Electric vehicles (EV) present an opportunity to help decarbonize the transportation sector and assist in the broader national transition to greater use of renewable energy. The EV market is rapidly expanding across the globe, with increasing consumer demand often coupled with generous government subsidies. The number of EVs on U.S. roadways surpassed 2.5 million in March 2022. With over 60 models available, EV sales in the United States nearly doubled from 2020 to 2021. The U.S. federal government is aiming to have EVs account for half of all new vehicle sales by 2030 as part of its broader goal to reach net-zero carbon emissions nationwide by 2050.

However, clean EVs are not a given. Supply chains gathering the metals, plastics, and other materials needed to produce EVs could become more carbon intensive. Production of the vehicles requires significant energy and water inputs. Using EVs requires expansive infrastructure and clean-sourced energy to be truly green. Each of these components of the EV life cycle requires intentional actions to ensure that the transition results in a meaningful reduction in carbon emissions.

To investigate the full life cycle carbon emissions associated with electric vehicles, Eno participated in a series of student and stakeholder dialogues organized by BMW. BMW held these events at three universities – the University of California at Davis, Clemson University, and Georgetown University. Dozens of students attended these moderated discussions, helping BMW to consider the most pressing concerns of the next generation of automotive planners, engineers, and policymakers. The Washington D.C. event included a stakeholder discussion, bringing together policymakers, manufacturers, energy producers, recycling representatives, embassy representatives, and others for a domestic and international perspective on EV implementation.

Following presentations from BMW and other industry experts, participants gave insights into barriers, challenges, and potential solutions to help meet decarbonization goals. This summary reviews the outcomes from those conversations and includes suggestions for the automobile industry and government for a smart transition to electrification.

Electric Vehicle Life Cycle Emissions

A typical internal combustion car will emit 125 tons or more of CO2 over its life cycle, with most of that coming from the combustion of gasoline. While estimates vary, the overall life cycle of carbon emissions are significantly lower for electric vehicles. This can vary depending on location, the energy source for charging, and whether the EV is a car, an SUV, or a light-duty truck. Per an estimate prepared by BMW, an electric car produced in 2019 will produce 54 or more tons of CO2 during its life cycle.

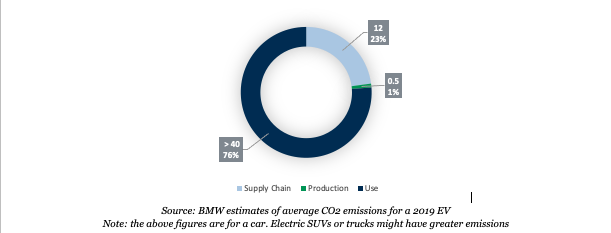

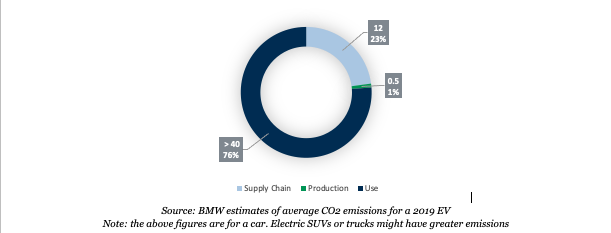

These 54 EV tons are divided into three distinct categories, shown in Figure 1. Of these 54 tons, 12 are emitted as part of the supply chain (i.e. the mining and transport of raw materials), 0.5 tons in the physical production phase, and over 40 tons in the use phase. Assessing the impact of an EV over its complete life cycle helps to more efficiently use resources and target policies that can bring overall carbon emissions down.

Figure 1: Electric Car CO2 Emissions by Use Phase (Tons)

Emissions in the supply chain

The supply chain, representing almost 25 percent of EV life cycle emissions, is the area where emissions will likely be greater than for traditional internal combustion engine vehicles. Absent any mitigation efforts, BMW projects EV supply chain emissions will increase by 40 percent over the next 10 years.

Producing batteries and other key components of EVs requires raw materials like lithium, nickel, and cobalt. These rare earth minerals are heavily concentrated in a few countries. For example, most cobalt production comes from the Democratic Republic of Congo while lithium is primarily concentrated in Chile, Australia, and Argentina. Not only will extraction take significant energy, finding ways to make the process more efficient will be challenging.

Given the highly global supply chain necessary to produce EVs, trade policy has an outsize role. Meeting the increased demand for EV production will require strong trade relations and investments in capacity development for countries that produce these raw materials. In light of this increased demand, some automakers are partnering directly with mines themselves, rather than suppliers, to source key materials. These direct agreements are not only aimed at ensuring automakers have a reliable supply of raw materials, but that the ensuring mines producing them are not utilizing forced or child labor.

While new materials will be needed for EV production, some of the supply chain emissions can be mitigated by using recycled materials. Utilizing secondary aluminum or steel can reduce emissions by a factor of 2 to 6, and broader mitigation efforts can reduce supply chain emissions for EVs by 23 percent by 2030. Aluminum and steel are already highly recycled materials, with 35 percent of aluminum and 69 percent of steel recycled in the United States. Some specialty steels in safety-critical components are typically sourced from new metals, but generally recycled steel and aluminum have no discernable difference from virgin material.

Plastics and battery components, on the other hand, are harder to recycle. Plastics can often lose some of their integrity when recycled, and there is not yet an established, widespread recycling industry and process for batteries. To be successful, it will be important to create an industry that can produce high-quality and cost-effective secondary materials to reuse in new vehicles. Part of the challenge is getting vehicles or components back to the manufacturer or supplier for re-use. One potential model could involve adding a deposit fee to the sticker price of a vehicle that is refunded when a consumer returns their car to a designated retailer or manufacturer. This model is based on deposit fees that exist for beverage containers in ten U.S. states and countries such as Norway or India, where consumers pay an up-front fee per can that is refunded when returned to a recycling facility.

While increasing the use of secondary materials in vehicle design can reduce carbon emissions, consumer perception remains a barrier. There remains a persistent view in some markets that secondary materials are inferior in quality. As automakers seek to incorporate more recycled materials in their vehicles, there will be a need for more consumer education to ensure demand and acceptance of more sustainably designed vehicles.

Reassuring consumers and manufacturers of the quality and sustainability of supply chains will require extensive access to information on suppliers and the ability for manufacturers to conduct thorough inspections. However, the nascent supply chains for other key materials remain difficult to audit, and the ability to verify adherence to sustainability metrics can get murkier the deeper one gets into the supply chain for a given raw material. Some potential solutions include having a third-party entity to verify sustainability in automobile manufacturing, similar to LEED certifications for buildings.

Emissions in the production phase

In addition to sourcing raw materials, many EV producers are seeking opportunities to reduce carbon emissions during the physical production of the vehicles themselves. While this is a small portion of the overall vehicle life cycle, it is highly visible. Emissions can accumulate with high production volumes, and automakers have direct control over curbing these emissions.

Automakers are already employing a wide variety of low carbon practices to help mitigate environmental effects of production. This includes water conservation efforts, solar and wind power on site, hydrogen and battery powered plant vehicles, and carbon offsets. But each of these come with financial tradeoffs. Because factories operate in a competitive global environment, financial incentives need to be in place for these strategies to make business sense. Further, employing them requires a different skillset that many in the industry are not trained for, so workforce initiatives to manage a solar array or a fix a hydrogen fuel cell vehicle need to be in place.

Sometimes, trade policy makes it more expensive or difficult to invest in renewable energy. For example, most industrial solar panel manufacturing has moved abroad, and finding domestically sourced panels exempt from tariffs or other rules can be challenging. While federal trade policy seeks to onshore production of both renewables and EV components to help meet climate targets, ramping up domestic production ability for renewables (as well as the raw materials for components like batteries) can be more costly and time consuming than importing them from other countries, like China. In addition, building domestic mining or production facilities will take upwards of five to ten years, so output will not be immediate. As a result, automakers and policymakers will need to balance the growing conflict between the need to meet decarbonization and electrification targets in a timely manner and the desire to expand domestic production capabilities for renewables and EV components.

Mitigating all carbon emissions from the production phase will ultimately require some form of carbon offsets. While this can help meet internal or external targets, experts recognize the limitations of carbon offsets and the need to prioritize other strategies first, then local offsets, before investing in offsets in other countries. Transparency is critical to maintaining public trust in the carbon reduction strategies.

Emissions in the use phase

The greatest amount of emissions come from the use phase, where charging and driving the vehicle accounts for more than 75 percent of total life cycle emissions. A major component of reducing these emissions will come from energy policy that prioritizes green energy. This will require close collaboration with utilities and energy providers as well as timing charging to coincide with solar and wind production.

Given that EVs are significantly cleaner than internal combustion engine vehicles, the broader challenge is accelerating the adoption of electric vehicles. The industry is at a critical phase, with many early adopters having already purchased EVs and more mass market models beginning to launch. Incentives, consumer education, and infrastructure to support charging will be important to facilitate broader adoption. This all starts a virtuous cycle, where more EV adoption supports more convenient charging solutions, which increases consumer comfort with full EV purchases, therefore fueling more adoption. But getting these incentives in place is a significant hurdle.

Among the more salient and visible obstacles to EV adoption is the need for expanded charging infrastructure and EV purchase incentives. The Infrastructure Investment and Jobs Act of 2021 (IIJA) supports a historic investment in EV infrastructure, including $7.5 billion towards establishing a national EV charging network. While the IIJA’s investment in vehicle electrification is a first step, this is small relative to the scale of infrastructure that will be needed to meet the nation’s target of reaching net zero emissions by 2050. According to one estimate, the United States needs to invest $87 billion in new charging infrastructure to fully electrify light-duty vehicles by 2035. This not only includes investments in public charging, but also expanding single-family, multifamily, and fleet charging solutions.

Automakers have pointed to charging concerns as one of the biggest barriers to mass EV adoption. While many customers will have the opportunity to charge their vehicles at home, there is a continued demand for widespread, public fast-charging stations among consumers. This demand is particularly acute for multifamily residences, especially in urban markets with multi-family housing, where at-home charging solutions are scarce. This involves maintaining some form of equity in investments. The private sector is most interested in where they can locate charging infrastructure that can serve the most consumers and get the most use, which typically is in more wealthy areas. But ensuing lower-income and rural EV adoption means investing in charging infrastructure that is not necessarily in the most economically viable location. Public policy and public investments are needed to help fill this gap.

The proliferation of EV infrastructure requires substantial coordination across city and state agencies, and will demand intensive collaboration with utility providers. Many local permitting processes are currently not equipped to handle the influx of new charging infrastructure that will need to be built in the coming years. There is also a growing demand for cities to enact zoning codes that incentivize new construction that either include or are capable of supporting charging infrastructure.

Another key equity concern relates to the affordability of the vehicles themselves. While the number of available EV models has expanded considerably over the past decade, EVs remain over $10,000 more expensive on average than their non-electric counterparts. Tesla and General Motors, which are the largest and most popular EV manufacturers, have already sold more than 200,000 plug-in vehicles, and as a result are no longer eligible for the $7,500 federal tax incentive. With over 190,000 sales of its many plug-in hybrid vehicles, Toyota is projected to hit its 200,000 cap by June 2022.

As part of its Build Back Better (BBB) proposal, the Biden Administration proposed expanding the federal incentive to $12,500 for EVs produced in the United States, and lifting the 200,000 vehicle cap for auto manufacturers. With the BBB bill stalled in Congress, the future of federal incentives remains unclear.

Increasing EV adoption will not only require expanding purchase incentives, but also educating consumers on the myriad incentives that exist at the state and local levels. Many utility companies, for example, have programs in place to help consumers install home-charging infrastructure. As more Americans purchase EVs, dealerships may play a critical role in providing consumer education and connecting customers with existing programs in their area.

The Road Ahead

In a circular economy, the lifecycle of an EV does not end when the car reaches the end of its useful life. Reuse and sustainable design will play a critical role in reducing overall lifecycle emissions for EVs, and the themes above are among the many unique challenges facing the EV industry. As the EV market expands, there will need to be greater awareness and solutions to address the complex trade, supply chain, and infrastructure dynamics that affect the sustainability and pace of EV production.

While there are major challenges in the mass production, adoption, and decarbonization of EV production, these are also an opportunity to align tax, land use, energy, and trade policy in a way that not only supports electrification, but also helps decarbonize each stage in the life of an EV. These investments could also help accelerate the production of renewable energy and use of recycled materials in other industries. Achieving these goals, however, will require strong coordination and political action across federal, state, and local governments as well as industry stakeholders.

Romic Aevaz and Katie Donahue contributed to the writing of this document.