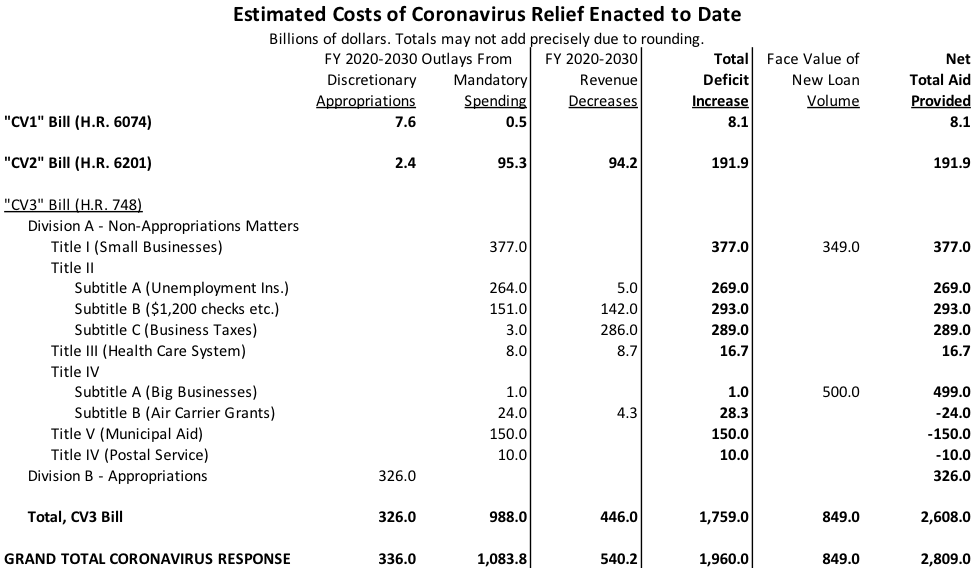

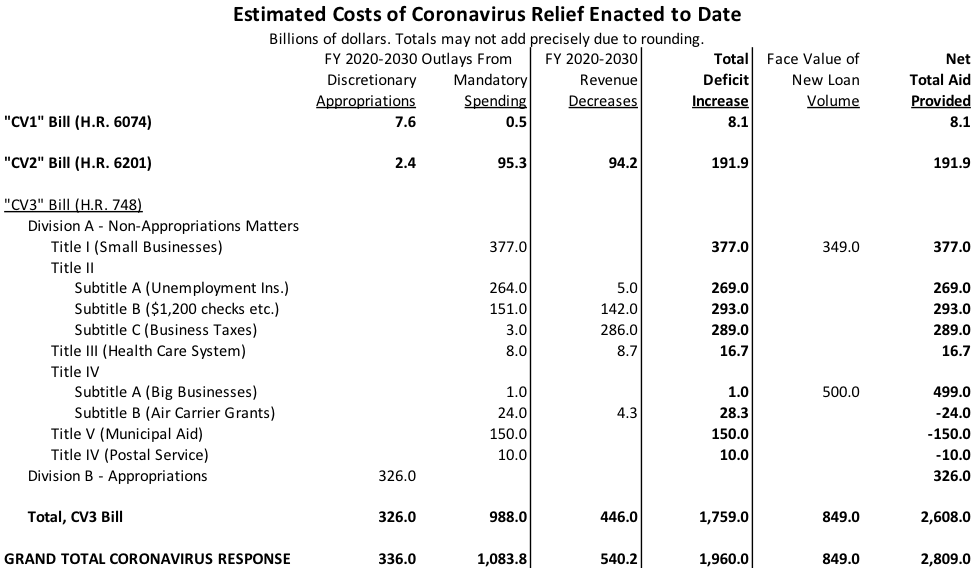

Today, almost three weeks after the mammoth “CARES Act” (the third legislative installment of coronavirus response) was signed into law, the Congressional Budget Office released its preliminary cost estimate of the law.

And what a cost estimate it was. CBO says that the bill will provide a net total of $2.61 trillion in aid – $1.31 in federal spending outlays, $436 billion in reduced tax receipts, and $849 billion in federal loans.

However – and it is crucial to point this out for bills like this – under the modern budget system enacted in 1990, the face value of the checks that the federal government writes when it makes loans are no longer counted towards the federal deficit. Only the long-term “subsidy cost” of the loan to the federal government is counted towards the deficit, at the time the loan is made. And CBO estimates that the long-term cost of the $349 billion in small business loans and the $500 billion in big business loans authorized by the bill will be near zero.

So the official estimate is that the CARES Act will increase federal deficits over the fiscal year 2020-2030 period by $1.76 billion. This is in addition to $8 billion from the first coronavirus response law and $192 billion for the second coronavirus response law. Total deficit increases from coronavirus bills enacted into law in March: $1.96 trillion.

The CBO cost estimate is remarkable for another reason – this is the first time that this author can remember a cost estimate where the detail tables at the back of the estimate were rounded to the billion dollars. Normal CBO procedure is to round dollar amounts to the million dollars. (The Joint Committee on Taxation’s score of the revenue portion of the CARES Act was rounded to the million.)

With regard to the $32 billion in authority provided by the CARES Act to make grants to air carriers and related contractors, CBO relies on up-to-the-minute news reporting that 70 percent of the assistance to big airlines will be grants but the other 30 percent will have to be repaid eventually. With that in mind, CBO estimates that the $32 billion in funding authority will only have a $24 billion net cost to the Treasury over ten years:

Using industry data on employee compensation, and assuming that all major carriers will receive assistance, CBO estimates that about $23 billion in grants will be disbursed over the 2020-2021 period. Using historical data from major credit-rating agencies on the probability of default and recoveries, and assuming interest rates of around 1 percent, consistent with Treasury plans, CBO estimates that about $9 billion in loans will be issued with an average subsidy rate of about 7 percent. Thus, on balance, the estimated subsidy cost of the loans will be about $1 billion over the 2020-2030 period.

In addition, the act authorizes the Secretary to receive warrants, options, and other securities as compensation for providing payroll assistance. According to Treasury announcements, the department plans to receive warrants under that authority with a face value equal to 10 percent of the loan volume. Assuming a five-year expiration date for the warrants, CBO estimates that the returns on the equity, which will be recorded in the budget as offsetting receipts, will total less than $500 million over the 2020-2030 period. The resulting net cost of the payroll assistance program, including grant payments, loan subsidy cost, and equity returns, is about $24 billion over the same period.

The CARES Act also set aside $46 billion out of the $500 billion in general loan authority for large businesses for air carriers and “businesses that are critical to national security.” CBO acknowledges a lot of uncertainty about this program but gives at preliminary estimate that the long-term cost to the federal government will only be $1 billion:

In the absence of sufficient information from those industries on the demand for loans, CBO estimates about half of the authorized loan volume ($23 billion) will be used, recognizing that the actual demand for loans could be higher or lower.

Given the eligibility criteria in the bill, CBO estimates that the credit risk of Treasury loans under this section will be similar to that of high-yield debt with a credit rating of at least B minus. Using historical data from major credit-rating agencies on the probability of default and recoveries, CBO estimates that the subsidy rate for the loan program will average about

10 percent. Thus, on balance, the program’s estimated credit subsidy cost will be about $2 billion over the 2020-2030 period.

The form and size of equity that the Treasury Department will receive are uncertain. If the department uses an approach similar the proposal reported for the airline payroll support program (as described in more detail below), it would receive warrants with a face value equal to 10 percent of the loan volume.15 On that basis, and assuming that the warrants expire in five years, CBO estimates that the returns on equity will total about $1 billion over the 2020-2030 period, lowering the net cost of the loan program to about $1 billion.