August 9, 2017

An organized federal role in mass transit began in 1964 with the Urban Mass Transit Act (P.L. 88-365). Section 3 of that Act authorized the Housing and Home Finance Administrator to:

make grants or loans (directly, through the purchase of securities or equipment trust certificates, or otherwise) to assist States and local public bodies and agencies thereof in financing the acquisition, construction, reconstruction, and improvement of facilities and equipment for use, by operation or lease or otherwise, in mass transportation service in urban areas

Even though the UMT Act was eventually codified into title 49 U.S.C. and renumbered in the 1990s, the program that allowed the Administrator (later the Secretary of Transportation) to pick and choose new transit projects for construction aid is still called “section 3” by some transit veterans. Aid to buses and formula-based capital upgrades to existing systems have now been removed from the program, which is codified in 49 U.S.C. §5309 as the Capital Investment Grants program and which is the vehicle that funds new fixed guideway projects and extensions, or “new starts.”

The current program is “discretionary” in two very different senses of the word. CIG is a discretionary grant program in that it gives the Secretary of Transportation the discretion to pick projects and the discretion whether or not to sign grant agreements that promise hundreds of millions of dollars for a project in future fiscal years. But since 2005, the program has also been discretionary in the budget sense – it is funded through annual discretionary appropriations from the general fund of the Treasury, which can be completely cut off by Congress in any fiscal year without exposing the federal government to legal liability. (If cutting off appropriations put the government in legal jeopardy, the spending would be classified as “mandatory.”)

But for most of the program’s history, it was not funded from the annual discretionary budget.

Prior to 1979.

As mentioned above, upon its inception in 1964, the whole section 3 program was discretionary grants, and it all originally relied on annual appropriations. Authorizations were $150 million per year over 1966-1969, with the Appropriations Committees averaging $140 million per year in follow-through. Starting in FY 1966, the appropriators gave the program a small degree of multi-year certainty by beginning to appropriate money for the program one fiscal year in advance.

Authorizations and appropriations increased in FY 1970 and FY 1971, at which point the Urban Mass Transit Act of 1970 (P.L. 91-453), titled “An act to provide long-term financing for expanded urban mass transportation programs,” created true multi-year certainty by giving the program a massive injection of general fund contract authority:

To finance grants and loans under sections 3, 7(b), and 9 of this Act, the Secretary is authorized to incur obligations on behalf of the United States in the form of grant agreements or otherwise in amounts aggregating not to exceed $3,100,000,000, less amounts appropriated pursuant to section 12(d) of this Act and the amount appropriated to the Urban Mass Transportation Fund by Public Law 91-168. This amount (which shall be in addition to any amounts available to finance such activities under subsection (b) of this section) shall become available for obligation upon the date of enactment of this subsection and shall remain available until obligated.

As part of the compromise to get the 1973 highway authorization law (P.L. 93-87) enacted, section 301 of that law increased the total amount of mass transit general fund contract authority by $3 billion, to $6.1 billion.

The Congressional Budget Act of July 12, 1974 prohibited Congress from creating new general fund contract authority. However, the budget law did not take effect until January 1976, and before it did, Congress enacted the National Mass Transportation Act of November 26, 1974 (P.L. 93-503), which added a final $4.8 billion of general fund contract authority for the mass transit discretionary program and also created a formula grant program, which was mostly for operating assistance, and gave it an additional $4 billion in general fund contract authority.

But everyone knew that this would be the last multi-year contract authority for mass transit, unless it got its own user-tax-financed trust fund or else got permanent dedicated access to the Highway Trust Fund.

FY 1979-1983.

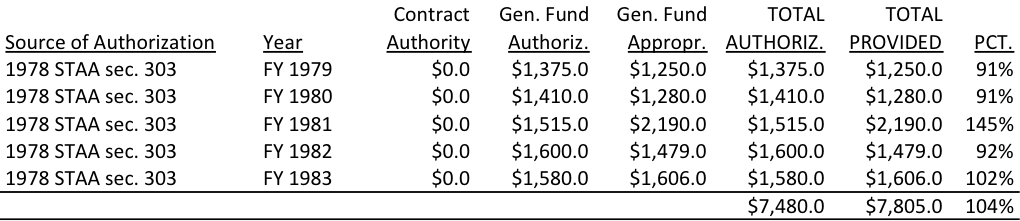

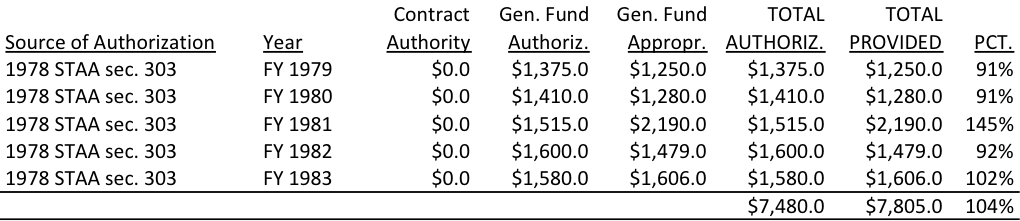

After attempts to pass a stand-alone mass transit authorization bill through Congress failed, the 1978 highway reauthorization law (P.L. 95-599) enacted in November 1978 contained a full mass transit reauthorization title for the first time. Since the Highway Trust Fund was not, at this point, open to mass transit authorizations, and since general fund contract authority was now prohibited, the 1978 law authorized an average of $1.5 billion in general fund appropriations over five years (FY 1979-1983) for the discretionary grant programs – if the Appropriations Committees could later provide the money.

Section 302 of the 1978 authorization law also attempted to put the existing “letter of intent” process on a firmer legal basis while acknowledging that Congress cannot legally pre-commit future annual discretionary appropriations:

The Secretary is authorized to announce an intention to obligate for a project under this section through the issuance of a letter of intent to the applicant. Such an action shall not be deemed an obligation as defined under section 1311 of the Act of August 26, 1954, as amended (31 U.S.C. 200), nor shall such a letter be deemed an administrative commitment. The letter shall be regarded as an intention to obligate from future available budget authority provided in an appropriation Act not to exceed an amount stipulated as the Secretary’s financial participation in the defined project under this section. The amount stipulated in the letter, when issued for a fixed guideway project, shall be sufficient to complete an operable segment. No obligation or administrative commitment may be made pursuant to such a letter of intent except as funds are provided in appropriations Acts…. Nothing in this paragraph shall affect the validity of letters of intent issued prior to the enactment of the Federal Public Transportation Act of 1978.

But Congress did not leave the Secretary the ability to issue letters of intent without limitation. The law also provided that:

The total estimated amount of future Federal obligations covered by all outstanding letters of intent shall not exceed [the $7.5 billion five-year authorization in the Act], less an amount reasonably estimated by the Secretary to be necessary for grants under this section which are not covered by a letter of intent. The total amount covered by new letters issued shall not exceed any limitation that may be specified in an appropriations Act.

The Carter Administration requested that Congress go back to the 1960s practice of providing appropriations one year in advance to provide more certainty, but Congress declined.

FY 1984-1992.

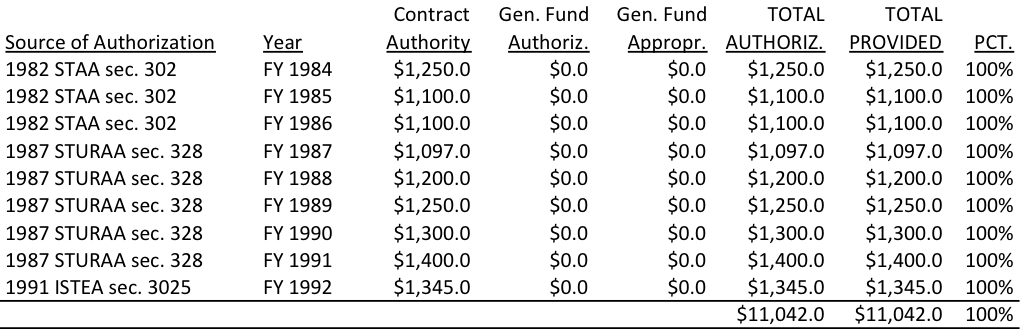

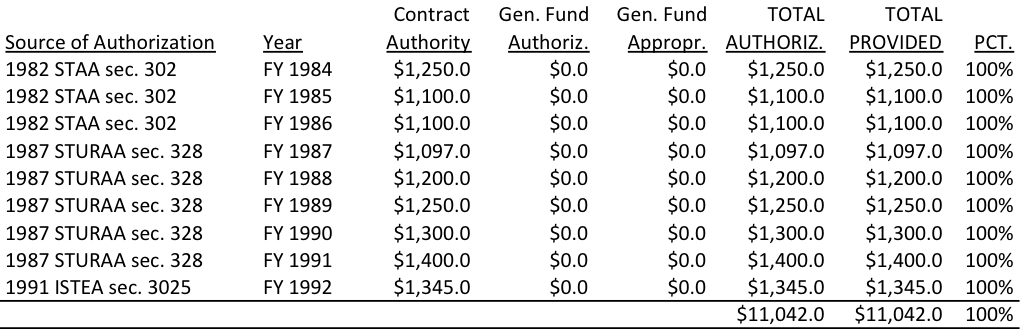

The landmark surface transportation law enacted in January 1983 (P.L. 97-473) (but legally called the Surface Transportation Assistance Act of 1982) more than doubled gasoline and diesel taxes and also created a new Mass Transit Account within the Highway Trust Fund, which meant that transit could start receiving new multi-year contract authority once again.

After a transition year in 1983, Congress started giving the discretionary grant programs all of the Trust Fund contract authority and made the formula programs and research programs completely dependent on annual appropriations. This practice continued in the 1987 surface transportation law enacted over President Reagan’s veto (P.L. 100-17).

The 1983 law also clarified that multi-year letters of intent or grant agreements made with contract authority “shall be deemed a contractual obligation of the United States for payment of the Federal share of the cost of the project.” The law continued to limit the aggregate total of all letters of intent to the amount of past appropriations and new contract authority.

President Reagan also consistently refused to request funds for the program, so Congress began earmarking the money in FY 1982. See this list of all FY 1982-1992 earmarks.

FY 1993-1997.

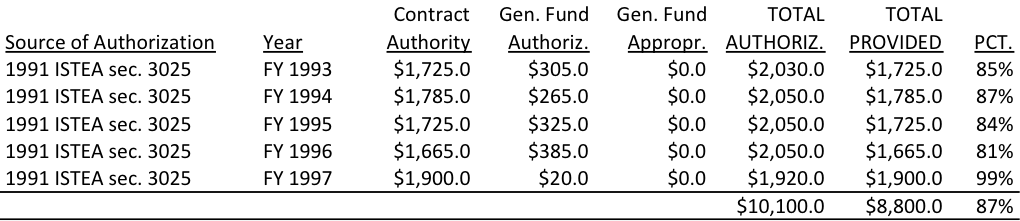

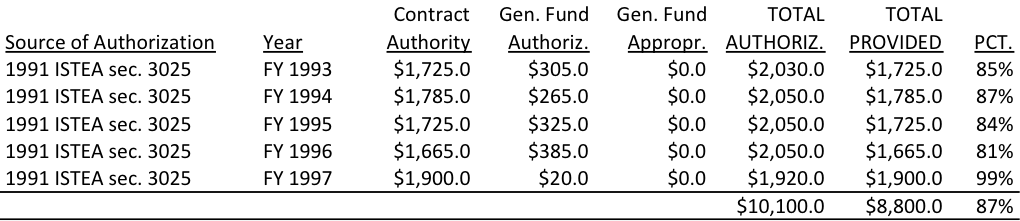

By the time Congress enacted the 1991 ISTEA law (P.L. 102-240), the working relationship between the Appropriations Committees and the transportation authorizing committees had deteriorated. The authors of ISTEA attempted to fund 85 percent of the annual discretionary grants program with HTF contract authority and the other 15 percent with annual appropriations – but the Appropriations Committee never provided the appropriations. The authorizers also gave contract authority for about one-third of the aspirational formula grant funding level.

(There was also an aspirational sixth-year balloon payment of contract authority written into ISTEA for FY 1997 but the Appropriations Committee reduced that down to $1.9 billion.)

ISTEA again clarified that grant agreements funded with contract authority “shall be deemed a contractual obligation of the United States for payment of the Federal share of the project” but that “Approval by the Secretary of a grant or contract with funds [subject to general fund appropriation] shall be deemed a contractual obligation of the United States…only to the extent that amounts are provided in advance in appropriations Acts.”

ISTEA also changed the “contingent commitment” ceiling on the aggregate amount of all funding agreements, letters of intent, etc.:

The total estimated amount of future obligations of the Government and contingent commitments to incur obligations covered by all outstanding letters of intent, full financing grant agreements, and early systems work agreements may be not more than the greater of the amount authorized under section 5338(a) of this title to carry out this section or 50 percent of the uncommitted cash balance remaining in the Mass Transit Account of the Highway Trust Fund (including amounts received from taxes and interest earned that are more than amounts previously obligated), less an amount the Secretary of Transportation reasonably estimates is necessary for grants under this section not covered by a letter. The total amount covered by new letters and contingent commitments included in full financing grant agreements and early systems work agreements may be not more than a limitation specified in law.

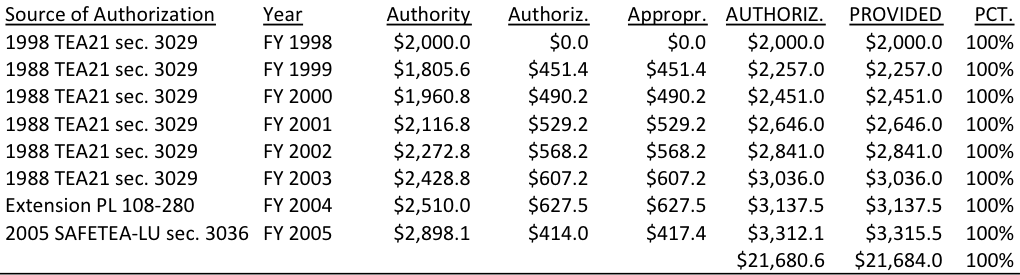

FY 1998-2005.

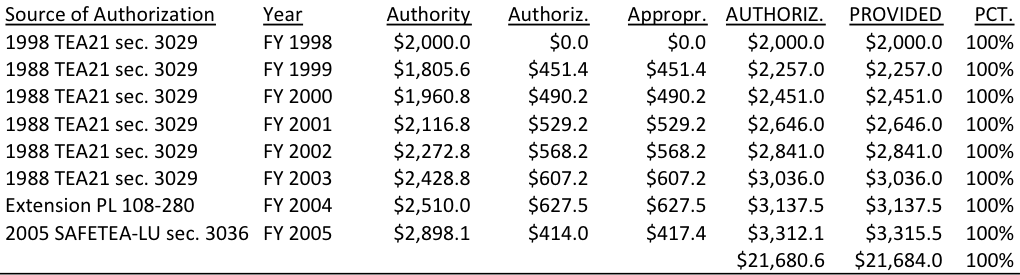

With the enactment of the 1998 TEA21 law (P.L. 105-178), the authorizing committees finally got the upper hand over the appropriators. The law changed House rules to require the Appropriations Committee to fully fund the general fund authorizations for mass transit in the bill, and amended the statutory spending caps in the Budget Enforcement Act so that the general fund transit money would not compete with other appropriations.

In addition, TEA21 began a new system where every dollar spent by the Federal Transit Administration, for any program, was taken 80 cents from the Trust Fund (in contract authority) and 20 cents from the general fund. This would have made it extremely complicated for the Appropriations Committees to underfund the general fund transit share of any account.

As a result, the amounts appropriated for the program under TEA21 and its extensions matched precisely with the authorization levels.

TEA21 did change the contingent commitment ceiling on total grant agreements, letters of intent, etc. Under TEA21, the cap only applied to grants for new fixed guideway systems and extensions. And instead of being the greater of the total funding authorizations for the program or 50 percent of the Mass Transit Account balance, the ceiling was now the “amount equivalent to the last 2 fiscal years of funding authorized under section 5338(b) for new fixed guideway systems and extensions to existing fixed guideway systems, less an amount the Secretary of Transportation reasonably estimates is necessary for grants under this section not covered by a letter.”

This would pose problems in the final year or two of an authorization law, when Congress was only extending the program for a few months at a time. This was amended in 2000 (sec. 380 of P.L. 106-346) to declare that two years were equal to three years.

FY 2006-present.

When Congress was drafting the legislation reauthorizing TEA21, through a long series of short-term extensions, they were faced with several financial problems. The biggest was that President George W. Bush categorically refused to increase federal motor fuel taxes, which constrained the amount of money available in the Highway Trust Fund and limited program growth.

But another problem was specific to the Mass Transit Account. Under the system established by TEA21, every dollar spent by the Federal Transit Administration was drawn 80 percent from the HTF and 20 percent from the general fund. For accounts “split-funded” on a dollar for dollar basis in this manner, Treasury practice is to pull the full amount of a trust fund obligation out of the trust fund account the moment the obligation is recorded and then let the money sit in the general fund until expended. For example, if FTA were to sign a contract obligating $100 million for a project, $80 million would immediately be transferred to the general fund and then would wait – possibly for five or ten years – to be spent with its matching $20 million from the general fund.

Even though mass transit capital projects have an extremely low “spendout rate” overall, split-funding on a dollar-for-dollar basis meant that the Mass Transit Account had a very high spendout rate.

Once the authors of the law eventually named SAFETEA-LU (P.L. 109-59) decided to get around President Bush’s refusal to raise taxes by “spending down” Highway Trust Fund balances to near-zero by the end of the authorization period in 2009, the issue of “spendout rates” took on critical importance. Highway spending from the HTF Highway Account programs have a low spendout rate – at the time, the estimate was 27 percent in the first year, 42 percent in the second year, and then a five- or six-year period of tailing off to zero.

That means that you could increase new spending obligations significantly in the last two or three years of the legislation before the actual bills came due and were drawn upon the Trust Fund – but this was not the case for the Mass Transit Account, where the Trust Fund balances would decrease as quickly as the new spending obligations.

So, instead of having 80 cents of every FTA dollar drawn on the Trust Fund and 20 cents drawn on the general fund, the authors of SAFETEA-LU decided to change the program structure so that about 80 percent of the total FTA budget was drawn on accounts that were exclusively Trust Fund contract authority and about 20 percent was drawn on accounts that were exclusively general fund appropriations.

The question was – which accounts were to be all Trust Fund and which were to be all general fund?

Funding the administrative expenses of FTA from the GF was a no-brainer – appropriators are always making tweaks to salary and expense accounts. And SAFETEA-LU gave the appropriators most transit research programs, since those were largely earmarked for universities in the districts of appropriators anyway. But these programs all only added up to $612 million over the 2006-2009 period, and they needed to authorize $7.2 billion over that same time period from the general fund.

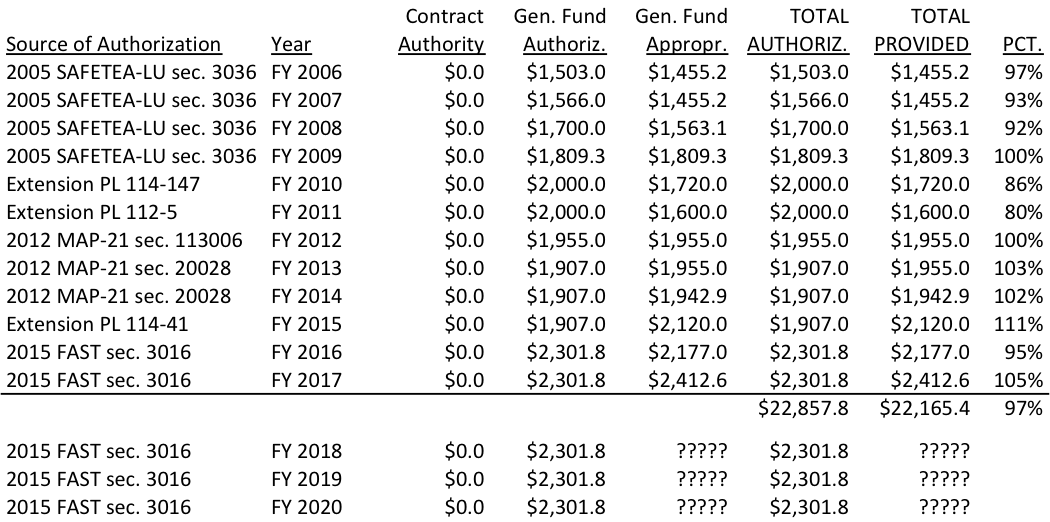

So SAFETEA-LU also broke up the “section 3” program – fixed guideway modernization and buses were put in with the formula programs in an all-Trust-Fund “Formula and Bus Grants” account, while fixed guideway new starts were renamed “Capital Investment Grants” and left completely at the mercy of the Appropriations Committees. SAFETEA-LU authorized $6.6 billion for the CIG program over 2006-2009 to be appropriated from the general fund.

One transit veteran said that new starts was chosen to be given back to Appropriations because they were a discrete package of slow-spending projects at about the right aggregate size and they came with a built-in lobbying effort from a wide variety of cities and states.

The accounting gimmick worked – total FTA outlays continued to rise throughout SAFETEA-LU but the Trust Fund was given a breather to allow its balances to build up, at the expense of the general fund:

| Total FTA Outlays, by FY (Billion $) |

|

TF |

GF |

Total |

| FY 2005 |

6.8 |

1.0 |

7.8 |

| FY 2006 |

2.0 |

6.7 |

8.6 |

| FY 2007 |

4.2 |

5.0 |

9.2 |

| FY 2008 |

6.0 |

4.0 |

10.0 |

| FY 2009 |

7.3 |

4.1 |

11.4 |

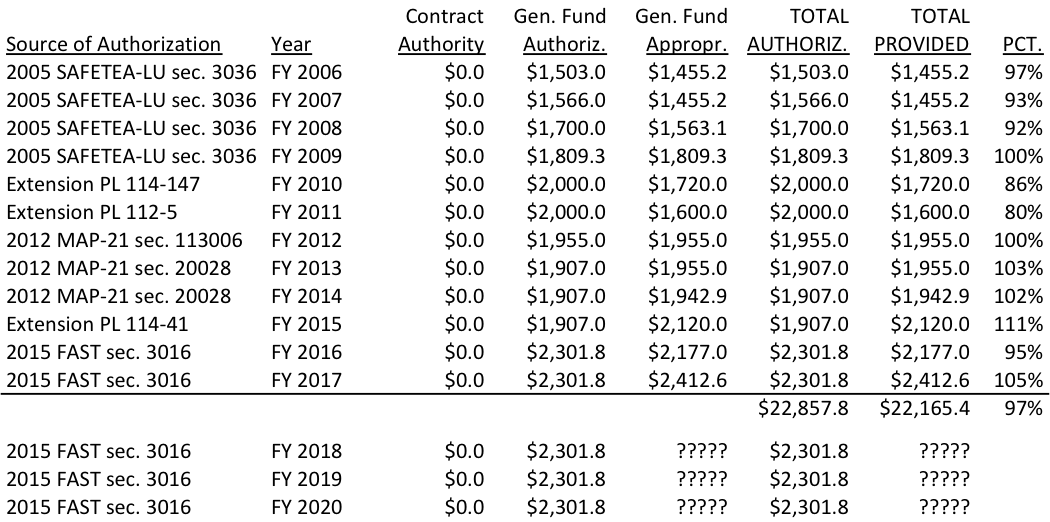

The appropriators did not quite fulfill the authorizing promises made by SAFETEA-LU but came close, providing about 95 percent of the money. The Obama Administration’s delay in focusing on SAFETEA-LU reauthorization left the program operating under short-term authorization extensions. The 2009 ARRA stimulus law (P.L. 111-5) gave an extra, unauthorized $750 million to the CIG program with priority given “to projects that are currently in construction or are able to obligate funds within 150 days of enactment…”

The takeover of the House of Representatives by the GOP stopped the growth rate of the program – the FY 2010 appropriations act, written entirely by Democrats, provided $2.000 billion for the program, but four months later, the FY 2011 appropriations measure took back $280 million of that, for a net 2010 total of $1.720 billion, and set the FY 2011 total at $1.600 billion.

The $280 million rescission was relatively painless, and the reason has to do with the contingent commitment cap. The FY 2010 appropriations act provided $200 million for the New Jersey Transit ARC tunnel under an early systems work agreement – not a full funding grant agreement – combined with $80 million in prior year appropriations. FTA’s FY 2011 CIG budget proposal, released in February 2010, said this about the ARC tunnel: “The proposed New Starts share of $3 billion would be the largest commitment for a single project in the history of the New Starts Program.”

The $3 billion total was so big, in fact, that FTA could not sign a full funding grant agreement in the last year of SAFETEA-LU or while operating under year-to-year extensions because it would have breached the contingent commitment ceiling that was then written into 49 U.S.C. §5309(g)(4). Section 171 of the FY 2010 appropriations law contained a waiver of the contingent commitment rule proposed by the Senate specifically to accommodate the ARC tunnel, but New Jersey Governor Chris Christie canceled the project in October 2010.

The 2012 MAP-21 law (P.L. 112-141) continued the process of authorizing the CIG program entirely from general fund appropriations. (That law also authorized rehabilitation of existing systems to be funded from the CIG account (called “core capacity improvements” so CIG is not exclusively “new starts” anymore.) But at the behest of the Senate Banking Committee, MAP-21 also got rid of any kind of limit on the aggregate amounts of FFGAs that the Secretary could sign (the contingent commitment authority cap that had been in law, in one form or another, since 1978).

The FAST Act of 2015 (P.L. 114-94) maintained the CIG program as a general fund discretionary appropriations program. Under MAP-21 and FAST, the dollar amount of the authorization has been less relevant (in part since the authorization levels for the last 3 years of the bill no longer serve as a ceiling on the aggregate total of FFGAs). The Appropriations Committees have exceeded the authorization level four times in the last six years.

The table does not include the $750 million in ARRA FY 2009 stimulus for the CIG program.