July 25, 2019

Today, the U.S. Department of Transportation announced the recipients of the fiscal year 2019 round of INFRA grant funding provided by the FAST Act of 2015, with 20 projects totaling $856 million in federal funds.

“This significant federal investment will improve major highways, bridges, ports, and railroads around the country to better connect our communities, and to enhance safety and economic growth,” said Secretary Elaine L. Chao.

The freight-focused INFRA grant program (legally, the Nationally Significant Freight and Highway Projects program, but no one can pronounce NSFHP) was created by the FAST Act and is codified at 23 U.S.C. §117. When creating the program, the Senate Environment and Public Works Committee originally tried to give itself a veto over any project selections by the Secretary, but this was almost certainly unconstitutional under the INS v. Chadha decision. So they settled for the process in §117(m), whereby the Secretary submits a project list to Congress but can’t start actually awarding funds to recipients for 60 days, which gives Congress time to pass a joint resolution disapproving the project list (though the President would presumably veto any such resolution, meaning that it would take two-thirds of both chambers to nullify the list by overriding the veto). Naturally, the Secretary submits the list to Congress right as Congress is about to embark on a five- or six-week vacation and thereby ensure that most of those 60 days expire without Congress being able to do anything.

(Elsewhere in this issue, Eno’s Paul Lewis reviews a new GAO report criticizing the lack of transparency in USDOT’s selection process for these grants – check it 0ut here.)

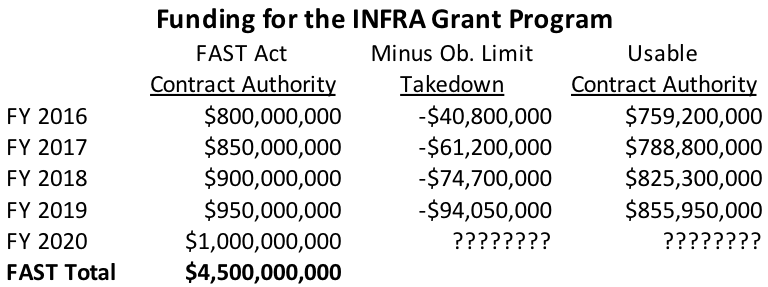

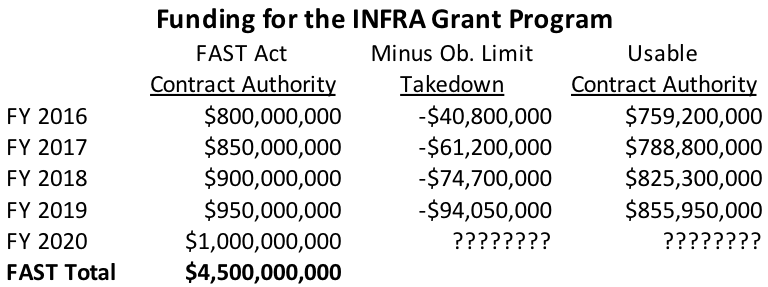

Total funding available. The $950 million in contract authority provided for the INFRA program by the FAST Act for FY19 was reduced by almost 10 percent by the application of the annual obligation limitation. This 9.9 percent reduction is almost twice as much as the 5.1 percent reduction that occurred in FY 2016. Ironically, the culprit, to some extent, is the INFRA program itself – large allocated programs like INFRA (and TIFIA) that are slow to get their contract authority legally obligated by the end of a fiscal year have to have new obligation limitation taken “off the top” at the start of the next fiscal year. For FY 2019, this prior-year “allocated carryover” totaled $4.43 billion, taken off the top of an obligation limitation of $45.26 billion, forcing significant reductions in INFRA, TIFIA, federal lands, and research programs.

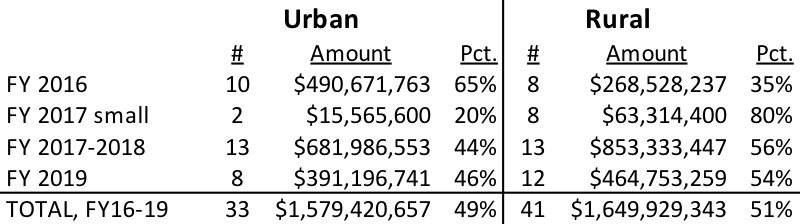

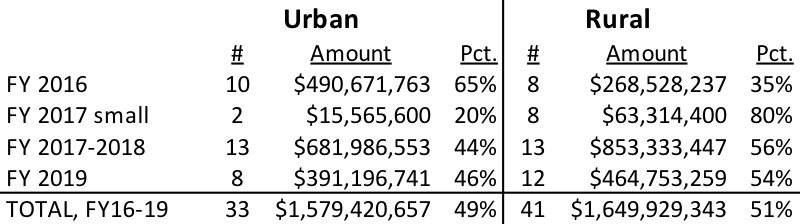

Urban-rural split. In the FY 2019 awards, 54 percent of the funding ($465 million) went for projects in rural areas (as “rural” is specifically defined in the INFRA statute, “an area that is outside an urbanized area with a population of over 200,000”), with the other 46% ($391 million) for projects in urban areas. The statutory set-aside for rural projects in §117(i) is 25 percent of total funding.

This brings the cumulative total for the program to date almost to a 50-50 split:

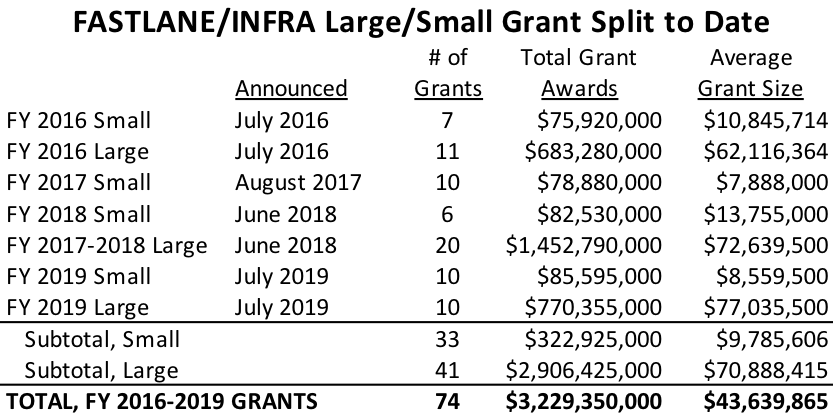

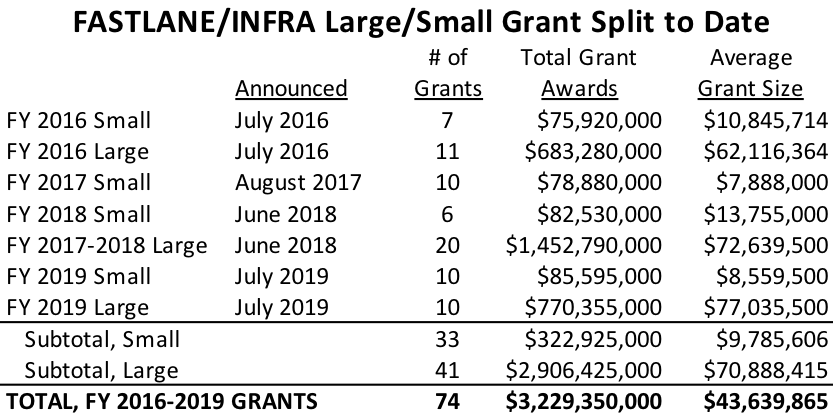

Large/small project split. INFRA was set up primarily for large projects having a total cost of over $100 million or, for smaller states, a cost exceeding a minimum percentage of their total annual formula funding, and a minimum grant size of $25 million. However, §117(e) sets aside 10 percent – no more, no less – of total funding for small projects that don’t meet the threshold, with a minimum grant size of $5 million. For the FY19 grants, the average large project grant was $77.0 million and the average small project grant was $8.6 million, which drags up the cumulative large project average and pushes down the small project average somewhat.

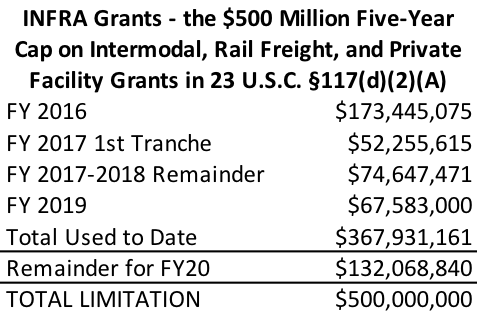

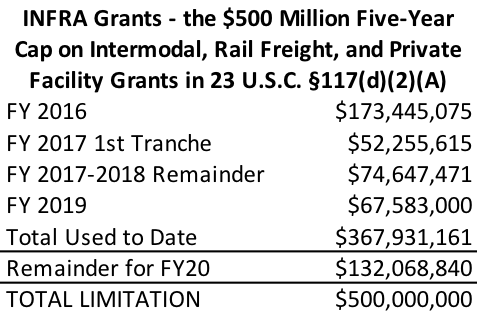

Rail/intermodal set-aside. §117(d)(2)A) of title 23 provided an aggregate limitation of $500 million on the total amount of INFRA award funding that could go towards rail freight, intermodal freight, or private facility grants. Going into this year, DOT had used a little over $300 million of the $500 million over FY 2016-2018. According to DOT, the FY 2019 grants use an additional $67.6 million towards that limitation, leaving up to $132 million for rail and intermodal freight grants in the final year, 2020.

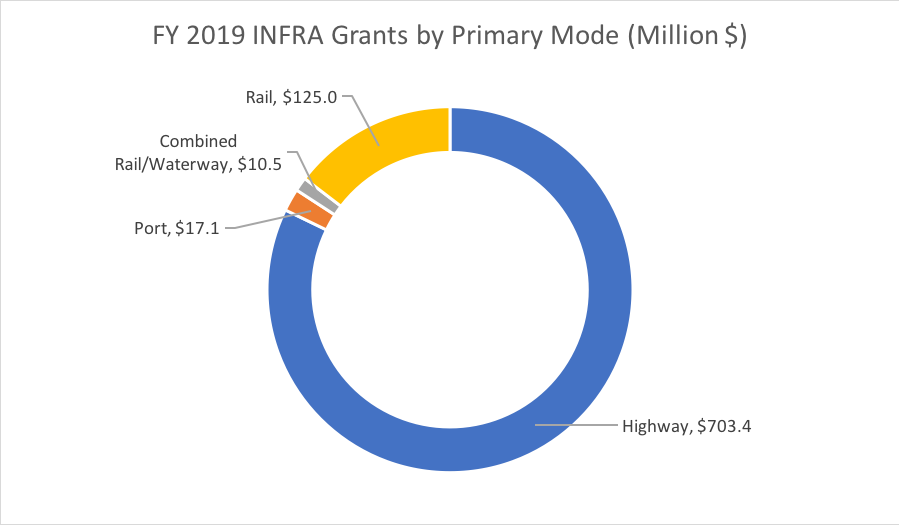

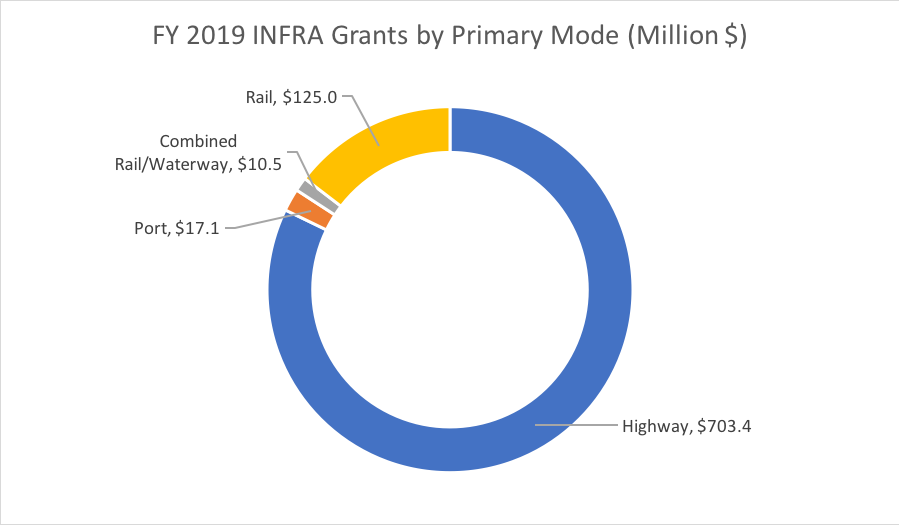

Modal distribution. 82 percent of the FY19 grant funding was for projects described by USDOT as primarily highway-focused (sometimes a new bridge or road will have a bike lane or grade crossing component, but not often). 14.6 percent was for rail projects, 2.0 percent for port projects, and 1.2 percent for a combined rail/waterway project.

Specific projects. Of the 20 grants announced, 12 are for $10 million are more. They are (in descending order of grant size):

- Mobile, Alabama – I-10 Mobile River Bridge and Bayway ($125 million) – This is a big, big project – a new six-lane, cable-stayed bridge over the Mobile River and a new eight-lane, seven-mile causeway spanning Mobile Bay. The $125 million INFRA grant only represents 5 percent of the $2.3 billion project cost. This project is a P3 (design, finance, construct and operate with a 55-year concession period) project. The state has also applied for a large federal TIFIA loan, and the repayment revenue stream revolves around tolling (as much as $6 per vehicle per trip), which is very unpopular with some of the locals.

- Baltimore, Maryland – Howard Street Tunnel Project ($125 million) – This freight project would pay for 27 percent of the cost of increasing the height of this old Baltimore and Ohio Railroad tunnel (now owned and operated by CSX) so that it can take double-decker container cars and eliminate a major freight bottleneck in the CSX system. According to the Baltimore Sun, Maryland had applied for a $228 million INFRA grant (49 percent of project cost), with the remainder split between a $141 million contribution from the state and a $91 million contribution from the railroad. It is not clear how the cost shares will change with the INFRA grant being capped at $125 million.

- Maricopa County, Arizona – I-17 Flexible Demand ($90 million) – This highway grant would be 47 percent of the estimated $320 million cost of adding a flex lanes system to 23 miles of Interstate 17 north of Phoenix (between Anthem Way and Sunset Point) to allow one-way traffic in alternate directions in different times of the day.

- Cape Canaveral, Florida – Spaceport Indian River Bridge Replacement ($90 million) – This grant would pay for about 55 percent of the $165 million cost of replacing the SR 405 bridge that is the main traffic connector between the Kennedy Space Center and the mainland of Florida. The original application asked for a $99 million INFRA grant, with the remaining cost of the project to be split 50-50 between NASA and the Florida state aerospace economic development agency (“Space Florida”). According to local news reports, engineers think the existing bridge may become unsafe for heavy freight (including spacecraft) by 2021. (This grant is similar to the Memorial Bridge grant in FY16 in that it is the FHWA budget supplementing another federal agency’s budget – in that case, it was the Park Service who was responsible for the bridge.)

- Rocheport, Missouri – I-70 Bridge and Mineola Hill Climbing Lanes ($81.2 million) – This grant represents 34 percent of the $192 million cost of building a new bridge to carry Interstate 70 over the Missouri River and constructing climbing lanes in Montgomery County, MO. According to the governor’s office, this grant triggers an automatic $301 million bond initiative for statewide bridges from the 2019 state budget that, in turn, frees up $301 million in committed cash which will now be spent on other projects on the Missouri STIP.

- Bend, Oregon – U.S. 97 North Corridor Project ($60.4 million) – This grant represents 45 percent of the $133 million cost of realigning and re-routing U.S. 97 north of the city of Bend.

- Providence, Rhode Island – I-95 Northbound Viaduct Project ($60.4 million) – In recent years, Rhode Island has reconstructed the southbound viaduct of the elevated I-95 through Providence. Last month, the General Assembly authorized a $200 million issuance of GARVEE bonds from future highway formula funding to begin reconstruction of the northbound viaduct, and the $60.4 million INFRA grant will supplement that.

- Itawamba County, Mississippi – SR 76 Freight and Capacity Improvements ($52.4 million) – This grant would pay for 55 percent of the estimated $96 million cost of building a new 8.3 mile, four-lane principal arterial segment of SR 76 that would (a) serve the Blue Springs, MS Toyota plant and help link it to the forthcoming Huntsville, AL Toyota-Mazda joint production facility and (b) complete construction of the Appalachian Development Highway System in Mississippi.

- Temecula, California – I-15/French Valley Parkway Improvements ($50 million) – This grant would support the northbound half of a new collector/distributor system long I-15 between Winchester Road and the I-15/I-215 junction, The final phase of the project, the construction of a new arterial and the southbound collector lanes, is still to come.

- Madawaska, Maine – Madawaska International Bridge Replacement ($36 million) – This grant would provide 50 percent of the cost of replacing the existing international bridge betwen Madawaska, Maine and Edmundston, New Brunswick, Canada.The existing bridge is under a 5-ton weight limit because of its age. The remaining cost of the project is to be split 50-50 between the State of Maine and the Province of New Brunswick.

- Pierre, South Dakota – US-14 and US-83 Missouri River Bridge ($13 million) – This grant will pay for about 28 percent of a project to replace the existing four-lane highway bridge (built in 1962) that carries U.S. 14, U.S. 83 and SR 34 over the Missouri River between Pierre and Fort Pierre.

- Southeast Arkansas and Northeast Louisiana Multimodal Freight Corridor ($10.5 million) – This grant is to improve a 95-mile freight corridor that stretches from McGehee, Arkansas to Talulah, Louisiana, to consist of short line rail safety upgrades and intermodal connectivity improvements to three inland waterway ports along the route.

The full list, alphabetized by state, is below. Fact sheets for each project, provided by DOT, can be found here.

| State |

Location |

Project Name |

Grant Award |

Project Cost |

INFRA share |

| AL |

Mobile |

I-10 Congestion Relief – Mobile River Bridge and Bayway |

$125,000,000 |

$2,292,060,227 |

5% |

| AL |

Tuscaloosa |

University Boulevard/US 82 Overpass Bridge Replacement |

$6,870,000 |

$11,450,000 |

60% |

| AR-LA |

Multiple counties |

SE Arkansas and NE Louisiana Multimodal Freight Corridor |

$10,516,259 |

$27,726,599 |

38% |

| AZ |

Maricopa County |

I-17: Flexible Demand |

$90,000,000 |

$192,300,000 |

47% |

| CA |

Temecula |

Interstate 15/French Valley Parkway Improvements Phase 2 |

$50,000,000 |

$110,131,181 |

45% |

| CO |

Multiple counties |

Passing Lanes in SE Colorado’s Ports-to-Plains Corridor (U.S. 287) |

$8,297,000 |

$24,800,000 |

33% |

| FL |

Cape Canaveral |

Cape Canaveral Spaceport Indian River Bridge Replacement |

$90,000,000 |

$165,000,000 |

55% |

| FL |

Miami |

PortMiami Bulkhead Rehabilitation and Capacity Expansion Project |

$8,046,741 |

$19,545,295 |

41% |

| GA |

Cumberland |

Akers Mill Ramp Phase II |

$5,000,000 |

$18,013,331 |

28% |

| MD |

Baltimore |

Howard Street Tunnel Project |

$125,000,000 |

$441,000,000 |

28% |

| ME |

Madawaska |

Madawaska International Bridge Replacement Project |

$36,000,000 |

$71,500,000 |

50% |

| MO |

Rocheport |

I-70 Rocheport Bridge & Mineola Hill Climbing Lanes |

$81,200,000 |

$255,801,380 |

32% |

| MS |

Itawamba County |

Freight and Capacity Improvements to SR 76 in Itawamba County |

$52,400,000 |

$96,000,000 |

55% |

| OH |

Cleveland |

Irishtown Bend M-90 Corridor Bank Stabilization |

$9,020,000 |

$31,875,430 |

28% |

| OR |

Bend |

US 97 Bend North Corridor Project (US 97 and US 20 Components) |

$60,400,000 |

$133,400,000 |

45% |

| RI |

Providence |

Transforming the Providence I-95 Northbound Viaduct |

$60,355,000 |

$250,000,000 |

24% |

| SD |

Pierre |

US14/US83/SD 34 MIssouri River Bridge |

$13,010,000 |

$46,228,000 |

28% |

| TX |

Greater DFW Area |

North Texas Strategic NHS Bridge Program (Bridges 2,5,6,9,10,11,12) |

$8,775,000 |

$45,312,000 |

19% |

| WA |

Union Gap |

Regional Beltway Connector |

$6,660,000 |

$17,950,000 |

37% |

| WV |

Wetzel County |

WV 2: Proctor to Kent |

$9,400,000 |

$97,000,000 |

10% |

|

|

TOTAL |

$855,950,000 |

$4,347,093,443 |

20% |