The mammoth coronavirus aid package signed into law two weeks ago today (on March 27) provided $88 billion in grant and loan authority for the aviation sector. However, as of this writing, none of that money has yet been provided to airlines, other aviation business, or airports.

$32 billion in air carrier and contractor grants. Despite the fact that section 4113(b)(2) of the law providing the funding says that “Not later than 10 days after the date of enactment of this Act, the Secretary shall make initial payments to air carriers and contractors that submit requests for financial assistance approved by to the Secretary,” as of this writing (mid-day on April 10, 14 days after enactment), none of that money has been granted yet.

However, President Trump led off yesterday’s daily White House coronavirus briefing by stating that he had, earlier that day, met with Treasury Secretary Mnuchin and Transportation Secretary Chao on the airline aid and that “we’ll probably be putting out a proposal and giving them some of the details, some of the very powerful details, over the weekend.”

Per procedures released March 30, air carriers and contractors were asked to submit their applications for payroll grant funding by 5 p.m. on April 3. However, on April 2, Mnuchin announced that the Treasury Department had hired Wall Street investment firms to advise on giving out both grants and loans to aviation businesses, and per news reports, Treasury then began asking applicants for additional information beyond that which had been required in the original application form – closely held details about their business structure and cash flow.

Also, the amount of money that the passenger airlines asked for, in the aggregate – the amount they said they paid on wages and benefits for the six-month April 1 – September 30 period in 2019 – reportedly exceeds the $25 billion that Congress provided for this purpose, so Treasury will have to reduce awards somewhat.

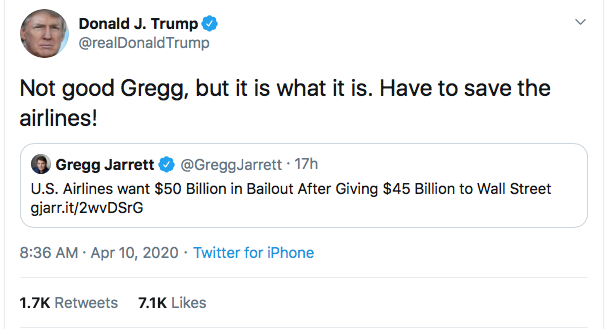

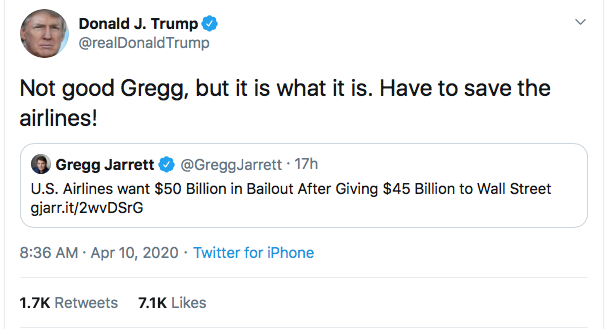

Trump himself pushed back against a Fox News analyst this morning on Twitter who had been echoing a line of attack against the airlines from the left – that since the major airlines had spent so much money in the last few years buying back their own stock to keep the price up, the airlines were somehow less deserving of federal aid:

Still no word whether or not Mnuchin will exercise the authority that section 4117 of the law explicitly gives him and demand some kind of temporary stock ownership in airlines that accept the grants.

$46 billion in aviation sector loans. Unlike the grants, the law did not provide any kind of deadline for making loans – there is only a December 31 cutoff of the authority to make such loans. The law provides authority for Treasury to make up to $25 billion in loans to passenger airlines, up to $4 billion in loans to cargo airlines, and up to $17 billion in loans for “businesses critical to maintaining national security,” a carve-out which everyone assumes was meant to apply to Boeing.

If the airlines are indeed on the verge of getting their $25 billion in grants in the next few days, that does diminish the immediate need for them to get loans. But that still leaves the other $17 billion for national security entities.

Two well-placed aviation journalists tweeted last night that Boeing could be on the verge of getting a $10 billion federal loan (see here and here). One of the reporters, Jon Ostrower, pointed out something important – the terms of any financial assistance provided to Boeing matter in a way that don’t apply to any loans given to airlines, because the U.S. and the European Union have spent most of the last two decades battling in the World Trade Organization dispute process over whether or not Boeing and Airbus receive financial aid from governments that leads to unfair competition in the civilian airliner market.

New direct aid from the U.S. government to Boeing, or from EU governments to Airbus, could upend the rationale for a lot of these WTO claims and decisions if the aid is provided on overly generous terms.

(On a related topic, there was an interesting blurb in Forbes today about Lufthansa that pointed out something interesting – the dominant business model in the aviation sector is for airlines not to own many of their airplanes directly – instead, one of a handful of large leasing companies like GE Capital or AerCap actually buys the plane from Boeing or Airbus and then leases it to the airline. This works out fine most of the time, but not owning your planes makes it more difficult to shrink your fleet quickly, as airlines are now having to do. Lufthansa is an outlier in that it owns almost all of its planes, which makes it much easier for them to shrink their fleets.)

$10 billion in grants for airports. We are also hearing that the allocations of this money could be announced as early as this weekend. The Federal Aviation Administration issued an updated FAQ document for the funding on April 4. Most of the apportionment of the $10 billion is pretty simple and can be done using information the FAA already had on hand weeks ago – $3.7 billion based on the number of enplanements in 2019, $500 million to “plus up” each airport’s regular FY 2020 Airport Improvement Program grants have a federal share of 100 percent, up to $2 billion via a tweaked version of the regular AIP entitlement formula program. However, $3.7 billion of the money is to be given out based on two different debt service numbers for each airport, and the FAA may not have had some of that data on hand for all airports. It remains to be seen if the FAA will give out the whole $10 billion at once, or do the part where they already had complete data first and then follow up thereafter with the rest of the money.