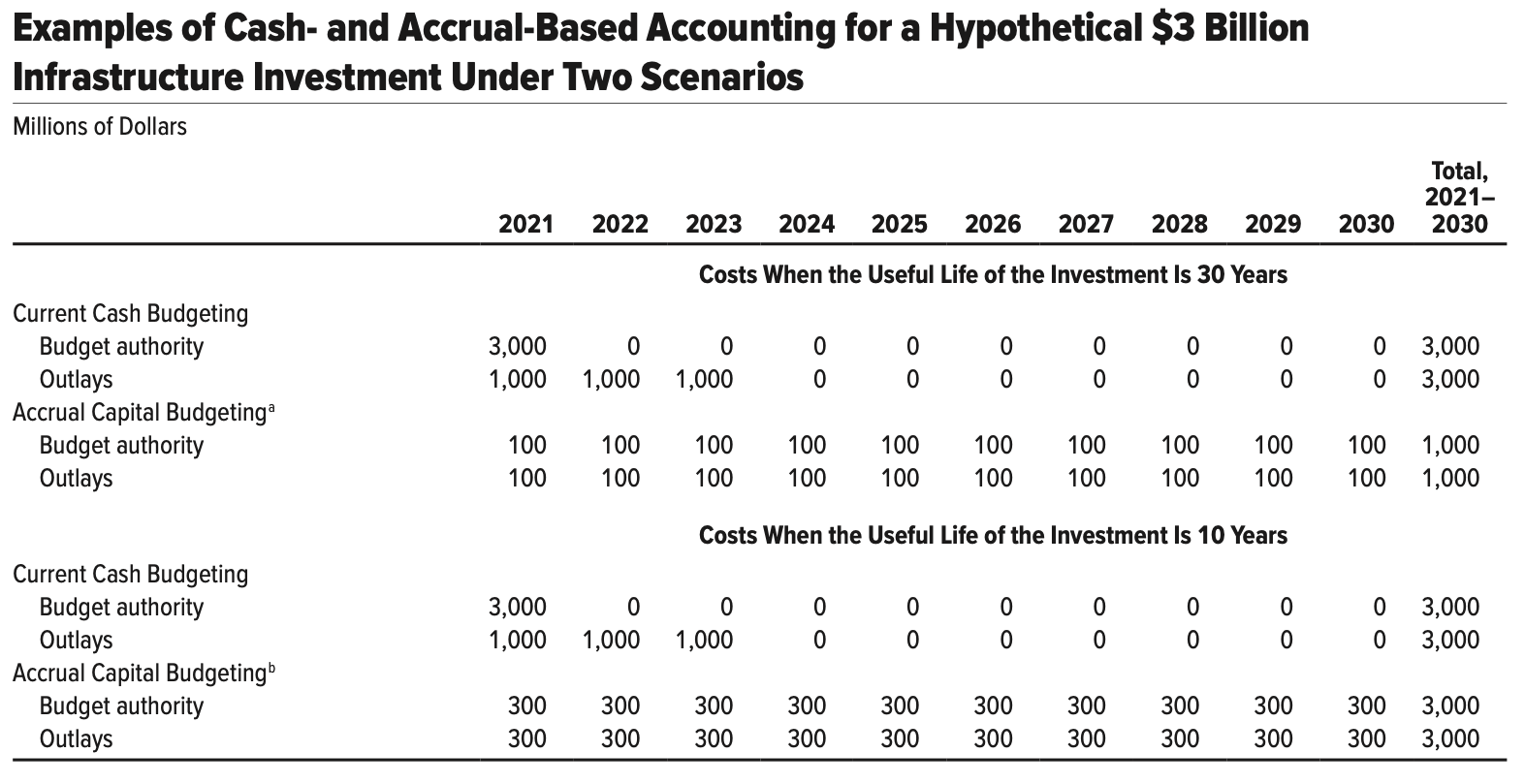

The difference between accrual and cash accounting really becomes visible when discussing long-lived investments. CBO provided accrual-versus-cash budget comparisons for two hypothetical $3 billion infrastructure investments: one with a useful life of 30 years, and one with a useful life of 10 years:

CBO, being CBO, did not come out in favor of any particular kind of budgeting (though they came close to recommending the Federal Capital Revolving Fund first proposed by OMB under the Trump Administration and included as part of the Biden Administration’s AJP). This approach would use a one-time slug of mandatory budget authority to establish a revolving fund for large purchases of federal buildings. Each such purchase would then be repaid by the tenant agency using amounts of annual discretionary appropriations over a 15-year period. Such capital revolving funds could also be useful for other types of capital funding where the assets are owned by the federal government, like the air traffic control system, or the Northeast Corridor.

The debate of how the federal government should budget capital programs so as not to discriminate against them is an old one. The report of the 1967 President’s Commission on Budget Concepts came out strongly against a separate capital budget, saying that “Such a budget would seriously distort the budget as a decision-making tool.” That commission did recommend that the federal government switch over to accrual accounting, but the Pentagon asked for a delay of that recommendation, citing the Vietnam war buildup, and that recommendation was never implemented.

A separate commission on capital budgeting under President Clinton did not recommend a separate capital budget, either. But it did make other recommendations, including the type of capital acquisition fund that OMB is pushing for federal buildings. (And the panel also recommended that the federal government never commit construction money until a “usable segment” of the project has been fully funded, defining “usable segment” as “one in which the benefits exceed the costs even if no further funding is appropriated.” Obeying this sage recommendation would have prevented the California high-speed rail debacle, for example.)

(Recommendation 6 of that report dealt with trust funds, recommended that state and local governments that receive federal support for capital items like highways “should be required to maintain assets financed by the federal government as a condition of receiving any additional federal support.”)

That 1999 report also predicted the recent debate on exactly what is “infrastructure” – it acknowledged fears “that adoption of a capital budget could create a strong temptation for policy makers to classify a wide range of expenditures as capital or investment (1) to avoid having to pay for them out of tax receipts or (2) to avoid having them subject to caps on discretionary spending.”

Prioritizing “pay-fors.” The biggest reason that 30-some states and many local governments use separate capital budgets is that it is much more appropriate to borrow money to buy a tangible capital asset that will last for many years than it is to borrow money just to meet operational expenses. The longer that an expenditure will provide benefits, the more logical it is to borrow money to pay for that expenditure over time.

But the federal government does not have a capital budget right now, and there is no way to set one up in time to consider the Biden plan. In a time of large, systemic deficits, the question becomes whether to offset the cost of capital spending at all, or just add it to the deficit in a time of low interest rates.

The Biden Administration, somewhat incongruously, is billing most of the American Jobs Plan as a one-time spending supplement that happens once in a generation but is proposing to pay for it with tax increases that would be permanent. It would make more sense to correlate permanent tax increases with permanent new spending programs (like the caregiver jobs in the AJP, which appear to be a permanent program), or with shoring up the existing open-ended Highway Trust Fund programs with the extra revenues they need to stay solvent in this and future decades.

If Congress winds up passing a package of one-time, non-recurring infrastructure and investment spending, deficit financing should be considered as an option, as should financing with spending cuts or transfers, or temporary tax increases that don’t outlast the new spending.

The views expressed above are those of the author and do not necessarily reflect the views of the Eno Center for Transportation.