The July 30 markup of the highway reauthorization bill by the Senate Environment and Public Works Committee left stakeholders with a positive feeling that morning, but by the end of the day, the specter of politics as usual had put a damper on emotions.

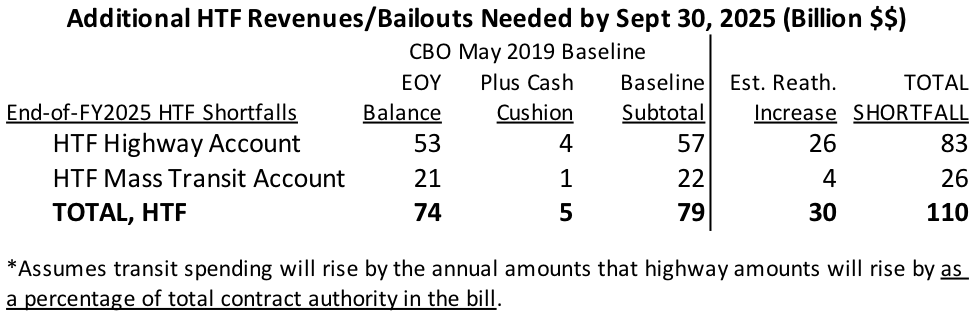

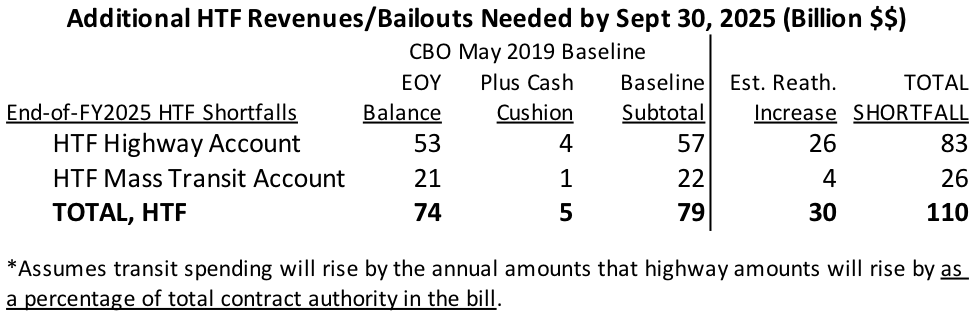

At around 5 p.m. on July 30, Senate Finance Committee chairman Chuck Grassley (R-IA) met with Environment and Public Works chairman John Barrasso (R-WY), the principal author of the highway bill, as well as Finance member John Cornyn (R-TX), who has been trying to take a leading role in increasing the size of the federal infrastructure investment. The meeting was to pitch Grassley, whose panel controls taxes and federal trust funds, on Barrasso’s proposals for filling the $110 billion revenue gap needed to pay for his proposed bill (if mass transit is given the same proportional share of funding it was given in the FAST Act of 2015, as shown in the following table):

After the meeting, Grassley told reporters that a gasoline tax increase was “off the table” and that, as far as any other “pay-fors” go, when the Senate returns in September, “we’re going to start the conversation with [Majority Leader Mitch] McConnell because if I’m going to exert a lot of both political capital as well as a lot of work to finance this, I want to make sure that we get it up on the floor.” (Quote taken from E&E News Daily.)

Barrasso did not say what his $110 billion, five-year revenue plan was, but it is hard to raise a lot of money from highway users quickly without increasing the existing motor fuel excise tax rates, because those taxes are incredibly easy for the IRS to administer (levied as they are at the wholesale tank farm) and, being taxes already in existence, can simply be ratcheted upwards with a minimum of extra paperwork. Levying new taxes on any class of highway user would take much longer to implement.

Practically speaking, what Grassley said is not really news – any legislation going to the floor was always going to need the permission of the Majority Leader. But for Grassley to publicly pass the buck to McConnell at this stage of the game brings the inevitable partisan political calculations to the forefront before some had expected.

Since the enactment of the FAST Act in December 2015, one thing has been crystal clear: Highway Trust Fund authorizations are going to expire on September 30, 2020, which is just five weeks before Election Day. This is likely why Barrasso has moved a reauthorization bill through his committee months ahead of schedule – because every day that brings the election closer makes Members of Congress, and the President. a little bit more politically risk-averse.

As such, every day that passes without action on a multi-year reauthorization bill makes it more likely that the most politically risk-averse option (a short-term HTF extension from October 1, 2020 through early summer 2021) will be enacted, because an extension of that duration can be enacted without a “pay-for” and will stick the next Congress, and possibly the next President, with the next Highway Trust Fund insolvency that is scheduled for mid-to-late summer 2021.

It’s also important to note that Grassley did not commit to paying for the next bill with highway user taxes. The last two authorization laws have relied on general fund bailouts to support about 20 percent of Trust Fund spending (in lieu of increasing user tax rates to fill the revenue gap). This violates the user-pay, user-benefit framework under which the Highway Trust Fund was created (and which was cited to give the Trust Fund its many exemptions from the budget rules that constrict most other federal programs). But the system of general fund bailouts has had a singular advantage: it has postponed a day of reckoning on the highway vs transit revenue split that will have to be faced if the Trust Fund is ever made solvent based on user taxes once again.

Highway vs transit imbalance.

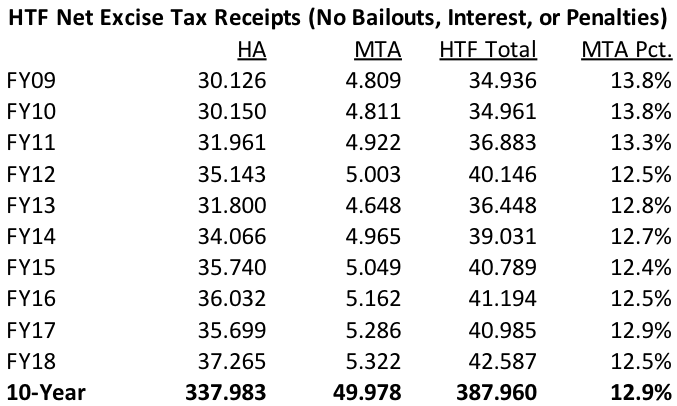

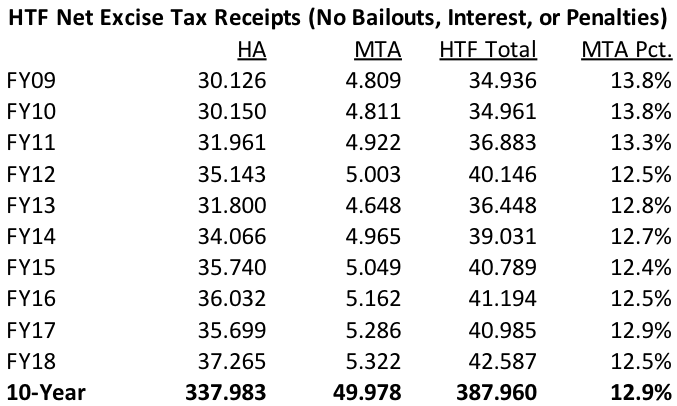

First, let’s look at the actual excise tax receipts deposited in each account of the Trust Fund every year for the last decade. (Net excise tax receipts only, so this does not include bailout transfers, or interest paid on balances (since interest can only exist over this period due to the bailouts) and does not count a hundred million dollars per year or so, on average, in safety penalties deposited in the Highway Account.)

The fluctuation is due to the fact that the three taxes on the trucking industry (sales tax on new trucks and trailers, sales tax on new truck tires, and annual heavy truck usage tax) are only deposited in the Highway Account, not the Mass Transit Account, and these taxes fluctuate with the business cycle, especially the tax in new truck and trailer sales. During the Great Recession, trucking companies postponed big purchases, so Highway Account tax receipts dropped by a greater percentage than Mass Transit Account tax receipts, and while things are going well (as they have lately), trucking companies buy more new trucks and trailers, so Highway Account receipts form a greater proportion of the total.

But throwing out the Great Recession years as anomalous, the Mass Transit Account gets between 12.5 and 13.0 percent of the actual excise taxes paid into the Trust Fund.

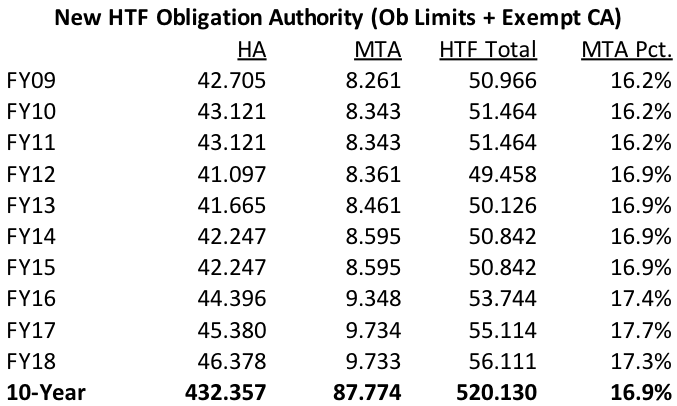

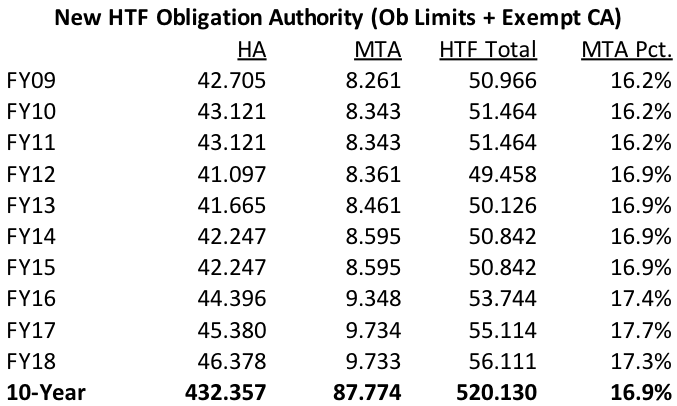

Now, let’s look at the new spending commitments to be drawn from the Trust Fund, approved by Congress in legislation, for those same ten years:

Even though the Mass Transit Account only gets between 12 and 13 percent of Trust Fund tax receipts in non-recession years, Congress now gives transit more than 17 percent of Trust Fund total Trust Fund spending authority.

As long as the Trust Fund is being kept solvent by bailouts from the general fund, this systemic imbalance doesn’t matter – Congress is free to borrow money from the bond market, or confiscate money from the Federal Reserve, and distribute that money however it likes, as needed at the time, to keep both accounts solvent.

But if Congress really does make an effort to put the Trust Fund back on the self-sufficient, user-tax model that was in use from 1956 through 2008 (and section 1525 of the bill approved by the EPW Committee expresses the sense of the Senate that this should happen), something will have to be done about this systemic imbalance. One of three things, or a combination of these things, must happen:

- The Mass Transit Account must be given a greater share of new tax revenues than the 20 percent of new revenues given to the Account by the 1982, 1990 and 1993 tax increases, or

- The current fuel tax system (whereby the Mass Transit Account gets a fixed 2.86 cents per gallon of the current gasoline and diesel tax rates) must be amended to give transit a greater share, or

- Funding for mass transit out of the Highway Trust Fund must be reduced down to a level that can be sustained by the actual tax revenues being deposited in the Mass Transit Account.

There is no fourth option.