The Federal Highway Administration told Congress this week that $3.5 billion in federal-aid highway contract authority balances held by states may have to be written off because they could be the result of a pre-2005 accounting error. However, any such writedown should not affect the total amount of federal highway money that the states can actually obligate and spend.

A tale of two systems

The problem is that two different computer systems used by the Department of Transportation are showing two very different numbers. One is FMIS (Fiscal Management Information System, pronounced FEE-miss), used by the Federal Highway Administration to track and manage highway apportionments, programs, and projects. The other is Delphi, the accounting system used by the entire Department of Transportation to record financial information that is then transmitted to the Treasury Department and the Office of Management and Budget (OMB) as part of official federal budget execution record-keeping.

FMIS and Delphi have different purposes and track some of the same things but also track different things.

| FMIS |

Delphi |

| Program/project management system |

Accounting system |

| FHWA-only |

DOT-wide |

| Does not interface with OMB/Treasury |

Provides budget data to OMB/Treasury |

| Not subject to annual financial audit |

Subject to annual financial audit |

| Designed to supervise individual programs and projects (NHS, CMAQ, STBGP, HSIP) |

Designed to record by budget account (“Federal-aid Highways”) |

| Tracks funding state by state |

Does not know state-by-state totals |

| Tracks funding by highway program |

Does not know program-by-program totals |

| Tracks funding by individual project |

Does not know individual projects |

| New contract authority is hand-entered |

New contract authority is hand-entered |

| Records obligations of contract authority |

Obligations automatically updated by FMIS |

| Records outlays of cash |

Outlays automatically updated by FMIS |

| Does not record liquidating appropriations |

Records liquidating appropriations and associates them with outlays |

| Expiration of contract authority is hand-entered |

Expiration of contract authority is hand-entered |

| Rescissions of contract authority are hand-entered |

Rescissions of contract authority are hand-entered |

While preparing for the scheduled $7.6 billion July 2020 highway rescission that was part of the FAST Act, FHWA discovered in summer 2019 2018 that the total amount of unobligated highway contract authority apportionments held by state and local governments shown in FMIS was $3.7 billion higher than the total shown in Delphi. But since the scheduled 2020 rescission was repealed, and since states were, collectively, rolling over close to $20 billion per year in unobligated balances back then and still getting and obligating over $40 billion per year in new money, the $3.7 billion discrepancy didn’t have to be addressed immediately. FHWA hired an accounting firm to go back and find the problem, and they found about $200 million of errors, reducing the discrepancy to $3.5 billion.

When the bipartisan infrastructure law (the IIJA) was enacted in November 2021, it did not contain any provisions requiring its funding to be accounted for separately from the rest of the budget (like the 2009 ARRA stimulus law had included). Nevertheless, OMB ordered that IIJA money be recorded separately in the budget and in the accounting systems that feed the budget (like Delphi). So, for the first time, Delphi now tracks contract authority provided by prior highway authorization laws separately from contract authority provided by the new authorization law.

This meant that, at the close of business on September 30, 2022, Delphi showed pre-IIJA contract authority balances held by state and locals to be $1.2 billion while FMIS showed $4.7 billion. This meant that, theoretically, states could, through FMIS, obligate a Delphi line-item below zero, which would set off all kinds of government-wide alarms. Accordingly, on October 1, 2022, FHWA held back the $4.7 billion in pre-IIJA contract authority from states, freezing the money in FMIS so states can’t obligate it.

This is a temporary solution, because most formula contract authority lapses (expires in a puff of smoke) after x number of years, usually four. At the end of this fiscal year on September 30, some of this $4.7 billion in pre-IIJA contract authority, even if it really exists, will lapse.

Accordingly, FHWA told Congressional committees this week that they are taking the following steps:

- DOT and FHWA will review all the individual transactions from the 2004-2005 period, when the Delphi system was being installed to replace a much older accounting system.

- While the review is ongoing, FHWA will work with states to allow them to obligate any pre-IIJA contract authority that is about to lapse if they de-obligate IIJA money on a dollar-for-dollar basis, preserving the old money from lapse, but would also make sure that the unobligated total never drops below zero in Delphi.

Once the audit in step #1 is complete, the results of the review will reveal possible options. To the extent that the review finds conclusive proof of any errors on the Delphi side, then Delphi balances can be adjusted upwards, reducing the size of the problem. But if a significant discrepancy between FMIS and Delphi remains, the fact that Delphi is the accounting system of record, which passes audit every year and which informs all of Treasury’s public reporting, comes into play. If a final decision has to be made administratively between the number in FMIS and the number in Delphi, then Delphi is going to win. DOT would then either have to ask Congress for a legislative fix or else have to write down unobligated contract authority that exists in FMIS but not in Delphi.

What happens in the event of a writedown?

Functionally, if FHWA writes down contract authority balances in FMIS, that will be the same thing (from a state point of view) as if Congress has passed a law rescinding that money. It will be taken off the state books.

We don’t know how the $3.5 billion overage is distributed between states. But Congress was told that the $3.5 billion is concentrated in the CMAQ program, the Transportation Alternatives program, and in the Surface Transportation Block Grant funding that gets sub-allocated to local governments by population. So a writedown would disproportionately affect those programs.

But it shouldn’t affect the actual net total amount of funding that a state can spend in a year, because the contract authority is in excess of the annual obligation limitation. For example, California was apportioned $4.904 billion in new formula contract authority for fiscal 2023 (subject to limitation) by the IIJA. But California’s share of the formula obligation limitation for fiscal 2023 was only $4.170 billion, meaning that $734 million of its new formula money, plus whatever pre-FY2022 unobligated balance they rolled over, is in excess of limitation and can’t be obligated for most of the year. (They may get most of that back in the August redistribution for final September Splurge of contract-signing.)

Backgrounder: The obligation limitation is a section in each year’s DOT Appropriations Act which says, in essence, “No contract authority in excess of $xx,xxx,xxx,xxx shall be obligated in fiscal year ____.” From the 1970s to 2011, new annual contract authority was far in excess of annual obligation limitations, leaving large carryover balances that either lapsed or were rescinded.

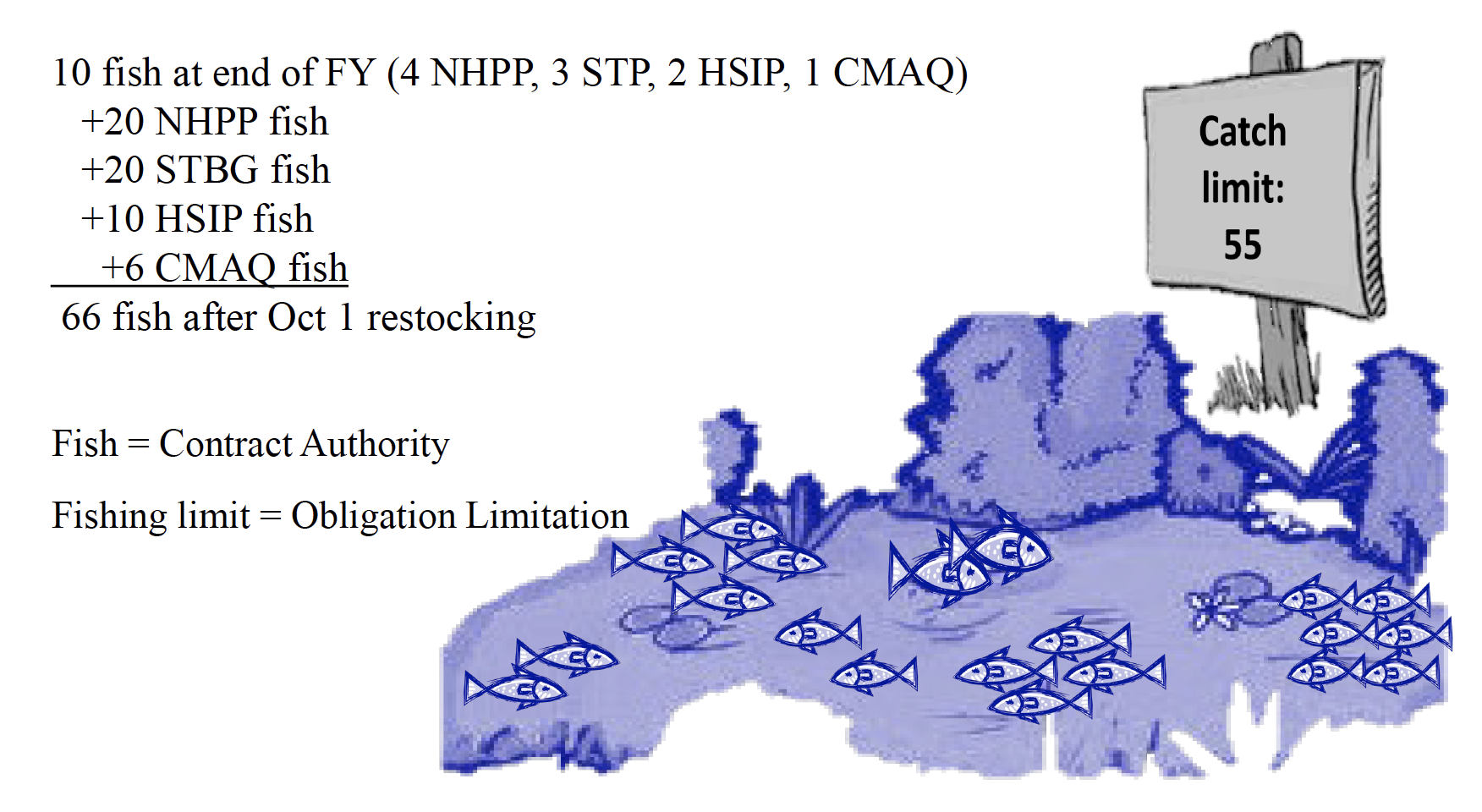

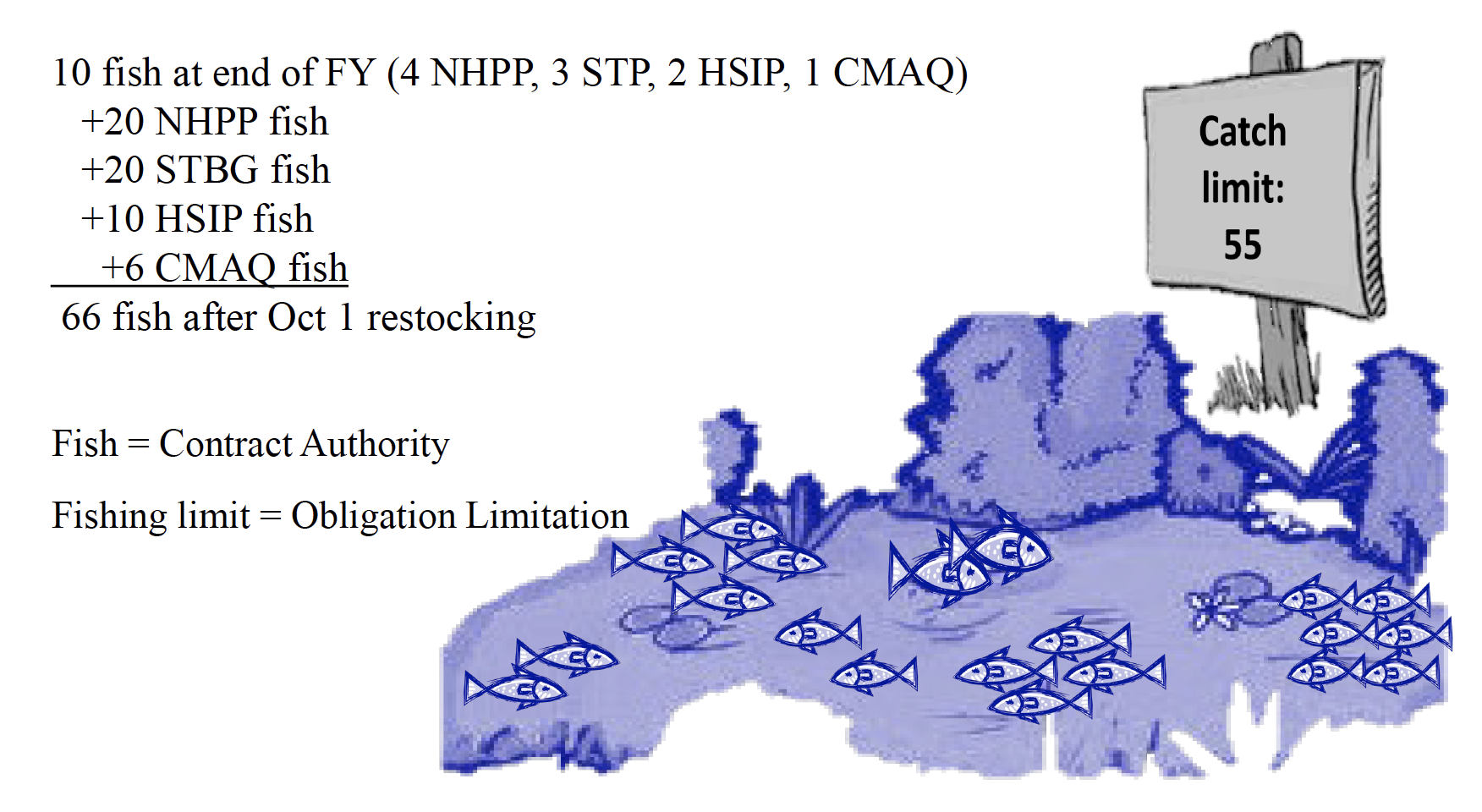

Back when NASCAR was popular, I used to describe the “ob limit” as a restrictor plate on an engine – it doesn’t decrease the size of the engine, or the amount of fuel in the tank, but it slows the rate at which the engine can burn the fuel. But FHWA uses a fishing analogy, complete with a graphic from their 2019 presentation to the Hill that is so adorable that I feel obligated to reproduce it here:

The bottom line: losing contract authority that was in excess of your obligation limitation doesn’t reduce the net total amount of money you can spend. But if the contract authority that you lose comes disproportionately from certain programs, it may restrict your ability to fund new projects in those particular programs. (Counterpoint: if CMAQ and TA were easy for everyone to spend in the first place, they wouldn’t be a disproportionate share of leftover balances.)

What should be done to prevent this from happening in the future?

There are many sets of eyes (human and electronic) on actual cash going out of the Treasury (outlays) and coming into the Treasury (receipts), and budget errors there are few and far between. But when items are recorded in the budget that don’t have a direct effect on the cash going in and out of the Treasury, there are far fewer eyes on the numbers, and this is where errors often creep in.

Under the post-1976 budget system, contract authority in excess of the annual obligation limitation is completely divorced from the dollars that go out the door of the Treasury in the form of outlays. In theory, Congress could create $1 trillion of new contract authority, but if that contract authority was subject to an annual obligation limitation, and that limitation stayed at the current $59 billion per year, that extra $1 trillion of contract authority would not increase federal outlays at all. Similarly, Congress could pass a law rescinding that $1 trillion and it wouldn’t reduce federal outlays at all so long as the obligation limitation stayed the same.

Since misstatements of excess contract authority balances can have no effect on the budget bottom line (outlays), there apparently aren’t any automatic alarms that go off when those amounts are systemically misstated. One preliminary conclusion that was obvious from the 2019 briefing on this topic that DOT gave to Congress was that there needs to be better coordination between the two computer systems on entering and removing contract authority from each system.

Beyond that, this situation is the kind of thing that the Government Accountability Office (GAO) was created just over 100 years ago to look at.