The Federal Highway Administration has notified Capitol Hill that the Highway Account of the Highway Trust Fund probably won’t need an additional bailout transfer from general revenues until sometime in summer 2022 at current spending rates and estimated tax receipt levels. This comes on the heel of end-of-fiscal-year financial reports earlier this week that showed better-than-expected Trust Fund balances retroactive to the end of fiscal 2021 on September 30.

The pending bipartisan infrastructure bill would render all this moot because it contains a $90 billion bailout for the Highway Account and a $28 billion bailout for the Mass Transit Account, good to keep both accounts solvent at higher spending levels until sometime in 2026. But, as the BIB continues to be held up in the House, the new numbers show that short-term extensions of the FAST Act won’t require a bailout anytime soon.

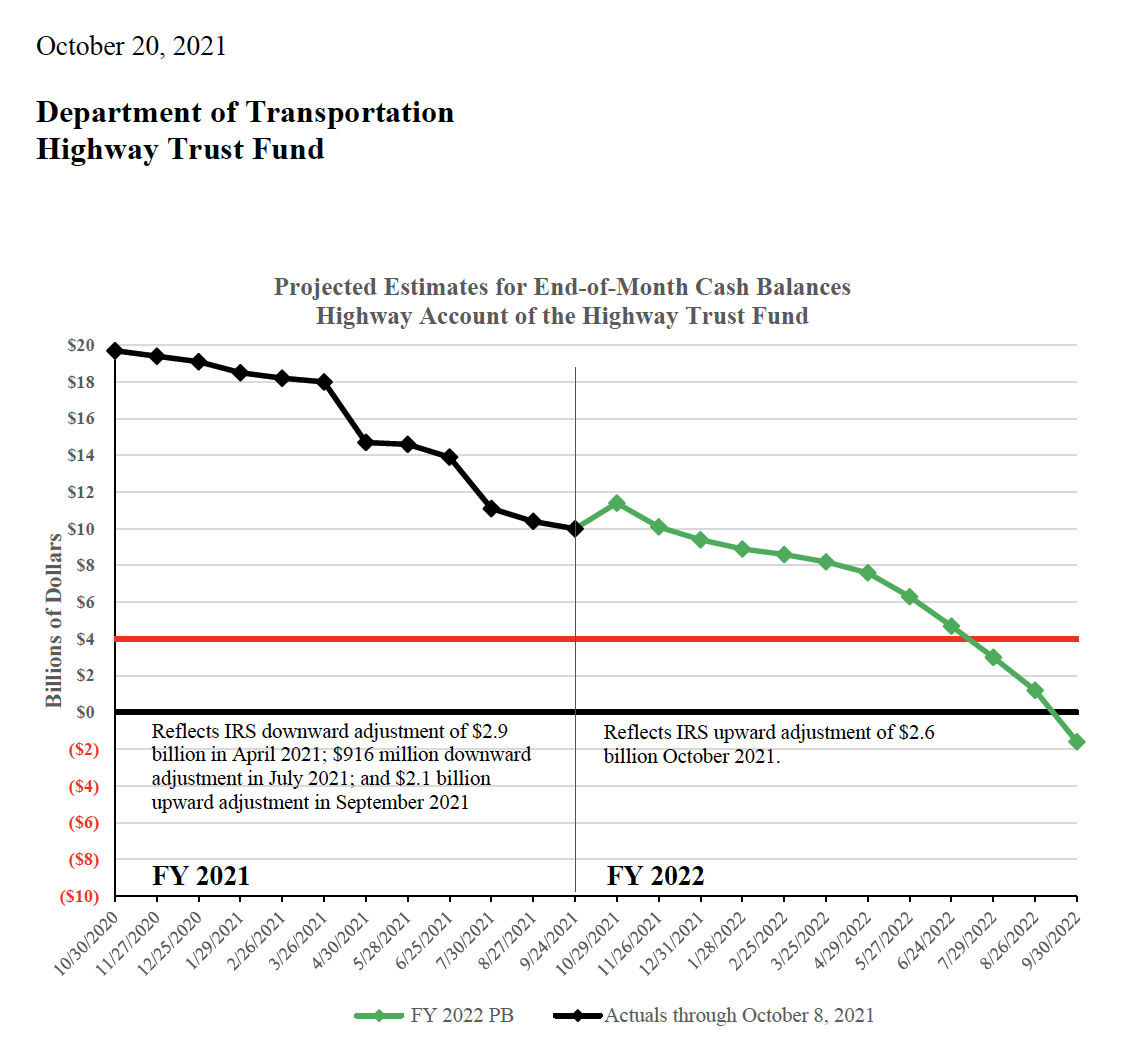

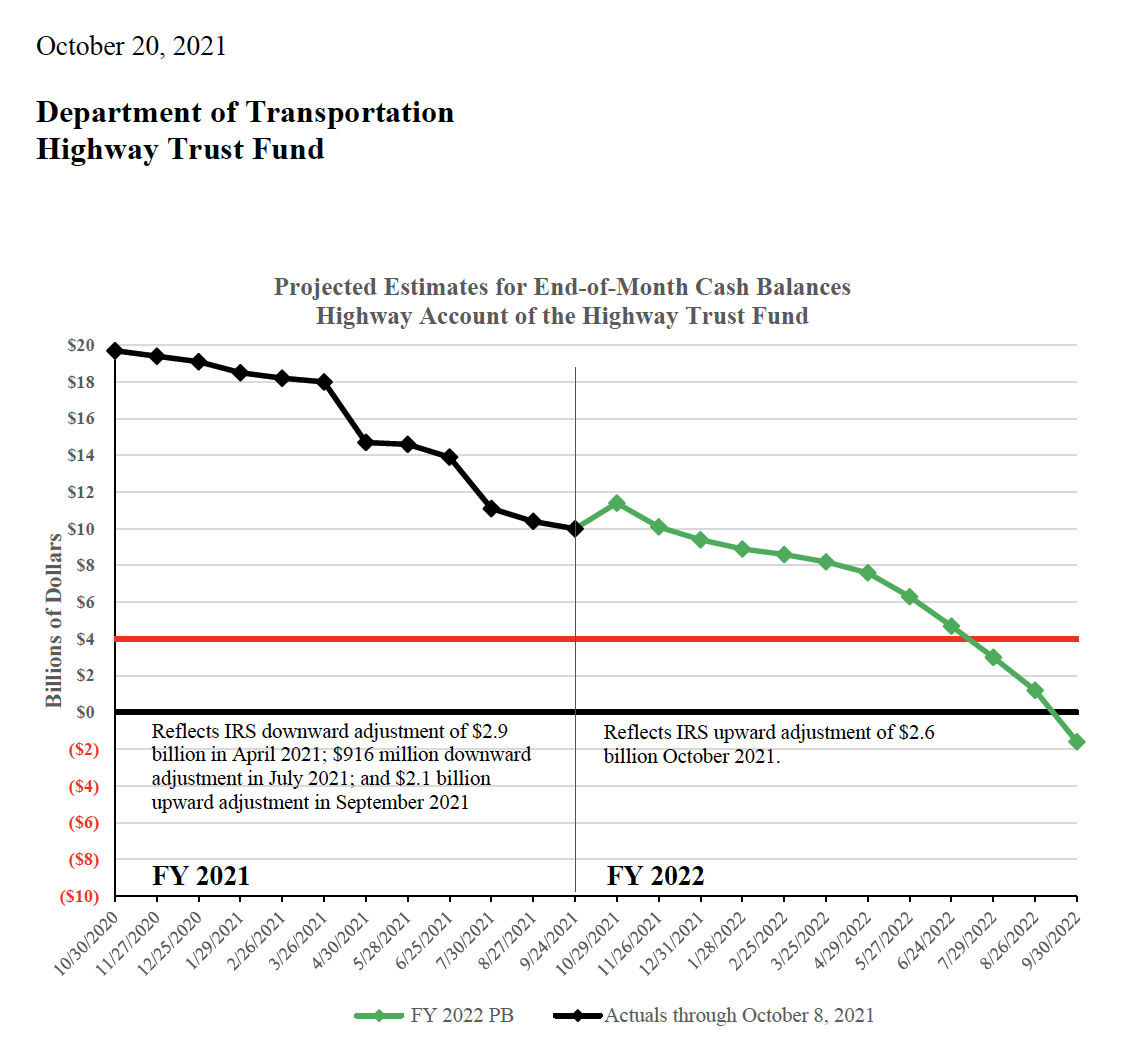

The Highway Account ended FY 2021 with $14.3 billion in balances, and FHWA now projects that the Trust Fund will get to December 31, 2021 with $9.4 billion. At that point, the construction slowdown in cold-weather states takes effect, and highway tax receipts usually equal or exceed outlays from the Account for the January-March period, before construction restarts in the spring.

The FHWA update, shown above, projects that the Highway Account would spend down to around $4 billion in June or July 2021, and at that point, FHWA would have to start artificially slowing reimbursements to states on a day-to-day basis so they don’t run out of cash waiting for the twice-monthly estimated excise tax payments to be deposited.

The FHWA chart mentions that the September 2021 totals were helped by a $2.1 billion upwards adjustment of the preliminary excise tax payments from the January-March 2021 quarter (a “true-up” adjustment based on the actual quarterly tax returns). And FHWA notified its division offices earlier today that the IRS has completed another “true-up” adjustment of $2.6 billion for the April-June 2021 quarter, which will be included in the October receipts. Between those two adjustments, that’s an extra $4.7 billion for the Highway Account in two months in addition to estimated ongoing tax payments.

It is possible that future quarterly tax reconciliations may “true-down” instead of “true-up” receipt levels, as happened in April 2021 and July 2021, which would hasten the date the next bailout would be needed. (COVID has done weird things to IRS tax processing.)

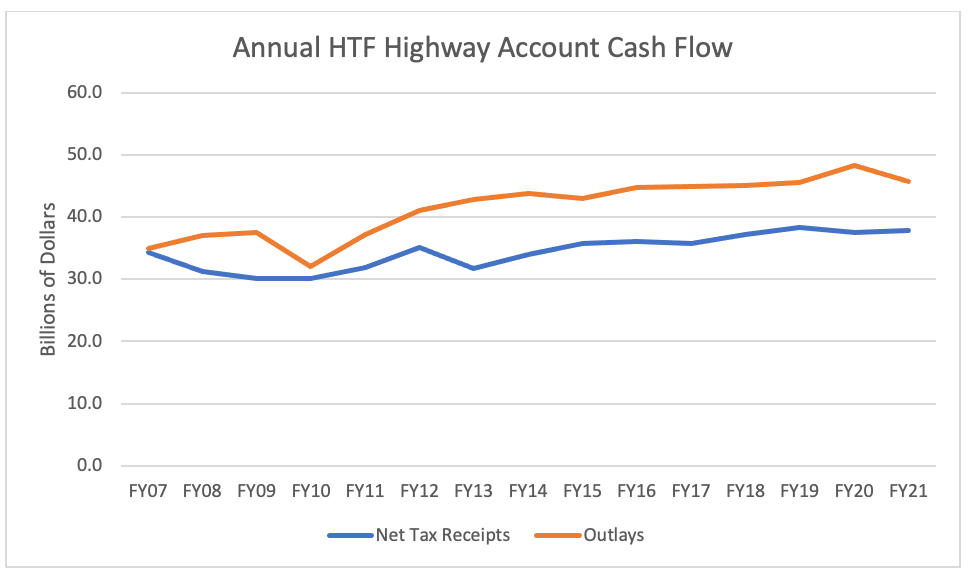

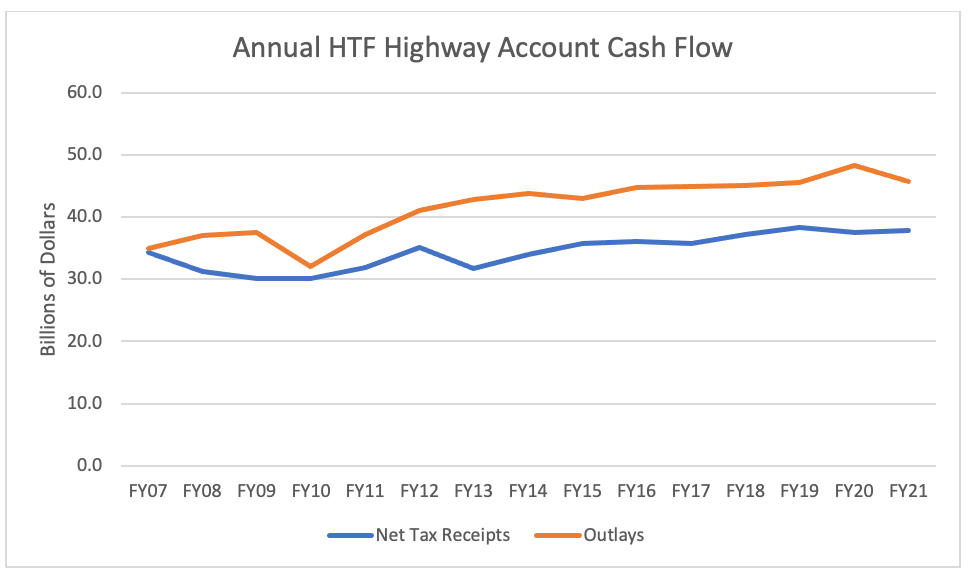

While adjusted tax receipts held steady, Trust Fund spending dropped slightly in 2021. First, let’s look at the Highway Account, where outlays totaled $45.7 billion in 2021, $2.5 billion (or 5.3 percent) below FY 2020 outlays. Part of this may be due to the usual end-of-authorization-period malaise that faces state DOTs, unsure what their annual federal highway funding levels are going to be for the next five years. In addition, many states and localities took advantage of the COVID lockdowns to actually accelerate construction rates in spring and summer 2020 to take advantage of reduced traffic, which may also have affected the outlays.

The following chart shows Highway Account tax receipts compared to outlays going back to fiscal 2007, the last full pre-insolvency year.

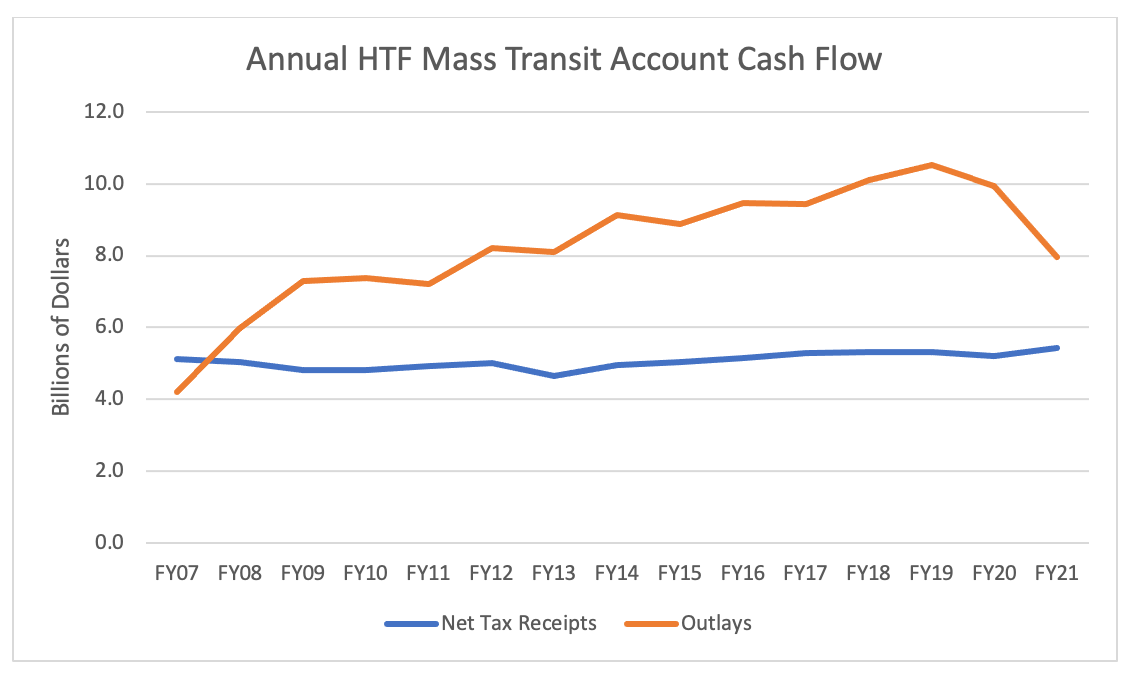

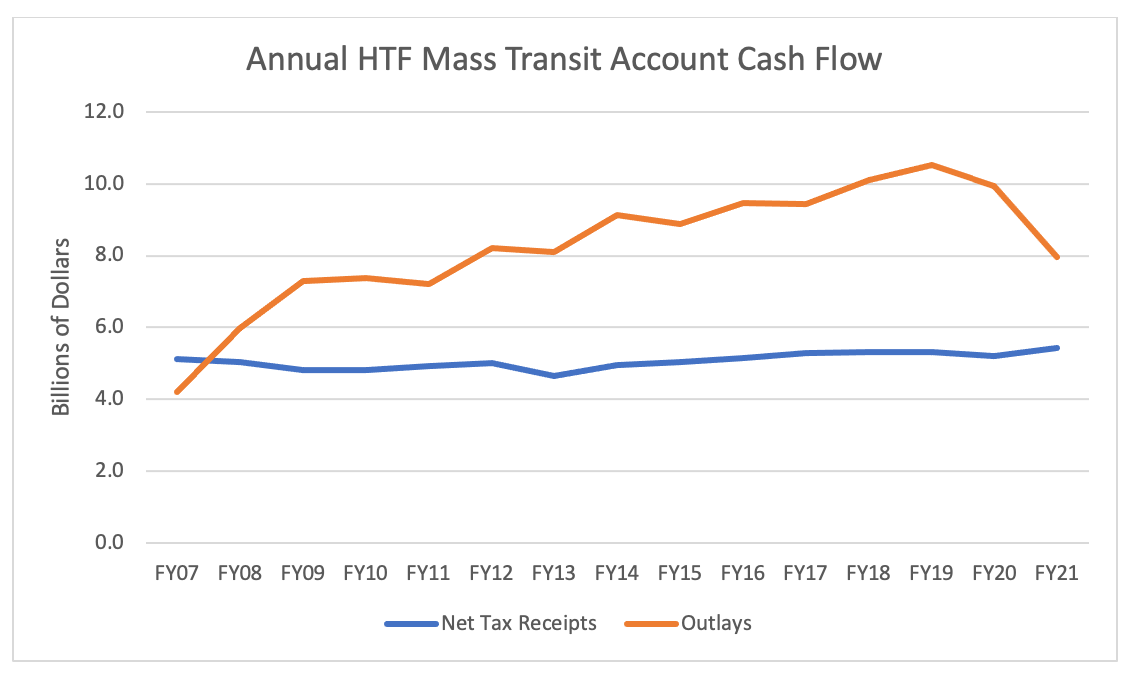

The spending drop is more pronounced in the Mass Transit Account, where tax receipts rose from last year, but spending fell by 20 percent (from $9.9 billion in outlays in FY21 to $8.0 billion in FY22, and note that outlays had actually reached $10.5 billion back in the pre-COVID FY19).

The most likely culprit is the “substitution effect” of that $69 billion in COVID-related aid given to mass transit providers out of general revenues. When given a choice between using their normal federal funding from the Trust Fund, which (for areas over 200 thousand in population) is capital-only, or using their COVID money which can be used for operations or capital, they are choosing to spend the COVID money first, and postpone the expenditure of their regular federal money until later.

The year-end balances are well in excess of the recent projections of the Congressional Budget Office:

|

Highway |

Transit |

Unified |

|

Account |

Account |

Total |

| CBO Feb. 2021 Prediction |

8.447 |

3.870 |

12.317 |

| CBO July 2021 Prediction |

7.759 |

5.291 |

13.050 |

| Actual Year-end Balances |

14.264 |

6.878 |

21.142 |

For the Highway Account, this may be enough to get into next year. In October 2020, the Highway Account ran a $3.37 billion cash deficit. Subtracting a like amount from the $14.26 billion balance above would leave around $10.9 billion. But in November 2020, the Highway Account only ran a $186 million deficit, and then a $900 million deficit in December 2020 (another true-up month). Then, the January-March recharging period, where cold weather slows down outdoor construction to the point that Trust Fund tax receipts exceed outlays and allow balances to build back up.

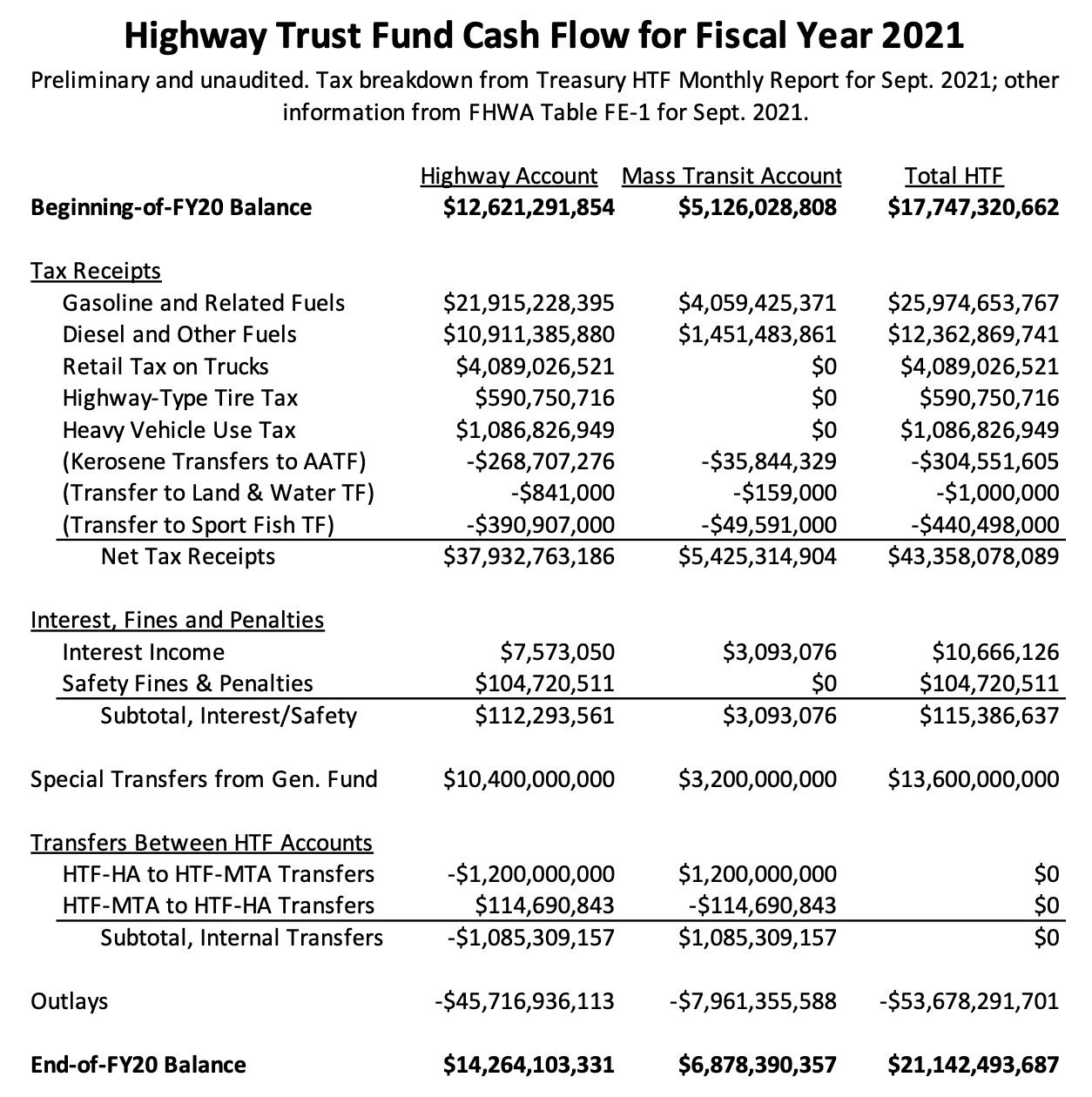

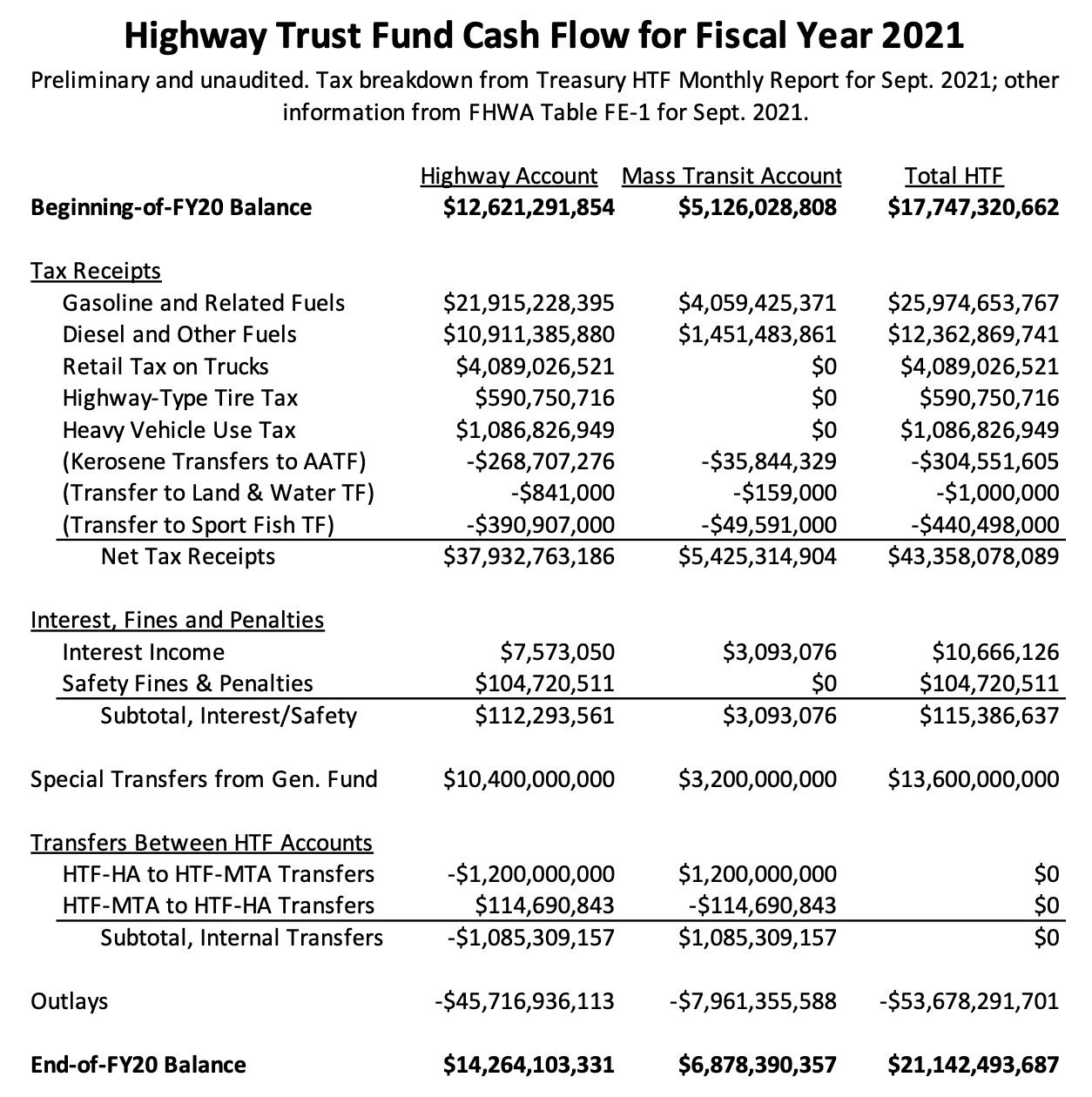

A chart showing detailed Trust Fund cash flow in 2021 is bellow.