Several things became clear after the White House released President Biden’s full budget for fiscal 2022 last Friday. One was the full scope of the President’s American Jobs Plan (see writeup here), and another was the annual chapter in the Analytical Perspectives volume of the budget that maintains a focus on federal “investment” spending.

Much of the debate on the AJP and the efforts to rewrite the dictionary definition of “infrastructure” was really useless, because there was already a perfectly good concept called “investment” that has had a special budget analysis every year dating back to Eisenhower. “Investment” is defined in OMB Circular A-11 as “spending for programs and activities that will yield benefits largely in the future.”

Traditional concepts of infrastructure all fall into the investment category, as do federal purchases of real estate or major equipment. But so does federal spending on the conduct of research and development, and so does federal spending on the conduct of education and training.

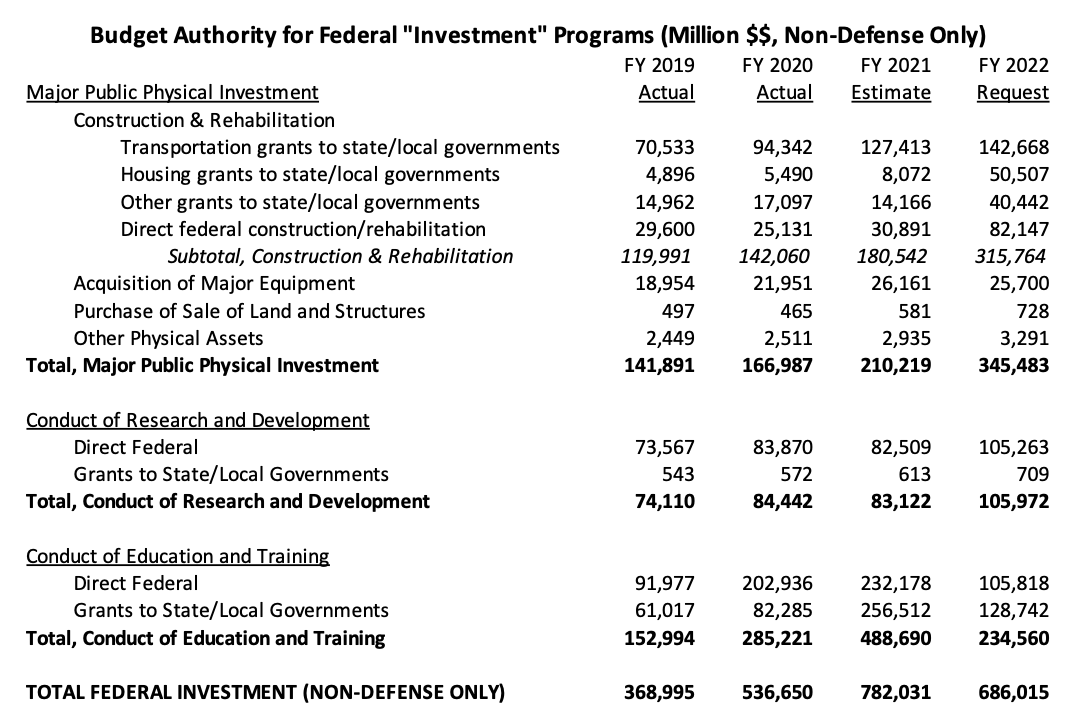

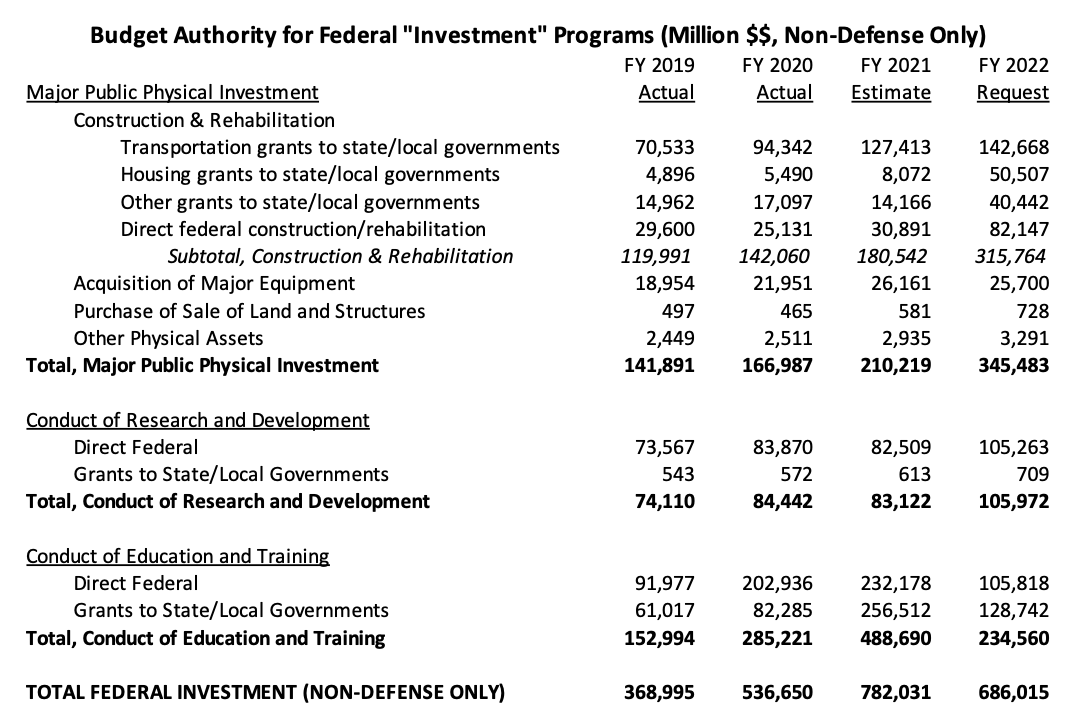

The “Federal Investment” chapter in the annual Analytical Perspectives volume of the budget slices and dices this investment spending into the three categories mentioned above (major public physical capital, conduct of R&D, conduct of education and training), and also by whether the expense is national defense or non-defense and whether the expense is a direct federal one or if it is a grant to a non-federal entity (usually a state and local government) for an investment.

In terms of budget authority (permission to make new federal spending commitments), federal non-defense investment spending totaled $782 billion in 2021. But it will drop to $686 billion in 2022, even if the President’s full American Jobs Plan is enacted, for two reasons.

One is that the most of the budget authority under the AJP would be doled out over five fiscal years, 2022 to 2026 (and a little bit would be provided thereafter). Only 28 percent of total AJP budget authority would be made available in fiscal 2022, and that drops to about 15 percent per year thereafter for the next four years. (90 percent of the BA would be provided in years one through five, with the remainder dripping out over years six through ten.)

The other reason why the 2022 budget would have less investment than 2021 is the tremendous amount of COVID-justified emergency relief funding for education that was provided by Congress in fiscal 2020 and 2021. In 2019 (the pre-COVID year), the federal government spent $92 billion on direct conduct of education and training (mostly financial assistance programs provided directly to student, like Pell Grants) and then spent another $61 billion on education grants to state and local governments. In 2020, the grants grew to $82 billion, and in 2021, they grew to $257 billion, while the direct federal expenses increased to $232 billion over that same period.

Even with the focus on education spending in the American Jobs Plan, the 2022 tranche of that money would be significantly less than total federal COVID aid to education.

The following table shows federal investment spending (in terms of budget authority), non-defense only, for the last full pre-COVID year of 2019, the COVID years of 2020 and 2021 (so far), and for fiscal 2022 under President Biden’s request, including the year-one tranche of the American Jobs Plan.