December 4, 2014

Many observers of transportation debates have long wondered: how do we get a user tax increase through an anti-tax Congress so that we can prop up the finances of the federal trust fund that pays for our programs?

The question has now been answered, and that answer is: put the user tax increase in a broadly popular but completely unrelated bill, and put it in the middle of a list of items that starts with the word “penis.”

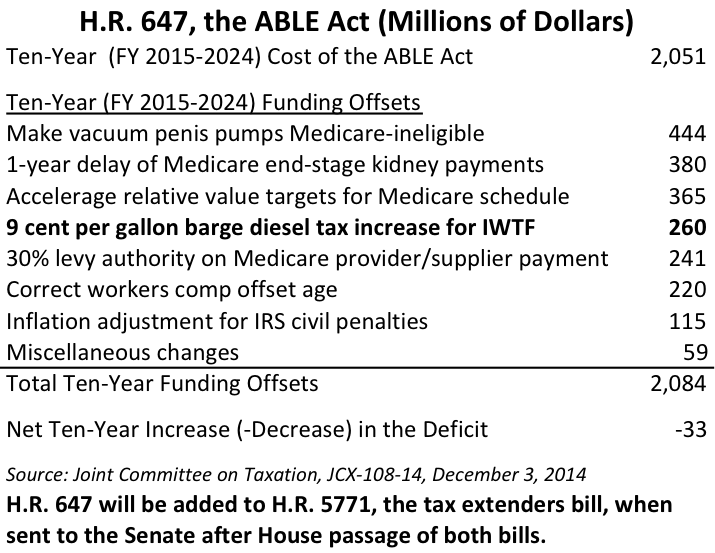

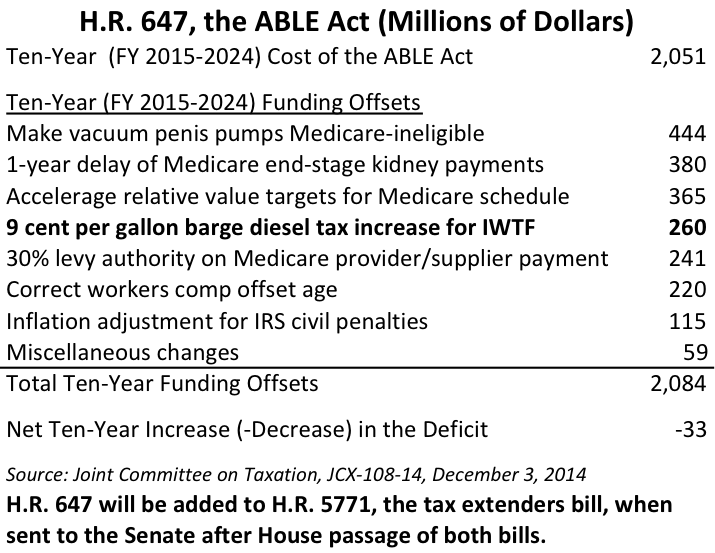

Yesterday, the House of Representatives passed the ABLE Act (H.R. 647), which allows disabled individuals to set up tax-free savings accounts (similar to “529” college savings accounts) that don’t count towards income caps for other federal disability benefits. The bill cost $2 billion over ten years, so the bill sponsors assembled a list of unrelated “pay-fors” that completely offsets the ten-year cost of the bill.

Among those pay-fors was a 45 percent increase in the diesel fuel tax charged to barge operators that supports the Inland Waterways Trust Fund – the tax will go up from 20 cents per gallon to 29 cents per gallon, effective on April 1, 2015, raising an estimated $260 million over ten years.

But the biggest offset in the ABLE Act was the denial of Medicare payments for vacuum-based penis erection pumps, which will save $444 million over ten years.

During yesterday’s House debate on the ABLE Act, the words “diesel” or “waterways” were never uttered. And to the extent that the media covered the offsets part of the bill, somehow it was the vacuum penis erection pump provision that got most of the attention.

Of course, it’s not just the wide popularity of the underlying ABLE Act or the distraction of the penis-pump offset that allowed a 45 percent increase in a transportation user tax to sail through the GOP-controlled House unnoticed. Several other factors were involved.

- The element of surprise. The ABLE Act as reported from the Ways and Means Committee on November 12 did not include the barge diesel tax provision. But the bill as reported was not deficit-neutral. Bill sponsor Ander Crenshaw (R-FL) and committee and House leaders worked throughout November to find an adequate list of offsets, and while they had settled on the barge diesel tax as being part of the list several weeks ago, this was not made public until 8:15 p.m. on December 1, when the text of the ABLE Act and a substitute amendment from Crenshaw which included the offsets was posted on the House Rules Committee website (along with the text of the tax extenders bill). Since the ABLE Act was a completely unrelated social/welfare type bill, no transportation reporters bothered to look at it. (The diesel tax was brought to TW’s attention by a friend who covers more broad-based tax and budget things at 4:15 p.m. Tuesday, well after the TW update for that day had gone out.) Less than 48 hours passed between the time that the barge diesel tax increase was made public and the time that the bill passed the House.

- Taxpayers who actually want their taxes to go up. The inland waterway barge industry pays the barge diesel tax to support the Inland Waterways Trust Fund, the balance of which was earlier estimated to drop down to around $40 million at the end of FY 2014. For several years, the Obama Administration has proposed replacing the diesel tax with a system of user fees (almost tolls, really) on lock operations. But the barge industry likes the current diesel tax system and fears change, so the industry itself has been advocating an increase the barge taxes that it pays. The industry organization even wrote letters to the tax-writing committees of Congress, asking them to raise the tax from 20 cents per gallon to 29 cents per gallon instead of adopting the fee/toll system. Ways and Means chairman Dave Camp’s (R-MI) holistic tax reform proposal from nine months ago included a 6 cent increase in the IWTF tax, and the industry wanted to be taxed at an even higher rate. This is what distinguishes the barge diesel tax from the highway gasoline tax – the actual gasoline taxpayers (oil and gas companies) are not advocating for a tax increase, nor are the pass-through taxpayers (motorists) for the most part.

- Key supporters in Congress. During this year’s debate on the water resources authorization bill, and during consideration of the annual Corps of Engineers appropriations bill, many legislators who don’t serve on the tax committees urged their tax-writing colleagues, publicly and privately, to go along with the tax increase to pay for more waterways improvement projects. And the way the IWTF works (paying 50 percent of qualified inland waterways projects) revolves to an unusual extent around big projects. The Olmsted Lock and Dam replacement across the Ohio River currently sucks up most of the IWTF money, and that project is a top priority of Senate Republican Leader Mitch McConnell (R-KY). And in the longer term, the Chickamauga Dam lock replacement will be the next IWTF megaproject, and that is in the home state of presumed incoming Energy and Water Appropriations chairman Lamar Alexander (R-TN), who, along with Dianne Feinstein (D-CA), wrote a public letter to the Finance Committee on June 26, 2014 advocating that the barge diesel tax rate be raised from 20 to 29 cents per gallon.

There is an inherent problem with using the IWTF tax money as a pay-for to make an unrelated bill deficit-neutral, which anti-deficit groups would have focused on if given more time. In essence, the $260 million raised over the next ten years by the 9 c.p.g. barge diesel tax increase is being counted twice. If the proceeds of the tax increase are being used to pay for the ABLE Act, then logically, the money should not then also be available to pay for Olmsted or other inland waterways projects. And if the proceeds of the tax increase are deposited directly in the Inland Waterways Trust Fund and then spent on improving locks and dams, then that money really shouldn’t be counted as offsetting the money that the Treasury will lose by setting tax-free savings accounts for disabled individuals. But Congress chooses to ignore this kind of double-counting problem when convenient, because current budget rules allow it.

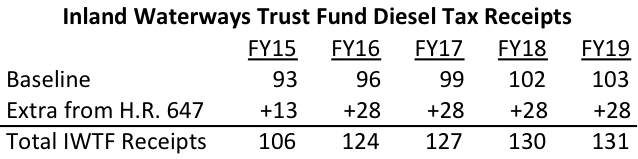

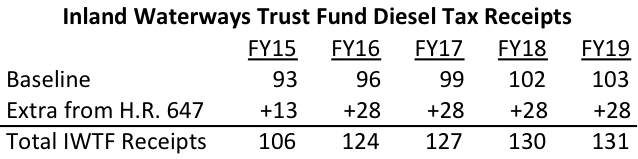

If one simply applies the budget effects of the Joint Committee on Taxation score of the ABLE Act to the Administration’s baseline projections for IWTF receipts and interest from the FY 2015 Budget, it looks like this:

The House passed the ABLE Act by a massive vote of 404 to 17 (5 Republicans and 12 Democrats voted “no”). The Senate companion bill has 70-odd cosponsors, but the bill will not be considered on its own in the Senate. Instead, the House used an unusual procedure to attach the ABLE Act to the larger $42 billion tax extenders bill (H.R. 5771), which the House also passed yesterday. The combined extenders-ABLE bill will now go to the Senate, where Majority Leader Reid is expected to try to muscle the bill through the Senate without amendment by the end of next week.

The extenders bill also includes two transportation-related provisions: an extension of the transit-parking benefit exclusion parity provision, and an extension of the tax credit for railroad track maintenance given to railroads. Both of these are extended through December 31, 2014, as are all of the other (much larger) extenders in the bill, as shown in the following table:

| The Tax Extenders Bill (H.R. 5771) (Millions of Dollars) |

| Provision |

From |

To |

10-Yr. Cost |

| Business R&D tax credit |

12/31/13 |

12/31/14 |

7,629 |

| Business renewable energy credit |

1/1/14 |

12/31/14 |

6,392 |

| Business subpart F active financing exception |

12/31/13 |

12/31/14 |

5,082 |

| Individual mortgage debt exclusion |

12/31/13 |

12/31/14 |

3,143 |

| Individual state/local sales tax deduction |

12/31/13 |

12/31/14 |

3,142 |

| Business 15-year straight-line cost recovery |

12/31/13 |

12/31/14 |

2,382 |

| Business 50% bonus depreciation & AMT credit |

12/31/13 |

12/31/14 |

1,492 |

| Business sec. 179 expensing limitation |

12/31/13 |

12/31/14 |

1,434 |

| Business work opportunity tax credit |

12/31/13 |

12/31/14 |

1,375 |

| Business biodiesel production tax credit |

12/31/13 |

12/31/14 |

1,297 |

| Business look-through foreign holding treatment |

12/31/13 |

12/31/14 |

1,154 |

| Various provisions under $1 billion each |

|

|

7,077 |

| Total Ten-Year Cost of Extenders Bill……………………………………………………….. |

41,599 |

|

|

|

|

| The “Under $1 Billion” Provisions Include: |

|

|

|

| Individual transit-parking benefit parity |

Complicated |

12/31/14 |

10 |

| Business railroad track maintenance credit |

12/31/13 |

12/31/14 |

207 |

Source: Joint Committee on Taxation, JCX-107-14R, December 3, 2014

Unlike most of the rest of the extenders, the transit parity benefit is forward-looking, not retroactive. The JCT estimate assumes an enactment date of December 15, 2014, so the $10 million cost is only for what trips might be taken and reimbursed in the last month of the year. An earlier extenders bill in the Senate that extended the transit parity benefit from July 1, 2014 to December 31, 2015 was scored as costing $180 million, so $120 million per year for a full extension is a good estimate.

Such an extension of the transit-parking benefit parity provision really does not give much help to workers who want to ride the subway or the bus, because employers would at most be able to provide only a few weeks of the benefits during December 2014 before the provision expires again. But inclusion of the transit benefit in the larger package keeps it in the conversation for possible permanent extension in tax reform legislation that will hopefully be considered by Congress during 2015. (Whereas if the transit benefit had been left out of the extenders bill, that would make it look even deader.)

(Subsequent addition: The Senate took up the House-passed H.R. 5771, including the IWTF barge diesel tax, and passed it without change on December 16 by a vote of 76 to 16. It is now Public Law 113-295.)