1 Associated Press, Shipyard Closing Reflects Decline of a U.S. Industry, Los Angeles Times, August 8, 1985

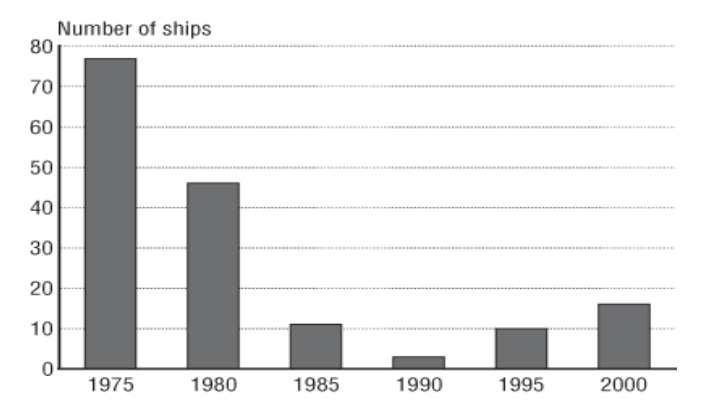

2 U.S. Department of Transportation, Transportation Statistics Annual Report 2001, Figure 1: https://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/transportation_statistics_annu al_report/2001/html/chapter_05_figure_01_132.html

3 U.S. Department of Transportation, Maritime Trade and Transportation, 2007, Table 7-2 https://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/maritime_trade_and_transport ation/2007/html/table_07_02.html

4 Shipbuilding, available at Homeland Security Digital Library: https://www.hsdl.org/?view&did=1759, page 15-3

5 The Future of American Shipbuilding, Marinelink.com, https://www.marinelink.com/article/shipbuilding/the-future-american-shipbuilding-805

6 Dun and Bradstreet, Shipbuilding: Regulatory and Policy Benchmarking, https://www.dsir.gov.in/reports/isr1/Shipping/9_7.pdf

7 The World Bank GDP per capita data available at: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?page=5

8 Associated Press, Shipyard Closing Reflects Decline of a U.S. Industry, Los Angeles Times, August 8, 1985 https://articles.latimes.com/1985-08-08/business/fi-3538_1_american-shipyard

9 Giles, Warren, WTO Finds South Korean Shipbuilding Subsidies Illegal, Bloomberg, March 7, 2005 https://www.bloomberg.com/apps/news?pid=newsarchive&sid=aWE0lGT7qzS0

10 European Parliament Fact Sheets, Shipbuilding, 4.7.3, available at: https://www.europarl.europa.eu/facts_2004/4_7_3_en.htm

11 Department of Transportation, Maritime Trade and Transportation, 2007, Table 7-2 https://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/maritime_trade_and_transport ation/2007/html/table_07_02.html

12 Britton, Rob, The Tilted Playing Field in International Airline Competition, Huffington Post, April 8, 2015 https://www.huffingtonpost.com/rob-britton/the-tilted-playing-field-_b_7028344.html

13 Emirates to make Orlando its 10th U.S. destination”, USA Today, March 24, 2015; “Emirates Adds 2nd daily Seattle Service from July”, https://airlineroute.net/2015/03/24/ek-sea-jul15/; “Emirates Adding Second Daily Dubai-Boston Flight”, TravelPulse, April 13, 2015. “Qatar Airways Set to Expand its USA Network with the Addition of Three New Routes”, Qatar Airways Press Release, May 4, 2015. https://www.qatarairways.com/global/en/press-release.page?pr_id=pressrelease_usa.

14 Lee, Darin and Amel, Eric, Assessing the Impact of Subsidized Gulf Carrier Expansion on U.S.- International Passenger Traffic, May, 2015 https://www.openandfairskies.com/wp- content/uploads/2015/05/CL-paper-on-Gulf-Carrier-Traffic-1.pdf, pages 2-3

15 ibid

16 An Assessment of Maritime Trade and Technology, Washington, D.C.: U.S. Congress, Office of Technology Assessment, OTA-O-220, October 1983, Chapter 4, page 100, can be found at: https://www.princeton.edu/~ota/disk3/1983/8302/830206.PDF

17 United States Census Bureau, U.S Economic Census 2012, NAICS code 336611 Shipbuilding and repairing. Note that this number is consistent with DoT’s analysis which estimated 107,000 jobs in ship building, The Economic Importance of the U.S. Shipbuilding and Repairing Industry, MARAD, May 30, 2013, available at: //www.marad.dot.gov/wp- content/uploads/pdf/MARAD_Econ_Study_Final_Report_2013.pdf

18 Toossi, Mitra, Labor Force Change, 1950-2050, Monthly Labor Review, May 2002, Bureau of Labor Statistics, available at: https://www.bls.gov/opub/mlr/2002/05/art2full.pdf

19 The Economic Importance of the U.S. Shipbuilding and Repairing Industry, MARAD, May 30, 2013, available at ://www.marad.dot.gov/wp- content/uploads/pdf/MARAD_Econ_Study_Final_Report_2013.pdf (page E-2)

20 Bureau of Labor Statistics, Establishment Data for State Employment, Seasonally Adjusted, Table D-1 available at: https://www.bls.gov/web/laus/tabled1.pdf

21 Congressional Record, U.S. Senate, October 23, 1995 page 28996 which can be found at: https://books.google.com/books?id=HH9KOKGZJJYC&pg=PA28996&lpg=PA28996&dq=how+many+ shipbuilding+jobs+1980&source=bl&ots=Vk5a2XHg1Z&sig=Epr5bJiFlJbJ4cXhpsPyZ7- 53kU&hl=en&sa=X&ei=88dgVdvTCIiryAS8lIGwBQ&ved=0CFEQ6AEwBw#v=onepage&q=how%20m any%20shipbuilding%20jobs%201980&f=false

22 Senville, Wayne, Keeping the Economy Afloat, PlannersWeb, Nov. 2012, available at: https://plannersweb.com/2012/11/keeping-economy-afloat/

23 State of Maine, Department of Labor, Top 50 Private Employers in Maine, 2015, available at: https://www.maine.gov/labor/cwri/publications/pdf/MaineTop50Employers.pdf

24 United States Census Bureau, U.S Economic Census 2012, NAICS code 336611 https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ECN_2012_US_0 0A1&prodType=table. This is a conservative estimate given that there are other forms of aviation that might be affected

25 Americans 4 Aviation, Creating Jobs, 2015 available at: https://airlines.org/industry/#economic

26 Partnership for Open and Fair Skies, Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar and the UAE, January 28, 2015, available at: https://www.openandfairskies.com/wp-content/themes/custom/media/White.Paper.pdf, page 51. 27 Comments on Gulf Carrier Subsidy Claims, United States Government Questions and Answers, US Docket DOS-2015-0016-001, Technical and Clarification Questions on the Gulf Subsidies Report, available at: https://www.regulations.gov/#!documentDetail;D=DOS-2015-0016-1300

28 Oxford Economics, Economic Benefits from Air Transport in the US, 2011, available at: https://www.iata.org/policy/Documents/Benefits-of-Aviation-US-2011.pdf

29 462 jobs calculated using the indirect multiplier of 1.64 and the induced multiplier of 0.42 from Oxford Economics above.

30 This analysis uses the standard point estimates for multipliers and jobs created. Given the inherent statistical variance around these estimates, I prefer to use more rounded figures, which are statistically identical to those derived from point estimates. Put another way, the exact figures multiply out to 1,731.95 jobs using the Oxford analysis. Statistically that is identical to 1,730.

31 Partnership for Open and Fair Skies, Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar and the UAE, January 28, 2015, page 51

32 Lee, Darin and Amel, Eric, Assessing the Impact of Subsidized Gulf Carrier Expansion on U.S.- International Passenger Traffic, May, 2015, page 3

33 Partnership for Open and Fair Skies, Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar and the UAE, January 28, 2015, page 47

34 Readling, Brigid, World Population Hitting 7 Billion, October 2011, available at: https://www.earth- policy.org/indicators/C40/population_2011

35 Britton, Rob, Big Three: U.S. Airlines Versus Persian Gulf Carriers, Forbes, May 2015, available at: https://www.forbes.com/sites/realspin/2015/05/12/the-big-three-u-s-airlines-versus-persian-gulf- carriers/

36 Partnership for Open and Fair Skies, Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar and the UAE, January 28, 2015, page 5

37 Americans 4 Aviation, Creating Jobs, 2015 available at: https://airlines.org/industry/#economic

38 Department of Transportation, MARAD Report: Nation’s Shipyards Support $36 billion in GDP, July, 2013, available at: https://www.dot.gov/briefing-room/marad-report-nation%E2%80%99s- shipyards-support-36-billion-gross-domestic-product

39 Congressional Budget Office, The Distribution of Household Income and Federal Taxes 2011, November, 2014 available at https://www.cbo.gov/publication/49440

40 Boehner, John, Boehner Discusses GOP Solutions for Middle-Class Families, January 2015, available at: https://www.speaker.gov/video/boehner-discusses-gop-solutions-middle-class-families

41 Obama, Barack, State of the Union Address, January 2014, available at: https://www.whitehouse.gov/the-press-office/2014/01/28/president-barack-obamas-state-union- address

42 U.S. Treasury Department and Council of Economic Advisors, An Economic Analysis of Infrastructure Investment, 2010, available at: https://www.treasury.gov/resource-center/economic policy/Documents/infrastructure_investment_report.pdf

43 White, Ronald, Full Steam Ahead for Nascco Shipyard in San Diego, Los Angeles Times, July, 2011, available at: https://articles.latimes.com/2011/jul/03/business/la-fi-made-in-california-shipyard- 20110703

44 U.S. Congressional Record, Statement of Senator Breaux, October 23, 1995.

45 Costello, John and Kavanagh, David, Sun Shipbuilding and Dry Dock Co. A Short History, Sun Ship Historical Society, 2007, available at: https://www.sunship.org/sshs_short_history001.pdf

46 U.S. Department of Commerce, Maritime Administration, Report on Survey of U.S. Shipbuilding and Repair Facilities, 1980, available at: https://www.marad.dot.gov/wp-content/uploads/pdf/1980_- _Report_on_Survey_of_US_Shipbuilding_and_Repair_Facilities.pdf

47 ibid

48 U.S. Census Department data as reported at https://en.wikipedia.org/wiki/Chester,_Pennsylvania and https://en.wikipedia.org/wiki/Demographics_of_Philadelphia

49 Dorwart, Jeffery, Shipbuilding and Shipyards, The Encyclopedia of Greater Philadelphia, Rutgers University, 2013, available at: https://philadelphiaencyclopedia.org/archive/shipbuilding-and- shipyards/

50 Button, Kenneth and Stough, Roger, Air Transport Networks: Theory and Policy Implications, Edward Elgar Publishing, 2000 page 254

51 Partnership for Open and Fair Skies, Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar and the UAE, January 28, 2015

52 Lipinski, Dan, Dold, Bob, and more, letter to Secretary Kerry and Secretary Foxx, April 30, 2015, available at: https://lipinski.house.gov/uploads/Bipartisan%20Letter%20to%20Secretary%20of%20State%20Jo hn%20Kerry%20and%20Transportation%20Secretary%20Anthony%20Foxx.pdf

53 ibid