President Biden’s proposed 2024 budget outline makes a lot of “big picture” proposals that go completely in the opposite direction that the new House Republican majority wants to go, conflict that probably won’t be reconciled until after a government shutdown showdown, or a debt ceiling showdown, or both, later this year.

Discretionary appropriations. Using the OMB scoring from Summary Table S-8, here is the White House plan for “base” discretionary appropriations (excluding emergencies and adjustments). They create a separate category for veterans health, as many in Congress want to do, in addition to the traditional defense and non-defense categories. In billions of dollars:

|

FY 2023 |

FY 2024 |

Increase |

|

Enacted |

Request |

Bil. $ |

Pct. |

|

|

|

|

|

| Base Defense |

858.3 |

886.4 |

+28.1 |

+3.3% |

| Base Veterans Health |

118.7 |

121.0 |

+2.3 |

+1.9% |

|

|

|

|

|

| Base Non-Defense |

641.2 |

688.1 |

+46.9 |

+7.3% |

| Remove CHIMP Gimmicks |

+18.6 |

+30.6 |

|

|

| “Real” Base Non-Defense |

659.8 |

718.7 |

+58.9 |

+8.9% |

Even though Congress has urged less reliance on budget gimmicks such as the Crime Victims Fund and childrens health “CHIMP” (CHange In Mandatory Program) adjustments that artificially lower the appearance of spending in the Commerce-Justice-Science and Labor-HHS-Education bills, the budget would increase these gimmicks by $12 billion.

Setting aside defense and veterans, the Biden budget would increase base appropriations for remaining non-defense by $59 billion.

House Republicans want to cut this number down below $500 billion.

That simply isn’t possible. $500 is far enough from $719 as to be irreconcilable. So the House GOP will generate a budget and see where the votes are.

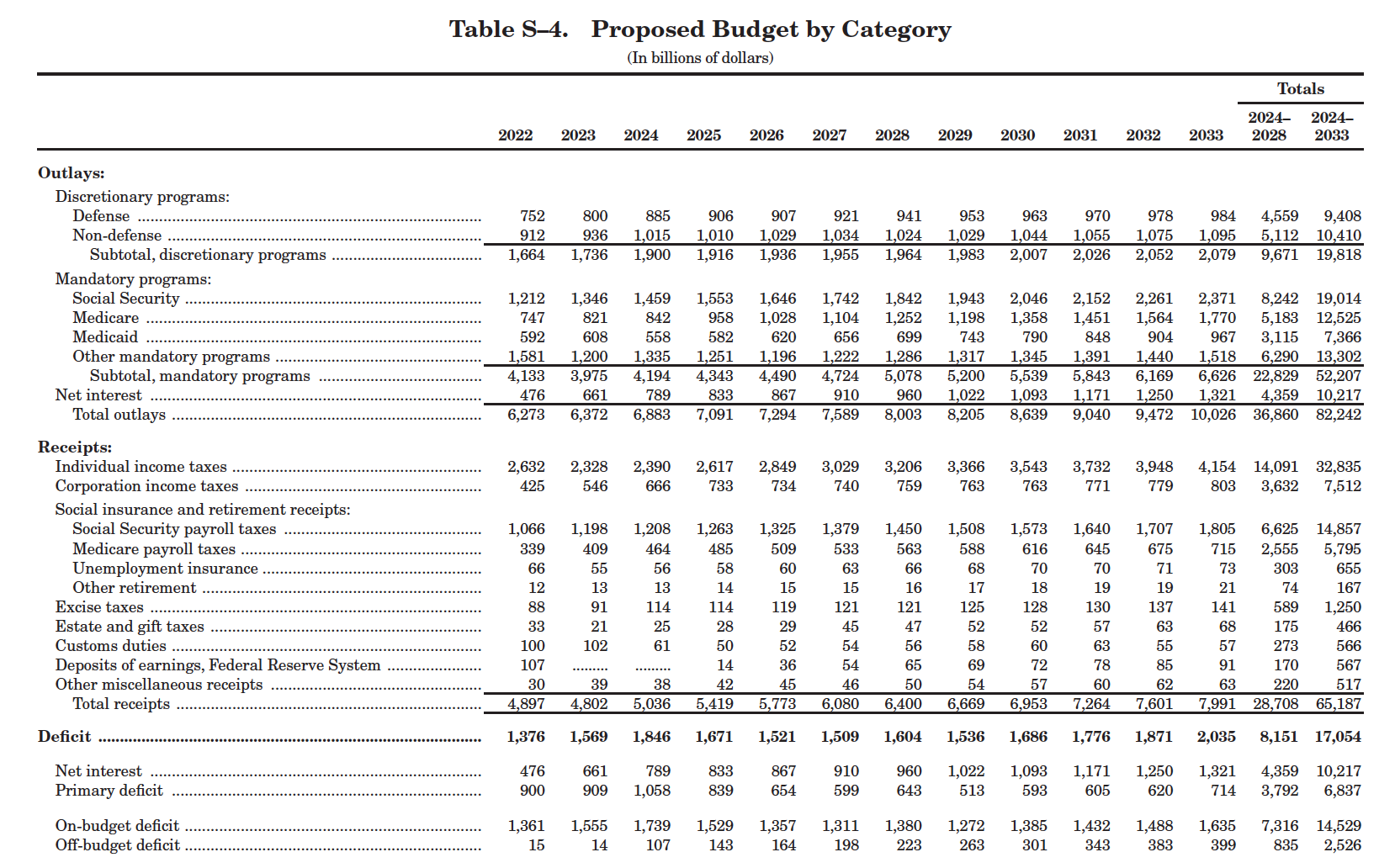

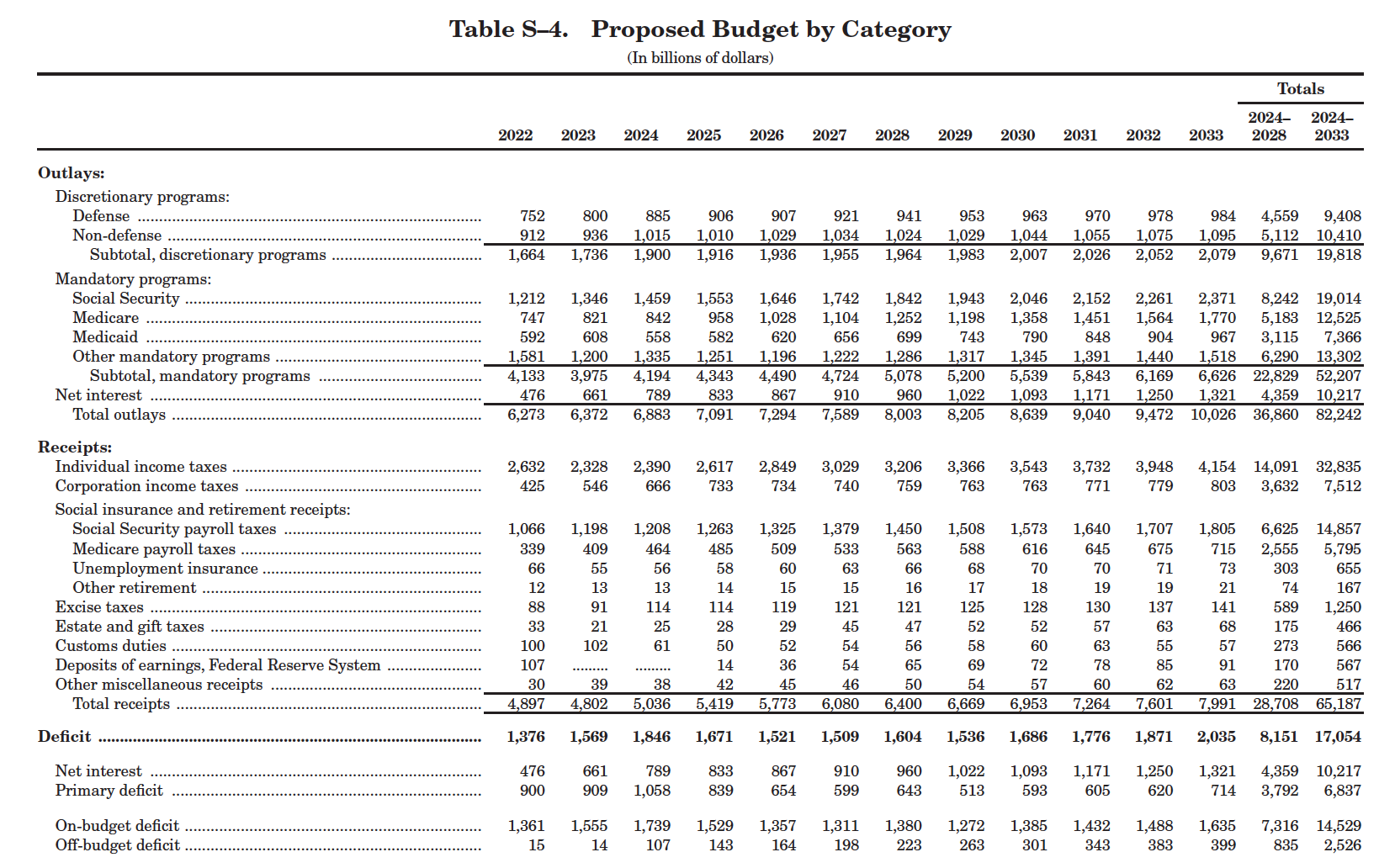

Everything else. Discretionary appropriations are the most visible part of the spending side of the budget because Congress has to pass new bills every year to avoid a shutdown. But such spending is only 28 percent of total spending under the Biden budget. The main summary table in the Budget document is so concise and well-designed that we might as well show it here:

Under the President’s budget, total deficits would dip back down to the $1.5 trillion per year mark and hover for a few years before getting back to $2 trillion per year a decade from now. But the more worrisome part is the net-vs-primary bit at the bottom.

In FY 2022, the government ran a $1.376 trillion deficit, and only $476 billion of that represented net interest on previous deficits, so $900 billion was the “primary deficit” from new policies. A 2 to 1 ratio of primary deficit to net interest. Fast forward a decade hence, and that will be reversed – $1.321 trillion in net interest versus a $714 billion primary deficit, a ratio of almost 1 to 2.

Put another way, under this budget, net interest on the federal debt will start exceeding all non-defense discretionary i 2030.

And this interest forecast is based on the economic assumptions in Table S-9, which predict the rate on the 10-year Treasury note dropping from 2023’s 3.9 percent ack to 3.4 percent by 2026 and hovering there fore the rest of the decade. A higher interest rate environment, even a slightly higher one, will make the net interest situation much worse.

The total deficits over the next decade under the OMB “baseline” (cost if we just keep doing everything wee did in 2023 over and over again, plus inflation, and allow expiring tax law to expire) total $19.9 trillion, and the budget claims to reduce those by $2.9 trillion, to $17.1 billion over 10 years.

Within that, there are some tradeoffs – an additional $1.1 trillion in mandatory spending over 10 years on child care, preK, health care, and college affordability, offset by $1.17 trillion in increased taxes on rich individuals ($437 billion), international corporations ($493 billion), and an increase in the tax on corporate stock buybacks ($238 billion), none of which sounds like it is going to be included in the House budget.

Similarly, the budget proposes spending an additional $428 billion over a decade on health care, offset by $650 billion in increased Medicare taxes on the rich.