The Congressional Budget Office today released a new report entitled Issues and Options for a Tax on Vehicle Miles Traveled by Commercial Trucks. The study estimated that, if a nationwide VMT tax had been in use in 2017, it would have raised $2.6 billion for each cent-per-mile of the tax rate if applied to all commercial trucks, but that yield would have been cut to $1.6 billion for each cent-per-mile if the tax was only levied on combination (tractor-trailer) trucks.

The study starts off by looking at questions that Congress would have to answer when designing a truck VMT tax system:

Which trucks to tax? The study generally presents two options – a VMT tax levied solely on combination trucks with any number of axles, in any configuration, or a VMT tax levied on those combination trucks plus all single-unit trucks (including box and pickup trucks) which are over 10,000 pounds gross weight or which have six or more tires. Trucks and vans weighing less than 10,000 pounds and possessing only four tires would be exempt from the VMT tax under all scenarios, and buses and motorhomes would also be exempt.

Which roads to tax? CBO looked at three possibilities: taxing truck VMT on Interstate highways only (41 percent of all truck VMT occurs on Interstates, and over half of all combination truck VMT is on Interstates), taxing truck VMT on Interstates and other arterial roads only, or taxing truck VMT on all public roads. The issue of which roads should be taxed also dovetails with which mechanism is used to collect the tax:

How to collect the tax? The report examines three collection methods – periodic odometer readings, in-truck RFID tags monitored by road gantries or posts (like EZ-Pass), and in-truck electronic logging devices (ELDs) or similar technology. Each of the three methods varies in terms of which road system usage is taxed, the capital costs and enforcement (operational) costs to government to run the system, and whether or not the mechanism would be compatible with congestion pricing in urban areas.

|

Which |

Capital |

Enforcement |

CP- |

|

Roads? |

Cost? |

Cost? |

Compatible? |

| Odometer |

All |

None |

High |

No |

| RFID Reader |

Some |

High |

Low |

Yes |

| ELD |

All |

Low |

Medium |

Maybe |

Where capital costs are concerned, CBO cites one estimate of the cost of installing an RFID collection system on all Interstate highways at $55 billion.

What tax rate to set? CBO ran five different scenarios, all assuming a system in place for the entirety of the year 2017. And each scenario was run two different ways – a VMT tax on all commercial trucks mentioned above, and a VMT tax on combination tractor-trailers only (so there are ten total outcomes). Two of the scenarios assumed hypothetical fixed tax rates (one cent per mile and five cents per mile). The other three scenarios used whatever cent-per-mile rate would have been necessary to raise fixed revenue amounts – the taxed trucks’s share of:

- the FY 2017 Highway Trust Fund deficit ($13.5 billion); or

- the FY17 HTF deficit and all HTF fuel taxes paid in FY17; or

- The FY17 HTF deficit and all HTF taxes paid in FY17.

Those results are shown in the table below, reproduced from the data in Table 2 of the CBO report.

CBO Scenarios for a Truck VMT Tax, Covering All Public Roads, If in Effect in 2017

|

|

|

All Commercial Trucks |

Combination Trucks Only |

|

|

Rate |

Revenue |

Rate |

Revenue |

|

|

(Cents/mile) |

(Billion $/yr.) |

(Cents/mile) |

(Billion $/yr.) |

| Scenarios Defined by Tax Rate |

|

|

|

|

|

1 cent per mile |

1.0¢ |

$2.6b |

1.0¢ |

$1.6b |

|

5 cents per mile |

5.0¢ |

$12.8b |

5.0¢ |

$8.0b |

| Scenarios Defined by Revenue Target |

|

|

|

|

|

Taxed truck share of HTF deficit |

1.9¢ |

$4.8b |

2.5¢ |

$4.0b |

|

Taxed truck share of HTF deficit and fuel taxes |

5.6¢ |

$14.4b |

7.0¢ |

$11.3b |

|

Taxed truck share of HTF deficit and all HTF taxes |

7.5¢ |

$19.4b |

9.9¢ |

$16.1b |

Unfortunately, the report did not give results from weight-graduated or axle-graduated tax scenarios. This is of particular importance because…

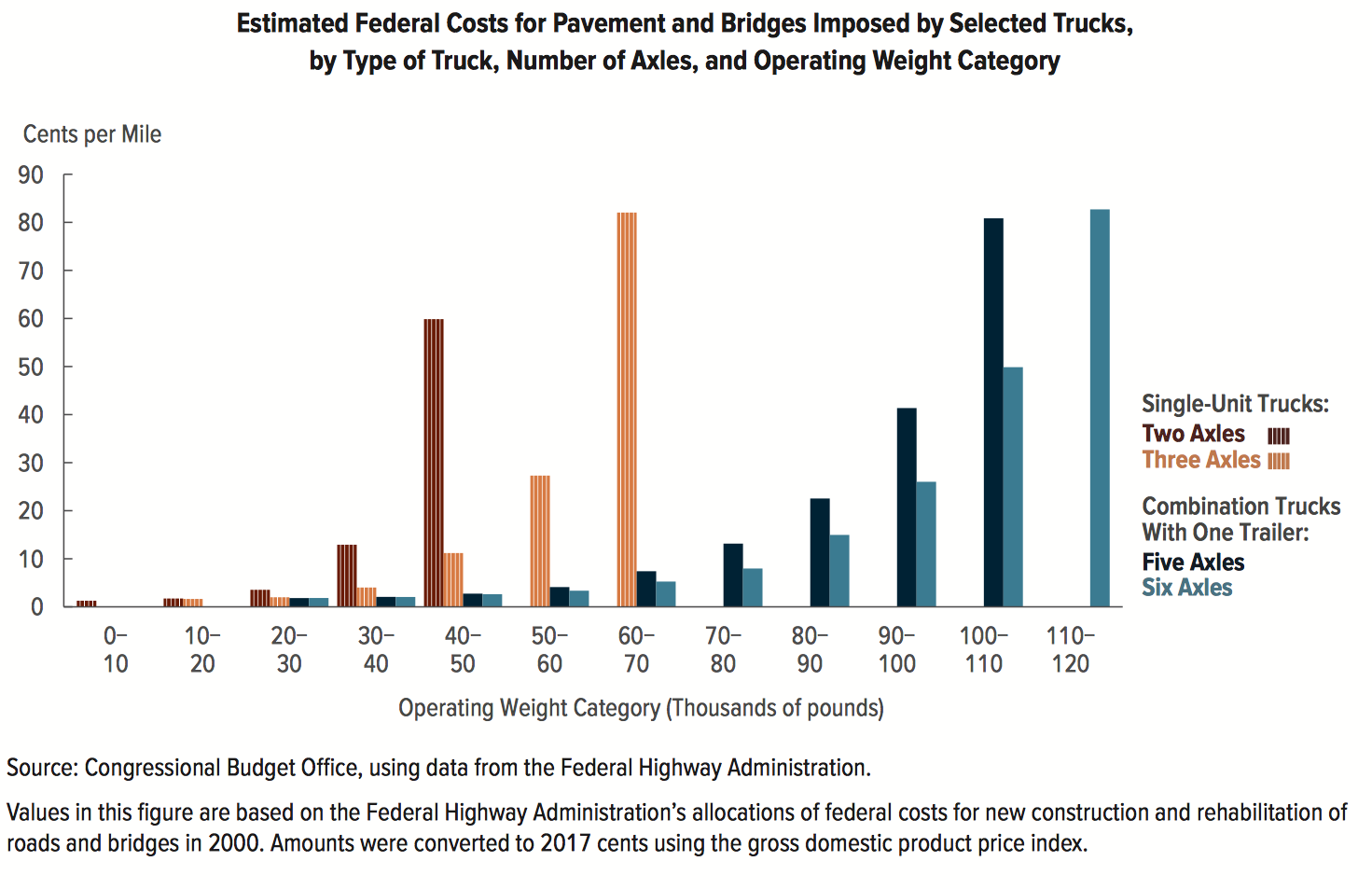

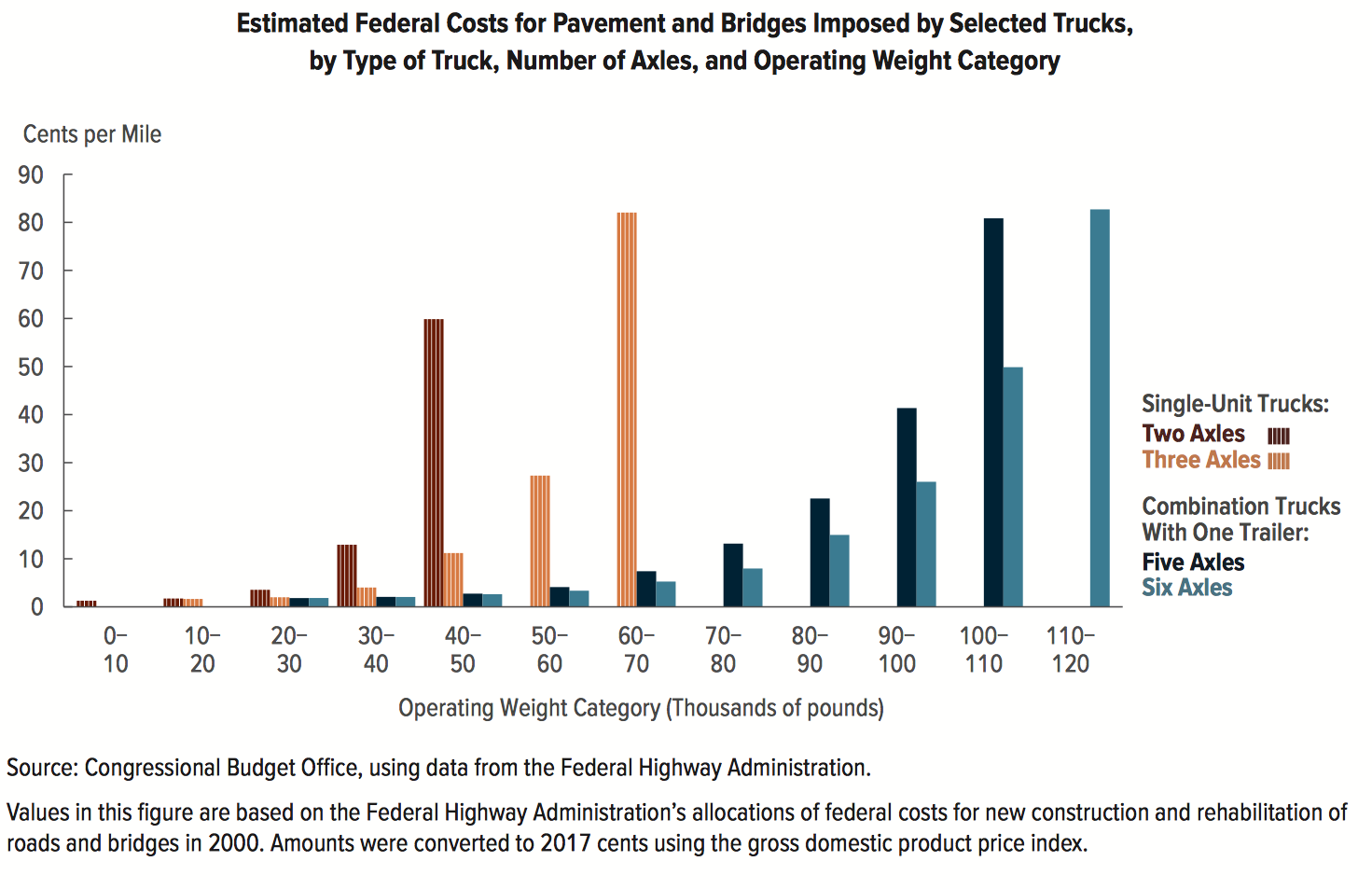

Cost allocation. The Federal Highway Administration has not published a highway cost allocation study since the 2000 addendum to the 1997 study. But the CBO report does take the per-mile costs to FHWA for the various classes of truck from the 2000 Addendum and converts them to 2017 dollars using the GDP price index. That chart, from page 12 of the CBO report, clearly shows that heavy trucks are incurring costs on roads and bridges that approach 80 cents per mile in some instances of super-heavy trucks. So adding weight and axle elements to any truck VMT tax would go a long way towards putting the Highway Trust Fund on a more fair cost allocation system.

Odds and ends. There were a few other worthwhile nuggets in the CBO study:

- ETW has long wondered exactly how many collection points there are for the current federal excise taxes on motor fuels. CBO says: “gasoline and diesel taxes can be administered at low cost because they are collected from a small number of firms (the taxes are assessed at roughly 1,300 fuel distribution terminals nationwide, and the number of distinct firms is smaller)…”

- The gasoline tax, if viewed as a tax and not a user fee, is of course regressive because poor and working-class people spend a much higher share of their total household income on gasoline than do rich people. CBO also puts some numbers on the regressivity of the diesel fuel tax insofar as it is passed through to consumers as part of the costs of the goods they purchase: “…the diesel tax is regressive. Specifically, CBO estimates that in 2017, households in the lowest income quintile (the bottom fifth of the distribution) paid about 0.06 percent of their income as a result of the diesel tax, compared with roughly 0.02 percent for households in the highest quintile.” A VMT tax would also be regressive: “In CBO’s assessment, those households would have spent the same proportions of their income as the result of a VMT tax that yielded the same amount of revenues.”

- “Pavement damage sharply increases with trucks’ weight per axle; thus, a VMT tax that varied with weight per axle…could reduce such damage by giving carriers an incentive to use trucks with more axles. (Note that the existing tax on diesel fuel gives carriers at least a small incentive to use fewer axles because adding axles increases road friction and hence decreases fuel efficiency.) By contrast, a uniform tax on all trucks could increase pavement damage if it led carriers to use fewer trucks carrying more weight per axle.”

State-level truck VMT taxes. In addition, Appendix A of the report analyzes the existing truck VMT tax systems currently in use in the U.S. states of Kentucky, New Mexico, New York, and Oregon. (Illinois has an optional truck VMT tax program, and Rhode Island has a mandatory truck tolling system on Interstates but only two of the 12 planned toll facilities have been opened so far.) Kentucky’s system is the only one with a flat rate (2.9 cents per mile) that does not vary with truck weight. New Mexico and New York have relatively low, weight-based graduated tax rates – New Mexico’s range is 1.1 cents to 4.4 cents per mile, while New York’s is between 0.8 cents and 5.5 cents per mile. Oregon, however, has a tax scale ranging from 6.2 cents to 28.8 cents per mile. And Oregon’s estimated tax evasion rate is the lowest of any U.S. system (between 3 and 7 percent). Kentucky’s evasion rate is 7+ percent, New Mexico’s evasion rate is between 27-43 percent, and New York’s evasion rate is between 33-50 percent. (Tax evasion seems to increase with longer reporting periods – Oregon requires monthly reporting while the other states have quarterly reporting, but in New York’s case, that can stretch to annual reporting.)

Foreign nation truck VMT taxes. And Appendix B analyzes the truck VMT tax systems used in Germany, Austria, Switzerland, New Zealand, Russia, and the Czech Republic. The Russian system, like Kentucky, is the only one with a flat rate (the equivalent of 12 cents per mile). The other countries vary the rate not just on weight and the number of axles, but also in some cases by rate of emissions, or by time of day or place of travel (combining VMT with congestion pricing). In those other countries, the tax rate can range from as low as the equivalent of 8 cents per mile (New Zealand) to as high as $1.46 per mile (Czech Republic). The various systems also levy the VMT taxes on different road sets – in Switzerland and New Zealand, the VMT taxes are levied on all roads, but in Germany they are only on autobahns, and in Austria, Russia and the Czech Republic they are only levied on certain major roads.

Once again, that new CBO report can be read here.