After we had a couple of days to digest the Trump Administration’s ten-year, $810 million surface transportation reauthorization proposal, we asked the question – if the Highway Trust Fund portion of the plan were to be funded solely by increasing federal gasoline and diesel fuel excise taxes, how much would those taxes have to be increased?

The plan would provide $755 billion in contract authority from the Trust Fund over the ten year period of fiscal years 2021-2030 and would assume obligation limitations in each fiscal year equal to that contract authority. The Office of Management and Budget estimates that the amount of extra cash that would go out the doors of the Treasury over the ten-year period (outlays) from increased obligations over the (inflation-adjusted) baseline level would be $75.4 billion.

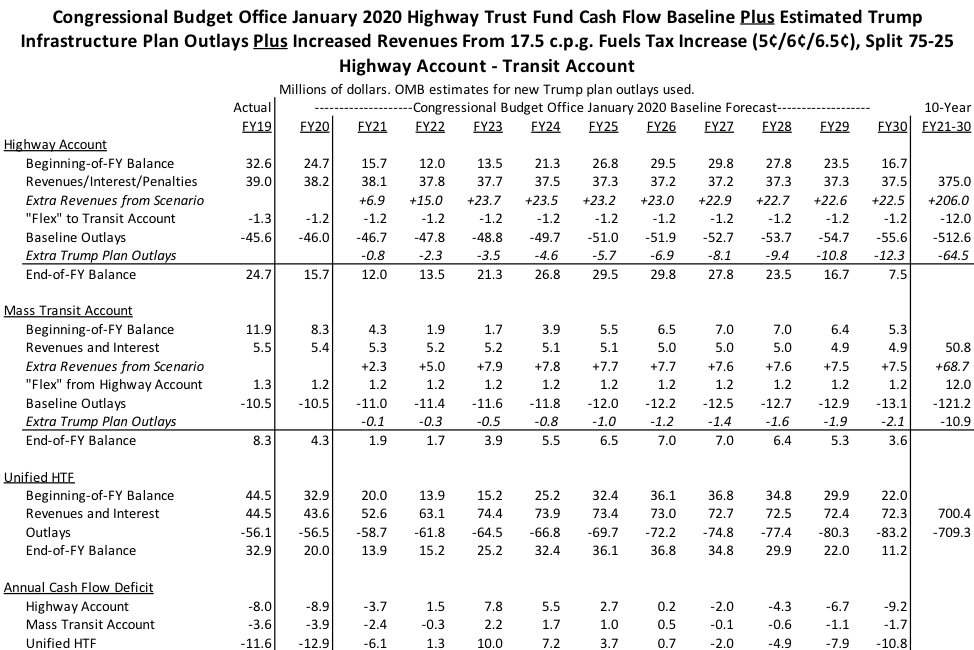

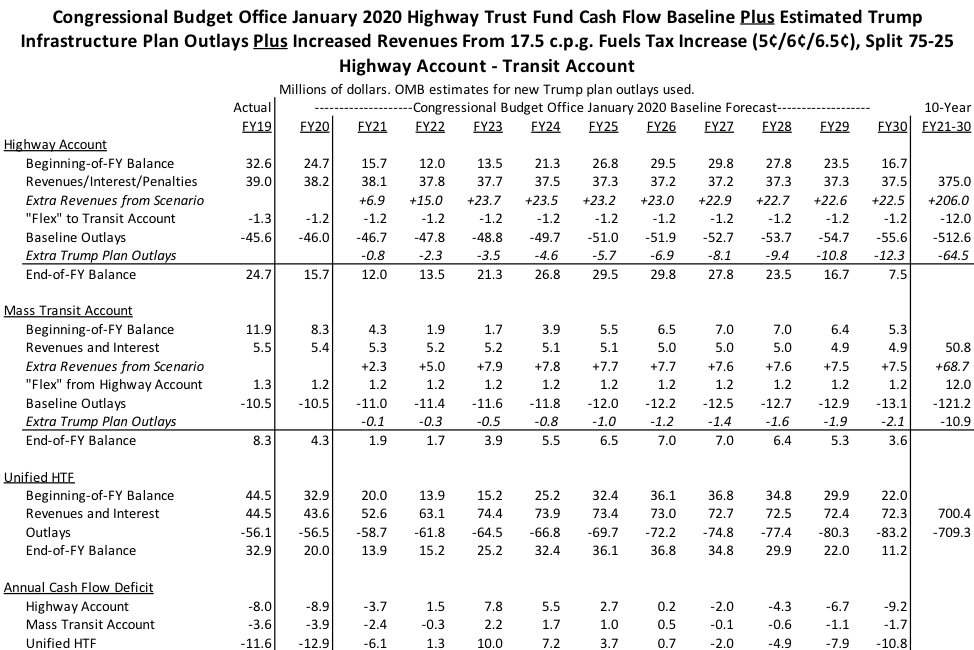

The Congressional Budget Office last month released its updated Highway Trust Fund cash flow forecast, which estimated that, under current tax rates and FY2020-plus-annual-inflation spending levels, the Trust Fund would need $188 billion to get to zero balances every year through the end of 2030 ($133.9 billion for the Highway Account and $54.1 billion for the Mass Transit Account). Add to that the need to have a small cash “cushion” on hand at the end of every year so that neither account runs out of cash on a day-to-day basis at the height of warm-weather construction season while waiting for twice-monthly tax deposits), and the size of the “revenue hole” increases to $193 billion or so at baseline.

Add the extra $75 billion from the Trump plan, and you get $263.5 billion in extra tax receipts of other transfers needed.

(Yes, we know you’re not supposed to mix estimates, but CBO is the only year-by-year Trust Fund baseline we have so far, and OMB’s outlay estimates for the Trump plan are the only ones we have, so we are forced to mix CBO tax and current law spending estimates with OMB new spending estimates. The budget does say that the OMB estimated for the Trust Fund end-of-2030 baseline revenue hole is $185 billion, which is only $3 billion off from CBO, and being only 1.6 percent apart at the end of ten years is pretty close, actually.)

If one wanted to fill the revenue hole entirely with increased excise taxes on highway users, and if you did the whole thing by raising the tax rates on gasoline and diesel fuel (and no one – not the Trump Administration, and not any party leader in Congress, is specifically endorsing this), we calculate that you would need:

A 17.5 cent-per-gallon tax increase, phased in over three years:

- 5.0 cents per gallon increase in FY 2021

- 6.0 cents per gallon increase in FY 2022

- 6.5 cents per gallon increase in FY 2023

Split 75 percent for the Highway Account and 25 percent to the Mass Transit Account.

Using the January 2020 CBO revenue baseline, each penny of federal gasoline and diesel taxes is currently projected to bring in $17.7 billion over the next decade ($1.84 billion per penny in 2021, sliding steadily to $1.71 billion per penny in 2030). We have to assume complete inelasticity of demand (assume that increases in price will not decrease demand in the slightest) because we aren’t economists, and we decided not to split tax increases below half-cent increments.

At those CBO multipliers, a 17.5 cent per gallon fuels tax increase, phased in via the above schedule, would bring in $274.5 billion over ten years. A 75-25 split would leave the Highway Account with a projected end-of-2030 balance of $7.5 billion and leave the Mass Transit Account with a projected balance of $3.6 billion at that time. (Our original run had the 2023 increase at only 6.0 cents, but that would have left the Trust Fund with only $2 billion in year-end balances – too low.) Going to a 6.25 cent increase in 2023 instead of 6.5 cents would probably get the end-of-2030 balances closer to the bare minimum, and you might be able to shave a penny or two off of the 2022 and 2023 increases by doing indexation instead, but re-basing the whole tax and then putting in inflation factors each year was more Excel work than we wanted to do.)