The effects of coronavirus on dedicated Highway Trust Fund revenues is pretty straightforward – stay-at-home orders and “social distancing” are reducing most people’s weekly driving habits to the bare essentials, which will soon show up in the monthly Trust Fund tax reporting for April. (Raw data at the refinery level shows gasoline production has dropped by about 40 percent from pre-COVID levels.) And in any time of business cycle uncertainty, businesses postpone capital purchases, so the receipts from the federal excise tax on the sale of new trucks and tractor-trailers should drop precipitously this month.

And we know, anecdotally, that the revenue drops are causing state DOTs to cancel or postpone a lot of contracts for the spring-summer 2020 construction season that they were about to let starting this month, which will eventually drive down Highway Trust Fund spending levels.

But has the coronavirus yet begun to drive down Highway Trust Fund cash outlays? Possibly, but it’s too early to tell.

The federal government does not actually hand out cash under the federal-aid highway program until the very end of the process. Once a state DOT has actually paid a highway contractor for work done, the state submits an electronic invoice to the Federal Highway Administration, which usually (but not always) responds with a wire transfer that day or the following day. So daily HTF outlays for the highway program closely track the work being done by construction workers out in the field.

This work is largely cyclical, and the farther north a state is, the more its highway program slows down drastically in winter and then ramps up again in summer-spring-fall. In FY 2019, HTF Highway Account outlays were around $2.7 billion per month in January, February, March and April 2019, before ramping up in May-June-July before peaking at between $5 and $5.5 billion per month in August and September.

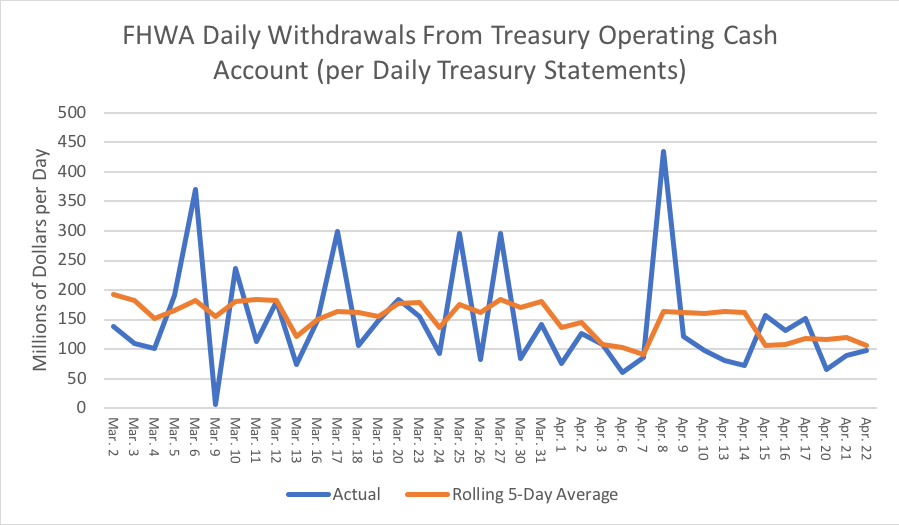

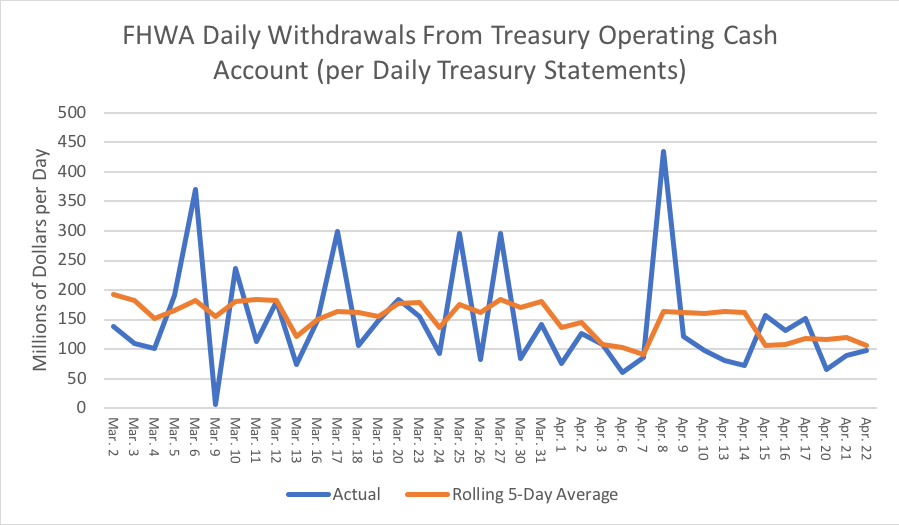

We don’t have daily outlay reporting from FHWA – not precisely. But we do have the Daily Treasury Statement, which shows daily withdrawals from the U.S. Treasury operating cash account held at the Federal Reserve Bank of New York, and those withdrawals should track very closely with actual outlays. (The Treasury Department said that it made the first $2.9 billion in disbursements to airlines of salary support grants on April 20, and the DTS for that date shows $2.804 billion withdrawn for that program from the NY Fed.)

The FHWA cash withdrawal data is lumpy – on March 9, for some reason, withdrawals dropped to near-zero (maybe the staff had a day off, or there was some kind of computer or bookkeeping suspension). And on April 8, there was a weird $435 million withdrawal, which is over $300 million more than the day before or the day after.

But by using a rolling five-day average, it seems clear that the FHWA daily cash flow is indeed down a bit. The rolling five-day average for the last six business days has been in the $106 million to $119 million per day range. The average of all the five-day averages in the month of March was $168 million per day.