The nonpartisan Congressional Budget Office issued its updated Budget and Economic Outlook for the year yesterday.

The headline news out of the entire document was CBO’s estimate that, during the just-ended fiscal year 2020, the U.S. public debt held by the public grew to exceed gross domestic product ever-so-slightly at the end of the year in September ($21.02 trillion in debt versus $21.00 trillion in GDP). This was the first time since 1946 that year-end debt subject to limit has exceeded GDP.

This was caused by the combination of a huge spending spree and a sharp economic contraction, which both reduced federal tax collections and temporarily shrank GDP, which is the denominator side of that calculation. Even through growth is expected to rebound, CBO thinks that debt will increase more rapidly. CBO projects that debt as a share of GDP will rise to 102.3 percent of GDP by September 30, 2021 and thence to around 107 percent a decade from now. (The WWII-era high was 106 percent.)

Like Hemingway said about bankruptcy, the crossing of the line came slowly, then suddenly:

| Public Debt Held by the Public As a Percentage of GDP, End-of-Fiscal-Year |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| 65.8% |

70.3% |

72.2% |

73.7% |

72.5% |

76.4% |

76.0% |

77.4% |

79.2% |

100.1% |

Transportation taxes. The revenue portion of the new forecast estimates that, at current tax rates enshrined in law (if extended indefinitely), the receipts from Highway Trust Fund excise taxes will be fully recovered back to their predicted pre-COVID levels in fiscal 2022 (almost). HTF tax receipts were $43.6 billion in the fully pre-COVID fiscal year 2019 and dipped to $42.7 billion in FY 2020. They should have dropped by more than that in 2020, but for a lot of snail-mail tax returns and other documents that sat, unopened, at IRS headquarters for the better part of last year.

Now that the mail is being opened, the estimated taxes paid electronically by oil producers are being reconciled with the (actual) subsequent paper filings, which is lowering the net fiscal 2021 tax collections for things that should have been credited against 2020. CBO has estimated this into a $3.3 billion “timing adjustment” lowering the Trust Fund’s 2021 net total by that amount, to $36.9 billion.

CBO then projects receipts to increase back to $42.7 billion in 2022 and then stay right around that level for six more years, as small growth in trucking taxes counteracts a small but steady decline in motor fuel tax receipts.

| CBO February 2021 Baseline Projections – Highway Trust Fund Net Tax Receipts (Million $$) |

|

|

|

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY31 |

|

Gasoline etc. |

25,289 |

23,235 |

25,250 |

25,166 |

24,984 |

24,773 |

24,589 |

24,431 |

24,271 |

24,131 |

24,005 |

23,871 |

|

Diesel/other fuels |

10,447 |

10,366 |

10,538 |

10,613 |

10,696 |

10,771 |

10,814 |

10,809 |

10,788 |

10,767 |

10,746 |

10,721 |

|

Truck/tractor/trailer sales |

4,951 |

4,793 |

5,003 |

5,005 |

5,065 |

5,194 |

5,301 |

5,425 |

5,579 |

5,750 |

5,917 |

6,084 |

|

Tires for heavy vehicles |

507 |

518 |

535 |

547 |

559 |

572 |

584 |

593 |

603 |

612 |

622 |

632 |

|

Heavy vehicle use tax |

1,463 |

1,295 |

1,336 |

1,366 |

1,398 |

1,430 |

1,459 |

1,483 |

1,507 |

1,531 |

1,554 |

1,579 |

|

Timing adjustment |

0 |

-3,289 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Total, HTF receipts |

42,656 |

36,918 |

42,662 |

42,697 |

42,702 |

42,740 |

42,747 |

42,741 |

42,748 |

42,791 |

42,844 |

42,887 |

CBO projects demand for civil aviation to rebound more slowly. In the pre-COVID fiscal 2019, net tax receipts for the Airport and Airway Trust Fund totaled $15.8 billion. Halfway through fiscal 2020, as COVID began spreading, Congress suspended the excise taxes on commercial aviation that supported the Trust Fund. As a result, total AATF tax receipts dropped to $9.0 billion for that year. The tax holiday lasted through December 31, 2020, so it also killed the first quarter of fiscal 2021. But even now that the taxes have returned, the volume of passenger travel and fuel use being taxed is still down significantly.

As a result, CBO projects AATF tax receipts will only be $9.4 billion in fiscal 2021 and then rise to $14.6 billion in 2022. Only in 2023 are tax receipts, at $16.2 billion, projected to once again exceed the 2019 level of $15.8 billion. (But, unlike highway taxes, the aviation excises have real growth anticipated thereafter.)

| CBO February 2021 Baseline Projections – Airport and Airway Trust Fund Net Tax Receipts (Million $$) |

|

|

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY31 |

|

Domestic air passengers |

6,497 |

5,931 |

9,570 |

10,752 |

11,991 |

12,431 |

12,857 |

13,271 |

13,691 |

14,126 |

14,560 |

14,981 |

|

International air passengers |

1,847 |

2,559 |

3,826 |

4,176 |

4,509 |

4,703 |

4,850 |

4,994 |

5,140 |

5,291 |

5,446 |

5,549 |

|

Air cargo (freight) transportation |

300 |

500 |

648 |

637 |

627 |

630 |

637 |

642 |

647 |

652 |

657 |

662 |

|

Aviation fuels |

390 |

425 |

583 |

600 |

615 |

616 |

617 |

617 |

617 |

617 |

617 |

618 |

|

Refunds |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

-14 |

|

|

Total, AATF receipts |

9,020 |

9,401 |

14,613 |

16,151 |

17,728 |

18,366 |

18,947 |

19,510 |

20,081 |

20,672 |

21,266 |

21,796 |

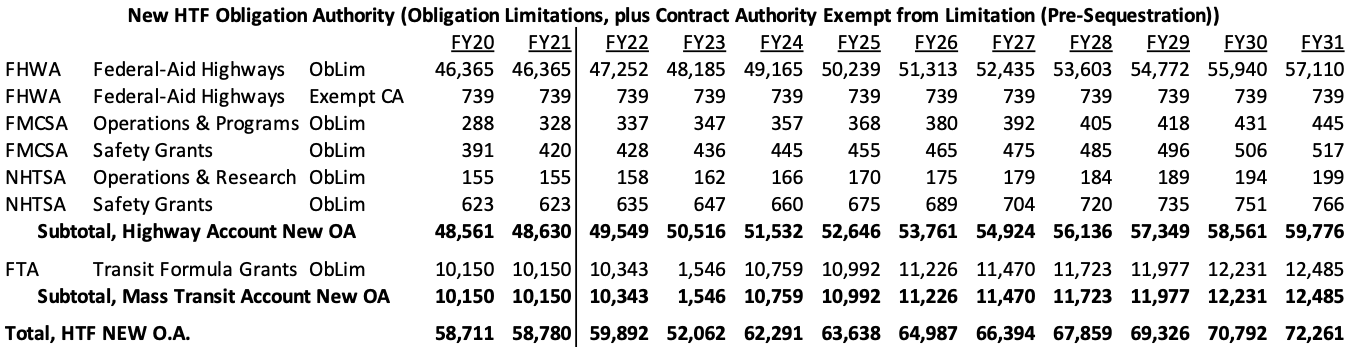

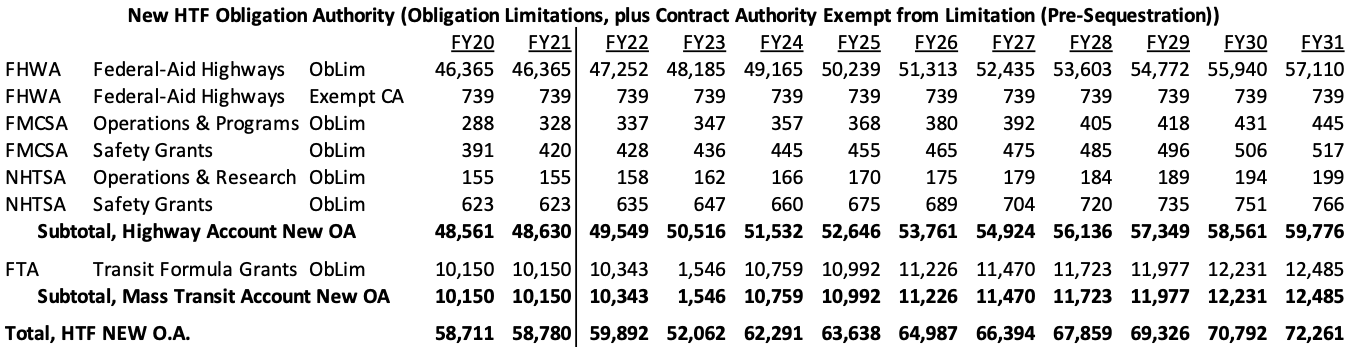

Transportation spending. Rules set in the mid-1980s govern how CBO, and their White House counterparts, have to construct the “baseline” for future spending levels. Accounts that are subject to annual appropriations (the discretionary budget) get the most recently enacted total amount of budget authority, extrapolated forward for annual inflation increases (personnel accounts get a slightly different inflation bump than other accounts). For other accounts, entitlement programs get baseline increases based on demographic changes in the populations they serve, and for cost adjustments. Other multi-year programs (like contract authority for transportation trust fund programs) are frozen in perpetuity and extended at the same level of the final year of the last authorization law.

Then CBO looks at each year’s amount of old and new budget authority, estimates how long it will take to obligate and spend out, and estimates how much cash will be disbursed by the Treasury for each account each year.

Highway Trust Fund programs are more complicated. Contract authority is frozen at the last year’s level (so, for example, Transit Formula Grants contract authority in the baseline is $10.15 billion every year, from 2020 to 2031). But CBO projects the outlays from that spending based on the annual obligation limitation on each account in the annual appropriations bills. Those “ob limits” get annual inflation increases. So, while for fiscal 2021, the new contract authority for Transit Formula Grants is $10.15 billion and the ob limit on that account is also $10.15 billion, the baseline predicts that by 2031, the ob limit will have grown to $12.49 billion, while the annual amount of new contract authority is still $10.15 billion per year.

(Yes, this also causes annual outlays to increase above new budget authority, which eventually becomes impossible in the real world, but trust fund budgeting requires you to assume several impossible things at once.)

Starting in 2012, the Senate Budget Committee started letting the transportation committees use the inflation-adjusted obligation limitation baseline instead of the frozen-forever budget authority baseline when drafting transportation reauthorization bills.

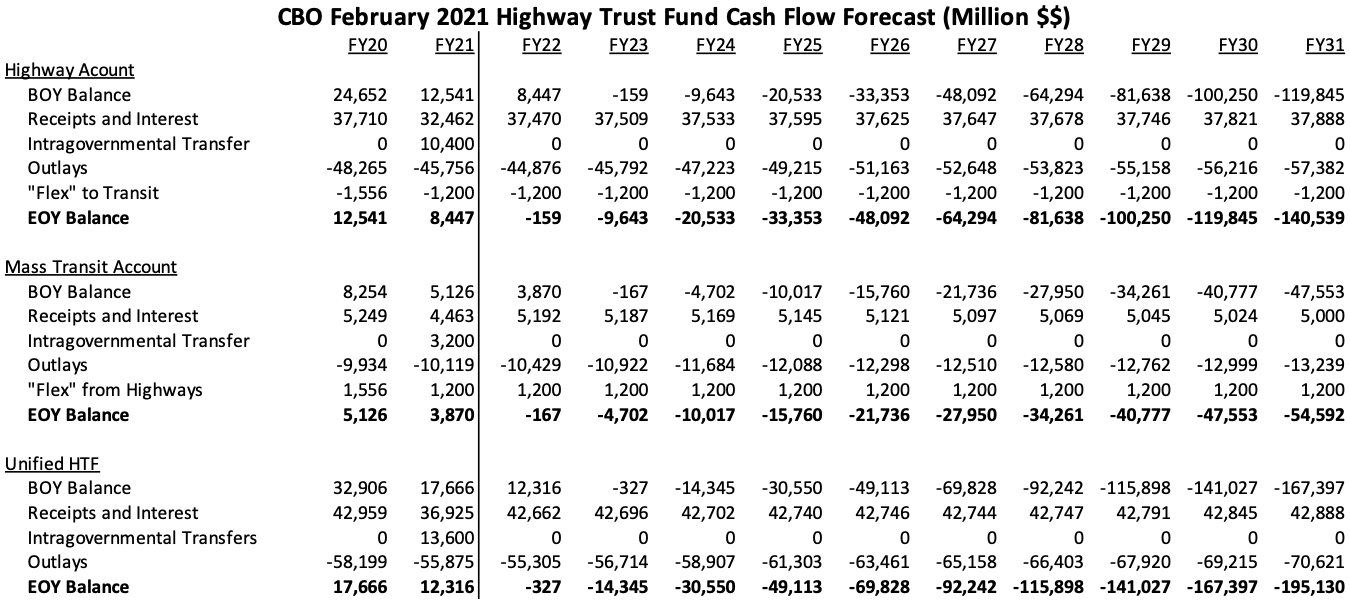

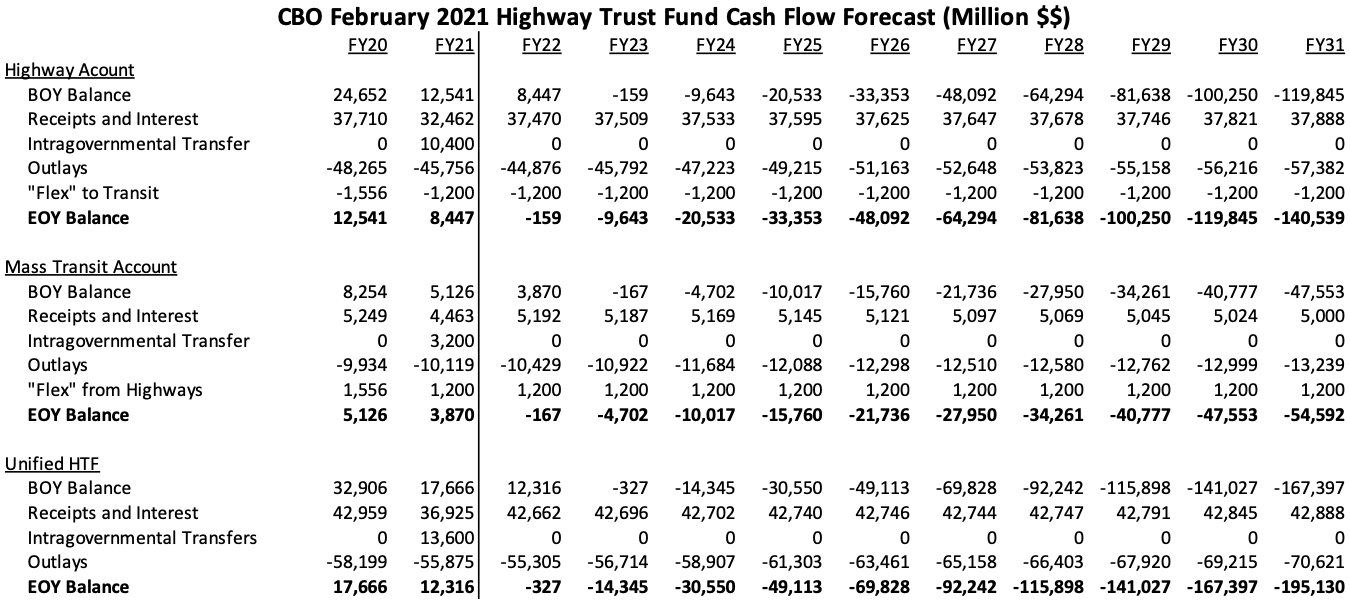

Highway Trust Fund cash flow. The tax revenues above, and the outlays from the obligation authority numbers shown immediately above, combine to form the newly updated Highway Trust Fund cash flow forecast. With the $13.6 billion from the general fund transferred to the Trust Fund last October ($10.4 billion to the Highway Account and $3.2 billion to the Mass Transit Account), CBO projects that at these spending rates, both accounts of the Trust Fund will remain solvent until summer 2022. (Slightly negative balances are projected for end-of-FY22, which in the real world means the Trust Fund would have run out of cash on a day-to-day basis possibly sometime in August, definitely at some point in September.)

The Trust Fund is projected to run an annual cash deficit of $12.6 billion in 2022, rising to a deficit of $20.7 billion in 2027, and thence rising more rapidly, to a deficit of $27.7 billion in 2031.

The amount of extra money (from tax increases or additional general fund transfers) that the Trust Fund needs to pay for a five-year reauthorization bill at the above obligation levels is estimated to be $75 billion (combined end-of-year cumulative cash deficit, plus a $5 billion “cushion” to prevent those day-to-day insolvencies in August-September). The extra money needed for a six-year bill is $97 billion. And the amount of extra money, above current taxes, needed to keep the Trust Fund solvent for a decade at these spending levels is $200 billion.