There has been a lot of talk in the last week about the “80-20 highway-transit split,” and not all of it was accurate. Herewith: a brief explainer.

What 80-20 originally meant:

In 1982, a political deal was struck whereby urban legislators would vote for a huge 5 cent-per-gallon gasoline and diesel fuel tax increase demanded by highway interests (taking the total from 4 cents per gallon to 9 cents per gallon, more than doubling the tax rate), in exchange for 1 cent of the tax increase – 20 percent – going to a new Mass Transit Account in the Highway Trust Fund.

This 80-20 split of fuel tax increases was retained when the 5 cent gas/diesel tax increase from the 1990 budget deal was eventually deposited in the HTF, and was also retained when the 4.3 cent fuels tax increase from the 1993 budget deal was eventually deposited in the Trust Fund.

| Year |

Increase |

80% to Highway Acct. |

20% to Mass Transit Acct. |

| 1982 |

5 cents |

4 cents |

1 cent |

| 1990 |

5 cents |

4 cents |

1 cent |

| 1993 |

4.3 cents |

3.44 cents |

0.86 cent |

| TOTAL |

14.3 cents |

11.44 cents |

2.86 cents |

HTF excise taxes have not been increased since 1993. However, the taxes that were in existence prior to 1982 are all still retained in the Highway Account, and none of that money goes to the Mass Transit Account. This includes the 12 percent sales tax on new heavy trucks and tractor-trailers, which is the only one of the Trust Fund taxes that is a percentage of a sales price, which means it is the only one of the Trust Fund taxes that is effectively indexed for inflation.

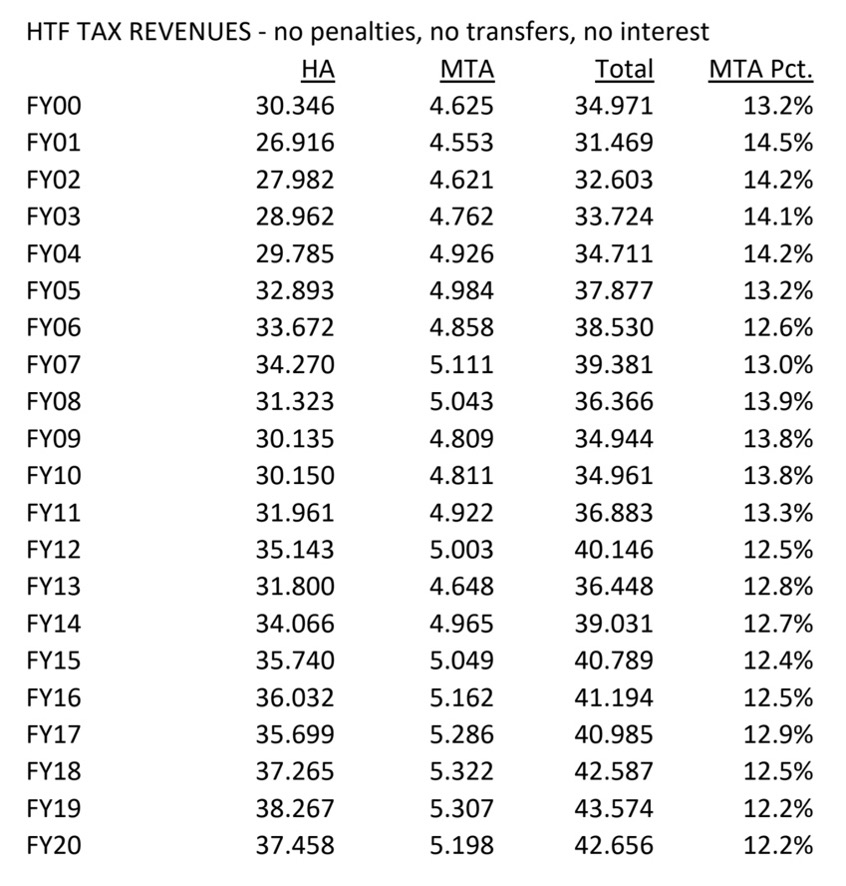

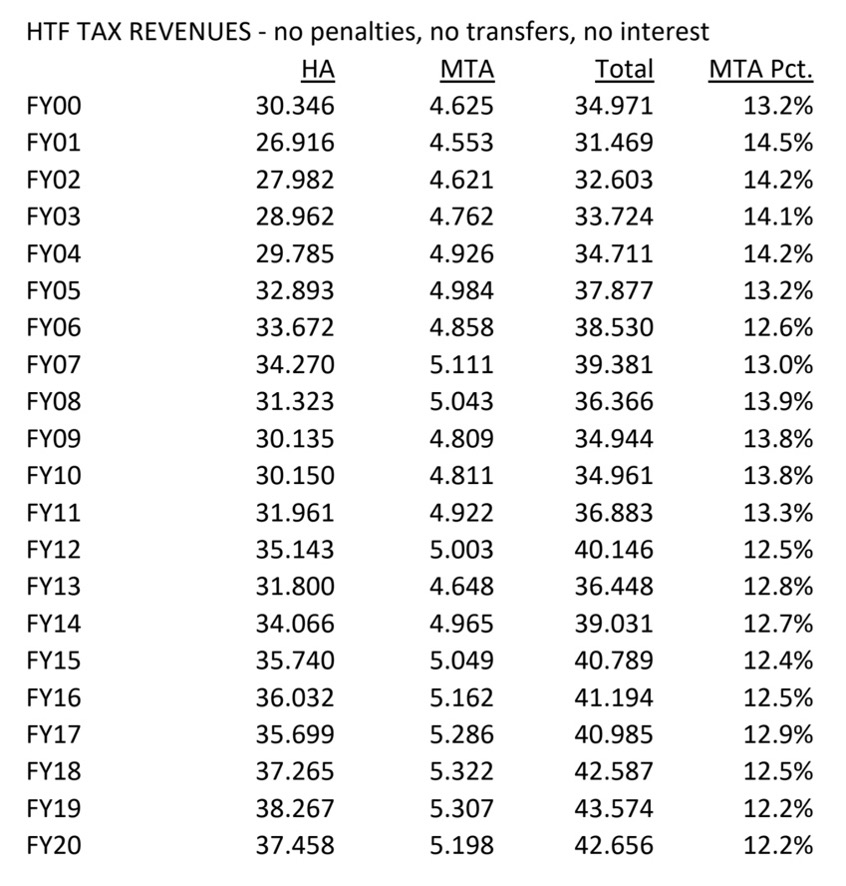

As a result, Mass Transit Account tax receipts have never come close to being 20 percent of total Trust Fund tax receipts. Over the last 20 years, the average has hovered around 13 percent of total Trust Fund tax receipts – not 20 percent.

What 80-20 later came to mean:

Mass transit started off receiving money from the General Fund of the Treasury, and even after transit started getting money from the Highway Trust Fund as well, the General Fund continued to play a significant part in supporting transit program funding.

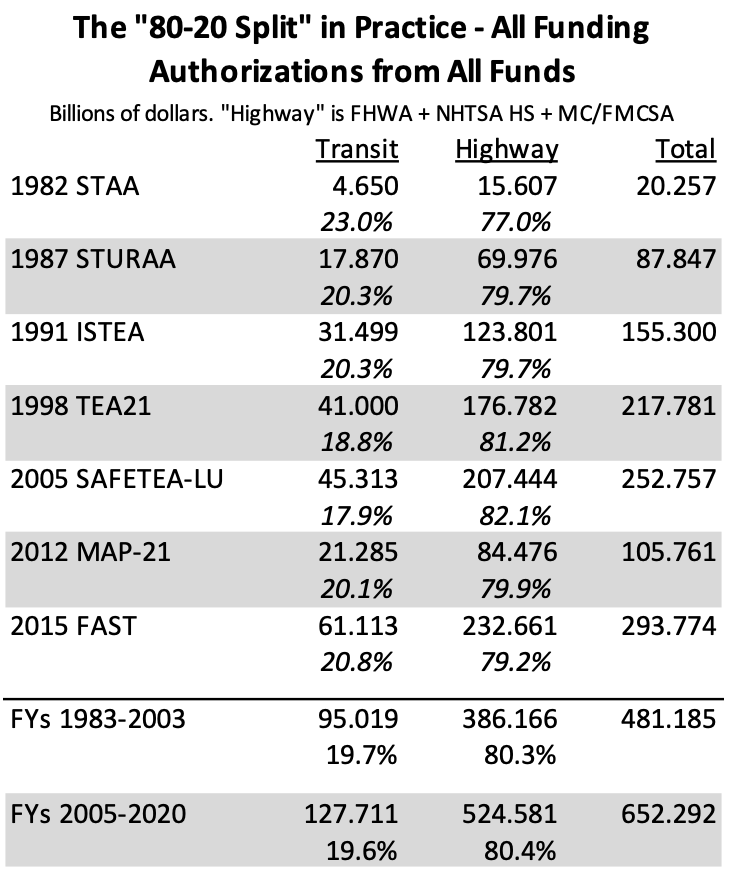

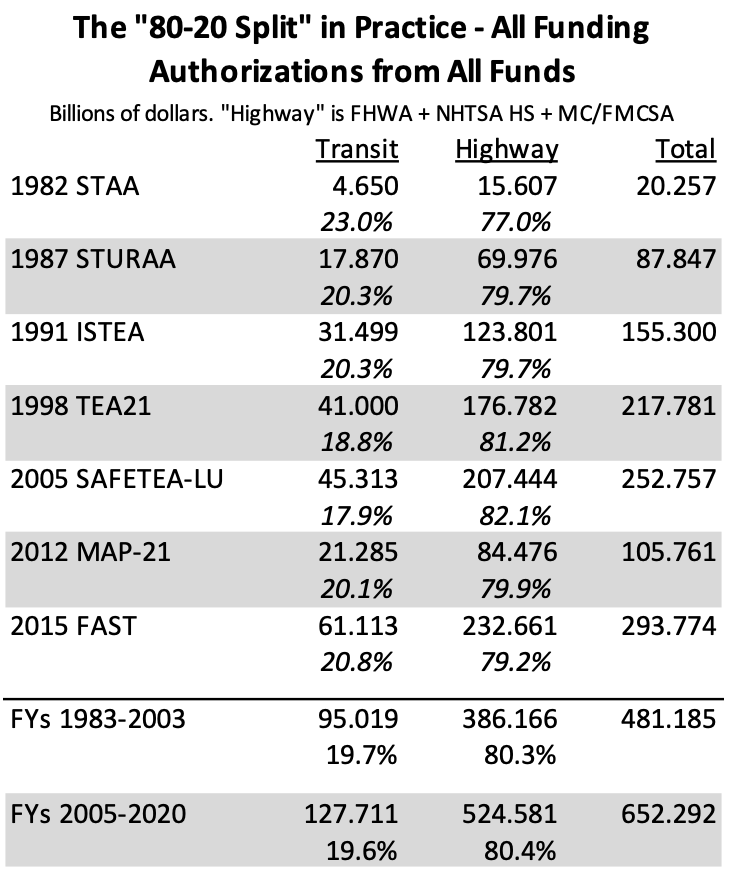

Over the 1983-2003 period (the spans of the 1982, 1987, 1991 and 1998 multi-year transportation funding authorization laws), total funding authorizations for mass transit programs averaged 19.7 percent of total funding authorizations for highway and highway safety programs, from all sources.

This started out as a coincidence – if there was a plan to have an 80-20 split of total authorizations, no one ever mentioned it at a committee hearing or on the House floor or Senate floor prior to 2002. The earliest reference we can find to an 80-20 split of funding was a statement by the Surface Transportation Policy Project in a September 2002 House hearing, noting that “We are at the point where the relative distribution of roughly 80/20 split may have to be revised to meet the rising needs for transit capital.”

However, total authorizations for mass transit programs in the 2005, 2012 and 2015 reauthorization laws have, consciously, been kept around the 80-20 mark. (The totals below exclude railroad funding in FAST because most prior authorizations did not address railroads.)

What 80-20 has never meant:

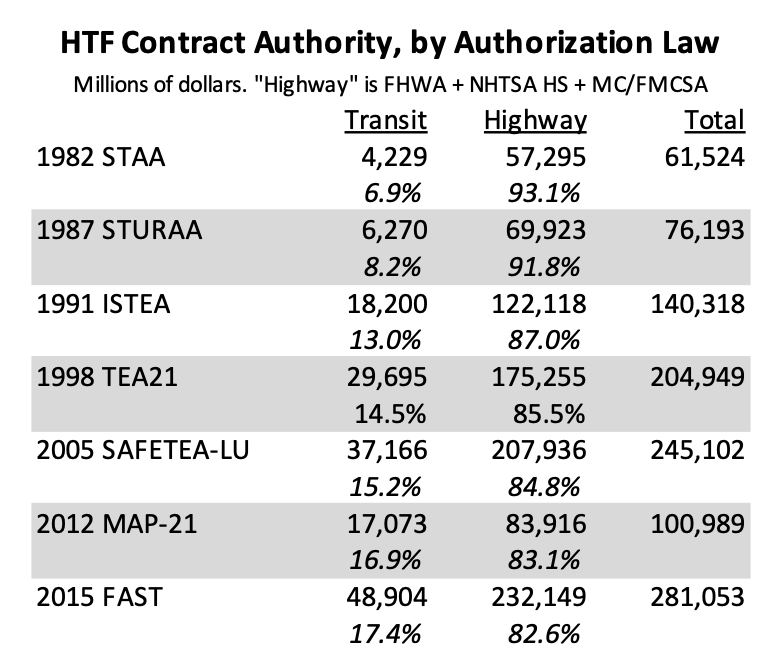

Contrary to what some people have been saying, there has never been an 80-20 highway-transit split of Highway Trust Fund contract authority. Early on, authorizations for Mass Transit Account contract authority were constrained by the tax revenues projected to flow into the Account, which, as explained earlier, have never been above around 14 percent of total Trust Fund tax revenue.

The 2005 SAFETEA-LU law used a one-time accounting trick that drastically slowed down Mass Transit Account cash flow for a few years and allowed contract authority to exceed projected receipts. At the end of the SAFETEA-LU period, the Trust Fund ran out of money, and since then, the Mass Transit Account has received 21.0 percent of the General Fund bailout funding approved by Congress, which has allowed the Transit Account’s share of total Trust Fund spending to continue growing. But transit spending out of the Trust Fund is still a good bit short of 20 percent of the total.

The House-passed INVEST in America Act would give the Mass Transit Account 20 percent of total Trust Fund contract authority for the first time, up from the 17.4 percent under the 2015 FAST Act. (Which is why the bill gives the Transit Account 26.4 percent of the $148 billion General Fund bailout transfer in section 11002 – because the Mass Transit Account is much more insolvent, as a percentage of dedicated revenues, than is the Highway Account.)