August 16, 2017

The Congressional Budget Office has issued an updated, but still incomplete, score of the budgetary impact of the Federal Aviation Administration reauthorization bill approved by the House Transportation and Infrastructure Committee (H.R. 2997). The legislation would split up the FAA and turn responsibility for air traffic control over to a new private, non-profit corporation that would charge its own user fees.

The score of the bill as originally reported from the T&I Committee was of course incomplete, as that version of the bill did not contain the changes in tax levels from the Ways and Means Committee or the changes in Budget Control Act spending caps from the Budget Committee – both of which are necessary to make the plan work. It was only afterwards that the House Rules Committee posted the text of a revised version of the bill that incorporated those changes and a few others. As such, the new CBO score is the cost estimate of the revised version on the Rules website.

The new score from CBO includes the score of the reduction in aviation excise taxes recommended by the chairman of the Ways and Means Committee to avoid charging the aviation community twice for the same air traffic control services (Ways and Means never had a formal meeting or vote on the issue). But it does not include the effects of the reduced discretionary appropriations under the bill (since appropriations for air traffic control would no longer be necessary) or of the reduction in Budget Control Act caps on discretionary spending in section 643 of the revised bill.

This is mostly because the budget process is not set up to score bills that include significant discretionary spending components and significant mandatory spending/tax revenue components. There are two budget scoring systems – one for discretionary appropriations and one for mandatory/revenue – and never the twain shall meet.

However, in the past, CBO has tried to do a composite score on some major legislation that had both elements.

Look at the CBO score of the last example: the Bipartisan Budget Act of 2015. That legislation was a deal to increase the BCA caps on discretionary spending by $80 billion over two years and offset that spending increase with $80 billion in mandatory spending reductions and user fee increases over ten years. The CBO score of the mandatory/revenue elements of the bill is at the bottom of page 4 of the estimate – $79.9 billion in deficit reduction. But then, at the top of page 5, CBO also has a separate memo line that scores the changes in the BCA spending levels ($80.0 billion in cap increases, an additional $0.5 billion in extra program integrity funding for Medicare and disability fraud detection and IRS tax enforcement, offset by $1.1 billion in non-scorable savings in mandatory spending savings from less Medicare and disability fraud and extra tax receipts from better IRS enforcement). Even people not familiar with the intricacies of the budget process can add the totals at the bottom of page 4 and the top of page 5 and see that the new discretionary spending is pretty much evenly offset with the new mandatory savings.

CBO did not do that here, although they did mention the discretionary savings in footnote (b) of the new estimate. Part of the problem may be that the cap decrease in section 643 of the revised bill does not have a specific dollar amount – it deems a FY 2021 cap reduction in whatever the amount of FY 2020 appropriations for air traffic control are, and those precise amounts won’t be written for another two years.

Part of the problem may also be that the Budget Control Act spending caps are set to expire after 2021 (it was a ten-year deal written in 2011). Most Republicans who are not on the Appropriations Committees, including party leaders, want to see the caps extended at some point past 2021, but it has not happened yet. It is not at all certain that CBO is allowed to assume discretionary savings from reductions in spending caps that do not yet exist in law.

Whatever the reason, both the original CBO score of H.R. 2997 and the new CBO score of the revised bill effectively assume that the federal government will pay double for air traffic control after 2020 – once through the annual discretionary appropriations process, and a second time through the outlays of the new ATC corporation, which CBO classifies as part of the federal government even though the corporation is explicitly non-governmental. (This classification is a judgment call with which the White House Office of Management and Budget disagrees.)

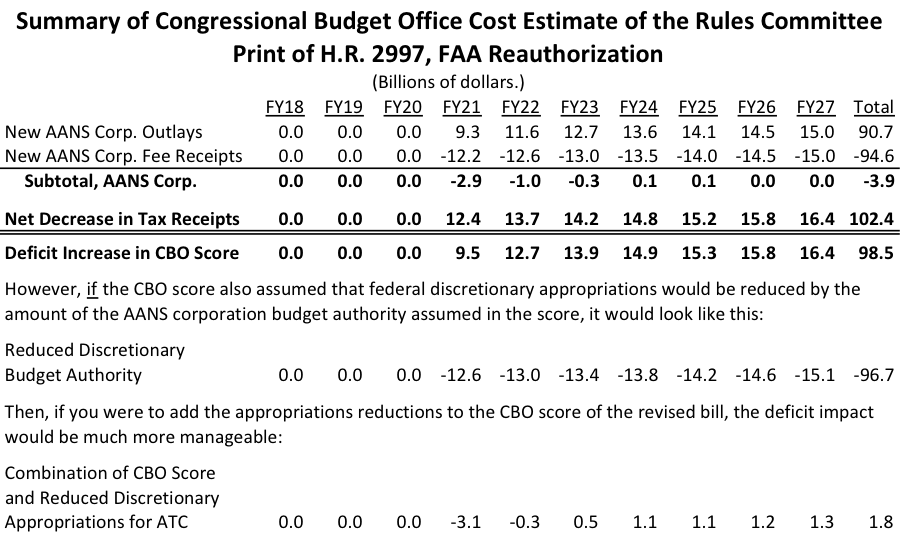

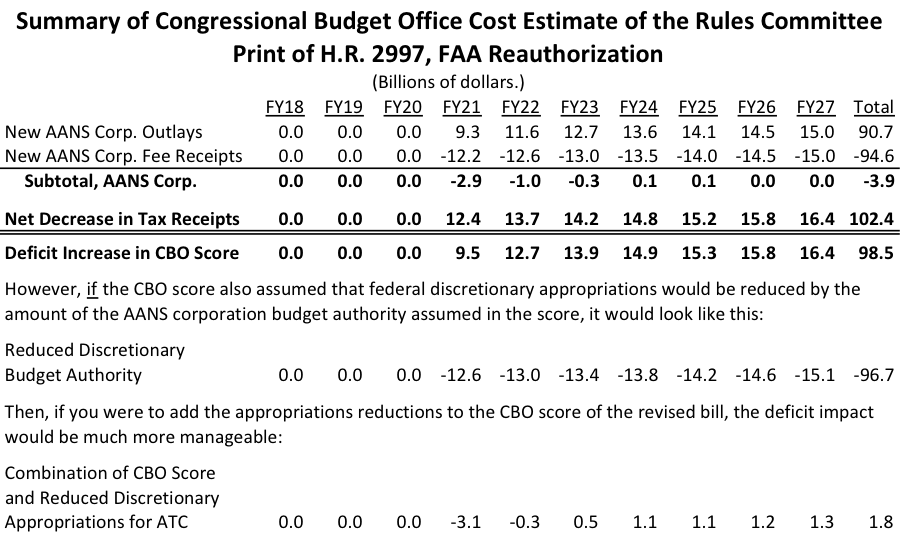

The new score, like the old one, assumes that the spending (outlays) of the new ATC corporation over the 2021-2027 period will be $90.7 billion and that the fees charged by the corporation over the same period will be $94.6 billion. If you are T&I Chairman Bill Shuster (R-PA) or another supporter of the bill, you believe that this money should not show up in a CBO score at all because it is not part of the government. But if you believe that CBO is correct and the ATC corporation’s cash flow should be shown as part of the federal budget, then the ATC corporation, on its own, will reduce federal deficits by $3.9 billion since the fees will slightly exceed the outlays.

CBO (in cooperation with the Joint Committee on Taxation) then scores the aviation excise tax reductions in title VIII of the revised bill as costing the government a net $102.4 billion in lost revenue over the 2021-2027 period. $102.4 minus $3.9 equals a net deficit increase of $98.5 billion, which is the bottom line of the new CBO estimate. But it must be emphasized again that the new CBO score implicitly assumes that the federal government will pay twice each year for the same air traffic control services starting in 2021 – once through the spending of the new ATC corporation, and a second time through the regular appropriations process.

If one were to assume that Congress will in fact be unwilling to pay twice for the same services, and that appropriations for what is left of the FAA after 2020 will be substantially reduced, then the score would look drastically different. Using CBO’s own numbers for ATC corporation budget authority as a proxy, discretionary appropriations might be reduced by $96.7 billion under the bill, which would make the total deficit impact of the bill a manageable $1.8 billion. But, since the budget process does not really allow CBO to combine estimates of discretionary spending changes and mandatory spending/receipt changes, the CBO estimate can’t really take the next step and combine the two. (We can – see table below.)