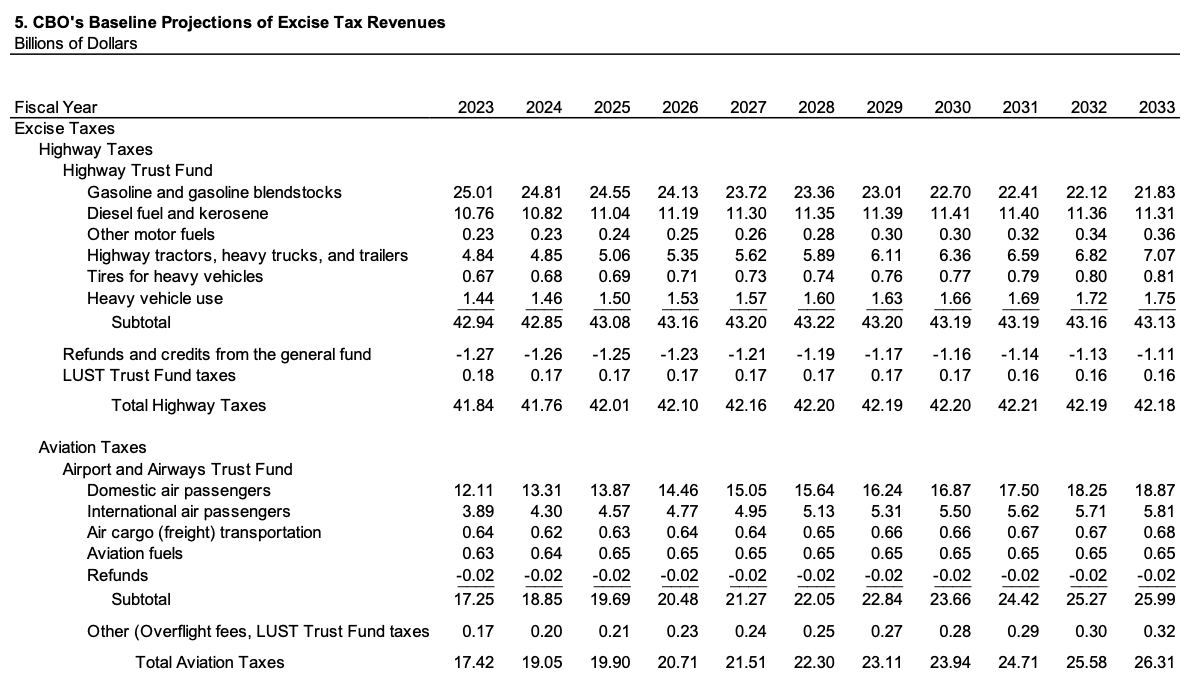

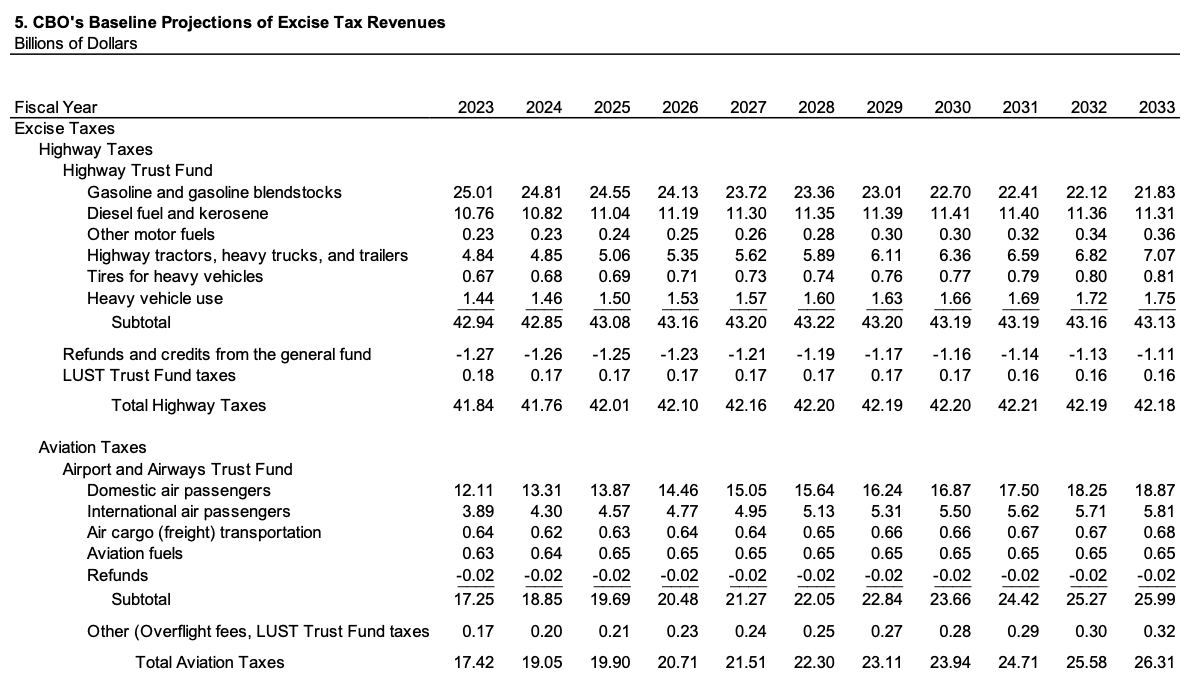

As part of its annual budget outlook release this week, the nonpartisan Congressional Budget Office updated its 10-year federal excise tax forecast and predicts that the annual decline in gasoline tax receipts will accelerate slightly.

In their May 2022 forecast, CBO saw $239 billion in gas tax receipts over the 10-year 2023-2032 period, and the new forecast lowers that a bit to $236 billion over the same period.

But on the bright side, CBO also predicts that receipts from aviation taxes will be back to pre-COVID normal levels in 2023, at $17.25 billion, besting the pre-COVID FY 2019 tax total of $16.0 billion. This is way up from $11.4 billion in fiscal 2022, and $8.2 billion in 2021.)

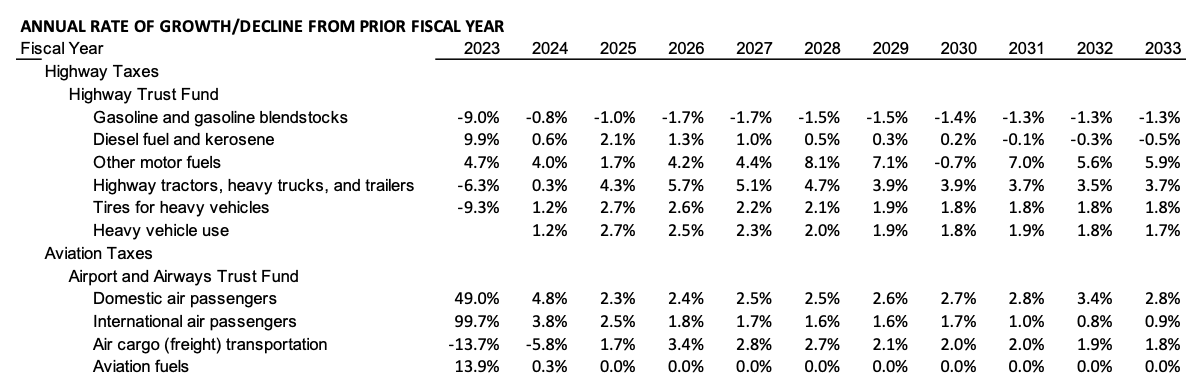

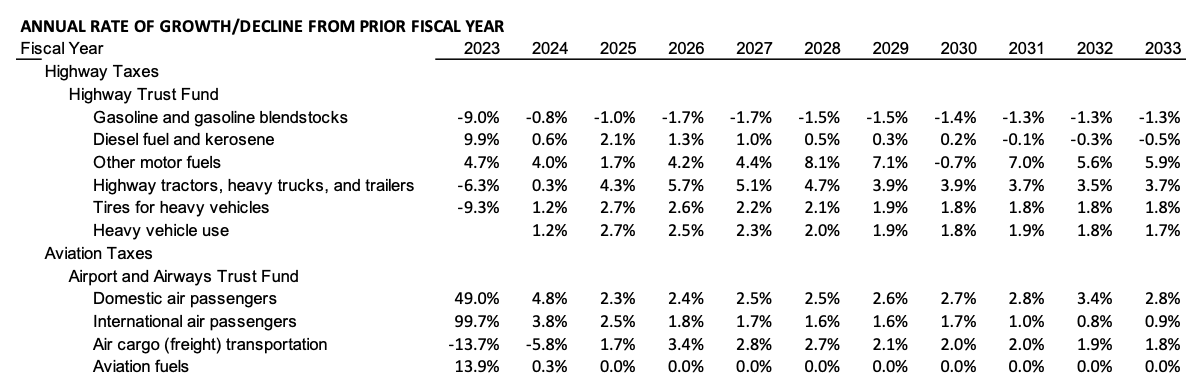

Using the raw data shown above from CBO, ETW converted that to year-over-year growth/decline rates. The average decline in annual gasoline tax receipts, year-over-year, starting next year will be 1.4 percent per year. (We start next year because the FY23 tax receipts grow a lot more from FY22, because FY22 was still a COVID year on the aviation side and was also affected by delayed crediting of gas and diesel tax receipts that had sat around in unopened mail during early COVID. Treasury is only now finally dug out of that.)

But CBO predicts gasoline taxes to decline in every single year of the forecast. by contrast, they predict diesel tax receipts go trow at diminishing rates until 2030, when they start to decline slightly as well because of more fuel-efficient trucks. The other trucking taxes will continue to grow in the projection, and the sales tax on new trucks, tractors and trailers is projected to grow most of all, because it is the only highway user tax that has a built-in inflation adjustment.

By contrast, growth in the taxes on domestic airline passengers are projected to grow at an average of 2.9 percent per year starting in 2024, and the tax on international travel is projected to grow at 1.7 percent per year. (There are some inflation increases built into those as well.)

Air cargo tax growth is predicted to decline a bit more in 2024 before reverting back to a smaller annual growth rate.