May 24, 2017

As promised in March, the fiscal year 2018 budget proposes to remove air traffic control (ATC) operation from the Federal Aviation Administration (FAA) and turn it over to a non-profit, non-governmental, user-fee-funded corporation starting in FY 2021. So far, this is similar to the plan put forward last year by House Transportation and Infrastructure chairman Bill Shuster (R-PA).

As ETW noted last month, the budgetary treatment of such a proposal is complicated for reasons both conceptual and practical. Conceptually, whether or not an independent ATC corporation would still be scored as part of the federal government is a judgment call. And practically, there are a lot of moving parts from different Congressional committees – the authorizing committees have to create the corporation, the tax committees have to reduce excise taxes that are being replaced by user fees, and the budget committees have to change budget categories to account for FAA spending that will no longer be necessary. Since the Shuster bill never made it to the House floor last year, none of the other committees had to make the hard decisions on the practical side.

The new budget request does score the cash flow of the ATC corporation as non-governmental, which is the opposite take on that question from the one the Congressional Budget Office had last year. But on the practical side, a lot of people supporting Shuster’s plan last year had assumed that the whole thing would be orchestrated to be “budget-neutral” so that the decreased federal spending from taking air traffic control off the books of the government would line up with the decreased aviation excise taxes.

The Trump Administration has gone in a different direction.

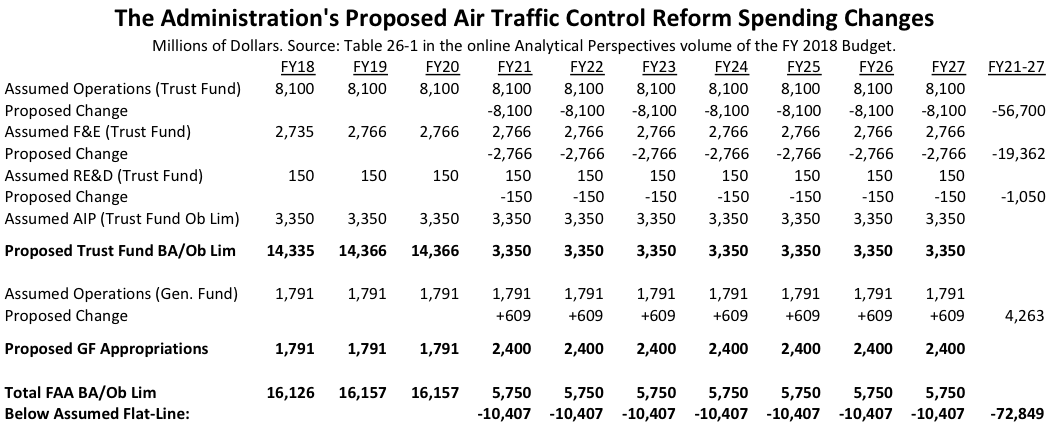

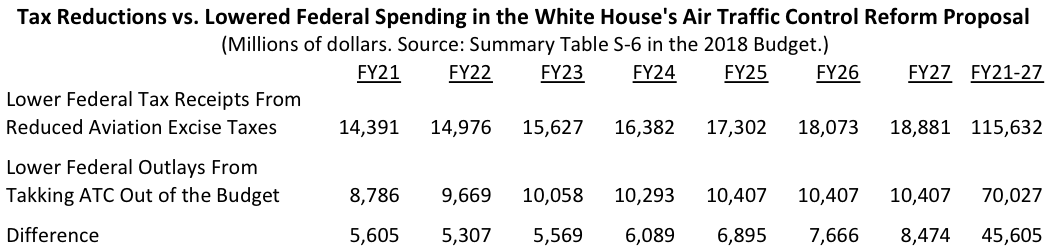

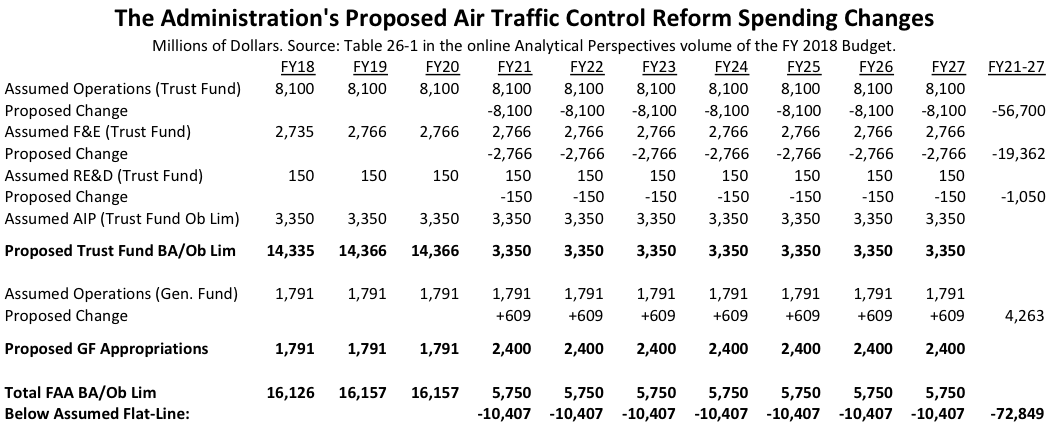

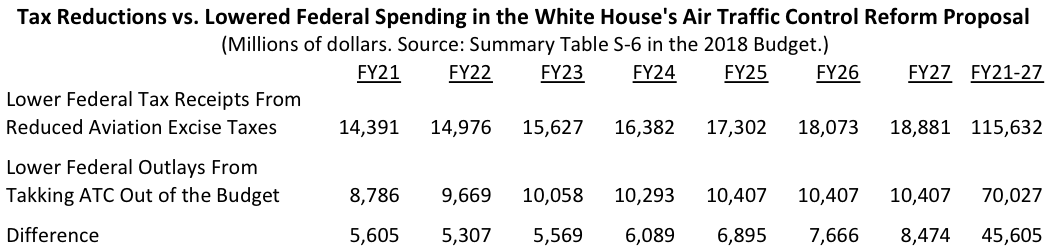

The budget proposes to reduce discretionary spending caps in the Budget Control Act by an average of $10.4 billion per year starting in 2021 since discretionary appropriations for air traffic control will no longer be necessary. OMB estimates that the outlays (cash flow) from this will equal $70.0 billion over the 2021-2027 period.

But OMB is proposing to decrease existing aviation excise taxes by $115.6 billion over the 2021-2027 period, making it impossible to argue that the Administration’s ATC reform legislation would be budget-neutral. Instead, using the summary tables in the Budget itself, the legislation appears to increase federal deficits by $45.6 billion over the 10-year budget window.

The Administration is proposing that the remaining FAA functions for safety regulation and certification be funded entirely out of general revenues, not aviation excise taxes. (That general fund support is estimated to be $2.4 billion in 2021). The remaining excise taxes would only support the Airport Improvement Program at $3.35 billion per year. The budget documents say “The reform proposal in the Budget assumes the ticket tax will end, but has not yet developed the precise tax rates for the remaining aviation excise taxes.”

A fact sheet on ATC reform on the White House website notes that the imbalance between future spending and revenues is based estimates that may or may not be accurate: “The proposal does generate a projected difference between revenue and spending reductions, but that difference is based on a point-in-time estimate related to growth assumptions in the Budget. From 2000, aviation excise tax collections have increased on average 2.6 percent per year, whereas spending has increased by an average of 2.9 percent annually over the same time period. A projection based on those historical trends would suggest this proposal represents a smaller cost to the Government (roughly $20 billion, rather than the $46 billion reflected in the Budget).”

CBO’s most recent baseline for the Airport and Airway Trust Fund is here and does give credence to the argument that current tax revenues are not matched properly with FAA spending trends. It shows that under current spending and revenue trends, the traditional general fund contribution to the FAA would drop to zero by 2024 and that the uncommitted balance in the Trust Fund would rise from $5.8 billion at the end of 2016 to $18.4 billion at the end of 2027.

From an appropriations point of view, the “out-years” of the budget assume flat-lined funding after 2018, with the changeover in 2021 reducing new appropriations by $10.4 billion per year (an $11.0 billion per year reduction in appropriations from the Airport and Airway Trust Fund, offset by $600 million or so per year in increased general fund appropriations).

Chairman Shuster has not yet issued a statement on whether or not the ATC reform he will pursue in this Congress will aim for budget neutrality or will follow the Administration’s lead and propose a net tax reduction on the aviation sector. (The Ways and Means Committee and the Budget Committee would have jurisdiction.)