Under the Biden Administration’s proposed budget for fiscal 2024, this will be the year when all of the pre-Biden mass transit Capital Investment Grant projects get paid off and the next generation of quasi-obligations incurred.

The budget proposes to spend $1.2 billion to pay off the final installments of the four “New Starts” that have signed full funding grant agreements (FFGAs) – L.A. Westside parts 2 and 3, Minneapolis Southwest LRT, and Seattle Lynnwood Link. (Having only four ongoing FFGAs is unusually low, because in fiscal 2022-2023, the Administration prioritized the first $3.2 billion of the IIJA infrastructure law’s advance appropriations for the CIG program to paying down the federal share of active FFGAs earlier than scheduled, so as to save the project sponsors some debt service costs.)

To replace those four projects (and the others that went before), the Administration proposes to sign seven new multi-year grant agreements, promising a gobsmacking total of almost $19 billion in total federal CIG program appropriations over a decade. (Six of the proposed projects are New Starts and the other is a Core Capacity project).

These seven projects collectively have already received $727 million in federal CIG appropriations, and the budget proposes another $2.6 billion in fiscal 2024, if Congress appropriates the full $2.85 billion budget request for the CIG program (in combination with the third $1.6 billion installment of IIJA funding).

But that still leaves $15.5 billion in future post-FY24 appropriations necessary in future years to pay off the promises that the Administration would make in this budget cycle. Even if you assume that the entirety of the remaining $3.2 billion from the 2025 and 2026 installments of IIJA money were to go to these seven projects, the amount of new appropriations that Congress would have to make in 2025 and future years to pay of these bills would total $12.3 billion, which is a lot by historical standards.

The four largest New Start projects proposed to be signed in 2024 would each have larger annual installment payments than any projects in CIG history. (NYC Second Avenue Phase 1 was $278 million per year, Honolulu was $250 million per year, and LIRR East side Access was $219 million per year.) If the FFGAs for the four biggest proposed projects follow the usual installment schedule, here is how much Congress will have to provide in FY 2025 and future years:

|

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY31 |

FY32 |

FY33 |

Total |

| BART SV II |

500.0 |

500.0 |

500.0 |

500.0 |

500.0 |

500.0 |

500.0 |

500.0 |

102.9 |

4,102.9 |

| Chicago Red Line |

350.0 |

350.0 |

350.0 |

350.0 |

350.0 |

138.2 |

|

|

|

1,888.2 |

| Hudson Tunnel |

700.0 |

700.0 |

700.0 |

700.0 |

700.0 |

700.0 |

700.0 |

700.0 |

252.9 |

5,852.9 |

| NYC 2nd Ave 2 |

496.8 |

500.0 |

500.0 |

500.0 |

461.3 |

|

|

|

|

2,458.1 |

| Subtotal, Big 4 |

2,046.8 |

2,050.0 |

2,050.0 |

2,050.0 |

2,011.3 |

1,338.2 |

1,200.0 |

1,200.0 |

355.8 |

14,302.1 |

(It is possible that the FFGAs might lower the annual installments starting in 2026, when the IIJA advances run out, but that would stretch the timeframe out several more years.)

It should be noted that these FFGAs are not legally binding – they contain language, repeated over and over, that say that the grant agreement is NOT a contractual agreement of the U.S. government and that it does not represent a legally binding obligation to pay money. Nevertheless, FFGAs work as a way of “morally” binding future Congresses to make appropriations because of the practical and political difficulties that would erupt if Congress forced FTA to walk away from a FFGA halfway through the payoff schedule.

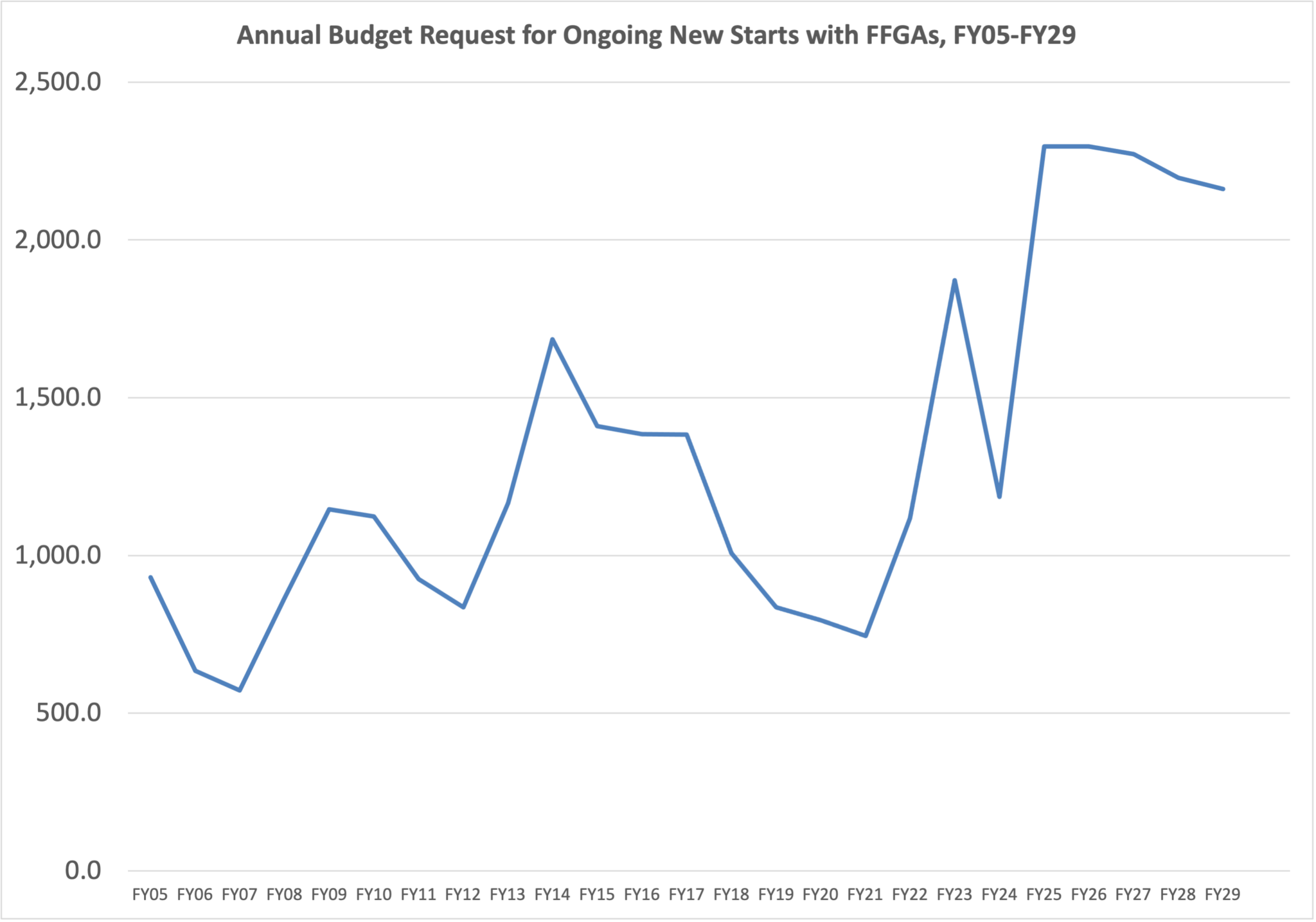

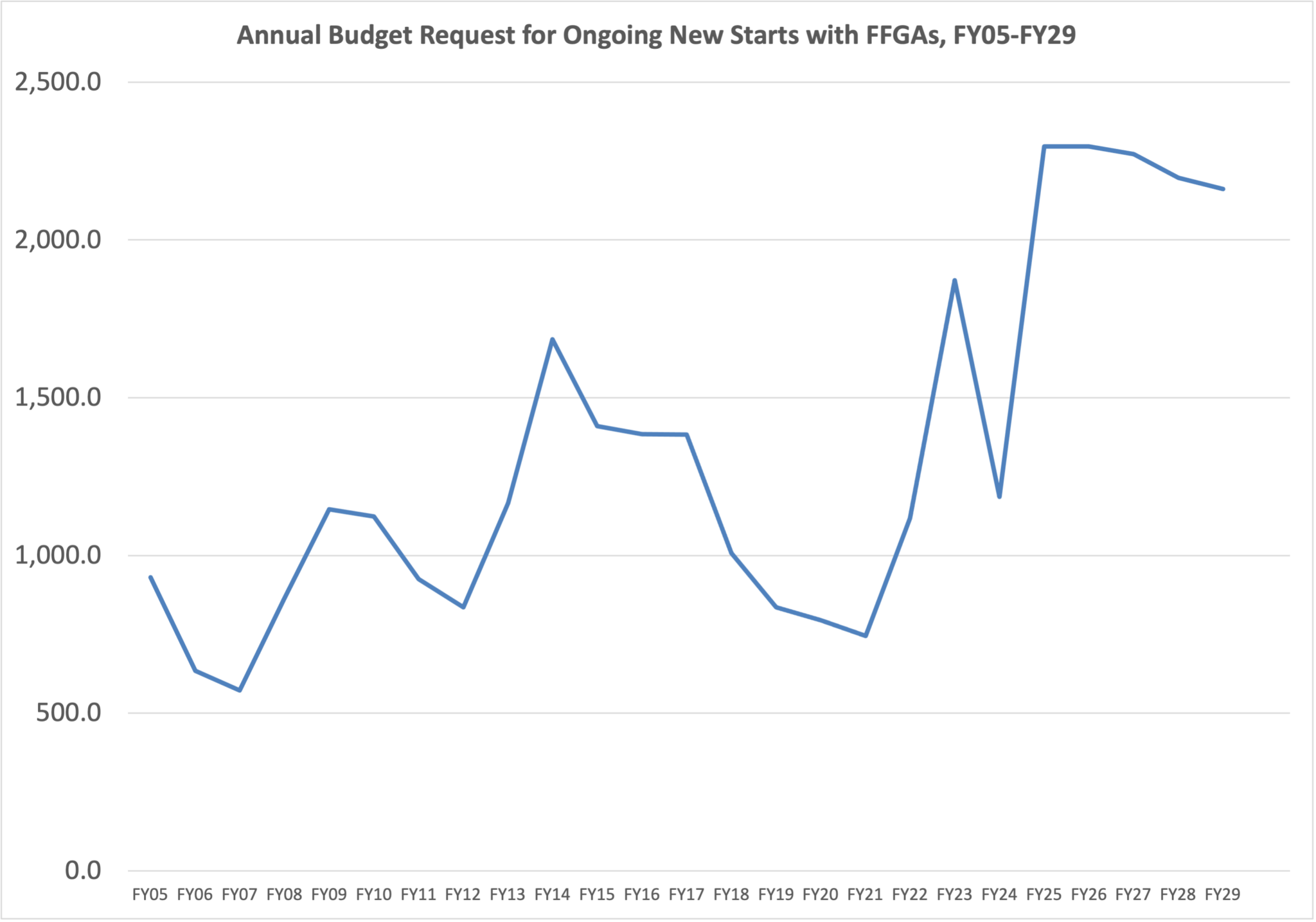

Signing these FFGAs would represent a quantum jump in the annual amount required “off the top” of the CIG for ongoing New Starts. We went back 20 years in the annual reports. and charted out the annual budget request for New Starts with signed FFGAs. The amount that would be set aside in this manner in 2025 and future years under the Administration plan is far higher than the norm.

The major projects to be recommended for FFGAs in the 2024 budget are:

- Hudson River Tunnel, $6.65 billion CIG commitment, which is 45.4% of a total capital cost of $14.65 billion. The big one. You know it, you either love it or hate it. It should be noted that this one is not yet legally eligible for a FFGA because it has not yet graduated from the Project Development phase into the Engineering phase of the CIG program. FTA says: “The [Gateway Development Commission] submitted a request to enter Engineering to FTA in late October 2022, which included an updated total capital cost estimate for the joint project of $16.063 billion with the public transportation component of that being $14.653 billion. The Capital Investment Grants (CIG) program share in that request is $6.653 billion (45.4 percent of the public transportation component). As of March 2023, the request to enter Engineering remains under review.”

- BART Silicon Valley Phase II. $4.60 billion CIG commitment, which is 49.4% of a total capital cost of $9.32 billion. This one is also still in Project Development, but unusually, it started out in the Expedited Project Delivery Pilot Program but then things didn’t work out. FTA says: “In October 2022, VTA stated it would no longer pursue EPD Pilot Program funding and requested to re-enter CIG Project Development. FTA re-admitted the project into CIG Project Development in December 2022. VTA anticipates entering Engineering in Fall 2023, receiving a Full Funding Grant Agreement in 2024, and opening for revenue service in March 2033.”

- NYC Second Avenue Subway, Phase 2. $3.40 billion CIG commitment. This was 49% of the earlier $5.95 billion project cost, but the project sponsors updated the cost estimate by $750 million in December 2022, dropping the CIG share down to 44.2 percent. FTA says that this one isn’t quite ready either: “As of March 2023, there remain additional steps MTA must complete before the FFGA review can be completed and an updated rating developed.” (For the full story of the Second Avenue line, please read my Eno colleague Philip Plotch’s book, Last Subway: The Long Wait for the Next Train in New York City (2020).)

- Chicago Red Line Extension. $2.24 billion CIG commitment, which is 60 percent of total capital cost of $3.73 billion. This project would extend the Red Line south from 95th Street to 130th Street. Again, this one is also not eligible for a FFGA immediately, because it is also still in PD: “CTA anticipates gaining entry into the Engineering phase in mid-2023, receiving a Full Funding Grant Agreement in late 2024, and opening for revenue service in late 2029.”

- Houston University Corridor BRT. $939 million CIG commitment, which is 60 percent of a total capital cost of $1.57 billion. This is pricey for a BRT system (most of those fit in the under-$150m Small Start category), but this one is 25 miles long, with exclusive bus lanes, signal priority, a new operating facility, offboard fare collection, and the purchase of 47 new 60-foot electric buses. “METRO anticipates completion of the environmental review process by May 2023, receipt of a Full Funding Grant Agreement by November 2024, and opening for revenue service in October 2030.”

- Salt Lake City FrontRunner Double Track. $671 million CIG commitment, which is 69.5% of a $966 million capital cost. This is the lone core capacity project proposed for an FFGA this cycle and it would double track the FrontRunner light rail from Provo to Ogden, doubling train frequency (from 30/60 peak/off-peak to 15/30 peak/off-peak). “UDOT anticipates completing the environmental review process with receipt of a Categorical Exclusion from FTA in December 2022, receiving a Full Funding Grant Agreement in September 2024, and opening for revenue service in late 2028.”

- Charleston, SC Lowcountry Rapid Transit. A relatively minor $375 million CIG commitment, which is 60 percent of a total $625 million capital cost. This would be a 11.7-mile BRT service between Charleston and North Charleston, “in a combination of median-running and side-running exclusive lanes. The Project includes 19 60-foot articulated electric buses with doors on both sides, two non-revenue vehicles, four electric bus opportunity chargers, traffic signal priority, upgrades to the existing operations and maintenance facility, and a park-and-ride facility with space for approximately 140 vehicles.” This one is already in the Engineering phase and sponsors anticipate a FFGA by December 2024.

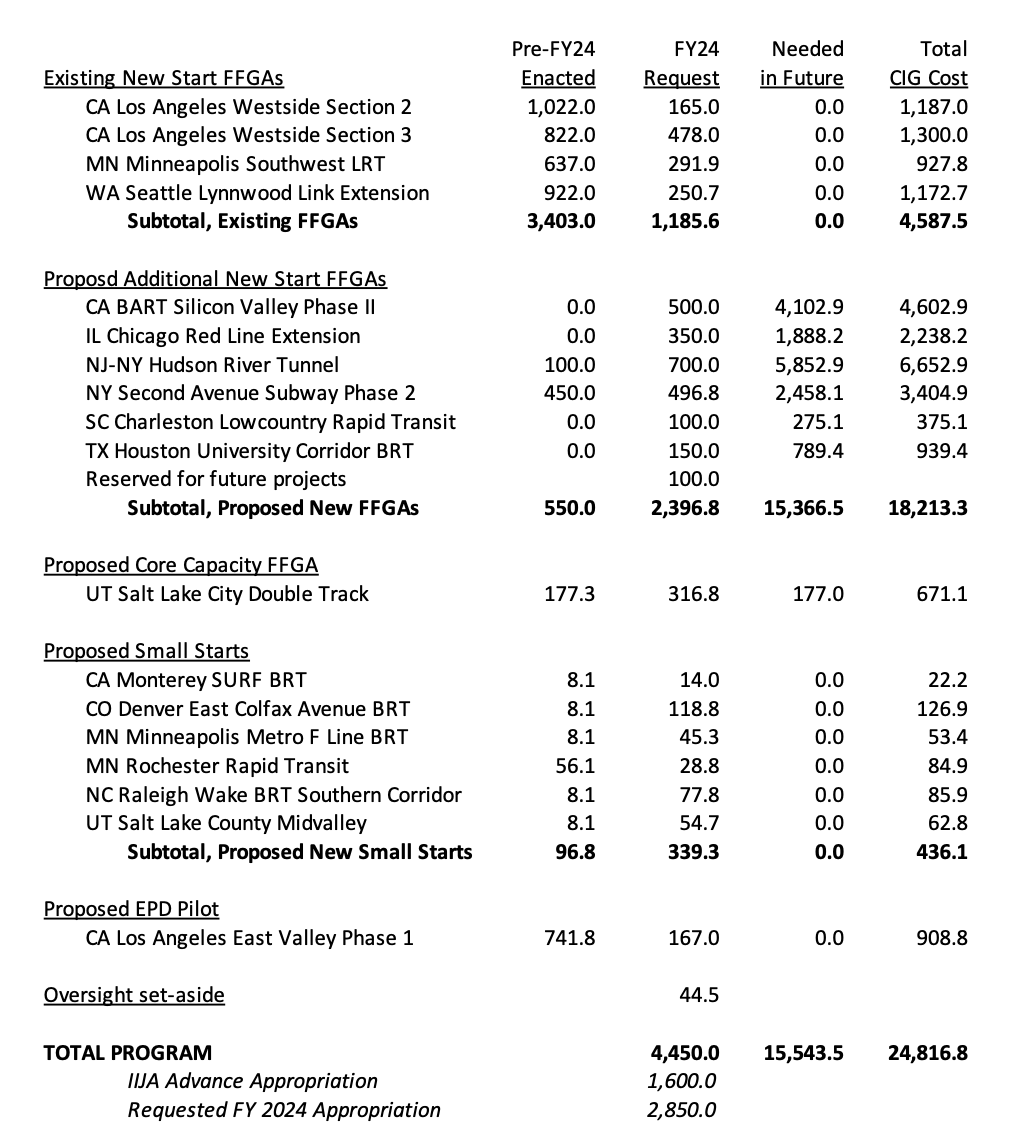

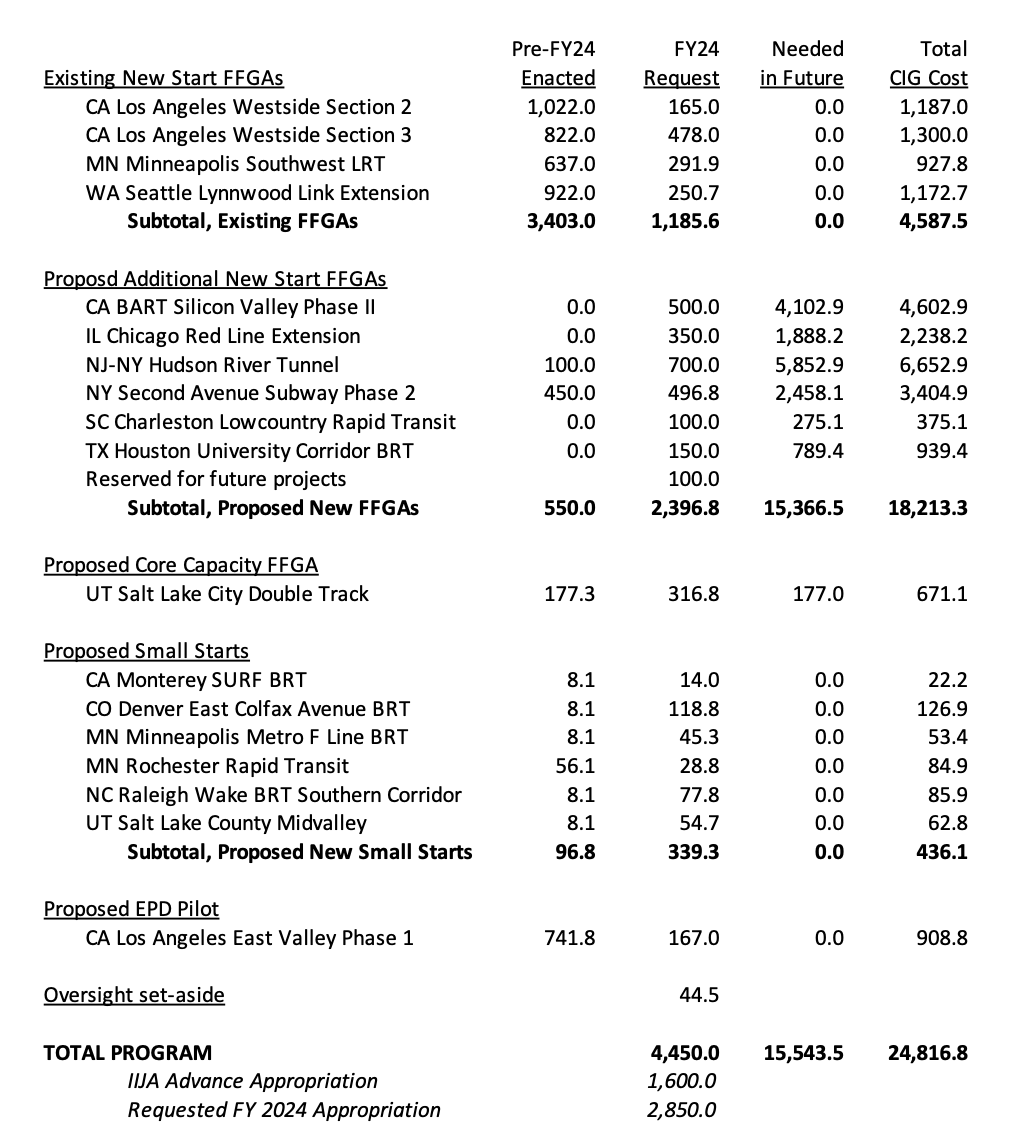

The budget request for CIG is below (in millions of dollars).