The House of Representatives and Senate have left town for the year after passing two mammoth spending and tax bills with a total fiscal impact of $2.9 trillion. Both measures are expected to be signed into law by President Trump on Friday, December 19, averting any possible government shutdown and fully funding the federal government for the remainder of fiscal year 2020.

The 12 annual appropriations bills were split into two packages – one revolving around the Defense and Homeland Security bills, which could reliably draw more Republican votes, and the other with domestic priorities featuring Democratic wins (to which were attached extensive changes in tax policy), to pass with more Democratic votes.

The first package (“Consolidated Appropriations Act, 2020”) contains 4 of the 12 annual appropriations bills, (Defense, Homeland Security, Commerce-Justice-Science, and Financial Services) and was piggybacked onto an unrelated bill, H.R. 1158. That package passed the House on December 17 by a vote of 280 to 138 (Republicans voted 130 to 62 in favor of the bill; Democrats voted 150 to 75). Then, on December 19, the Senate passed the legislation by a vote of 82 to 11 (7 Dem no votes, 4 GOP no votes).

The second package (“Further Consolidated Appropriations Act, 2020”) contains the other 8 spending bills (Agriculture, Energy and Water, Interior-Environment, Labor-HHS-Education, Legislative Branch, Military Construction/VA, State/Foreign Operations, and Transportation-HUD) as well as a a wide variety of “other matters” including expensive health care extenders and repeal of Obamacare taxes (especially permanent repeal of the so-called “Cadillac tax” which by itself reduces projected tax revenues by $201 billion over 10 years) and a package of extenders of expiring tax provisions. After hijacking the unrelated bill H.R.1865, the House passed the package on December 17 by a vote of 297 to 120 (Democrats voted 218 to 7 in favor; Republicans voted against by a margin of 112 to 79). Then, the Senate on December 19 approved the legislation by a vote of 77 to 16 (10 Republicans and 6 Democrats voted no).

Transportation tax extenders. The tax extenders package added to H.R. 1865 immediately prior to House passage includes section 112, retroactively extending the railroad maintenance tax credit for short line railroads in section 45G of the tax code, which expired January 1, 2018, to January 1, 2023. The amendment extends the biodiesel tax credit in section 40A of the tax code and several other alternative fuels credits from their expiration on December 31, 2017 through December 31, 2020. And section 302 of the amendment repeals the provision of the 2017 tax law that treats employer-provided parking and transit benefits provided by tax-exempt entities as unrelated business taxable income (the so-called “church parking lot tax“), retroactive to the enactment of the 2017 law.

The cost. In all, the cost of the two packages together (per the Congressional Budget Office’s new cost estimates for bill 1 and bill 2) is $2.9 trillion – $1.4 trillion in discretionary appropriations for 2020, an additional $1.1 trillion in mandatory appropriations for 2020 that no one ever talks about, and $391 million in 10-year costs of all of the other stuff in the second bill. Tax extenders as a self-executed amendment added another $54 billion per JCT. Excluding emergency appropriations, here is the total fiscal impact so far, in billions of dollars:

|

|

Package 1 |

Package 2 |

Total |

|

|

|

|

|

| FY20 Discretionary Appropriations |

|

|

|

|

Base Defense |

630.6 |

35.9 |

666.5 |

|

Base Non-Defense |

137.0 |

484.5 |

621.5 |

|

Overseas Contingency Operations |

70.9 |

8.6 |

79.5 |

|

Other Discretionary |

20.0 |

4.7 |

24.7 |

|

Subtotal, Discretionary |

858.5 |

533.7 |

1,392.2 |

|

|

|

|

|

| FY20 Mandatory Appropriations |

24.8 |

1,051.0 |

1,075.8 |

|

|

|

|

|

| 10-Year Increases in Direct Mandatory Spending |

0.0 |

22.5 |

22.5 |

|

|

|

|

|

| 10-Year Decreases in Tax Revenues (Base Bill) |

0.0 |

368.2 |

368.2 |

|

|

|

|

|

| 10-Year Decreases in Tax Revenues (Extenders Add-on) |

0.0 |

53.8 |

53.8 |

|

|

|

|

|

| Total Fiscal Impact |

883.3 |

2,029.2 |

2,912.5 |

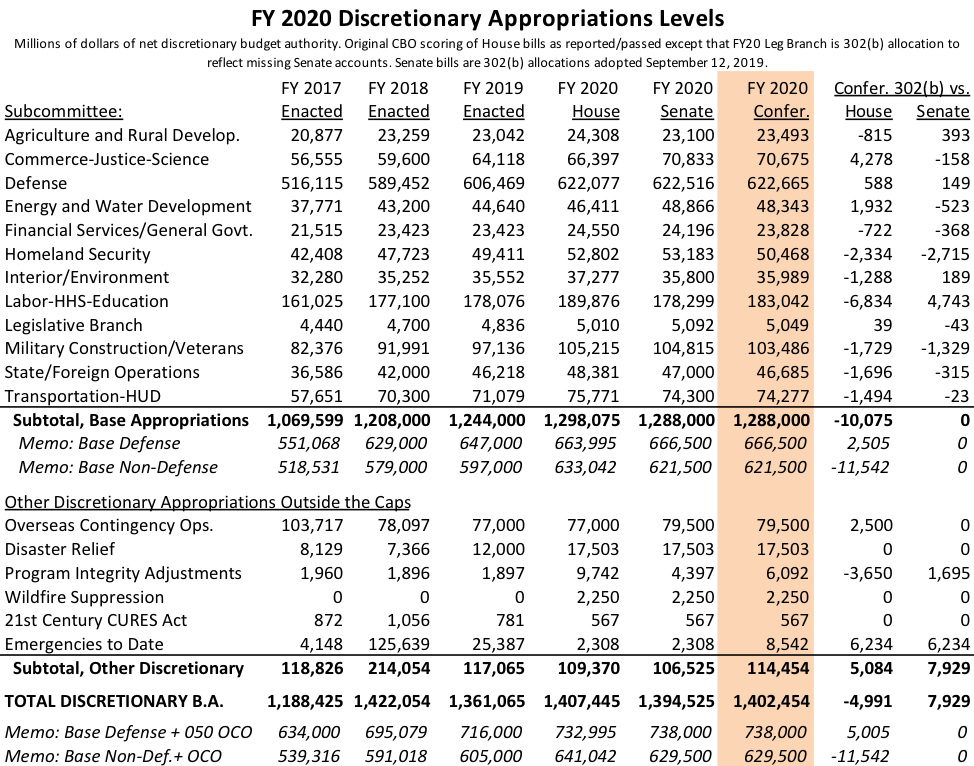

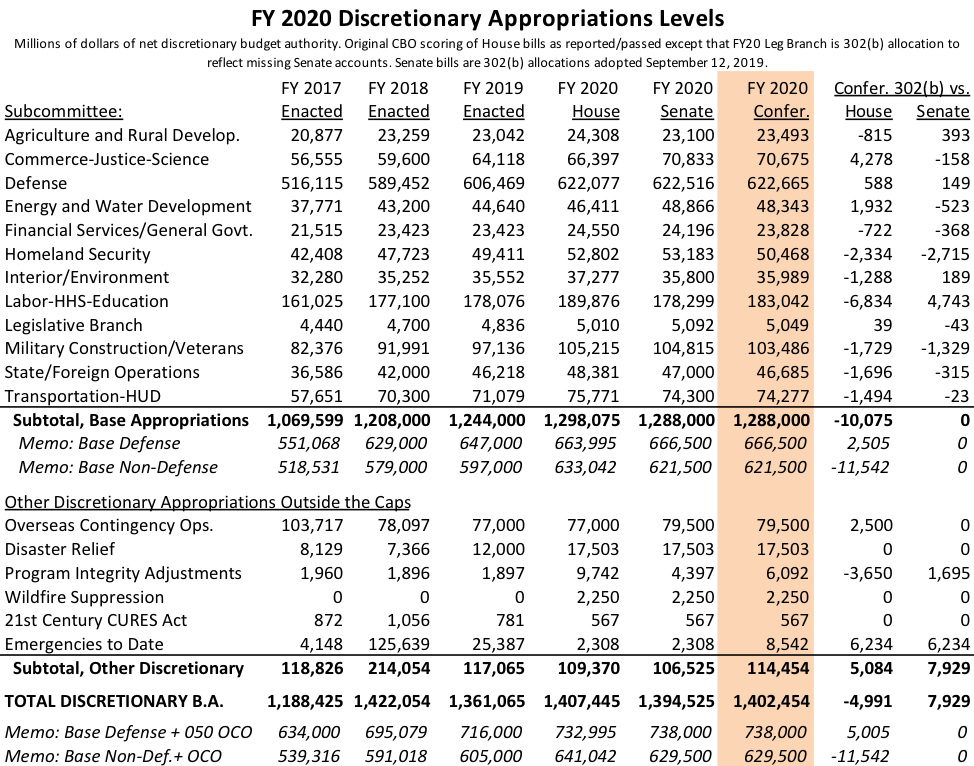

Final totals for the 12 appropriations bills. Just in terms of discretionary appropriations, when you add in re-estimates of 2020 emergency appropriations already enacted, here is how the Congressional Budget Office scores of the final twelve appropriations bills line up to the versions of the bill originated by the House and Senate, and to the three prior years:

As you can see, the House-passed bills (drafted before there was a bipartisan agreement on overall spending totals had to be reduced by a collective $10 billion to hit budget caps – non-defense spending had to come down $11.5 billion and defense had to come up $2.5 billion. And the House’s Commerce-Justice-Science had to count an additional $4.2 billion under the non-defense cap because the amount of one-time spending for the 2020 Census outside the non-defense cap was reduced from the House’s $7.5 billion down to $2.5 billion. Most of the non-defense reduction from the House-passed levels came out of the Labor-HHS-Education bill. But both chambers were able to reduce the cost of their Homeland Security bills because the final resolution of the U.S.-Mexico border wall was not to increase the explicit appropriation for it from last year’s levels but instead to once again let the President transfer money from elsewhere in the budget.

Elsewhere in this issue, we have the following articles summarizing the two fiscal bills agreed to this week:

Reminder: every budget, bill, report, document, or other analysis relating to the FY 2020 federal transportation budget can be found at enotrans.org/fy20