The novel coronavirus’s effects on the economy are broad, and evolving every day. No one thought a month ago that the U.S. would be thrown into a severe (and hopefully short) recession before Easter. And changing travel patterns are at the root of the economic impact – people are ordered to stay home wherever possible, devastating the travel, hospitality, and restaurant industries, and making profound short-term changes in commuting patterns and transit usage.

What effect is this changing demand for travel likely to have on the Highway Trust Fund, which is funded by gasoline and diesel fuel excise taxes, as well as several taxes on the trucking industry?

For the first five months of fiscal year 2020, the Highway Trust Fund had a good run. Here are the net total excise tax revenues received by the Trust Fund for the first five months (remember that, because taxes are deposited twice a month, and are deposited about two weeks after collection, October is effectively a two-week month while September is a six-week month.) Net tax revenues for the first five months were $16.8 billion, nearly $1.7 billion above the similar total in FY 2019.

|

FY 2019 |

FY 2020 |

| Oct |

784.1 |

874.4 |

| Nov |

4,259.0 |

4,510.0 |

| Dec |

3,676.7 |

3,893.5 |

| Jan |

3,319.3 |

3,861.4 |

| Feb |

3,577.4 |

3,646.8 |

| First 5 Mo. |

15,616.5 |

16,786.0 |

This is going to come to a screeching halt once the March numbers are in, with stay-at-home orders and furloughs reducing the need or desire of many Americans to drive. Gasoline purchases will definitely take a hit, as will the receipts from the tax on sales of new trucks and trailers (since fleets always start postponing new equipment purchases, wherever possible, at the start of a recession).

Here are the five Highway Trust Fund excise taxes in terms of net receipts for fiscal year 2019. totaling $43.6 billion.

| Gasoline |

26,010.9 |

59.7% |

| Diesel/special fuels |

10,413.9 |

23.9% |

| Truck/trailer sales |

5,329.7 |

12.2% |

| Heavy tires |

534.6 |

1.2% |

| Heavy vehicle use |

1,285.2 |

2.9% |

| Total, Net HTF Taxes |

43,574.1 |

100.0% |

How far will tax receipts drop for the remaining seven months of FY 2020?

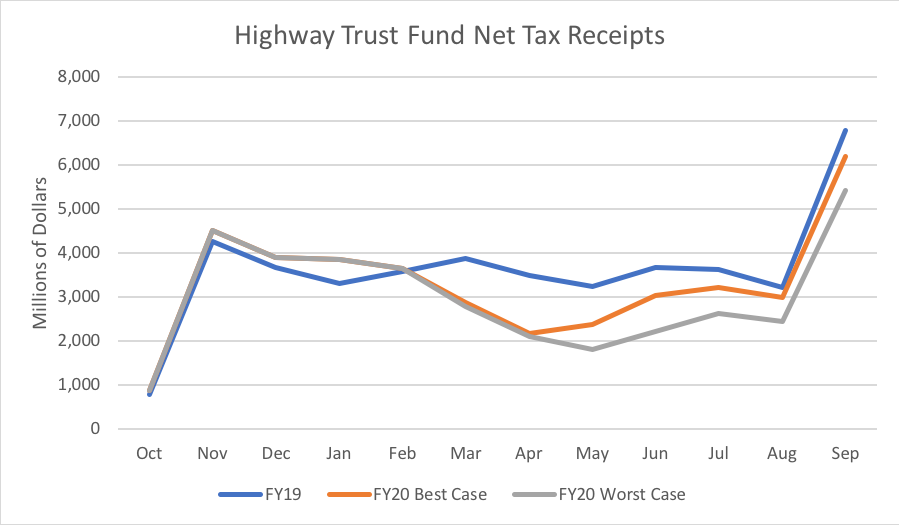

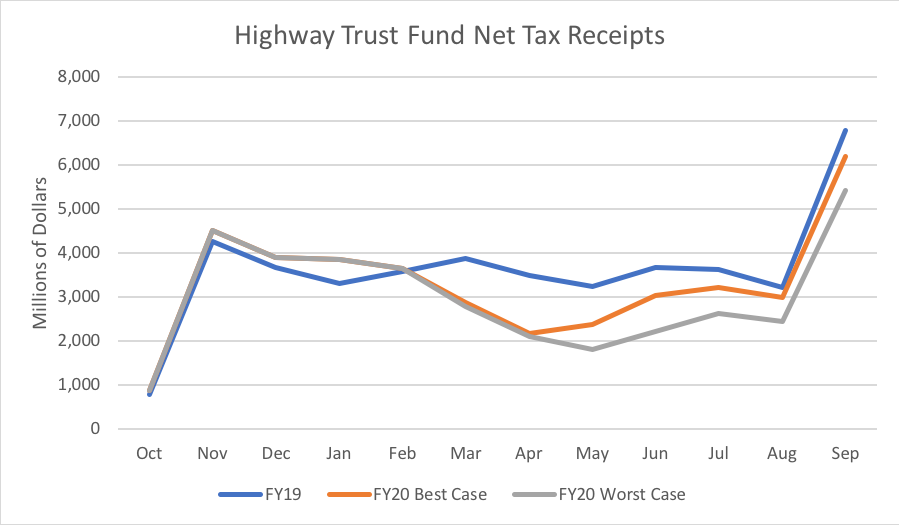

Let’s look at a hypothetical best-case scenario: gasoline purchases drop 30 percent from FY 2009 levels in March, then drop to 50 percent of FY 2009 in April and May, rise back to 70 percent in June, 80 percent in July, 90 percent in August, then 100 percent of the 2019 levels for September. Meanwhile, the truck/trailer tax receipts drop by 50 percent for the remainder of the fiscal year. (Receipts from the truck/trailer tax fell from $3.81 billion in FY 2007 to $1.45 billion in FY 2008.)

This best-case scenario would see HTF net tax receipts for the final seven months of FY 2020 drop by $5.1 billion below the FY 2019 levels. Weigh that against the $1.7 billion above-FY19 level for the first five months, and total Trust Fund taxes for the year are down $3.9 billion, to $39.7 billion.

Now, let’s look at a worst-case scenario, where the virus keeps popping back up whenever governors try to lift social distancing restrictions, and the economy has real trouble restarting. Let’s assume that diesel fuel purchases start declining in May and drop 10 percent below their 2019 levels through the end of the fiscal years. Assume a 65 percent drop in truck sales from now to the end of the year as well. And assume that gasoline demand stays at 50 percent of 2019 levels through June and only recovers to 90 percent of FY19 by September.

Under that scenario, Trust Fund revenues for the last seven months of FY 2020 are $8.5 billion below the 2019 levels. Deduct the $1.7 above-2019 totals from the first five months, and you finish FY 2020 almost $7.4 billion below 2019 receipts – at $36.2 billion. (In the table below, remember that October is a two-week month and September a six-week month.)

In the best case scenario, $4.6 billion of the reduced revenues for the remainder of the year would come from the Highway Account and $0.5 billion from the Mass Transit Account. In the worst case scenario, $7.7 billion of the losses in the last seven months of the year would come from the Highway Account and $0.9 billion from the Mass Transit Account.

In the Congressional Budget Office’s updated Trust Fund baseline released a few weeks ago, the Highway Account was projected to end FY 2020 with a carryover cash balance of $15.3 billion and the Mass Transit Account would end the period with a balance of $3.7 billion. Even the worst case scenario would not cause either account to run out of money before the end of the fiscal year. But we definitely won’t have until late summer 2021 before the Mass Transit Account runs out of money, as the baseline predicted – the Trust Fund’s depleted revenues will need to be replenished fairly early in fiscal year 2021, lest state DOTs and transit agencies be denied prompt repayment for federal-aid expenses already incurred.

(Of course, it is possible that our worst-case scenario isn’t the worst case at all, which would mean that all bets are off.)