The House will vote today on two bills which combine 12 appropriations bills, several tax bills and a host of other provisions with a cumulative fiscal impact of around $3 trillion.

The legislation. The first package (“Consolidated Appropriations Act, 2020”) contains 4 of the 12 annual appropriations bills, (Defense, Homeland Security, Commerce-Justice-Science, and Financial Services). The second package (“Further Consolidated Appropriations Act, 2020”) contains the other 8 spending bills (Agriculture, Energy and Water, Interior-Environment, Labor-HHS-Education, Legislative Branch, Military Construction/VA, State/Foreign Operations, and Transportation-HUD) as well as a a wide variety of “other matters” including expensive health care extenders and repeal of Obamacare taxes (especially permanent repeal of the so-called “Cadillac tax” which by itself reduces projected tax revenues by $201 billion over 10 years). The joint explanatory statements for the various divisions of the first package can be read here and those for the second package can be viewed here.

As ETW predicted last week, the House will pick up two unrelated House bills that have been amended and passed by the Senate and use those as the “legislative vehicles” for the two fiscal packages, because House amendments to Senate amendments to House bills are privileged in the Senate and can be taken up more quickly there than can original House-passed bills. (Time is of the essence since current appropriations expire at midnight on December 20.) Package 1 is using H.R. 1158 (the “DHS Cyber Hunt and Incident Response Teams Act”) and Package 2 is using H.R. 1865 (“National Law Enforcement Museum Commemorative Coin Act”).

The process. Under a special rule adopted by the House Rules Committee just after midnight this morning, once the House convenes at 9 a.m. today it will first consider the Senate amendment to H.R. 1158 and a motion to add Package 1, with just one hour of debate and no amendments. Then, the House will consider the Senate amendment to H.R. 1865 and a motion to add Package 2 and a new amendment adding a new Division Q to Package 2 that extends a host of expired or expiring tax benefits, which will also receive just one hour of debate. Then both packages go to the Senate, where the Majority Leader will try to work out agreements to bring both packages up for votes by Friday.

Transportation tax extenders. The tax extenders package includes section 112, retroactively extending the railroad maintenance tax credit for short line railroads in section 45G of the tax code, which expired January 1, 2018, to January 1, 2023. The amendment extends the biodiesel tax credit in section 40A of the tax code and several other alternative fuels credits from their expiration on December 31, 2017 through December 31, 2020. And section 302 of the amendment repeals the provision of the 2017 tax law that treats employer-provided parking and transit benefits provided by tax-exempt entities as unrelated business taxable income (the so-called “church parking lot tax“), retroactive to the enactment of the 2017 law.

The cost. In all, the cost of the two packages together (per the Congressional Budget Office’s new cost estimates for bill 1 and bill 2) is now approaching $3 trillion – $1.4 trillion in discretionary appropriations for 2020, an additional $1.1 trillion in mandatory appropriations for 2020 that no one ever talks about, and $391 million in 10-year costs of all of the other stuff in the second bill. Tax extenders as a self-executed amendment will add another $54 billion per JCT. Excluding emergency appropriations, here is the total fiscal impact so far, in billions of dollars:

|

|

Package 1 |

Package 2 |

Total |

|

|

|

|

|

| FY20 Discretionary Appropriations |

|

|

|

|

Base Defense |

630.6 |

35.9 |

666.5 |

|

Base Non-Defense |

137.0 |

484.5 |

621.5 |

|

Overseas Contingency Operations |

70.9 |

8.6 |

79.5 |

|

Other Discretionary |

20.0 |

4.7 |

24.7 |

|

Subtotal, Discretionary |

858.5 |

533.7 |

1,392.2 |

|

|

|

|

|

| FY20 Mandatory Appropriations |

24.8 |

1,051.0 |

1,075.8 |

|

|

|

|

|

| 10-Year Increases in Direct Mandatory Spending |

0.0 |

22.5 |

22.5 |

|

|

|

|

|

| 10-Year Decreases in Tax Revenues (Base Bill) |

0.0 |

368.2 |

368.2 |

|

|

|

|

|

| 10-Year Decreases in Tax Revenues (Extenders Add-on) |

0.0 |

53.8 |

53.8 |

|

|

|

|

|

| Total Fiscal Impact |

883.3 |

2,029.2 |

2,912.5 |

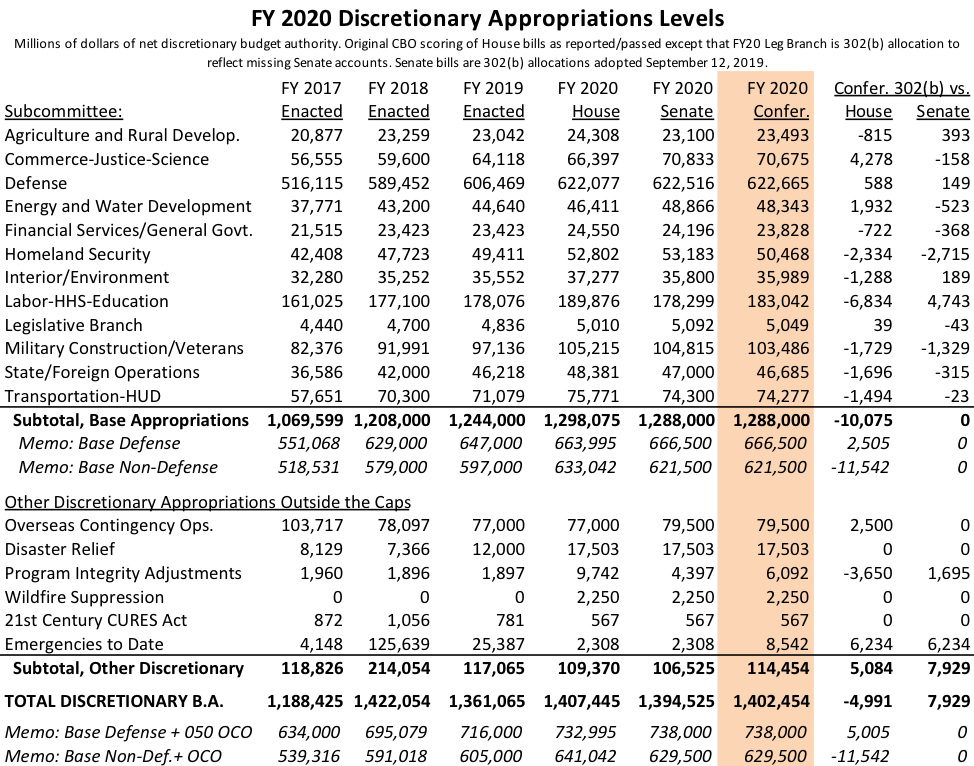

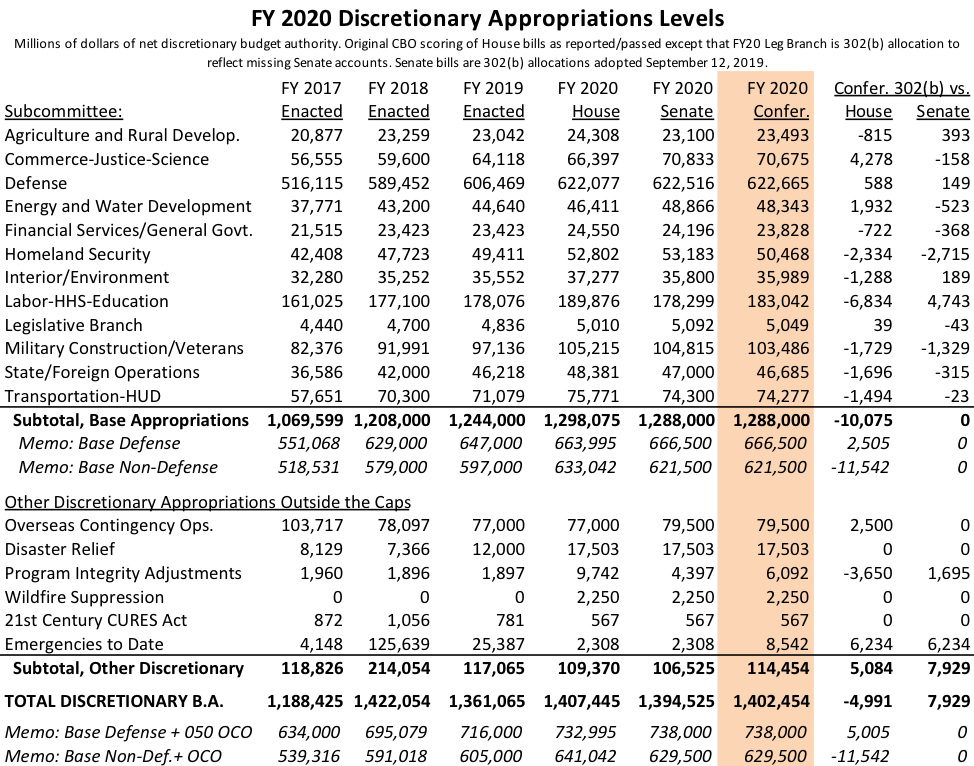

Final totals for the 12 appropriations bills. Just in terms of discretionary appropriations, when you add in re-estimates of 2020 emergency appropriations already enacted, here is how the Congressional Budget Office scores of the final twelve appropriations bills line up to the versions of the bill originated by the House and Senate, and to the three prior years:

As you can see, the House-passed bills (drafted before there was a bipartisan agreement on overall spending totals had to be reduced by a collective $10 billion to hit budget caps – non-defense spending had to come down $11.5 billion and defense had to come up $2.5 billion. And the House’s Commerce-Justice-Science had to count an additional $4.2 billion under the non-defense cap because the amount of one-time spending for the 2020 Census outside the non-defense cap was reduced from the House’s $7.5 billion down to $2.5 billion. Most of the non-defense reduction from the House-passed levels came out of the Labor-HHS-Education bill. But both chambers were able to reduce the cost of their Homeland Security bills because the final resolution of the U.S.-Mexico border wall was not to increase the explicit appropriation for it from last year’s levels but instead to once again let the President transfer money from elsewhere in the budget.

The rest of the week. The House hopes to wrap up its final week of session in 2019 in the following manner:

- Tuesday – appropriations and tax bills.

- Wednesday – impeaching the President.

- Thursday – U.S.-Mexico-Canada trade agreement.

- Friday – wait to make sure that the Senate can deal with its share of the workload.

Over the next 36 or so hours we will be adding content summarizing this massive legislation. If a link below is blue, click on it to go to the appropriate article. Keep checking back.

Reminder: every budget, bill, report, document, or other analysis relating to the FY 2020 federal transportation budget can be found at enotrans.org/fy20