The COVID-19 pandemic has prompted a reconsideration of nearly all aspects of the November 2020 elections, from campaigning and fundraising to the act of voting itself. Several states have delayed their spring primary elections and lawmakers have introduced legislation to expand vote-by-mail amid a patchwork of state regulations. For transportation agencies looking beyond current revenue shortfalls, the economic crisis appears likely to affect plans to place transportation measures on the ballot this year.

An immediate challenge facing transportation ballot measures is the physical barrier to election activities. In some communities, stay-at-home orders and social distancing requirements have already affected the ability of petitioners to place initiatives and referenda on the ballot. Some states and cities have adjusted requirements or deadlines for signature collection, while others are undergoing litigation. In Utah, Governor Gary Herbert issued an executive order suspending several rules governing signature collection, binding and mailing of petition packets, as well as allowing signature collection via fax or e-mail. Washington State allows petitioners to file referendum and initiatives online amid closure of the State election office, while the State of Oklahoma has pushed forward the 90 day window for signature collection until the State’s emergency declaration is lifted. Attempts to permit digital signature collection and modify existing laws governing ballot measures are under litigation or legislative debate in states including Massachusetts, Arizona, Montana, and Ohio.

In addition to limits on traditional campaign activity, the economic uncertainty surrounding COVID-19 will have a significant impact on whether localities move forward with planned transportation ballot measures. Traditional revenue streams for many state and local governments – like income, fuel, property, and sales taxes – have taken a major hit, placing significant financial stress on local budgets. Additionally, investors have withdrawn an unprecedented amount of money from the municipal bond market, making it difficult for governments to borrow.

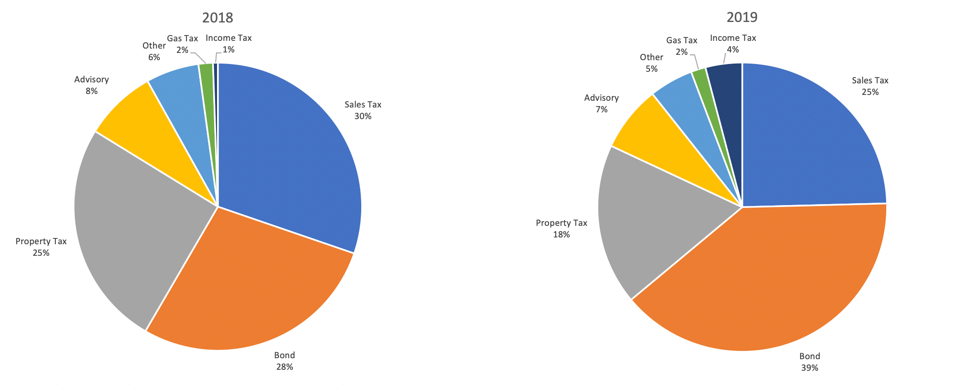

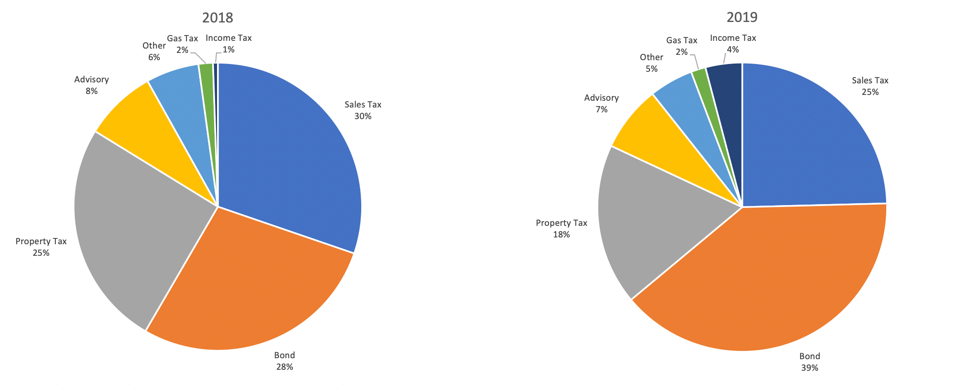

Over the past decade, voter approved sales taxes and bond measures have become an increasingly common source for new investments in transportation and as a source of matching funds for Federal grants. In 2018, nearly 60% of all transportation ballot measures were local sales tax or property tax measures, while a quarter were general obligation bonds. These patterns also held up during the relatively light 2019 election cycle. As uncertainty around tax revenue projections and the municipal bond market continues to rise, communities are likely to revisit plans to bring local tax or bond measures to voters.

Ballot Measures by Type (% of all Measures)

Source: Eno Transportation at the Ballot Box Database

Measures potentially affected by the COVID-19 crisis are not only intended to fund new investments, but also include renewals of taxes from past election cycles that fund existing services. Among the measures slated to appear on ballots this year include a potential multi-billion dollar transit measure in Austin, a 0.8% sales tax increase measure to fund bus service in Cincinnati (Issue 7), and a $7 billion transportation bond in Portland. While voters in Cincinnati will have until April 28 to mail in their ballots and vote on Issue 7 amid the postponement of Ohio’s March 17 primary, the fate of other measures scheduled for later in the spring and fall is less clear.

Several municipalities have already begun withdrawing or postponing ballot measures for 2020. The Faster Bay Area coalition recently tabled their efforts to put a one-cent sales tax increase to invest nearly $100 billion in public transit on the November ballot across the nine county region, while San Diego officially called off its ElevateSD measure. ElevateSD would have asked voters for a half-cent sales tax increase to fund a range of proposed projects including new bus routes, a trolley extension to the airport, and free fares for youth riders.

Similar actions have been taken in Bend, Oregon, where a $190 million bond measure for May has been postponed, and King County, which is no longer pursuing an August sales tax measure to renew funding for bus service and transit passes for students as part of the Seattle Transportation Benefit District. The benefit district is currently funded by a 0.1% sales tax and $60 car tab fee passed in 2014, which expires at the end of the year, though a city-only measure has not yet been ruled out.

On the other hand, several transportation ballot measures appear to be on track to proceed: a $105 million statewide transportation bond in Maine, a $6.7 billion transit expansion measure in Gwinnett County, Georgia, a May renewal of a 10 cent-per-gallon gas tax in Portland, a half-cent sales tax increase in Sacramento, and a 1/8-cent sales tax measure to raise $100 million a year for CalTrain in the Bay Area. Some municipalities that are scheduled to finalize funding mechanisms and project lists for their November measures during the spring and summer are beginning to openly reassess their timelines and financial situation, such as for Portland’s November bond, Austin’s multi-billion dollar transit measure, and San Antonio’s $40 million transportation measure in November. Further announcements are likely to come in the weeks and months ahead, particularly as localities approach their deadlines for placing measures on the ballot. It remains to be seen whether agencies will move ahead with their measures, or if the initial round of withdrawals and postponements are a warning sign of more to come.

The potential disruption of transportation ballot measures is yet another example of the challenges facing governments and transit agencies, who rely heavily on bonding and local tax revenue not only to fund new infrastructure, but also for day-to-day operations. Almost a third of all transit funding nationwide – $24 billion – comes from local funding sources and agency levied taxes, of which 54% ($13 billion) comes from sales taxes.[1] As shown below, local revenue also provides a majority of capital and operations funding for many of the nation’s largest transit agencies, who are already reeling from a collapse in fare revenue.

Share of Capital and Operational Expenditures by Funding Source

| Agency |

Expenditure Type |

Fares |

Local |

State |

Federal |

| New York City MTA |

Capital |

63% |

5% |

6% |

25% |

|

Operations |

55% |

15% |

31% |

0% |

| MBTA (Boston) |

Capital |

0% |

0% |

45% |

55% |

|

Operations |

46% |

10% |

44% |

0% |

| CTA (Chicago) |

Capital |

0% |

23% |

1% |

76% |

|

Operations |

44% |

36% |

20% |

1% |

| WMATA (DC) |

Capital |

0% |

29% |

17% |

54% |

|

Operations |

41% |

32% |

21% |

6% |

| SEPTA (Philadelphia) |

Capital |

0% |

22% |

45% |

33% |

|

Operations |

38% |

7% |

49% |

6% |

| King County Metro (Seattle) |

Capital |

6% |

50% |

1% |

42% |

|

Operations |

35% |

62% |

3% |

0% |

| San Diego MTS |

Capital |

0% |

36% |

14% |

50% |

|

Operations |

34% |

15% |

28% |

22% |

| MARTA (Atlanta) |

Capital |

0% |

85% |

1% |

14% |

|

Operations |

33% |

55% |

0% |

11% |

| SFMTA (San Francisco) |

Capital |

0% |

23% |

11% |

66% |

|

Operations |

30% |

53% |

15% |

1% |

| RTD (Denver) |

Capital |

0% |

84% |

2% |

13% |

|

Operations |

27% |

60% |

0% |

13% |

| Tri-Met (Portland) |

Capital |

0% |

92% |

1% |

7% |

|

Operations |

27% |

51% |

0% |

22% |

| Metro Transit (Minneapolis) |

Capital |

0% |

77% |

8% |

15% |

|

Operations |

27% |

7% |

61% |

5% |

| UTA (Salt Lake City) |

Capital |

0% |

54% |

9% |

37% |

|

Operations |

20% |

66% |

0% |

14% |

| LA Metro |

Capital |

0% |

58% |

6% |

36% |

|

Operations |

19% |

53% |

11% |

16% |

| DART (Dallas) |

Capital |

0% |

22% |

0% |

78% |

|

Operations |

16% |

80% |

0% |

4% |

| Harris County Metro (Houston) |

Capital |

0% |

94% |

0% |

6% |

|

Operations |

13% |

76% |

0% |

11% |

Source: 2018 National Transit Database

Nationwide, agency levied taxes and local funding play a slightly larger role in funding capital expenditures than operations (37% of capital expenditures vs 33% of operational expenditures), though these shares vary by agency.1 From 2017 to 2018, local funding for capital expenditures increased by nearly 13% while funding for operations increased by roughly 2%.[2] Given the limited Federal role in funding transit operations, the extent to which agencies rely on local revenue for operations is dependent on their farebox revenue and level of state funding for transit. Agencies that receive less state or Federal funding for capital investments may rely heavily on local funding to cover capital projects or generate matching funds to procure federal grants.

Agencies like King County Metro, MARTA, and Harris County METRO rely heavily on local revenue for both operations and capital, while others rely on local funding for one or the other. Metro Transit in Minneapolis is far more reliant on local revenue for capital expenditures (77% for capital versus 7% for operations), while the opposite pattern holds true for DART in Dallas (22% for capital expenditures versus 80% for operations). These differences not only illustrate which agencies are most vulnerable to tax revenue shortfalls, but can also explain whether ballot measures are more likely to support new capital investment or operations (i.e. more frequent service or free/reduced fare programs). As a result, postponement of ballot measures may result in delaying new capital projects for some agencies, or curtailing operations for others, particularly if existing taxes set to expire at the end of 2020 are not renewed.

Transit agencies received a vital $25 billion in emergency aid from Congress to cover operating costs. But the ongoing COVID-19 crisis has raised questions about the future of transit funding and the extent to which any new funds will have to be used to cover basic operations and force agencies to delay capital or state-of-good-repair projects. The looming decisions over whether or not to proceed with ballot measures underscores the difficult need to balance service and capital expansion to meet future transportation demands with immediate financial and operational concerns in the wake of the economic crisis. As municipalities and agencies continue to assess the fallout from COVID-19, the fate of 2020 ballot measures will determine agencies’ outlook and direction for the years ahead.

[1] Source: 2018 National Transit Database

[2] Source: 2020 APTA Fact Book