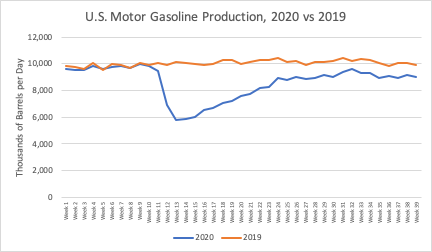

Data from the Energy Department through the end of September continue to support the hypothesis that, post-lockdowns, U.S. gasoline production has stabilized at a “new normal” level of around 10 percent below the levels from the corresponding week of 2020. Production levels for the last two weeks of September 2019 were 8.6 and 8.7 percent, respectively, below the corresponding weeks in 2019.

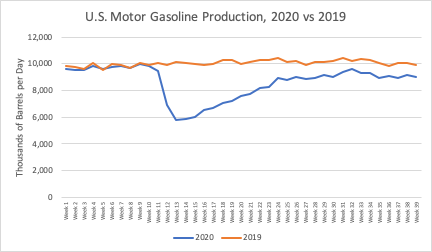

For the last 12 weeks, total gasoline production is down 9.7 percent from the 2019 comparable. Going back a month further, to the last 12 weeks, total gasoline production is only down 10.4 percent from 2019 levels. (As the chart below shows, after cutting weekly production by 43 percent at the end of March, refineries and blenders slowly let gasoline production creep back up starting in the second week of April (usually a big weekly jump followed by a smaller jump in the second week, repeated). The week ending June 26, 2020 was the first week since March that weekly gasoline production was below 2020 levels.

Weekly gasoline production totals are an attempt by the oil companies to gauge the approximate levels of demand for the product at the gas pump a couple of weeks after production. And since gasoline use is still a reasonable proxy for total vehicle-miles traveled (though getting less accurate each year), it also represents their educated guess as to a “new normal” stabilized level of vehicular movement.

But when you are looking at the excise taxes paid on gasoline at the federal and state levels, all of the federal taxes and most state taxes are paid when the fuel leaves the refinery or terminal rack, not when the motorist purchases the fuel at the pump a week or two after that. (Some states and localities levy a sales tax on gasoline, which is collected at the point of sale to the consumer.) So the number of gallons of motor gasoline produced each week should be a pretty good proxy for the final amounts of cent-per-gallon gasoline excise taxes paid into the Highway Trust Fund and state highway funds.

(“Final amounts”) is a term of art – oil producers pay estimated taxes to the federal Highway Trust Fund twice a month, and then correct those estimates for the actual amount of fuel that went out the door when they file tax returns every three months. The Treasury Department then makes upwards or downwards adjustments in Trust Fund deposits based on the quarterly returns. But the collapse in production in April was so quick, that the estimated payments may have been more off than usual, and there is apparently a mountain of unopened mail backlog at the IRS, so the producers who file on paper instead of electronically may not have had returns entered yet – it’s a mess.)

The Treasury Department normally releases the Highway Trust Fund revenue results, with adjustments, for the month of September (and for the fiscal year) around the 16th or 17th of October.