January 9, 2018

Voters across 34 states approved nearly $41 billion in new transportation investments last year, according to Eno’s new issue brief about the 2018 transportation ballot measures.

Of the $70.65 billion in transportation funding on the ballot in 2018, voters approved about 58 percent of that total, though 77 percent of the ballot measures passed (the average ballot measure that failed was worth more money than the average measure that passed). This excludes hundreds of local road measures in Michigan and Ohio, which are routine renewals of property tax assessments for road maintenance. Those tend to pass overwhelmingly, and our analysis considers them separately.

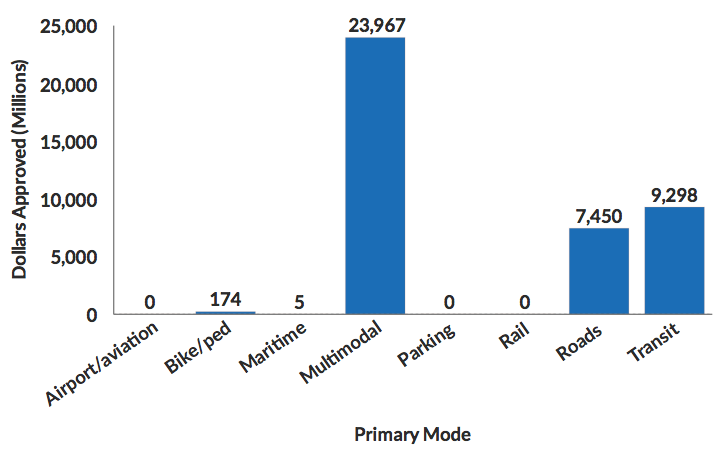

By mode, voters approved far more ballot measures to raise money primarily for roads than for any other mode, passing 80 of the 113 ballot measures to raise money for roads – a 71 percent success rating. While more measures were approved for road funding than for any other mode, looking at the actual dollar amounts approved tells a different story. Voters approved far more money for transit projects than for roads – $9.3 billion for transit vs. $7.5 billion for roads. Multimodal measures – those that will raise money for many different modes – will raise the most money.

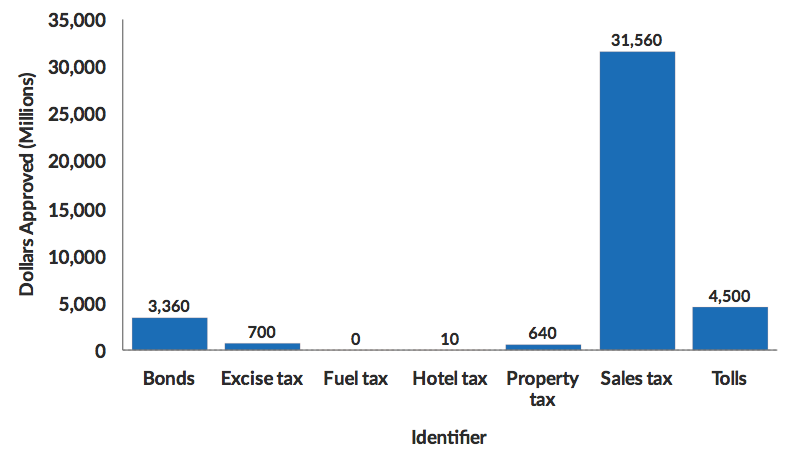

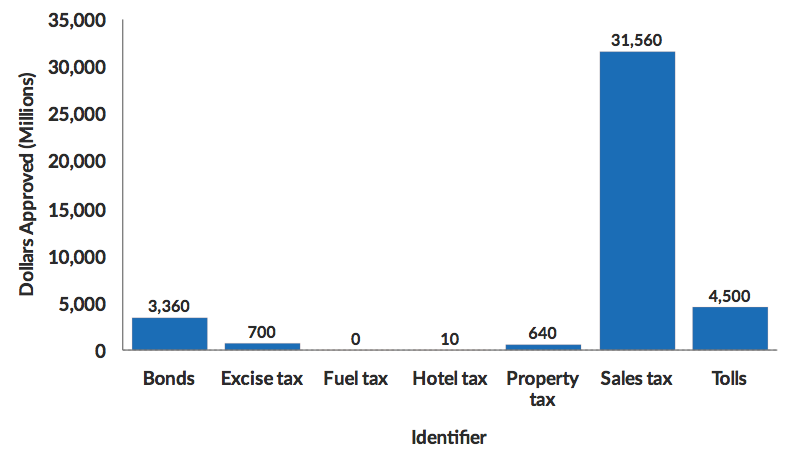

Ballot measures raise revenue for transportation measures in a wide variety of ways. The most common in 2018 were sales taxes (55 measures), bonds (54), and property taxes (48). Bonds were the most popular at the ballot box, enjoying an 88.89 percent success rate. Eighty-three percent of property tax increases were passed, and sales taxes enjoyed a lower success rate of 61.8 percent.

Most of the approved measures will raise money through sales tax increases (55 measures), bond sales (54 measures), or property tax increases (48). The sales tax measures that passed will raise most of the money ($31.7 billion), thanks in large part to the one percent sales tax increases passed in Broward and Hillsborough counties in Florida. Transportation-specific user fees like tolls and vehicle registration fees were scarce, with only one measure for each of those sources. Fuel taxes were also uncommon, and all three were rejected by voters, including statewide measures to raise the state’s gasoline tax in Missouri and Colorado.

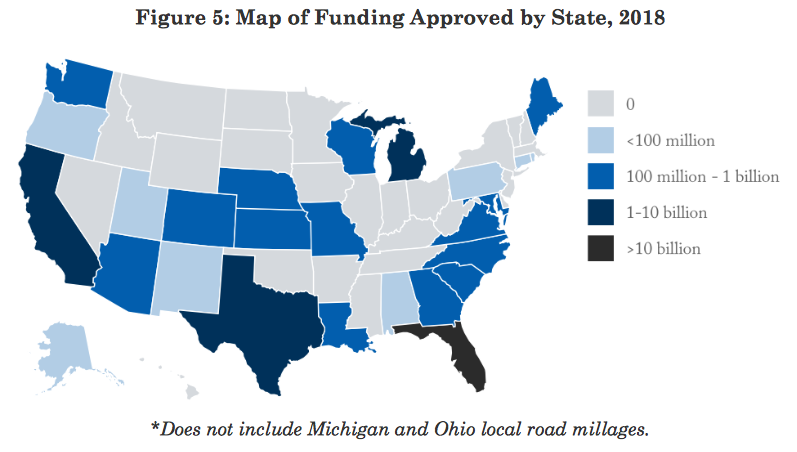

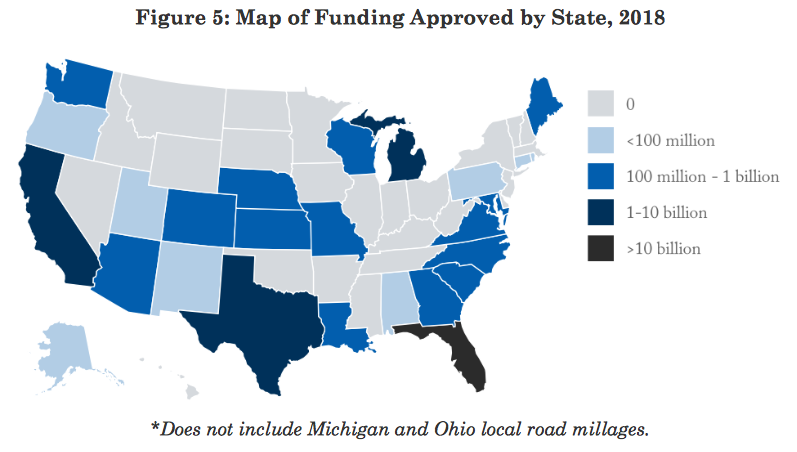

Thirty-four states had at least one transportation ballot measure this year. Looking at the map of where voters supported raising money for transportation shows no real pattern, with voters in just about every region approving transportation ballot measures. One exception is the north-central United States, where no funding was approved.

Voters in Florida approved far more funding for transportation than voters in every other state combined. The vast majority of the $24.411 billion approved by Florida voters came in the form of two penny sales tax increases passed in Broward County ($15.63 billion) and Hillsborough County ($8.28 billion).

California came in a distant second place, with just over $8.6 billion approved for transportation. The largest chunk of this was passed not on Election Day, but back in June, when a nine-county region in the Bay Area approved Measure 3 to raise $4.5 billion in tolls for traffic relief and public transit. California voters also rejected Prop 6, which would have repealed last year’s fuel tax increases.

Click here to read Eno’s full analysis of the 2018 transportation ballot measures.