March 14, 2018

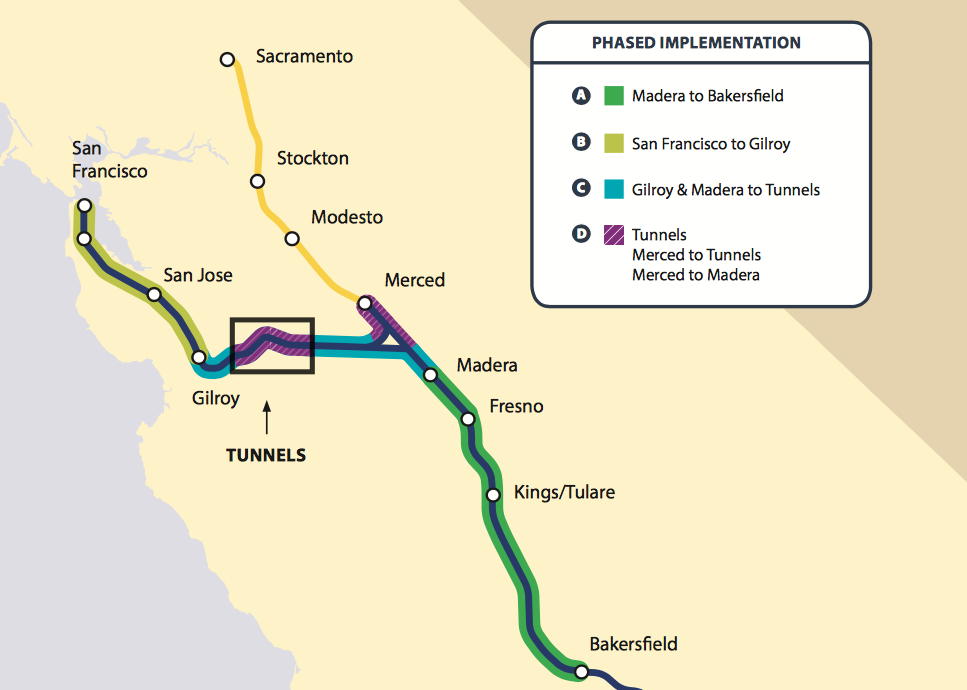

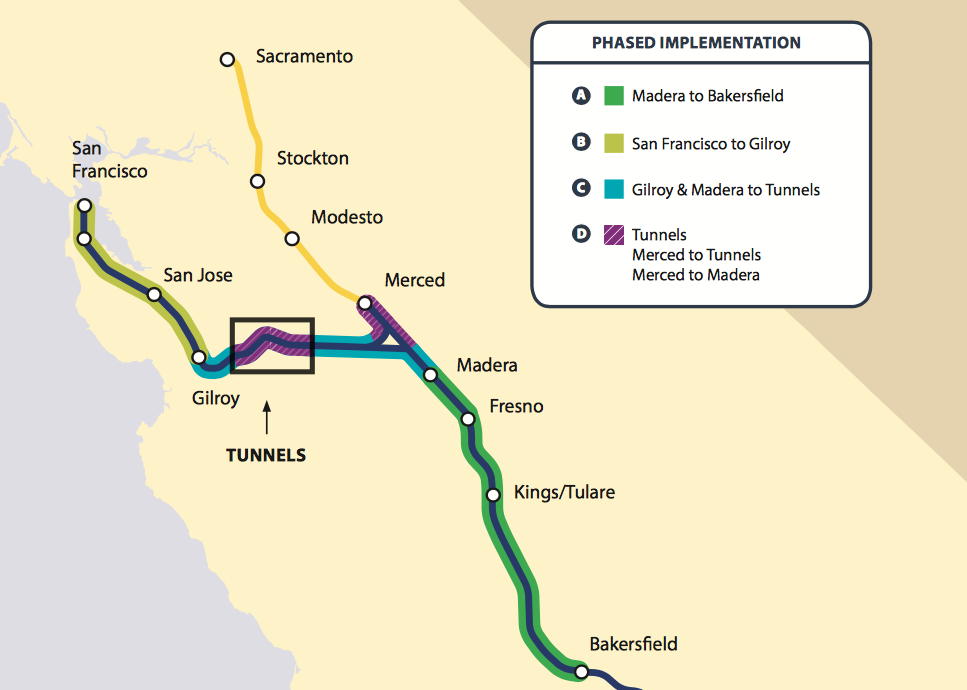

Last Friday, the California High Speed Rail Authority (CHSRA) released a draft 2018 business plan stating that costs for completing Phase 1 of the system (San Francisco to Anaheim) could rise as high as $98 billion, that completion will take four more years to complete than was estimated two years ago, and that the authority will probably need additional funding from somewhere in order to complete the initial operating segment of the system. The authority even raises the possibility of operating two non-connected segments – one from San Fransisco to Gilroy, and the other from Madera to Bakersfield – while waiting for more money from somewhere so they can finish digging tunnels to connect the two segments.

ETW has prepared a new timeline of the various cost estimates on this project, so people can see how the cost has soared and the scope of the project has narrowed over the 1999-2018 period, in case anyone wants the full historical picture. But we can sum it up with this small table:

| California High Speed Rail System |

| Phase 1 (San Francisco to Anaheim) |

|

Phase 1 Cost |

In Service |

|

YOE Dollars |

By Year |

| Nov. 2008 Plan |

$42 B |

2020 |

| Dec. 2009 Plan |

$43 B |

2020 |

| Apr. 2012 Plan |

$68 B |

2028 |

| Apr. 2014 Plan |

$68 B |

2028 |

| Apr. 2016 Plan |

$64 B |

2029 |

| Mar. 2018 Plan |

$63B-$98B |

2033 |

Let’s start with the small and work up to the big. (For those not intimately familiar with Golden State geography, there is a nice map of the proposed system here.)

Central Valley ICS. As previewed in January, the new draft business plan confirms that the cost of the initial construction segment (ICS), or Central Valley line (the 119 mile test track running from Madera (20-some miles northwest of Fresno) to Shafter (20 miles northwest of Bakersfield)) has risen from $6.0 billion in the 2011 plan to $10.6 billion. The Authority says this work, currently under construction, will be complete by 2022, as promised in the 2016 plan (but there won’t be any high-speed trains at that point – it could lead to slightly faster Amtrak service in the interim).

CHSRA is proposing to use $4.75 billion of its its proceeds from the state’s quarterly cap-and-trade carbon auctions to fill the funding gap between the old estimate and the new estimate.

|

2011 Plan |

2016 Plan |

2018 Plan |

| Federal FY09 ARRA |

2,387 |

2,041 |

2,186 |

| Federal FY10 |

929 |

929 |

929 |

| State Prop 1A |

2,684 |

2,609 |

2,766 |

| State Cap-and-Trade |

0 |

2,234 |

4,751 |

| Total, Central Valley |

6,000 |

7,813 |

10,632 |

| Mil. $$ per Mile |

50 |

66 |

89 |

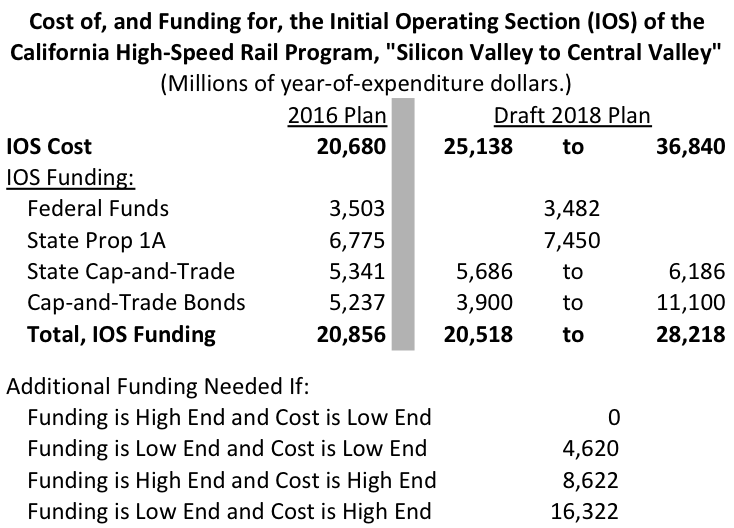

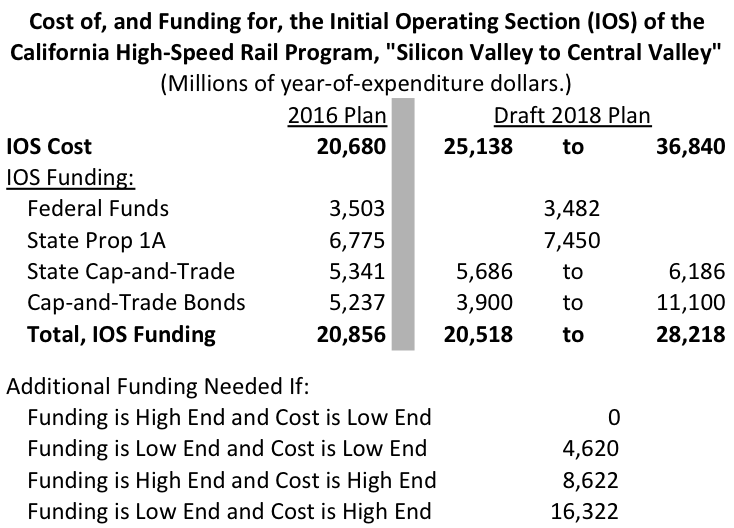

Valley to Valley IOS. In the earlier 2016 business plan, the initial operating segment (IOS) was defined as running from San Jose to Shafter, connecting Silicon Valley to the Central Valley, or “Valley to Valley.” The new business plan slightly redefines and expands the IOS:

In this Draft 2018 Business Plan, we now define the Silicon Valley to Central Valley Line as service between San Francisco and Bakersfield. This line has stronger ridership potential and higher commercial value than the shorter line between San José and Poplar Avenue (north of Bakersfield) laid out in the 2016 Business Plan. This is a strategic enhancement that will generate higher revenue which can then be used to help fund expanding the system in Southern California. Connecting Merced as part of this initial line remains a high priority, but, as in 2016, funding for this connection still must be identified.

(March 16 addendum: The tireless Ralph Vartabedian at the Los Angeles Times looked through the supporting documents accompanying the new plan and reports that, in another cost-saving measure, the 30-mile San Jose to Gilroy segment will no longer be true high-speed rail with its own right-of-way – instead, trains will run at a maximum 110 miles per hour on or near the existing Union Pacific right-of-way, complete with grade crossings, saving $1.7 billion.)

In the 2016 business plan, the total cost of the San Jose to Shafter IOS was pegged at $20.9 billion. In the new plan, CHSRA gives a range of possible costs. The extensions into San Francisco and Bakersfield add between $1.5 and $2.3 billion to the plan, but the significant increase in the cost of the ongoing Central Valley and, especially, increases in the estimated cost of the Gilroy to Carlucci Road segment that will include 15 miles of tunnels, now have a range of costs for the revised IOS between $25.1 billion and $36.8 billion. CHSRA is using a lower-end total of $29.5 billion for some presentations.

| Cost of Silicon Valley to Central Valley IOS (2018 Draft BP) |

|

Year of Expenditure Dollars (Million) |

|

Low |

CHSRA Uses |

High |

| San Jose to Gilroy |

2,252 |

3,217 |

4,826 |

| Gilroy to Carlucci Road |

8,199 |

10,249 |

13,323 |

| Carlucci Road to Madera |

2,033 |

2,392 |

2,870 |

| Central Valley Segment |

10,100 |

10,632 |

12,227 |

| S.F. and Bakersfield Ext. 1 |

1,529 |

1,911 |

2,342 |

| Rolling Stock 1 |

1,025 |

1,139 |

1,252 |

| Subtotal, V2V |

25,138 |

29,540 |

36,840 |

In the 2016 plan, CHSRA proposed to issue revenue bonds based on future cap-and-trade quarterly auction proceeds in order to finish paying for construction of the IOS. This plan has run into some problems. Three times in 2016 and 2017, the quarterly auctions collapsed and there were almost no takers. Revenue streams that vanish periodically and reappear can’t be securitized. So the 2018 draft plan asks that the legislature pass a law doing three things to allow CHSRA to issue cap-and-trade bonds, or use future proceeds to take out federal loans, soon:

- Extend the cap-and-trade program, currently set to expire in the year 2030, through 2050.

- Guarantee that if cap-and-trade auction receipts tank again, CHSRA will automatically be provided with other state funds in an amount sufficient to meet its debt service needs. (This is essentially a general obligation guarantee of the bonds.)

- Provide, somehow, that future appropriations of cap-and-trade revenues to CHSRA cannot be impaired by future legislatures. (CHSRA is not at all clear on how this would work in practice.)

If the legislature does all these things, the new plan assumes that CHSRA can raise between $3.9 and $11.1 billion in bonds or federal loans between 2021 and 2023, to be repaid by cap-and-trade revenues from the years 2024 through 2050. The big variation in the potential total is because CHSRA used “a base case scenario of $750 million per year and a sensitivity of $500 million per year. Two interest rates were used—4 percent and 6 percent—as well as a range of assumptions about how much coverage would need to be applied to annual debt payments.”

However, the question of whether or not the legislature will be able to take these actions may be mooted by California voters in three months. On June 5, voters will decide Proposition 70, which was the political cover required by the handful of Republicans in the state legislature who voted last year to extend the cap-and-trade program until 2030. If approved by voters, Prop 70 will amend the state constitution to cut off the use of all cap-and-trade proceeds on January 1, 2024 unless a two-thirds supermajority of both chambers of the state legislature approve a plan for spending the money.

(Last week, a Republican lawmaker sued the State Attorney General, saying that he was trying to sandbag Prop 70 by giving it a misleading short title that will appear on the ballot.)

If Prop 70 passes, then obviously, CHSRA can’t borrow against post-2023 cap-and-trade revenues because they will no longer be entitled to post-2023 revenues, no matter what the legislature says between now and then, unless the 2024 legislature gets a two-thirds vote to give CHSRA a share of cap-and-trade proceeds once again.

But even if Prop 70 fails this summer, there is a strong likelihood that it still won’t be enough to allow CHSRA to finish building the IOS. Costs for the revised IOS could range from $25.1 billion to $36.8 billion, but with the bonds and the pre-2024 cap-and-trade receipts and more Prop 1A funding and the federal money from the first two years of the Obama Administration, total funding available to CHSRA for this would be between $20.5 billion and $29.2 billion.

If CHSRA is lucky, and Prop 70 fails and the legislature guarantees their bonds and the bonds raise close to the high end of projections and the IOS costs fall near the low end of projections, they won’t need any more money to complete the IOS. But that is a lot of variables, and if CHSRA gets very unlucky, they could need as much as another $16 billion from somewhere to complete the IOS.

Facing the very real possibility that they will run out of money, even if Prop 70 is defeated and they can start issuing cap-and-trade bonds, CHSRA’s new business plan is preparing to run two separate systems, on either side of the mountains, until the tunnels under the Pacheco Pass (the last part of the IOS and potentially the most expensive) can be completed:

…we are currently evaluating how these funds can be most effectively employed to overlay an incremental delivery approach. Specifically, our current plan is to implement the line incrementally by targeting the delivery of two independent operational lines—one in the Central Valley and one from San Francisco to Gilroy—providing early passenger service in those two corridors by either our partner agencies or the Authority. This then isolates the tunnel through the Pacheco Pass as the unfunded asset on which to focus future federal, state and/or private funding.

(Ed. Note: Sadly, the ridership assumptions in the plan only assume full San Francisco to Bakersfield service. Ridership projections for operational Madera to Bakersfield bullet train service would be really interesting. And, as noted above, the new plan calls for the San Fran to Gilroy service to be regular-speed, not high-speed.)

It is at this point that the business plan actually starts getting enthusiastic about the Trump Administration’s infrastructure plan:

One expression of support for ongoing major transportation infrastructure projects is the infrastructure plan proposed by the current administration. Now under consideration in Congress, the plan includes several elements that would make a variety of funding and financing tools for high-speed rail available, including infrastructure investment incentives, expanded federal credit programs and private activity bonds. Access to these programs could provide the program with a low cost of debt and more flexible repayment terms.

Should an infrastructure program that includes these and other potentially favorable funding and financing tools be passed into law, it would provide an opportunity to seek and secure additional federal financial support that could coincide with the Silicon Valley to Central Valley Line and/or extensions to complete the Phase 1 System. We believe that the program, using a mix of matching funds from state sources, could deliver the benefits and funding leverage that the federal government is seeking to achieve.

Remainder of Phase 1. Since CHSRA now admits it will probably run out of money before finishing the V2V San Francisco to Bakersfield segment, it is glaringly obvious that there are zero dollars currently identified to extend that system south from Bakersfield through Los Angeles to Anaheim to complete Phase 1 of the system. CHSRA has three general suggestions for filling that funding gap:

- The positive cash flow generated from selling tickets and operating the first parts of the system which could be leveraged for financing

- Potential private investment under the right conditions; and

- Additional public funds, including federal funds, which can help match project-generated funding.

According to CHSRA’s latest projections, the combination of 1, 2 and 3 would have to raise between $38.1 billion and $61.3 billion in order to complete the remainder of Phase 1. This would make the Phase 1 total cost between $63.3 billion and $98.1 billion.

|

Year of Expenditure Dollars (Million) |

|

Low |

CHSRA Uses |

High |

| San Fran. to San Jose 2 |

1,659 |

2,074 |

2,696 |

| Merced to Wye |

2,028 |

2,386 |

2,863 |

| Bakersfield to Palmdale |

13,076 |

16,345 |

19,614 |

| Palmdale to Burbank |

13,159 |

17,546 |

25,442 |

| Burbank to Los Angeles |

1,256 |

1,478 |

1,699 |

| Los Angeles to Anaheim |

3,049 |

3,587 |

4,125 |

| Heavy Mainten. Facility |

173 |

216 |

281 |

| Rolling Stock 2 |

3,712 |

4,124 |

4,536 |

| Subtotal, Phase 1 Remainder |

38,112 |

47,756 |

61,256 |

| |

|

|

|

| TOTAL PHASE 1 |

63,250 |

77,296 |

98,097 |

CHSRA is picking a $77.3 billion midpoint between the low end and high end of the Phase 1 total cost range, but that is probably low. Just look at the “Palmdale to Burbank” section, where the range is $13.2 billion to $25.4 billion. But this is the section that starts on the San Andreas Fault (Palmdale is the town where the fault is most visible) and moves the project from the North American Plate to the Pacific Plate. This segment includes over 20 miles of tunnels through the San Gabriel Mountains and the San Gabriel Fault. The Bakersfield to Palmdale section also includes 9 miles of tunnels through the Tehachapi Mountains and has a cost range from $13.1 billion to $19.6 billion.

In both cases, CHSRA is using a midpoint cost estimate that is a lot closer to the low end of the range than the high end of the range but is not providing much justification for picking towards the low end. Those areas are the ones where cost inflation for reasons other than right-of-way acquisition are most likely. (But right-of-way acquisition in Southern California, if what happened in the Central Valley is any indication, could be nasty as well.)

Phase 2? In 2008, just before Proposition 1A went before voters, CHSRA decided to break up the proposed high-speed rail system into two phases. Phase 1 is described above. Phase 2 would extend north from Merced, through Modesto and Stockton, to the state capital at Sacramento. It would also move inland from Los Angeles to San Bernadino and then loop south through Riverside to San Diego.

There is scant mention of Phase 2 in the new plan, but this mention makes it sound like a long time off:

After completion of the Phase 1 System and its first operating concession period, the state will have a fully developed and operable asset that it can continue to monetize over successive 20-30 year periods to generate funds for reinvestment, expansion (e.g., for Phase 2 extensions) or other purposes.

Phase 2 would bring HSR access to the third, fourth, fifth, and tenth-largest metro areas in the state. (Ranking shown below with 2011 populations.)

| California Metropolitan Statistical Areas |

| 1 |

L.A.-Long Beach-Santa Ana |

12.9m |

Phase 1 |

| 2 |

San Fran.-Oakland-Hayward |

4.4m |

Phase 1 |

| 3 |

Riverside-San Bernadino.-Ontario |

4.3m |

Phase 2 |

| 4 |

San Diego-Carlsbad-San Marcos |

3.1m |

Phase 2 |

| 5 |

Sacramento-Arden-Arcade-Roseville |

2.2m |

Phase 2 |

| 6 |

San Jose-Sunnyvale-Santa Clara |

1.9m |

Phase 1 |

| 7 |

Fresno |

0.9m |

Phase 1 |

| 8 |

Bakersfield |

0.9m |

Phase 1 |

| 9 |

Oxnard-Thousand Oaks-Ventura |

0.8m |

neither |

| 10 |

Stockton |

0.7m |

Phase 2 |