As Congress starts debating infrastructure bills, there is a lot of talk about getting the Highway Trust Fund back on a sound, user-pay basis and not repeating the $144 billion of bailouts from other sources that have been necessary to keep the Trust Fund afloat since it first ran out of money in 2008. The House Democratic infrastructure principles released this week include a call to “Address the long-term solvency of the Highway Trust Fund through user-based mechanisms.”

In the short term, there is no highway user tax or fee that can fill the Trust Fund’s revenue hole quickly enough except for an increase in the federal excise taxes on gasoline and diesel fuel. Other taxes can work around the edges, and the replacement of a fuel tax with a mileage fee is a promising option but would take close to a decade to fully implement.

But any increase in motor fuels taxes will have to address the looming mass transit funding imbalance that did not exist when Congress was debating earlier tax increases.

The 1982 motor fuels tax increase was made possible by a political deal – urban legislators would vote for the increase in exchange for 1 cent of the 5 cent per gallon tax increase being deposited in a new Mass Transit Account and dedicated to mass transit funding. The 1990 and 1993 fuels tax increases, once finally deposited in the Trust Fund, were also split 80-20, so that today, the Transit Account gets 2.86 cents per gallon (20 percent of 1982’s 5 cent increase, 1990’s 5 cent increase, and 1993’s 4.3 cent increase). All of the pre-1982 tax rate of 4 cents per gallon, and all of the trucking taxes, stay in the Highway Account.

Highway stakeholders, while they love to grumble about highway user revenues being “diverted” to transit, have generally gone along with the 80-20 split since then, acknowledging that it would be much harder to pass bills if the transit lobby started opposing the bills. Senator Max Baucus (D-MT) tried to throw transit back out of the Trust Fund in 2003-2004, and Rep. John Mica (R-FL) tried to do the same thing in 2011-2012, but neither man came close to having the votes to do so.

Meanwhile, Congress kept enacting authorization bills that gave transit funding levels that exceeded Mass Transit Account revenues by greater and greater amounts – and all the while, tax rates stayed flat. The result is that the Mass Transit Account today is far more out of balance than the Highway Account, on a percentage basis. (For example, the just-enacted FY 2020 appropriations process allows $48.6 billion in new Highway Account obligation authority, versus an estimated $38.1 billion in tax revenues coming into the Account, an overage of $10.4 billion, or 27 percent over tax receipts. The Mass Transit Account got $10.2 billion in new obligation authority against $5.3 billion in estimated tax revenues, an overage of $4.9 billion, or 92 percent over tax receipts.)

We took the new Congressional Budget Office cash flow baseline for the Trust Fund, which is premised on current tax rates (and on the FY 2020 appropriated spending totals, extrapolated forwards and given annual inflation increases of about 2 percent per year). Then we took the detailed CBO tax receipt forecast (Tab 5 of this spreadsheet) and divided each year’s estimated HTF gasoline tax receipts by 18.3 and the estimated diesel tax receipts by 24.3 to figure out how much money each current penny of motor fuels tax raises, and ran some scenarios.

Caveat: This approach assumes that demand for gasoline is completely inelastic and that no increase in price caused by a tax increase will reduce demand. (This is not completely true but it is mostly true about the levels we are talking about.) And we are ignoring the effects that increased excise tax rates have on income tax receipts for the general fund, which is a problem for a later day. Also, Congress would probably phase in a tax increase over time, and index it for inflation after that, but that looked like too much work for me, so we are assuming the entire tax increase up front.

The current baseline shows the Mass Transit Account running out of money late in FY 2021 and the Highway Account running out of money sometime in FY 2022. By the end of 2030, the Highway Account will be $144 billion in arrears and the Mass Transit Account will be $43 billion in the red.

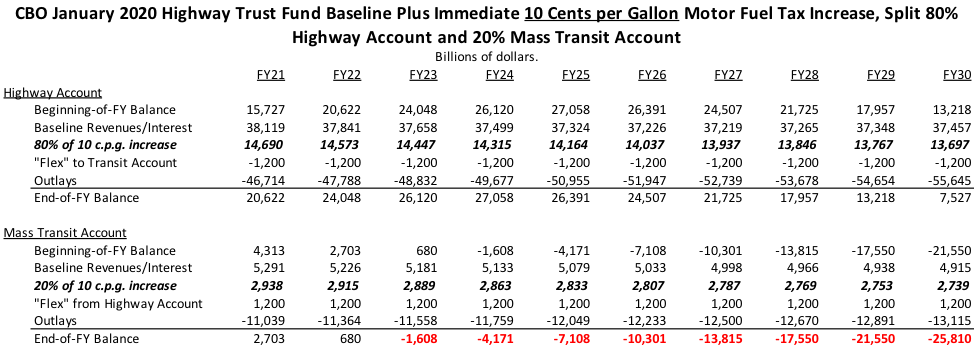

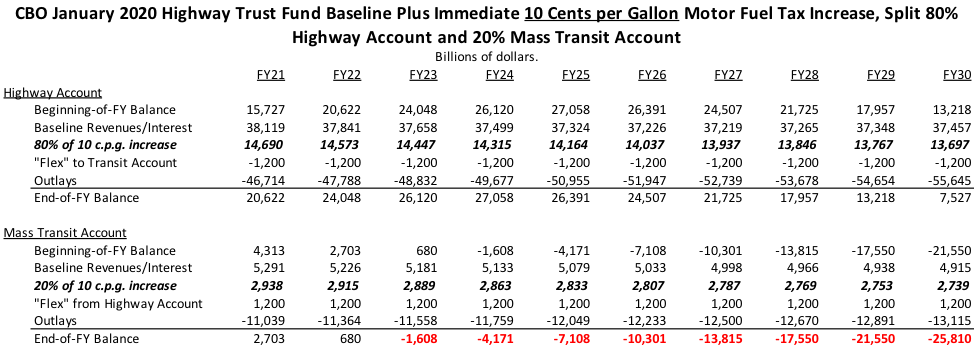

Suppose we increased gas and diesel taxes by 10 cents per gallon, effective on October 1, 2020 (the first day of fiscal year 2021), split the proceeds 80-20 between highways and transit, and kept everything else in the CBO baseline the same?

As you can see, a 10 cent increase split 80-20 keeps highways solvent at baseline spending levels, but it only postpones the date of the Mass Transit Account’s insolvency by two years, from 2021 to 2023.

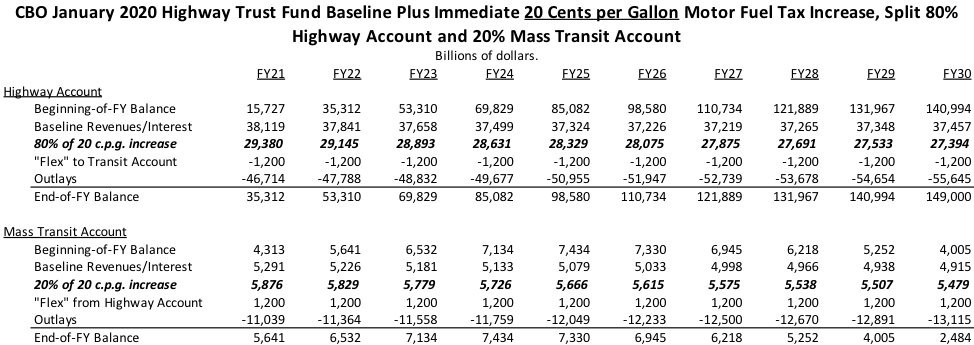

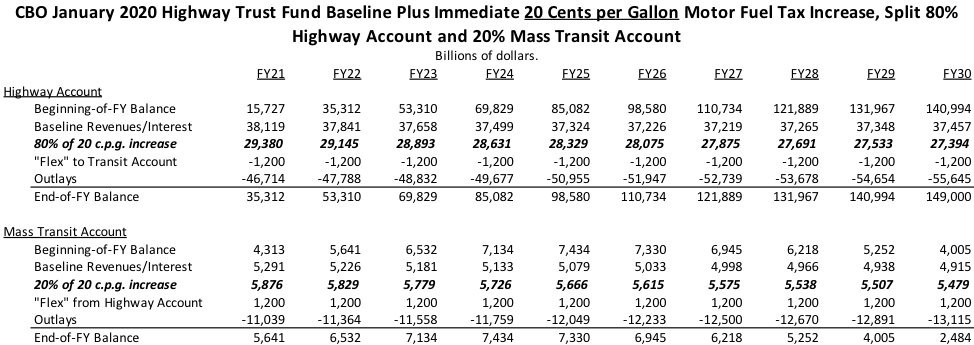

Okay, let’s double that – a 20 cents per gallon increase, immediately (which more than doubles the current gasoline tax and almost doubles the diesel tax), split 80-20, with everything else being the same as baseline:

A 20 cent per gallon immediate tax increase, split 80-20, would keep the Mass Transit Account solvent for a decade with at $1-2 billion dollars to spare at baseline spending levels. But the 80 percent of the money going to highways would support $145 billion or so in highway spending above baseline.

The assumptions underlying the cash flow baseline spending levels call for $551 billion in new obligation authority for the Highway Account for the ten-year 2021-2030 period versus $114 billion in Mass Transit Account obligation authority. In other words, under the baseline, the Highway Account would get 83 percent of the new spending authority over a decade. If you allowed the Highway Account to spend all that extra money they would get from 80 percent of a 20 cent tax hike, that would be close to $700 billion in new highway spending, not $551 billion, while transit would still be stuck at $114 billion over 10 years.

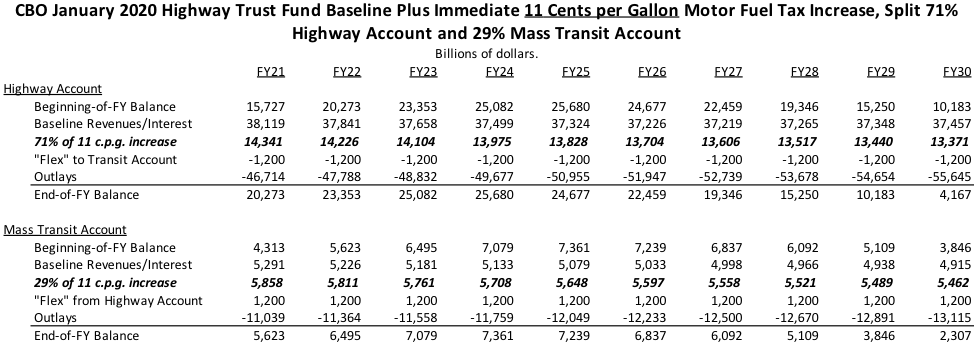

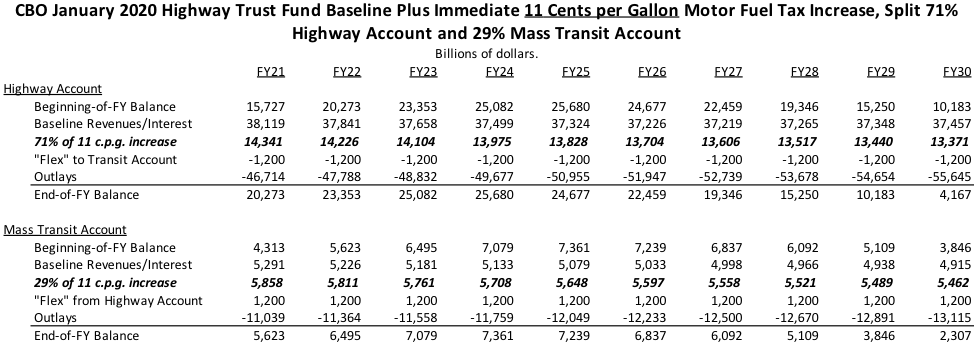

After much trial and error, we hit upon the bare minimum tax increase, and the bare minimum highway-transit split, that could be levied immediately to keep both accounts of the Trust Fund solvent for a decade at baseline spending levels. The magic formula appears to be:

An immediate 11 cent per gallon motor fuels tax increase, split 71 percent highways, 29 percent transit.

The other option, of course, is to cut mass transit spending from the Transit Account well below baseline levels, or (if spending is to be increased above baseline) to give transit much less of a percentage increase than highways, which might allow the 80-20 split of new revenues to continue. But the mass transit lobby likely would not sit still for that.

On the other hand, how far north of 20 percent will the highway lobby allow transit to take out of any new highway user revenue increases before some highway-focused states and pro-highway organizations start to walk away?