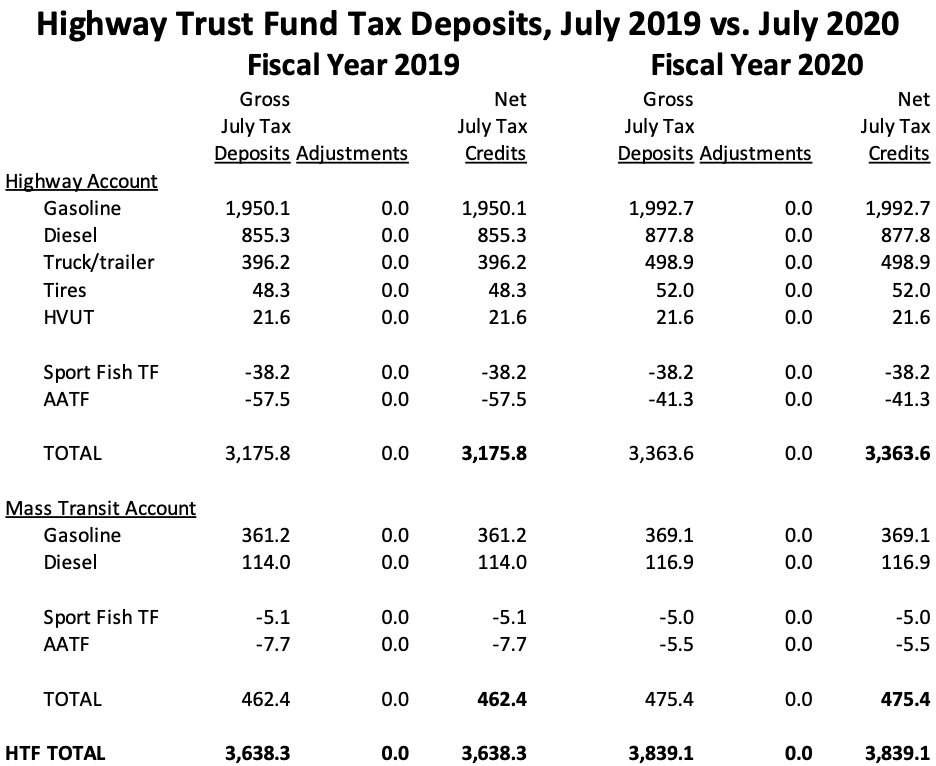

This morning, the Treasury Department published the monthly report of Highway Trust Fund tax receipts for July 2020, and those numbers show the intake from the federal excise taxes on motor fuels and trucking rebounding to slightly above normal (July 2019) levels.

July 2020 HTF net tax receipts (after transfers to other trust funds for estimated non-highway use of taxed fuel) totaled $3.84 billion, which is $201 million above the July 2019 level.

All five of the Trust Fund’s excise taxes – including the 12 percent sales tax on new heavy trucks and trailers – were up a bit from the July 2019 levels.

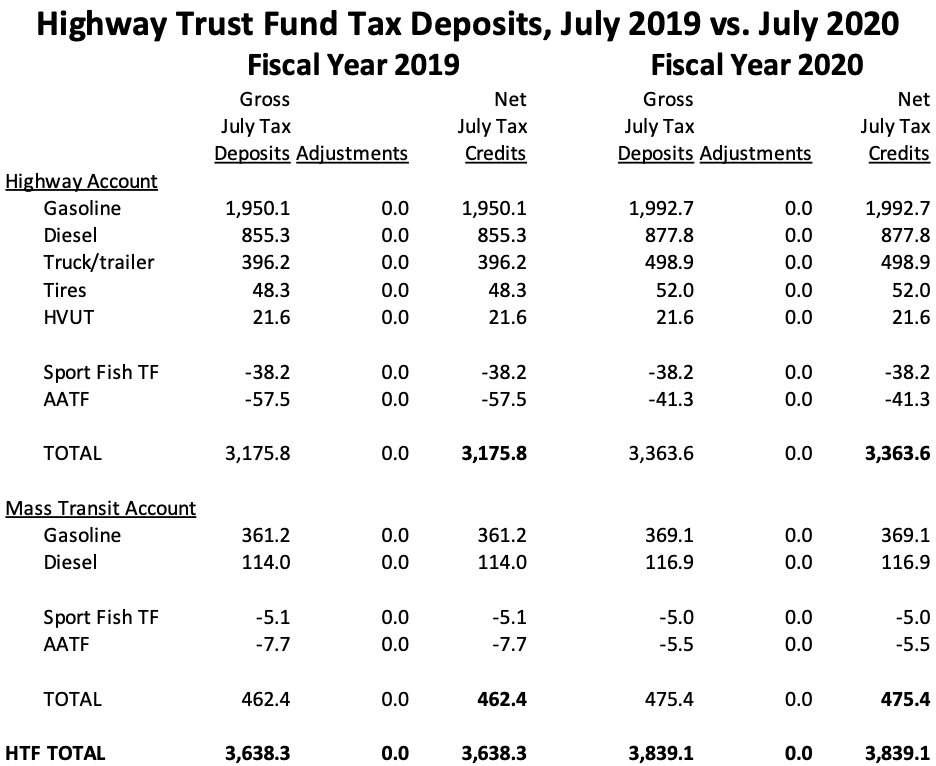

This takes time to be felt by the Trust Fund in the form of tax receipts – April tax receipts were only down 15 percent from 2019. The May receipts showed a misleadingly large drop – actual tax receipts were down 46 percent from 2019, but there was also a gigantic quarterly correction in the audited October-December 2019 quarterly tax payments, so the net hit to Trust Fund deposits was 78 percent.As ETW noted yesterday, gasoline production by refineries and blenders has rebounded – production dropped by more than 40 percent from 2019 levels in April 2020 but has since stabilized, so that for the last six weeks production is only down 10 to 12 percent from the comparable weekly 2019 levels.

The June tax collections showed a rebound but also had another large adjustment. The July numbers have no adjustment to past deposits.

For the fiscal year to date, Trust Fund net tax deposits (after transfers and after adjustments) are only down 12 percent from the first ten months of fiscal year 2019.

Net HTF Tax Credits (After Transfers, After Quarterly Adjustments) – Million Dollars

|

| Highway Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

June |

July |

FYTD |

|

FY 2019 |

690.7 |

3,715.3 |

3,207.2 |

2,895.5 |

3,117.6 |

3,429.8 |

3,048.3 |

2,851.1 |

3,211.5 |

3,175.8 |

29,342.8 |

|

FY 2020 |

773.1 |

3,946.6 |

3,249.4 |

3,378.9 |

3,184.6 |

2,807.1 |

2,633.2 |

587.9 |

1,909.2 |

3,363.6 |

25,833.5 |

|

Difference |

+82.4 |

+231.2 |

+42.2 |

+483.5 |

+67.0 |

-622.7 |

-415.1 |

-2,263.2 |

-1,302.3 |

187.8 |

-3,509.3 |

|

|

+12% |

+6% |

+1% |

+17% |

+2% |

-18% |

-14% |

-79% |

-41% |

+6% |

-12% |

| Mass Transit Account |

|

|

|

|

|

|

|

|

|

|

|

FY 2019 |

93.5 |

543.7 |

469.5 |

423.9 |

459.8 |

457.0 |

449.8 |

381.7 |

467.7 |

462.4 |

4,208.9 |

|

FY 2020 |

101.3 |

563.5 |

464.1 |

482.5 |

455.0 |

409.0 |

384.1 |

86.0 |

270.2 |

475.4 |

3,691.0 |

|

Difference |

+7.8 |

+19.8 |

-5.4 |

+58.6 |

-4.9 |

-48.0 |

-65.7 |

-295.7 |

-197.5 |

13.0 |

-518.0 |

|

|

+8% |

+4% |

-1% |

+14% |

-1% |

-10% |

-15% |

-77% |

-42% |

+3% |

-12% |