July 20, 2018

The House of Representatives this week passed a non-binding resolution rejecting the idea of a carbon tax as bad for the economy as one Republican prepares to introduce a bill next week replacing the federal motor fuels tax with a carbon tax.

Yesterday, the House voted, 229 to 180 (roll call here), to pass H. Con. Res. 119, which expresses the sense of Congress that a carbon tax “would be detrimental to American families and businesses, and is not in the best interest of the United States.” The vote was predominantly party-line, with only six Republican “no” votes and only seven Democratic “yes” votes.

|

Yes |

No |

“Present” |

| Republicans |

222 |

6 |

1 |

| Democrats |

7 |

174 |

1 |

| TOTAL |

229 |

180 |

2 |

Meanwhile, Rep. Carlos Curbelo (R-FL) is preparing to introduce legislation in the House next week levying a new carbon tax on CO2 emissions and using it to replace the existing federal taxes on gasoline, diesel fuel, and kerosene. In a draft summary of the legislation, the tax rate would be set at $23 per metric ton of CO2 emissions to start with, plus annual increases of two percent per year, plus a CPI inflation adjustment.

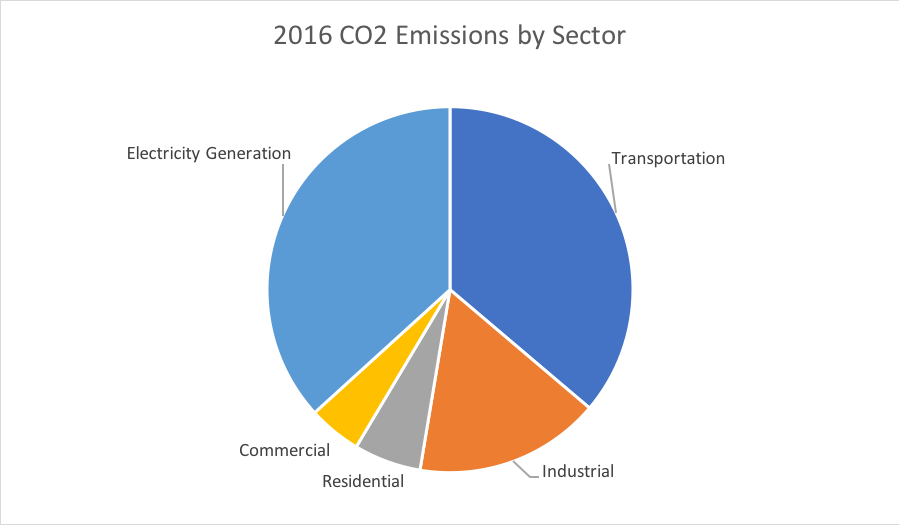

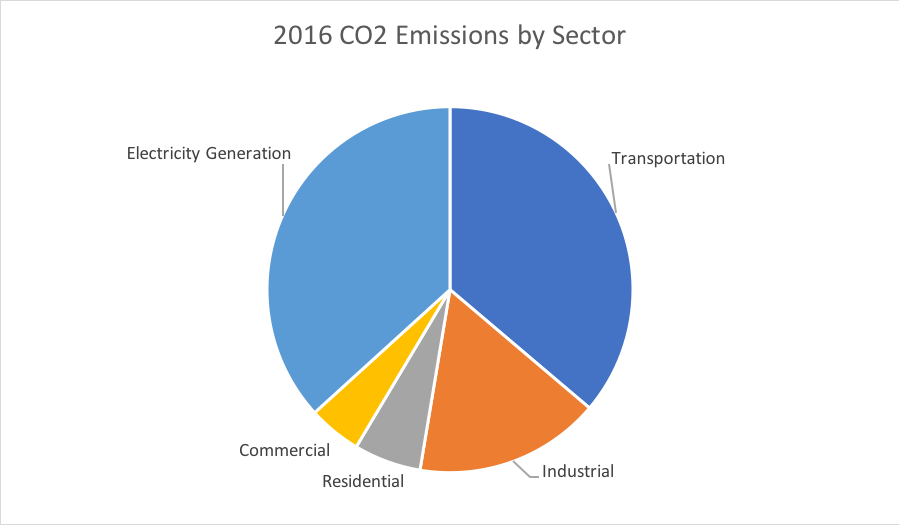

From a transportation perspective, the important thing to remember is that the burning of fossil fuels by the transportation sector only accounts for 36 percent of total CO2 emissions from fossil fuel combustion in the United States, according to the latest EPA estimates (see table ES-3 here).

Yet, under the draft Curbelo plan, the transportation sector would get 72.5 percent of the proceeds of the carbon tax (70 percent to the Highway Trust Fund and 2.5 percent to the Airport and Airway Trust Fund). 10 percent would go to states for grants to low-income households (a souped-up LIHEAP), 5 percent would go towards grants to states for coastal infrastructure resiliency, 3 percent to displaced energy workers, 2.5 percent for agricultural environmental incentive grants, 2 percent for coal mine cleanup, and the rest for a variety of research and mitigation programs. (This could all change by the time the final bill is introduced next week, of course.)

In 2016, fossil fuel combustion accounted for almost 5 billion metric tons of CO2 release in the United States. Exemptions and credits in the draft bill summary make it impossible to score. However, the Curbelo bill would tax CO2 release at $23 per ton to begin with. Even when the credits and the exemptions for de minimis producers and sectors are included, the legislation has the potential to deposit revenues into the Highway Trust Fund far in excess of the $35 billion per year that is currently deposited from the existing excise taxes on gasoline and diesel fuel.

Of course, giving the Highway Trust Fund the proceeds of wide-ranging taxes on non-transportation users instead of a dedicated tax on the highway use of motor fuels would put the final nail in the coffin of the user-pay, user-benefit principle that is supposed to underlie all federal trust funds. (The concept has taken a beating with the bailouts from general revenues supplementing the Trust Fund since 2008, but the Curbelo bill would make it official and permanent.)