The Federal Transit Administration signed a formal grant agreement this week with the Tempe, Arizona transit agency, promising $75 million in federal funding towards a new $192 million streetcar project.

Per the FTA announcement, “The Tempe Streetcar is a three-mile streetcar with 14 stations and six vehicles that will connect downtown Tempe, Arizona State University, and the emerging employment corridor of Rio Salado Parkway, which connects existing light rail serving Phoenix, Mesa, and Phoenix Sky Harbor International Airport.”

$50 million of the funding for the Tempe project was appropriated by Congress in fiscal 2017 and the other $25 million in fiscal 2018.

This brings the total amount of FTA Capital Investment Grant (CIG) funding formally committed to new projects via a signed grant agreement under the Trump Administration to $3.5 billion, for 16 projects with a total cumulative project cost of $9.4 billion.

Critics charge that this is not enough, as Congress has appropriated $7.6 billion towards CIG projects in the three appropriations cycles (FY 2017-2019) where President Trump has signed the appropriations bills into law.

As of September 30, 2018, FTA reported that $2.5 billion in prior year CIG appropriations covering fiscal years 2015-2018 were still legally unobligated. But this brings up an important point – signing a multi-year full funding grant agreement for a CIG project is not a legal obligation of the United States Government to pay anyone any money. The legal obligations come one year at a time, when FTA negotiates the signover of each year’s tranche of funding for a multi-year project.

Of the $2.5 billion in CIG appropriations from prior years that was still legally unobligated as of September 30, $1.9 billion was for projects that already had full funding grant agreements. $744 million of that total is just for the troubled Honolulu project, which stalled partway through construction, and FTA isn’t going to obligate that money until the project gets back on track. The remaining $1.2 billion is for other new starts and core capacity projects where FTA hasn’t handed an annual installment over yet, but the FFGA has been signed and there is no reason to think they won’t.

This is why section 143 of the pending fiscal 2020 continuing resolution that the President is expected to sign this week changes the hard deadline in the 2018 and 2019 appropriations bills for “obligation” of much of the FY18 and FY19 appropriations to “allocation” – a formal (but easily reversible) process within FTA assigning appropriated money to a particular project.

With regards to allocating funding to individual projects, FTA has recently updated its tables, and here is how that $7.6 billion in total CIG appropriations over the Trump era currently stands (in millions of dollars):

|

New |

Core |

Small |

Proj. Dev. |

|

|

Starts |

Capacity |

Starts |

Pilot |

TOTAL |

| FY17 Appropriated |

1,744.8 |

332.9 |

407.8 |

20.0 |

2,505.5 |

| FY17 Allocated to Date |

1,744.8 |

332.9 |

407.8 |

20.0 |

2,505.5 |

| FY17 Unallocated |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

|

|

|

|

|

| FY18 Appropriated |

1,506.9 |

715.7 |

400.9 |

0.0 |

2,623.5 |

| FY18 Allocated to Date |

1,506.9 |

702.0 |

373.9 |

0.0 |

2,582.8 |

| FY18 Unallocated |

0.0 |

13.7 |

27.0 |

0.0 |

40.7 |

|

|

|

|

|

|

| FY19 Appropriated |

1,370.7 |

530.0 |

526.5 |

100.0 |

2,527.2 |

| FY19 Allocated to Date |

1,235.7 |

0.0 |

0.0 |

100.0 |

1,335.7 |

| FY19 Unallocated |

135.0 |

530.0 |

526.5 |

0.0 |

1,191.5 |

|

|

|

|

|

|

| Total FY17-19 Unallocated |

135.0 |

543.7 |

553.5 |

0.0 |

1,232.3 |

So $1.2 billion has not yet been allocated by FTA. In addition, another $1.26 billion has been allocated by FTA to projects that have not yet had full funding grant agreements signed. This gives us an opportunity to review the status of the CIG program, by type of project, below.

New Starts. The Administration has not signed a multi-year new start project agreement since the Seattle Lynnwood Link in December 2018 (an eventual $1.2 billion federal CIG commitment towards a $3.3 billion project).

In addition, FTA has internally allocated an additional $415 million towards four new starts in the “pipeline, ” three of which are now listed on the FTA website under “Anticipated Funding Agreements for Execution.” (The fourth of these, Minneapolis Blue Line extension, had money allocated by Congress in FY16 and FY17 but has hit some delays.) This includes the final phase of the Los Angeles Purple Line Westside expansion, which feels like its grant agreement has been “just around the corner” for at least a year.

|

|

Eventual |

Allocated |

|

|

CIG Share |

to Date |

| New Starts |

|

|

|

AZ Phoenix Valley Metro South LRT |

530.0 |

100.0 |

|

CA Los Angeles Westside Purple Line Sec. 3 |

1,300.0 |

200.0 |

|

MN Minneapolis Southwest LRT |

928.8 |

15.0 |

|

WA Seattle Federal Way Light Rail |

790.0 |

100.0 |

|

Allocated, but Unsigned |

3,548.8 |

415.0 |

Core Capacity. The fiscal 2018 appropriations act set aside $715.7 million in appropriations for CIG core capacity improvement projects. The thinking at the time seemed to be that the two ongoing projects with signed grant agreements (Caltrain electrification and Chicago Red/Blue lines modernization) would receive their scheduled FY18 tranche payments of $100 million each, leaving $515.7 million to go towards other projects. (Rep. Rodney Frelinghuysen (R-NJ), who was chairman of the House Appropriations Committee at the time, doubtless hoped that some of that money would go towards Portal North Bridge replacement, part of the Gateway program of NY-NJ rail projects.)

Instead, FTA got clever. They accelerated the Caltrain and Chicago projects by doubling their annual tranche payments out of the FY18 appropriation to $200 million each, and then committed an astounding $300 million to the San Francisco BART Transbay Corridor project (a long, long way from New Jersey). After giving the final $2 million to the Dallas project (signed May 28, 2019 but almost all of the money had been appropriated a while back), this leaves just $13.7 million of the FY 2018 core capacity appropriation still unallocated.

As of this writing, the Administration had not allocated any of the $530 million in FY 2019 core capacity appropriations, but if Caltrain and Chicago each get their scheduled $100 million annual tranche, that would leave just $174 million for Caltrain and $466 million for Chicago left for Congress to appropriate in 2020 and future years, along with $330 million that could be allocated to Transbay Corridor or Portal North. (A recent FTA update to Congress does not list any other core capacity projects in the “pipeline.”)

The current status of the core capacity program, with the acknowledgement that the Administration has not yet allocated any FY 2019 core capacity appropriations, is shown in the chart below.

| Status of the FTA’s Capital Investment Grant Program’s “Core Capacity” Category as of Sept. 24, 2019 |

|

|

|

Federal CIG Appropriations |

Total Needed |

|

|

|

Allocated |

Needed in |

Fed. CIG |

|

|

|

to Date |

Future Years |

Contribution |

|

Projects With FFGAs Signed |

|

|

|

|

|

CA Caltrain Peninsula Electrification (5/23/2017) |

$373.0 |

$274.0 |

$647.0 |

|

|

IL Chicago Red/Purple Modern., Phase 1 (1/9/2017) |

$491.1 |

$465.5 |

$956.6 |

|

|

TX Dallas DART Red/Blue Platform Extens. (5/28/2019) |

$60.8 |

$0.0 |

$60.8 |

|

|

Subtotal, Core Capacity w/ Signed FFGAs |

$924.9 |

$739.5 |

$1,664.4 |

|

|

|

|

|

|

|

Projects With Funding Allocated by FTA but Without Signed FFGAs |

|

|

|

|

CA San Francisco BART Transbay Corridor |

$300.0 |

$869.0 |

$1,169.0 |

|

|

NY Canarsie Line Power Improvements |

$100.0 |

$0.0 |

$100.0 |

|

|

Subtotal, Core Capacity, Allocated but Unsigned |

$400.0 |

$869.0 |

$1,269.0 |

|

|

|

|

|

|

|

Other Core Capacity in Project Development Phase |

|

|

|

|

|

NJ Portal North Bridge |

$0.0 |

$772.0 |

$811.1 |

|

|

|

|

|

|

| TOTAL, CORE CAPACITY PROGRAM |

$1,324.9 |

$2,380.5 |

$3,744.5 |

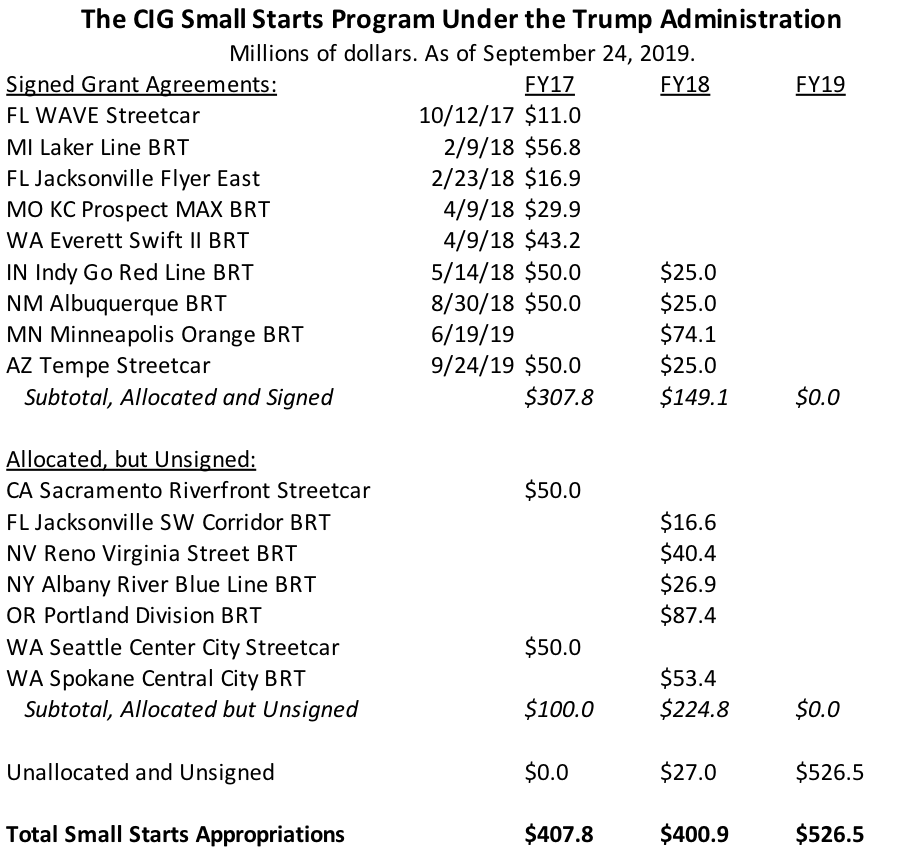

Small Starts. The Trump Administration has executed nine agreements for one-off “small start” CIG projects. They have made internal funding allocations for seven more projects which now have a reasonable expectation of federal funding at some future date. This leaves $27 million in FY 2018 small start appropriations, and the entirety of the $526.5 million FY 2019 small start appropriation, unaccounted for. There are at last 29 other projects that have been approved for entry into the small starts “project development” phase that want access to some of that $554 million.

Expedited Project Delivery Pilot Program. Section 3005(b) of the FAST Act authorized a pilot program to fund up to eight CIG-eligible projects which have to be supported through a public-private partnership, be operated and maintained by employees of an existing public transportation provider, and have a federal share not exceeding 25 percent of the project capital cost. Participants in the program get expedited review and evaluation of their applications.

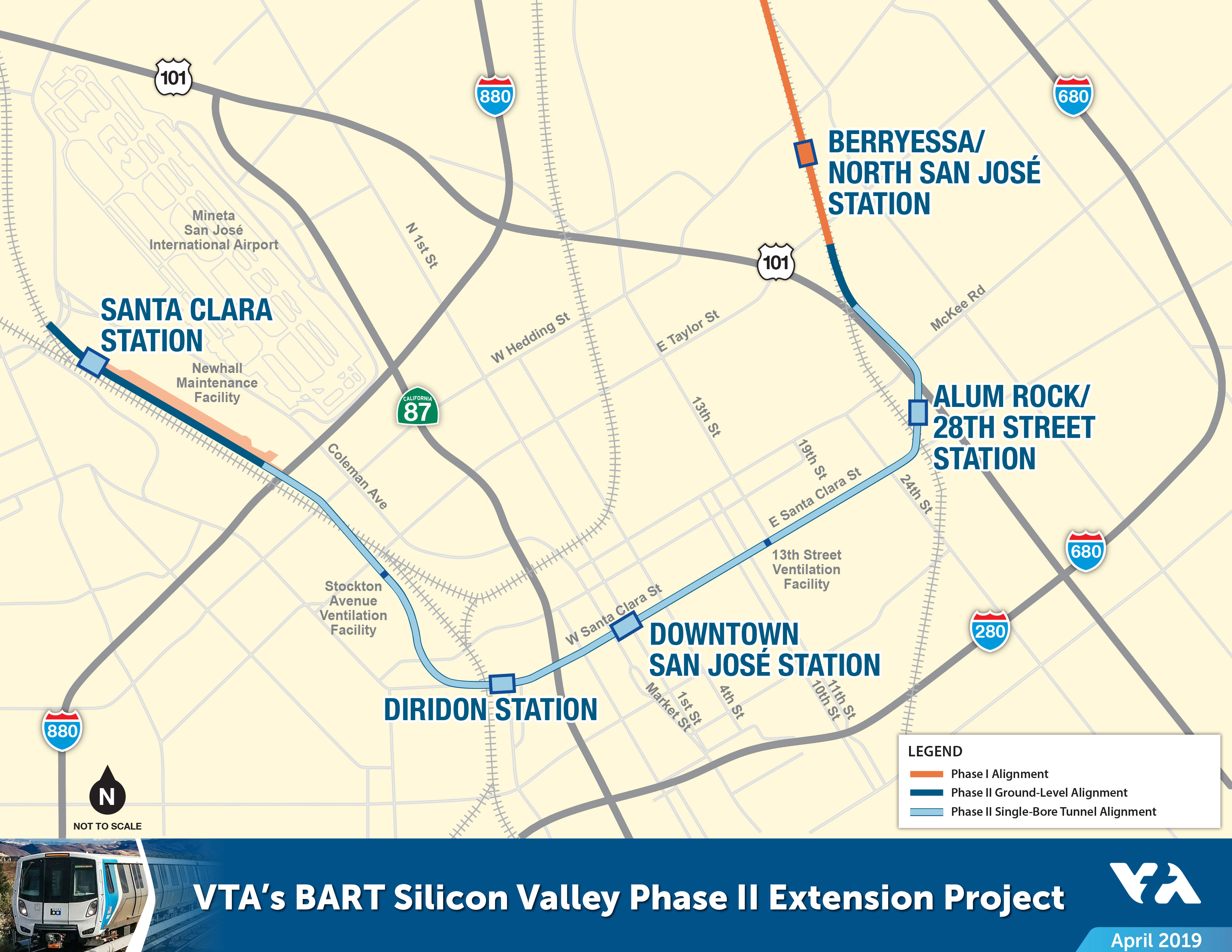

Congress appropriated $5 million in FY 2016, $10 million in FY 2017, and $100 million in FY 2019 towards this program. Late last month, FTA announced that it was allocating the entire $125 million to the Santa Clara Valley Transportation Authority for the 6.5-mile extension of the BART system from the Berryessa/North San Jose station (scheduled to open later this year) southwards to a new 28th Street station, then making a hard right turn to run southwest through downtown San Jose, then making another hard right turn to run northwest to Santa Clara. (Also known as BART Silicon Valley Phase II Extension Project.)

The eventual total cost to the CIG program of Phase II would be $1.395 billion, with $125 million already on-hand and allocated and an additional $1.27 billion to be appropriated by Congress in FY 2020 and future years. (Overall project capital costs are said to be $5.8 billion, which would put the CIG share right at 25 percent.) By volunteering for the project, VTA/BART have jumped to the head of the funding allocation list for projects in the new starts “pipeline” that include Portland Tri-Met Southwest Corridor and the two NYC-area megaprojects, the Hudson Avenue Tunnel and the Second Avenue Subway Phase 2. VTA’s website says they expect a full funding grant agreement to be signed in winter 2021.

(It also helps that this project got the highest rating of any proposed multi-year project in FTA’s internal evaluation process – financial rating “high,” project justification rating “medium-high,” averaging to an overall rating of “high.” None of the other projects in the pipeline have an overall rating better than “medium-high.”)